BigBear.ai Stock: Buy, Sell, Or Hold?

Table of Contents

Company Overview and Financial Performance: Understanding BigBear.ai's Potential

H2: BigBear.ai's Business Model and Revenue Streams:

BigBear.ai is a leading provider of artificial intelligence (AI)-powered solutions and data analytics services. They offer a range of products and services focused on mission-critical applications, primarily targeting government agencies and commercial enterprises. Their offerings include:

- Advanced analytics: Utilizing AI and machine learning to process and interpret vast datasets.

- Cybersecurity solutions: Protecting sensitive information through advanced threat detection and response.

- Mission support: Providing critical data analysis and decision support tools for various sectors.

BigBear.ai's primary revenue streams derive from government contracts and commercial partnerships. Analyzing their revenue growth trends and understanding the sources of this revenue is critical for assessing the BigBear.ai stock's future potential. Government contracts, while potentially lucrative, can also be subject to fluctuations in government spending. A diversified revenue base, including strong commercial partnerships, is vital for long-term stability. Keywords such as "Artificial Intelligence," "Data Analytics," "Government Contracts," and "BigBear.ai revenue" are essential to understanding their financial health.

H2: Financial Health and Key Metrics:

Understanding BigBear.ai's financial health requires a close look at key metrics like revenue, earnings per share (EPS), debt-to-equity ratio, and cash flow. Analyzing historical trends in these areas is crucial for predicting future performance and the impact on BigBear.ai stock prices. Investors should carefully examine:

- Revenue Growth: Consistent year-over-year revenue growth is a positive sign, indicating strong demand for BigBear.ai's services.

- EPS Growth: Rising EPS indicates increasing profitability, which generally boosts investor confidence.

- Debt Levels: High levels of debt can indicate financial risk and may negatively impact BigBear.ai stock performance. A low debt-to-equity ratio is preferable.

- Cash Flow: Strong and positive cash flow is essential for funding growth initiatives and sustaining operations. Keywords like "BigBear.ai financials," "EPS growth," "Debt levels," and "Cash flow" are critical for assessing their financial standing.

Market Analysis and Future Outlook: Predicting BigBear.ai Stock Movement

H2: Industry Trends and Competitive Advantages:

The AI and data analytics market is experiencing explosive growth, presenting significant opportunities for BigBear.ai. However, the company faces stiff competition from established players and emerging startups. Analyzing BigBear.ai's competitive advantages is vital for evaluating its potential for success. Key factors include:

- AI Market Growth: The global AI market is expanding rapidly, creating favorable conditions for companies like BigBear.ai.

- BigBear.ai Competitors: Identifying key competitors and assessing their strengths and weaknesses helps determine BigBear.ai's market position.

- Technological Disruption: The rapid pace of technological change presents both opportunities and threats. BigBear.ai must adapt quickly to stay competitive.

H2: Analyst Ratings and Price Targets:

To gauge market sentiment towards BigBear.ai stock, examining analyst ratings and price targets is crucial. While these predictions are not guarantees, they reflect the collective opinion of financial experts. Consider:

- BigBear.ai Stock Price Forecast: The consensus among analysts regarding future price movements provides valuable insight.

- Analyst Ratings: Ratings such as "buy," "hold," or "sell" reflect the analysts' assessments of the stock's potential.

- Price Target: Analyst price targets provide a range of potential future stock prices, based on their analysis. Tracking these changes over time helps monitor shifts in market perception. Keywords like "BigBear.ai stock price forecast" and "Analyst ratings" are crucial for this analysis.

Risks and Considerations: Potential Downside of BigBear.ai Investment

H2: Financial Risks and Uncertainties:

Investing in BigBear.ai stock carries inherent risks. Potential threats to the company's financial stability include:

- BigBear.ai Risks: These can include dependence on government contracts, competition from larger players, and potential economic downturns.

- Financial Uncertainty: The volatile nature of the tech sector introduces considerable uncertainty.

- Market Volatility: Stock prices can fluctuate significantly, creating both opportunities and risks.

H2: Geopolitical and Market Risks:

Geopolitical events and broader market fluctuations can significantly impact BigBear.ai's performance. Investors should consider:

- Geopolitical Risk: International conflicts or policy changes could disrupt operations or impact government contracts.

- Market Cycles: Economic downturns can reduce demand for BigBear.ai's services, affecting their profitability.

Keywords like "BigBear.ai risks," "Financial uncertainty," "Market volatility," "Geopolitical risk," and "Market cycles" highlight the potential downsides.

Conclusion: Making the BigBear.ai Stock Decision

Based on our analysis of BigBear.ai stock, the investment landscape presents both opportunities and challenges. The potential for significant growth in the AI and data analytics sector is undeniable, and BigBear.ai is well-positioned to capitalize on these trends. However, significant risks remain, including reliance on government contracts, competition, and broader market volatility. Therefore, a cautious approach is recommended.

While BigBear.ai's technological capabilities and market positioning are attractive, the significant risks warrant a Hold recommendation at this time. Further research and careful consideration of your personal risk tolerance are vital before making any investment decisions. Remember to diversify your portfolio and practice sound risk management strategies. Conduct thorough due diligence before buying or selling BigBear.ai stock.

Featured Posts

-

Mntkhb Alwlayat Almthdt Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 21, 2025

Mntkhb Alwlayat Almthdt Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 21, 2025 -

Is Your Love Monster Sabotaging Your Happiness Practical Solutions

May 21, 2025

Is Your Love Monster Sabotaging Your Happiness Practical Solutions

May 21, 2025 -

Japanese Manga Sparks Disaster Fears Impacts Tourism

May 21, 2025

Japanese Manga Sparks Disaster Fears Impacts Tourism

May 21, 2025 -

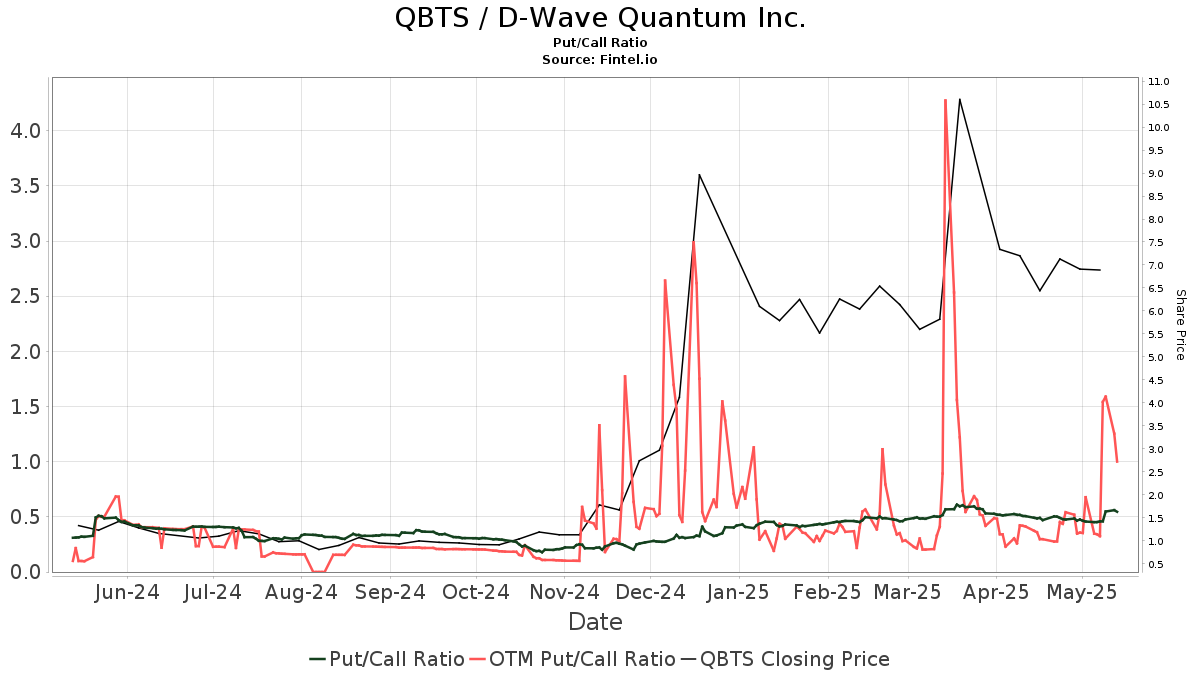

Investor Interest In D Wave Quantum Qbts Causes Of The Stock Price Increase

May 21, 2025

Investor Interest In D Wave Quantum Qbts Causes Of The Stock Price Increase

May 21, 2025 -

Extreme Price Hike For V Mware At And T Reveals 1050 Cost Increase From Broadcom

May 21, 2025

Extreme Price Hike For V Mware At And T Reveals 1050 Cost Increase From Broadcom

May 21, 2025

Latest Posts

-

Karate Kid Legacy Continues Early Reviews Praise Jackie Chan And Ralph Macchios Performances

May 23, 2025

Karate Kid Legacy Continues Early Reviews Praise Jackie Chan And Ralph Macchios Performances

May 23, 2025 -

New Karate Kid Legends Trailer A Legacy Forged In Family And Tradition

May 23, 2025

New Karate Kid Legends Trailer A Legacy Forged In Family And Tradition

May 23, 2025 -

Witness Family Honor And Tradition The Karate Kid Legends Trailer

May 23, 2025

Witness Family Honor And Tradition The Karate Kid Legends Trailer

May 23, 2025 -

Family Honor Tradition The New Karate Kid Legends Trailer

May 23, 2025

Family Honor Tradition The New Karate Kid Legends Trailer

May 23, 2025 -

Cobra Kai Behind The Scenes Look At Hurwitzs Early Pitch

May 23, 2025

Cobra Kai Behind The Scenes Look At Hurwitzs Early Pitch

May 23, 2025