Best Tribal Loans For Bad Credit: Direct Lender Options

Table of Contents

Understanding Tribal Loans and Their Advantages

Tribal loans are short-term loans offered by lending institutions owned and operated by Native American tribes. These institutions operate on tribal land, often allowing them to operate under different regulatory frameworks than traditional banks. This can be a significant advantage for individuals with bad credit who may find it difficult to qualify for loans through traditional channels. Understanding the nuances of tribal lending is key to making an informed decision.

Advantages of Choosing a Direct Tribal Lender:

Direct tribal lenders offer several key benefits over third-party brokers:

- Avoids Third-Party Fees: You avoid paying extra fees to intermediaries who simply connect you with lenders. This can save you a significant amount of money, particularly on smaller loan amounts.

- Potentially Faster Processing Times: Dealing directly with the lender streamlines the application process, potentially leading to faster approval and funding.

- More Transparent Terms and Conditions: Direct lenders provide clear and concise information about loan terms, interest rates, fees, and repayment schedules, minimizing potential misunderstandings.

- Direct Communication with the Lender: Direct communication allows for easier clarification of any questions or concerns throughout the loan process.

- Flexible Repayment Options: Some direct tribal lenders offer flexible repayment options tailored to individual circumstances, which can be helpful when managing your finances.

- Potentially Higher Loan Amounts: Compared to some other bad credit loan options, tribal loans may offer higher loan amounts, enabling you to address larger financial needs.

Finding Reputable Direct Lenders for Tribal Loans

Navigating the world of tribal lenders requires caution. Not all lenders operate with the same level of integrity. Therefore, thorough research is crucial before committing to a loan.

Tips for Identifying Legitimate Lenders:

- Check for Licensing and Registration: Ensure the lender is properly licensed and registered to operate within their respective tribal jurisdiction.

- Verify Contact Information and Physical Address: A legitimate lender will readily provide clear and verifiable contact information, including a physical address.

- Read Online Reviews and Testimonials: Check reputable review sites like the Better Business Bureau (BBB) for feedback from previous borrowers. Look for consistent positive feedback and address any negative reviews carefully.

- Look for Transparent Fee Disclosures: Reputable lenders will clearly outline all fees associated with the loan upfront, avoiding hidden charges.

- Beware of Lenders Promising Guaranteed Approval: Be wary of lenders who guarantee approval, as this often indicates predatory lending practices. Responsible lenders assess your application thoroughly.

- Utilize Reputable Resources: Consult resources like the Consumer Financial Protection Bureau (CFPB) for guidance and information on responsible lending practices.

Factors to Consider When Applying for Tribal Loans for Bad Credit

Securing a tribal loan involves careful consideration of several key factors:

Interest Rates and APR:

Compare interest rates and Annual Percentage Rates (APR) from multiple lenders. A lower APR indicates a lower overall cost of borrowing. Always factor this into your decision.

Loan Amounts and Repayment Terms:

Choose a loan amount that aligns with your financial needs and repayment capabilities. Shorter repayment terms mean higher monthly payments but less overall interest paid. Longer terms reduce monthly payments but increase the total interest paid.

Fees and Charges:

Understand all associated fees, including origination fees, late payment fees, and any prepayment penalties. These fees can significantly impact the overall cost of the loan.

Impact on Credit Score:

While tribal loans might not always be reported to major credit bureaus, consistently making on-time payments can positively impact your credit score over time. Conversely, missed payments can negatively affect your credit report.

Alternatives to Tribal Loans for Bad Credit

Tribal loans aren't the only option for individuals with bad credit. Exploring alternatives is crucial for finding the best solution for your financial situation.

- Payday Loans: These are short-term, high-interest loans often due on your next payday. They are generally not recommended due to extremely high interest rates and potential for a debt cycle.

- Personal Loans from Credit Unions: Credit unions sometimes offer more favorable terms than traditional banks, particularly for borrowers with less-than-perfect credit.

- Secured Loans: Secured loans require collateral, reducing the lender's risk and potentially resulting in lower interest rates. However, you risk losing the collateral if you default on the loan.

Careful consideration of all available options is crucial before making a decision.

Conclusion

Tribal loans for bad credit can provide a financial lifeline in emergencies, but they come with their own set of considerations. Direct lenders offer greater transparency and potentially faster processing, but thorough research is paramount. Understanding interest rates, fees, repayment terms, and the potential impact on your credit score is crucial. Remember to explore alternatives and compare offers from multiple reputable direct lenders before committing to a loan. Finding the right tribal loan for bad credit requires careful planning and research. Use this information to make informed decisions and compare options from reputable direct lenders. Start your search for the best tribal loans for bad credit today and regain your financial footing!

Featured Posts

-

Confirmed Jennifer Lopez Hosting The 2025 American Music Awards

May 28, 2025

Confirmed Jennifer Lopez Hosting The 2025 American Music Awards

May 28, 2025 -

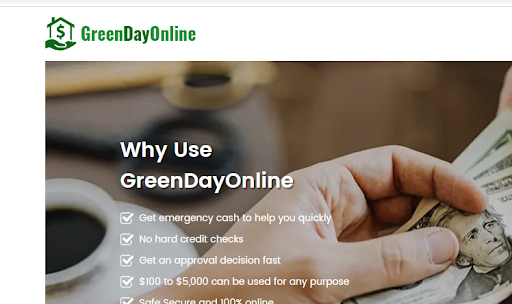

Russia Ukraine Conflict Increased Us Presence In Northern Europe

May 28, 2025

Russia Ukraine Conflict Increased Us Presence In Northern Europe

May 28, 2025 -

Le Samsung Galaxy S25 128 Go Un Smartphone Haut De Gamme Accessible

May 28, 2025

Le Samsung Galaxy S25 128 Go Un Smartphone Haut De Gamme Accessible

May 28, 2025 -

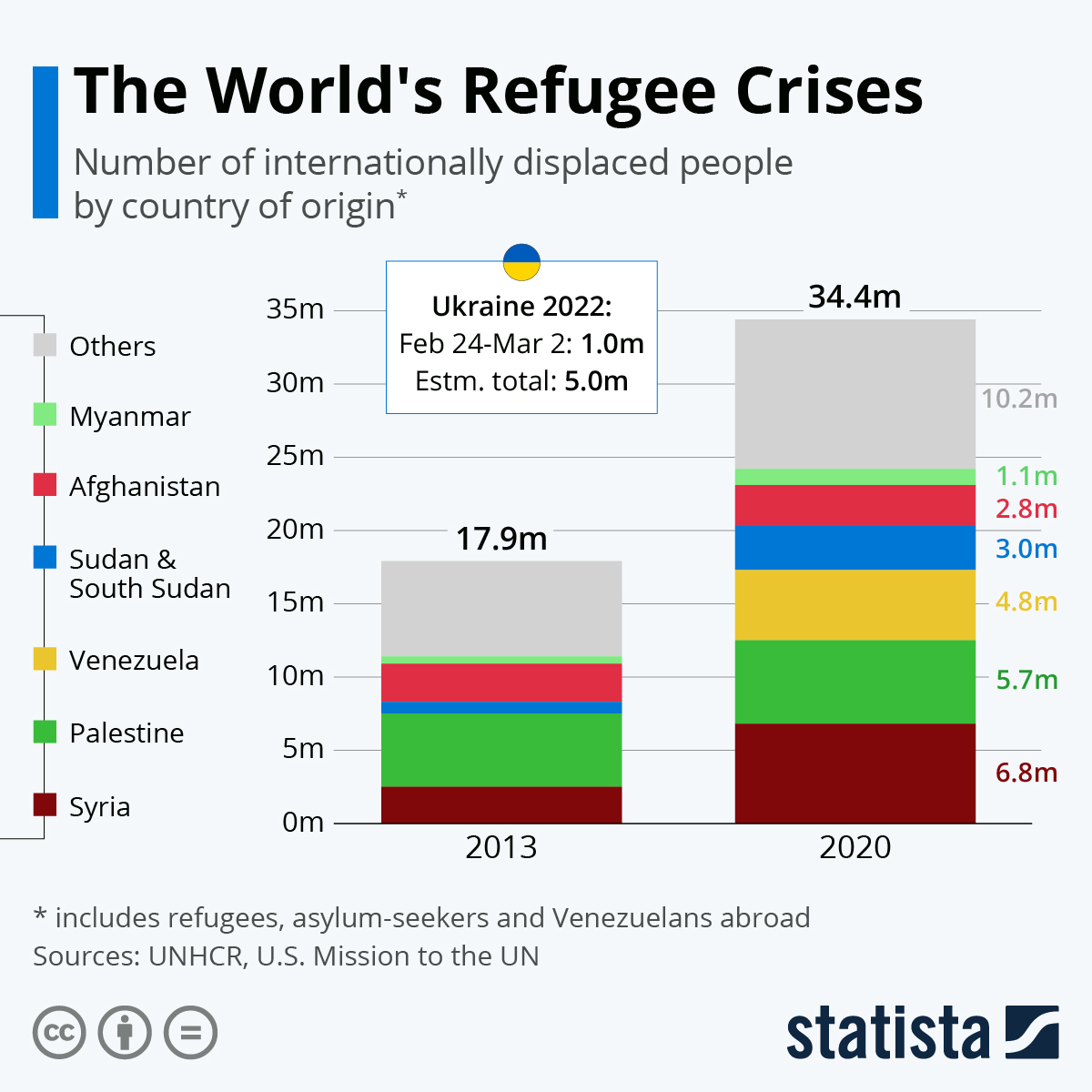

Magyarorszag Alfoeldi Terueleteinek Talajnedvesseg Problemai Es Megoldasaik

May 28, 2025

Magyarorszag Alfoeldi Terueleteinek Talajnedvesseg Problemai Es Megoldasaik

May 28, 2025 -

Dutch Deputy Prime Minister Cleared In Anti Semitism Controversy

May 28, 2025

Dutch Deputy Prime Minister Cleared In Anti Semitism Controversy

May 28, 2025

Latest Posts

-

5 Ans D Ineligibilite Le Jugement De Marine Le Pen Suscite La Controverse

May 30, 2025

5 Ans D Ineligibilite Le Jugement De Marine Le Pen Suscite La Controverse

May 30, 2025 -

Grand Est Subvention Pour Medine Provoque La Colere Du Rassemblement National

May 30, 2025

Grand Est Subvention Pour Medine Provoque La Colere Du Rassemblement National

May 30, 2025 -

Ineligibilite De Marine Le Pen Impact Sur La Politique Francaise

May 30, 2025

Ineligibilite De Marine Le Pen Impact Sur La Politique Francaise

May 30, 2025 -

Concert De Medine Subventionne En Grand Est La Reaction Outree Du Rn

May 30, 2025

Concert De Medine Subventionne En Grand Est La Reaction Outree Du Rn

May 30, 2025 -

Marine Le Pen Condamnee Analyse De La Decision De 5 Ans D Ineligibilite

May 30, 2025

Marine Le Pen Condamnee Analyse De La Decision De 5 Ans D Ineligibilite

May 30, 2025