BigBear.ai (BBAI) Stock: Buy Rating Holds Amidst Defense Spending Growth

Table of Contents

The Current "Buy" Rating for BigBear.ai (BBAI) Stock

Several reputable financial analysts have issued "buy" ratings for BigBear.ai (BBAI) stock, citing strong growth potential. This positive sentiment stems from several key factors related to the company's technology, market position, and projected growth. The rationale behind these ratings often includes ambitious price targets, reflecting the optimistic outlook.

- Analyst firm X's rating and target price: [Insert Analyst Firm X's rating and target price, along with a brief explanation of their reasoning. Link to the source if possible.] For example, "Analyst firm X has issued a 'Buy' rating with a price target of $XX, citing strong revenue growth potential driven by increased government contracts."

- Analyst firm Y's rating and target price: [Insert Analyst Firm Y's rating and target price, along with a brief explanation of their reasoning. Link to the source if possible.] For instance, "Similarly, Analyst firm Y has a 'Buy' rating with a target price of $YY, emphasizing BigBear.ai's innovative AI solutions within the defense sector."

- Key factors contributing to the positive outlook: These positive ratings are supported by BigBear.ai's advanced artificial intelligence and data analytics capabilities, which are highly sought after in the government and defense sectors. Their proven track record in securing and executing large-scale contracts also significantly contributes to this bullish sentiment.

Impact of Increased Defense Spending on BigBear.ai (BBAI) Stock

The significant increase in global defense spending presents a substantial tailwind for BigBear.ai. The company’s expertise in AI, data analytics, and cybersecurity directly aligns with the needs of defense organizations around the world, making it a prime beneficiary of this upward trend.

- Specific examples of recent or upcoming defense contracts: [Provide specific details about recent contract wins or upcoming bids. Quantify the value of these contracts whenever possible to demonstrate the impact on the company's revenue stream.] For example, "BigBear.ai recently secured a multi-million dollar contract with the [Government Agency Name] for the development of [Specific AI solution]."

- Government initiatives driving defense spending growth: [Mention relevant government initiatives and policies that are boosting defense spending. This adds context and credibility to your analysis.] This could include initiatives focusing on modernization, cybersecurity threats, or the development of advanced AI capabilities.

- BigBear.ai's competitive advantage in the defense sector: [Highlight the company's unique selling propositions, technological superiority, or strong partnerships that set them apart from competitors in the sector.] This might involve proprietary algorithms, unique data processing methods, or strategic alliances with key players in the defense industry.

BigBear.ai (BBAI) Stock: Risk Factors and Considerations

While the outlook for BigBear.ai (BBAI) stock appears positive, it's crucial to acknowledge potential risks. Investing in any stock involves inherent uncertainty, and BigBear.ai is no exception.

- Competition in the AI and data analytics market: The AI and data analytics market is highly competitive. BigBear.ai faces competition from established players and agile startups. Maintaining a competitive edge requires continuous innovation and adaptation.

- Dependence on government contracts: A significant portion of BigBear.ai's revenue comes from government contracts. This dependence exposes the company to the inherent risks associated with government procurement processes, including potential budget cuts or changes in policy priorities.

- Financial performance and future earnings projections: While the outlook is generally positive, investors should carefully examine BigBear.ai's financial performance, paying close attention to revenue growth, profitability, and debt levels. Future earnings projections need to be considered in the context of the competitive landscape and potential risks.

BigBear.ai (BBAI) Stock: Technical Analysis and Chart Patterns

Analyzing the technical indicators can offer further insights into the potential price movements of BigBear.ai (BBAI) stock. This is not financial advice and should be complemented by fundamental analysis.

- Moving averages (e.g., 50-day, 200-day): [Provide an interpretation of the moving averages, explaining what they suggest about the short-term and long-term trends. Use charts to support your analysis if possible.]

- Relative Strength Index (RSI): [Explain what the RSI indicates about the momentum and potential for overbought or oversold conditions. Link to any charts used.]

- Other relevant technical indicators: [Mention other relevant indicators, such as volume, support and resistance levels, or candlestick patterns, if applicable. Again, link to charts if appropriate.]

Conclusion

BigBear.ai (BBAI) stock presents an intriguing investment opportunity, supported by a "buy" rating from several analysts and the positive impact of growing defense spending. The company's strong technology, focus on AI and data analytics, and involvement in significant defense contracts all contribute to a promising outlook. However, potential investors should remain aware of the competitive landscape and the inherent risks associated with government contract dependence. While this article provides valuable insights into BigBear.ai (BBAI) stock, always conduct your own thorough research and consult with a financial advisor before making any investment decisions related to BigBear.ai (BBAI) stock. Consider factors such as the BBAI stock outlook, BigBear.ai stock investment strategies, and the current BBAI share price before making any decisions.

Featured Posts

-

Texas Lawmakers Seek To Limit Childrens Social Media Use

May 20, 2025

Texas Lawmakers Seek To Limit Childrens Social Media Use

May 20, 2025 -

Wwe Raw The Brutal Attack On Sami Zayn By Rollins And Breakker

May 20, 2025

Wwe Raw The Brutal Attack On Sami Zayn By Rollins And Breakker

May 20, 2025 -

6 Billion Awarded Public Works Ministrys Significant Investment In Coastal Protection

May 20, 2025

6 Billion Awarded Public Works Ministrys Significant Investment In Coastal Protection

May 20, 2025 -

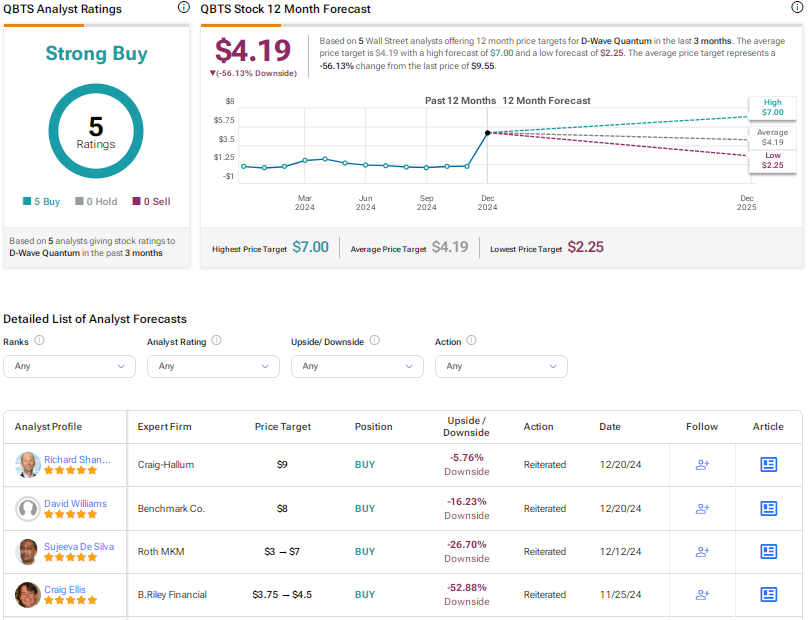

D Wave Quantum Qbts Stock Performance Explaining Todays Significant Gains

May 20, 2025

D Wave Quantum Qbts Stock Performance Explaining Todays Significant Gains

May 20, 2025 -

Ai Companies Win Big With Trump Bill Cautious Celebration Ahead

May 20, 2025

Ai Companies Win Big With Trump Bill Cautious Celebration Ahead

May 20, 2025