Betting On Natural Disasters: The Los Angeles Wildfires And The Changing Times

Table of Contents

The Rising Cost of Wildfire Insurance in Los Angeles

Wildfire insurance cost in Los Angeles and surrounding areas is skyrocketing. Homeowners insurance premiums are escalating dramatically in high-risk wildfire zones, forcing many to grapple with unaffordable coverage or even the inability to secure insurance altogether. This increase isn't arbitrary; several interconnected factors are driving these changes.

-

Increased Frequency and Intensity of Wildfires: The sheer number and destructive power of recent wildfires have led to significantly higher insurance payout claims. The massive destruction necessitates larger payouts, directly impacting insurers' bottom lines.

-

Rising Rebuilding Costs: The cost of rebuilding homes destroyed by wildfires has increased dramatically due to factors like labor shortages, material price increases, and stricter building codes designed to improve fire resistance. This translates into higher insurance premiums to cover these escalating reconstruction expenses.

-

Insurer Reluctance to Offer Coverage: Many insurers are becoming increasingly hesitant to offer coverage in high-risk areas, leading to a shrinking insurance market and further driving up prices for those who can still find coverage. This is a direct response to the substantial financial losses experienced in recent years.

-

Government Regulations: Changes in government regulations regarding building codes, wildfire mitigation, and insurance practices can also influence the cost of homeowners insurance. While intended to improve safety, these changes often impact premiums.

Examples: Premiums in areas like Malibu and Topanga Canyon have seen increases exceeding 50% in recent years, while some insurers have completely withdrawn coverage from these high-risk zones.

The Role of Climate Change in Increasing Wildfire Risk

The link between climate change and the increased intensity and frequency of Los Angeles wildfires is undeniable. Prolonged droughts, rising temperatures, and altered wind patterns are creating a perfect storm for devastating wildfires.

-

Prolonged Droughts and Drier Vegetation: Climate change contributes to longer and more severe droughts, leaving vegetation extremely dry and highly flammable. This creates a massive fuel load readily available to ignite and spread rapidly.

-

Rising Temperatures and Stronger Winds: Increased average temperatures dry out the landscape further, while stronger wind patterns fueled by climate change accelerate the spread of wildfires, making them much more difficult to control.

-

Changes in Precipitation Patterns: Shifting precipitation patterns can exacerbate the issue, leading to unpredictable rainfall that might temporarily reduce dryness but also create conditions that promote rapid vegetation growth, leading to increased fuel loads in the following dry season.

-

Scientific Evidence: Numerous scientific studies and reports from organizations like the IPCC and NOAA directly link climate change to the increase in both the frequency and intensity of wildfires across California, including the Los Angeles region. This data provides concrete evidence for the escalating risk.

Predictive Modeling and Risk Assessment

Insurance companies are increasingly relying on advanced predictive modeling and risk assessment tools to better understand and manage wildfire risk. These models utilize sophisticated algorithms and data analysis techniques to predict wildfire likelihood, intensity, and potential impact.

-

Improved Mapping of High-Risk Areas: These models help identify high-risk areas with greater precision, allowing insurers to target risk mitigation efforts and adjust premiums accordingly.

-

Better Prediction of Fire Spread and Intensity: Predictive analytics can help forecast the potential spread and intensity of wildfires, enabling better preparation and resource allocation.

-

More Accurate Risk Assessment for Insurance Pricing: By combining historical data with real-time information (satellite imagery, weather data), models deliver more accurate risk assessments, leading to more nuanced and fairer insurance pricing.

However, current models have limitations. Ongoing research is focused on improving accuracy, especially in predicting the complex interplay of weather patterns, fuel conditions, and ignition sources.

The Future of Wildfire Insurance and Disaster Betting

The future of wildfire insurance is inextricably linked to the evolving climate and the increasing frequency of extreme weather events. This creates opportunities and challenges for the insurance industry, investment strategies, and even the controversial realm of "disaster betting."

-

Impact on Insurance Industry: The rising cost of wildfire claims is forcing insurers to rethink their risk management strategies, potentially leading to higher premiums, stricter underwriting guidelines, and even withdrawals from high-risk areas.

-

Investment Strategies and Disaster Bonds: The growing awareness of disaster risk is creating new investment opportunities in the form of catastrophe bonds (cat bonds) and other financial instruments designed to transfer risk.

-

Community Resilience Programs: Proactive community-based disaster preparedness and resilience programs are becoming increasingly important for mitigating wildfire risk and reducing the financial burden on insurers.

-

Ethical Considerations of Disaster Betting: "Disaster betting" – speculating on the financial outcomes of natural disasters – raises significant ethical concerns, particularly regarding the potential for profiting from the suffering of affected communities. The long-term implications of these practices require careful consideration.

Conclusion:

The Los Angeles wildfires serve as a stark reminder of the escalating threats posed by natural disasters and the need for innovative solutions. The rising cost of wildfire insurance, amplified by climate change, necessitates a comprehensive approach involving improved risk assessment, stricter building regulations, and proactive community preparedness. While “disaster betting” might offer some financial strategies, it's crucial to prioritize responsible risk management and community resilience to mitigate the devastating consequences of future wildfires. Understanding the evolving risks associated with natural disasters, like the Los Angeles wildfires, is critical. Learn more about protecting yourself and your assets by researching wildfire insurance options and disaster preparedness strategies. Don't gamble with your future – invest in comprehensive natural disaster insurance.

Featured Posts

-

White House Cocaine Incident Secret Service Ends Investigation

May 01, 2025

White House Cocaine Incident Secret Service Ends Investigation

May 01, 2025 -

Actor Michael Sheen Pays Off 1 Million In Debt Helping 900 People

May 01, 2025

Actor Michael Sheen Pays Off 1 Million In Debt Helping 900 People

May 01, 2025 -

2025 Cruise Ship Trends Technology Luxury And Sustainability

May 01, 2025

2025 Cruise Ship Trends Technology Luxury And Sustainability

May 01, 2025 -

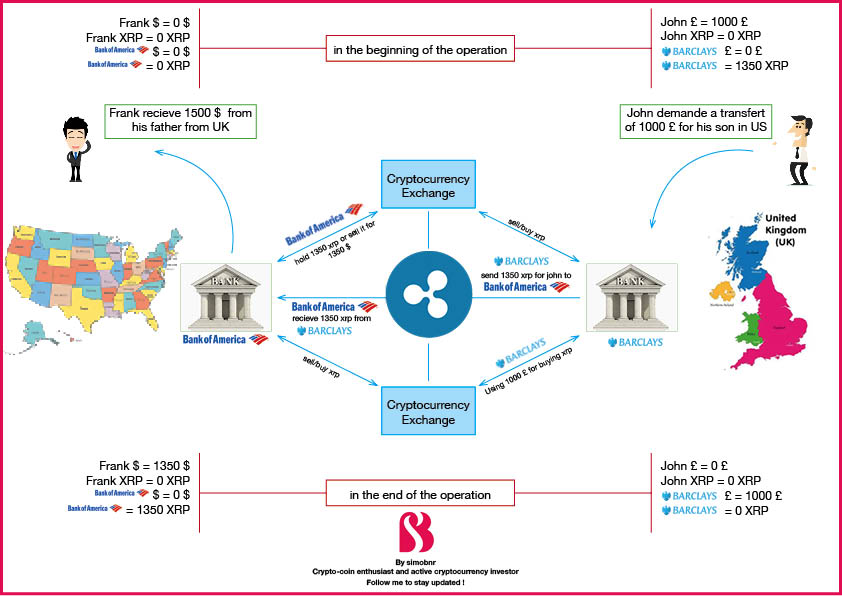

Understanding Xrp Ripples Cryptocurrency Explained

May 01, 2025

Understanding Xrp Ripples Cryptocurrency Explained

May 01, 2025 -

Bantuan Kembali Ke Sekolah Tabung Baitulmal Sarawak 125 Pelajar Asnaf Sibu Terima Manfaat 2025

May 01, 2025

Bantuan Kembali Ke Sekolah Tabung Baitulmal Sarawak 125 Pelajar Asnaf Sibu Terima Manfaat 2025

May 01, 2025

Latest Posts

-

Planning Your 2025 Cruise The Best New Ships To Consider

May 01, 2025

Planning Your 2025 Cruise The Best New Ships To Consider

May 01, 2025 -

2025 Cruise Ship Trends Technology Luxury And Sustainability

May 01, 2025

2025 Cruise Ship Trends Technology Luxury And Sustainability

May 01, 2025 -

New Cruise Lines And Ships 2025s Most Anticipated Launches

May 01, 2025

New Cruise Lines And Ships 2025s Most Anticipated Launches

May 01, 2025 -

Luxury And Innovation Exploring The 2025 Cruise Ship Scene

May 01, 2025

Luxury And Innovation Exploring The 2025 Cruise Ship Scene

May 01, 2025 -

Southern Cruise Itineraries 2025 Best New Ships And Destinations

May 01, 2025

Southern Cruise Itineraries 2025 Best New Ships And Destinations

May 01, 2025