BBAI lawsuit, BBAI investor rights, BigBear.ai stock, securities litigation, and class action lawsuit.

BBAI lawsuit, BBAI investor rights, BigBear.ai stock, securities litigation, and class action lawsuit.

If you've suffered financial losses due to investments in BigBear.ai (BBAI) stock, several potential legal claims might apply. Let's explore some key areas:

Investors often rely on accurate and complete information when making investment decisions. If BigBear.ai (BBAI) made misleading statements or omitted material facts that led to inflated stock prices and subsequent losses for investors, they might be liable. This could constitute BBAI misrepresentation, BBAI fraud, or securities fraud. Examples of such misleading statements could include (though this is not an exhaustive list and requires investigation):

These actions, if proven, constitute a violation of securities laws and can have a significant impact on the BBAI stock price, leading to substantial losses for investors. Keywords like material misstatement are crucial in these cases.

BigBear.ai (BBAI)'s management team has a fiduciary duty to act in the best interests of its shareholders. This means they must avoid conflicts of interest and prioritize the financial well-being of investors. A breach of fiduciary duty might involve:

Understanding the nuances of corporate governance is key to establishing a claim for breach of fiduciary duty. The actions of BBAI management are subject to scrutiny in such cases.

Market manipulation, including activities like pump and dump schemes, can artificially inflate or deflate the price of BigBear.ai stock. This can severely harm investors who buy or sell at manipulated prices. Examples might include:

If evidence of stock manipulation or BBAI stock price manipulation emerges, investors have grounds to seek legal redress.

Gross Law Firm has extensive experience in securities litigation and class action lawsuits, specializing in helping investors recover losses due to corporate misconduct. We have a proven track record of success in securing compensation for our clients. The June 10, 2025, deadline is fast approaching, emphasizing the urgency of taking action. Our services for BBAI investors include:

We are skilled securities lawyers and class action lawyers ready to provide you with the best BBAI legal representation.

Don't delay protecting your investment. Here's what you should do:

Taking these steps allows you to initiate BBAI legal action and potentially file a claim to seek compensation for your losses. Understanding the legal process and acting decisively is vital for investor protection.

BigBear.ai (BBAI) investors have several potential legal avenues to explore if they've suffered losses due to misleading statements, breaches of fiduciary duty, or market manipulation. The June 10, 2025, deadline is rapidly approaching. Don't miss out on the opportunity to protect your rights and potentially recover your investment.

Contact Gross Law Firm today for a free consultation. We are ready to assist you in navigating this complex legal landscape and securing the compensation you deserve. Call us at [Phone Number], email us at [Email Address], or visit our website at [Website Address] for BBAI legal help and to learn more about how to protect your investment. We are dedicated to helping you understand your BigBear.ai investor rights.

Avauskokoonpano Julkistettu Kamara Ja Pukki Sivussa

Avauskokoonpano Julkistettu Kamara Ja Pukki Sivussa

Voyage En Toscane Explorez La Petite Italie De L Ouest

Voyage En Toscane Explorez La Petite Italie De L Ouest

Van Rekening Naar Tikkie De Complete Gids Voor Nederlandse Betalingen

Van Rekening Naar Tikkie De Complete Gids Voor Nederlandse Betalingen

Discover Unusual Eats At The Manhattan Forgotten Foods Festival

Discover Unusual Eats At The Manhattan Forgotten Foods Festival

Potential Ban And Age Restrictions For Kartel Concert In Trinidad

Potential Ban And Age Restrictions For Kartel Concert In Trinidad

Top Gbr News Grocery Must Buys 2000 Quarter Found And Doge Poll Results

Top Gbr News Grocery Must Buys 2000 Quarter Found And Doge Poll Results

Grocery Savings And More Gbrs Top Stories This Week Including A 2 K Quarter

Grocery Savings And More Gbrs Top Stories This Week Including A 2 K Quarter

Gbr News Roundup Grocery Buys Lucky Quarter And Doge Poll Update

Gbr News Roundup Grocery Buys Lucky Quarter And Doge Poll Update

Teletoon Spring Streaming Jellystone And Pinata Smashling Highlight New Shows

Teletoon Spring Streaming Jellystone And Pinata Smashling Highlight New Shows

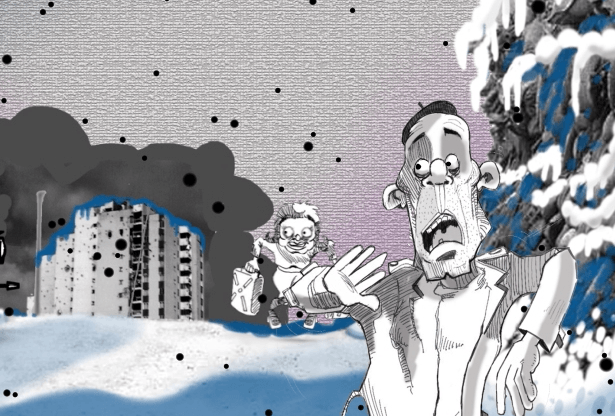

Looney Tunes Return Cartoon Network Collaboration Announced For 2025

Looney Tunes Return Cartoon Network Collaboration Announced For 2025