Best Personal Loan Rates Today: Quick & Easy Comparison

Table of Contents

Finding the best personal loan rates today can feel overwhelming. With so many lenders offering different terms and interest rates, knowing where to start is crucial. This guide simplifies the process, providing a quick and easy comparison of top lenders and helping you secure the best possible rate for your financial needs. We'll cover everything you need to know to find the best personal loan rates for your situation, from understanding the factors that influence your rate to avoiding potential scams.

Understanding Personal Loan Rates & Factors Affecting Them

Key Factors Influencing Your Interest Rate:

Your personal loan interest rate isn't randomly assigned; several key factors influence it. Understanding these factors is the first step to securing a competitive rate.

-

Credit score: Your credit score is a significant factor determining your interest rate. Lenders use your FICO score (a common credit scoring model) and your credit report from agencies like Experian, Equifax, and TransUnion to assess your creditworthiness. A higher credit score generally translates to lower interest rates, as lenders perceive you as a lower risk. Aim for a score above 700 for the best chances of securing favorable loan terms.

-

Debt-to-income ratio (DTI): Your debt-to-income ratio (DTI) represents the percentage of your monthly income that goes towards debt repayment. A lower DTI indicates you have more disposable income to handle loan payments, making you a less risky borrower. Lenders prefer lower DTI ratios, typically below 43%, for personal loan approval and better rates.

-

Loan amount and term: The amount you borrow and the repayment period (loan term) both influence your interest rate. While a longer loan term results in lower monthly payments, it also means you'll pay significantly more interest over the life of the loan. Conversely, a shorter loan term means higher monthly payments but lower overall interest costs. Carefully weigh these factors based on your budget and financial goals.

-

Lender type: Different lenders offer varying rates. Banks typically cater to a broader range of credit scores but might not always offer the most competitive rates. Credit unions often provide lower rates to their members but may have stricter eligibility criteria. Online lenders offer convenience and speed but may have higher rates for borrowers with less-than-perfect credit.

-

Interest rate types (fixed vs. variable): Fixed interest rates remain constant throughout the loan term, providing predictable monthly payments. Variable interest rates fluctuate based on market conditions, potentially resulting in unpredictable payments. A fixed-rate loan offers stability and predictability, while a variable-rate loan might initially offer a lower rate but carries more risk.

-

Bullet Points:

- Improve your credit score before applying by paying bills on time and reducing your credit utilization.

- Lower your debt-to-income ratio by paying down existing debts or increasing your income.

- Consider a shorter loan term to save on overall interest, even if it means higher monthly payments.

- Shop around and compare offers from multiple lenders—don't settle for the first offer you receive.

Quick Comparison of Top Lenders Offering Best Personal Loan Rates Today

Top Banks and Credit Unions:

This section would list 3-5 reputable banks and credit unions with brief descriptions. Due to the dynamic nature of interest rates, specific examples can't be provided here. However, you should include the following details for each lender:

- Lender Name

- Brief description of their offerings (e.g., known for competitive rates for excellent credit, offers lower rates for members)

Leading Online Lenders:

Similarly, this section would include 3-5 reputable online lenders. Details to include for each:

- Lender Name

- Brief description of their offerings (e.g., known for fast approvals, flexible loan terms, offers pre-qualification without affecting credit score)

Comparison Table:

| Lender | APR Range | Loan Amounts | Fees | Repayment Terms |

|---|---|---|---|---|

| Bank A | 6.00% - 18.00% | $1,000 - $50,000 | Origination Fee | 12 - 60 months |

| Credit Union B | 5.50% - 15.00% | $2,000 - $40,000 | None | 24 - 48 months |

| Online Lender C | 7.00% - 20.00% | $1,000 - $35,000 | None | 12 - 36 months |

(Note: This is sample data; replace with actual data from your research.)

How to Get Pre-Approved for a Personal Loan with the Best Rate

Steps to Secure the Best Personal Loan Rate:

Securing the best personal loan rate involves proactive steps:

-

Check your credit report and score: Before applying, obtain your free credit report and score from AnnualCreditReport.com to identify any errors and understand your creditworthiness.

-

Compare loan offers from multiple lenders: Don't settle for the first offer. Compare rates, fees, and terms from several lenders to find the most competitive deal.

-

Understand the terms and conditions before signing: Carefully review the loan agreement, including the interest rate, fees, repayment schedule, and any penalties for late payments.

-

Use a loan comparison tool: Several online tools can help you compare personal loan offers from various lenders. This simplifies the comparison process.

-

Read reviews and compare customer experiences: Check online reviews and ratings of lenders to gauge customer satisfaction and identify potential red flags.

-

Bullet Points:

- Avoid applying for multiple loans simultaneously, as this can negatively impact your credit score.

- Negotiate with the lender for a better interest rate—it's worth a try!

- Carefully review the loan agreement before signing. Don't hesitate to ask questions if anything is unclear.

Avoiding Personal Loan Scams and Protecting Yourself

Red Flags to Watch Out For:

Be wary of loan offers that seem too good to be true:

-

Guaranteed approval with bad credit: No legitimate lender guarantees approval regardless of your credit history.

-

Extremely low interest rates: Unbelievably low rates are a major red flag, often associated with predatory lending practices.

-

Upfront fees: Reputable lenders don't require upfront payments for loan processing.

-

High-pressure sales tactics: Legitimate lenders won't pressure you into making a quick decision.

-

Bullet Points:

- Research lenders thoroughly before applying.

- Read online reviews from multiple sources.

- Never pay upfront fees for a personal loan.

- Be wary of unsolicited loan offers that arrive through email or text message.

Conclusion

Finding the best personal loan rates today requires careful comparison and planning. By understanding the factors that influence interest rates, comparing offers from various lenders, and being aware of potential scams, you can secure a loan that aligns with your financial needs. Remember to check your credit report, shop around for the best rates, and choose a lender with transparent terms and conditions. Start your search for the best personal loan rates today! Use our comparison guide to find the perfect loan for your situation and secure a brighter financial future.

Featured Posts

-

Basarnas Duga Balita Tenggelam Di Parit Batu Ampar Terbawa Arus Ke Waduk Wonorejo

May 28, 2025

Basarnas Duga Balita Tenggelam Di Parit Batu Ampar Terbawa Arus Ke Waduk Wonorejo

May 28, 2025 -

Tyrese Haliburtons Availability Bulls Vs Pacers

May 28, 2025

Tyrese Haliburtons Availability Bulls Vs Pacers

May 28, 2025 -

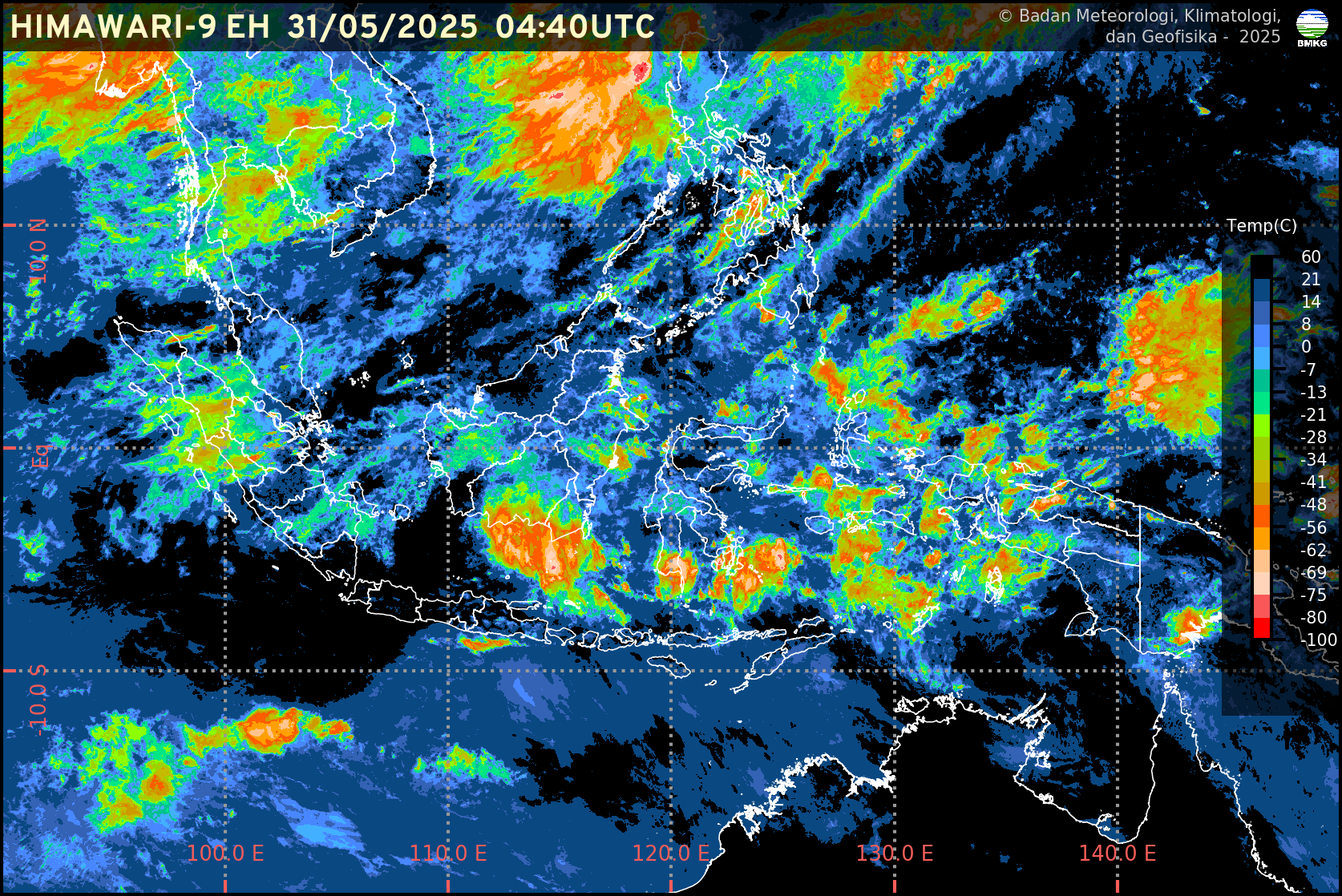

Prakiraan Cuaca Akurat Sumatra Utara Medan Karo Nias Toba

May 28, 2025

Prakiraan Cuaca Akurat Sumatra Utara Medan Karo Nias Toba

May 28, 2025 -

Kantor Nas Dem Bali Batal Jadi Kedai Kopi Fokus Raih Satu Kursi Di Senayan

May 28, 2025

Kantor Nas Dem Bali Batal Jadi Kedai Kopi Fokus Raih Satu Kursi Di Senayan

May 28, 2025 -

Saudia Resmi Luncurkan Rute Penerbangan Langsung Bali Jeddah

May 28, 2025

Saudia Resmi Luncurkan Rute Penerbangan Langsung Bali Jeddah

May 28, 2025

Latest Posts

-

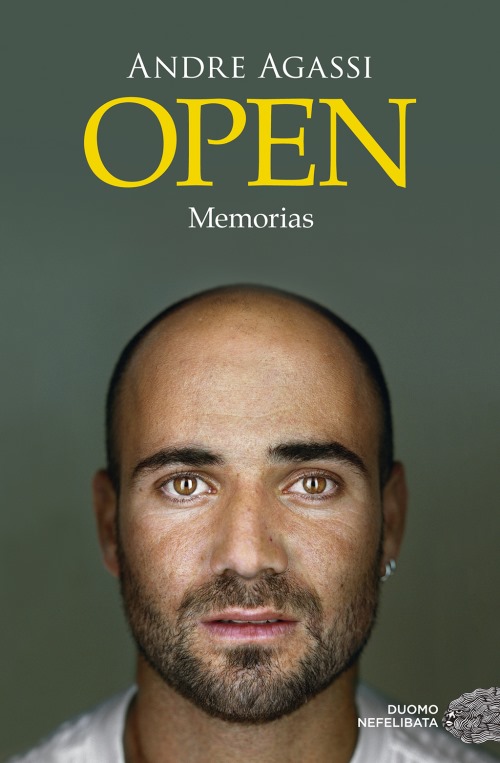

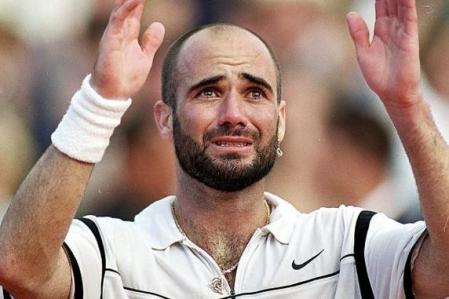

El Regreso De Andre Agassi Del Tenis A Un Desafio Impresionante

May 30, 2025

El Regreso De Andre Agassi Del Tenis A Un Desafio Impresionante

May 30, 2025 -

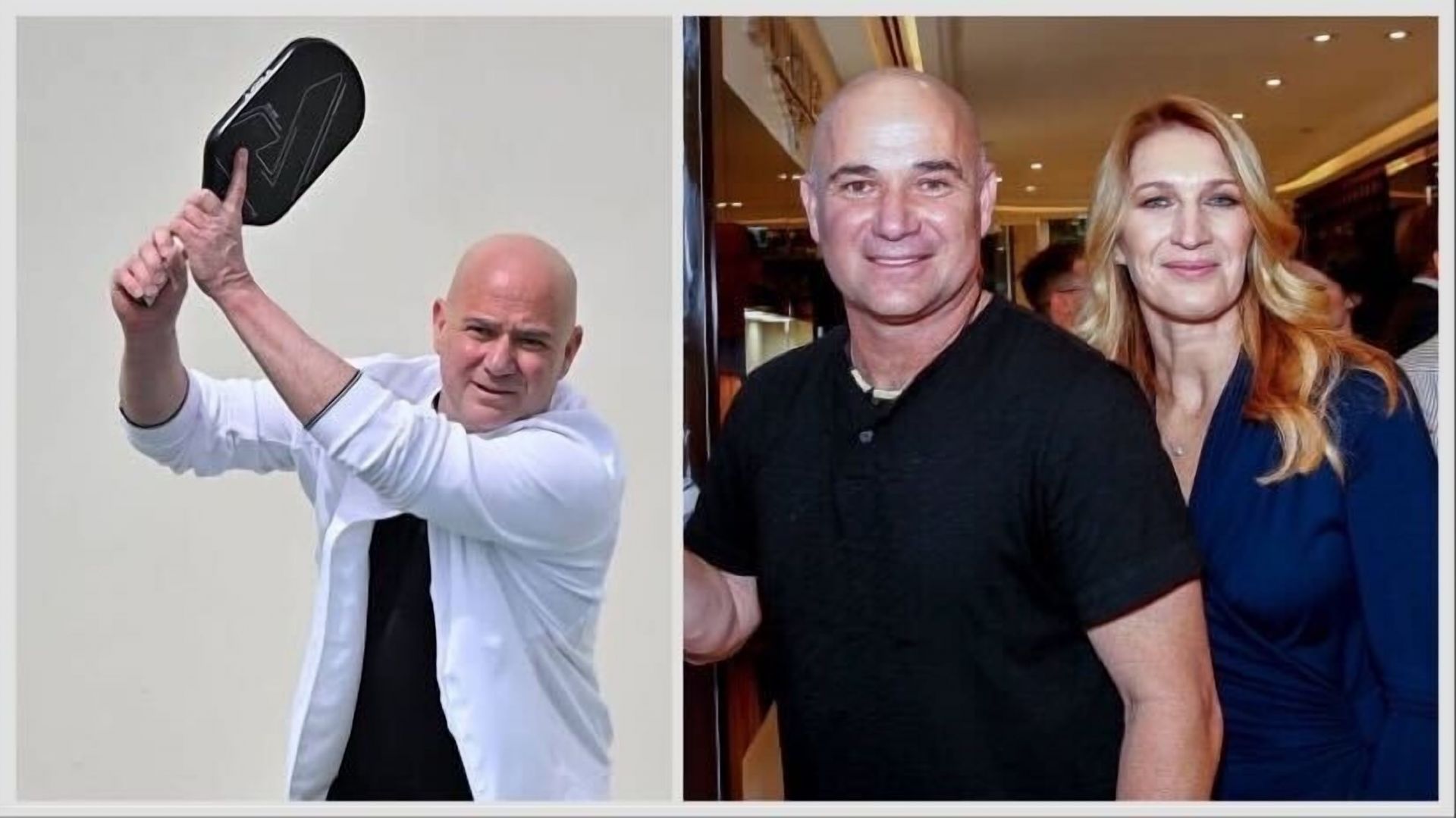

Steffi Graf Und Andre Agassi Enthuellen Ihre Pickleball Strategie

May 30, 2025

Steffi Graf Und Andre Agassi Enthuellen Ihre Pickleball Strategie

May 30, 2025 -

Andre Agassi Nueva Etapa Nueva Cancha Mismo Espiritu Competitivo

May 30, 2025

Andre Agassi Nueva Etapa Nueva Cancha Mismo Espiritu Competitivo

May 30, 2025 -

Andre Agassi Un Regreso Inesperado Lejos De Las Canchas De Tenis

May 30, 2025

Andre Agassi Un Regreso Inesperado Lejos De Las Canchas De Tenis

May 30, 2025 -

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025