BigBear.ai Stock: Is It A Smart Investment Right Now?

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

BigBear.ai's core business model centers on providing advanced AI-powered solutions, primarily to the national security, intelligence, and commercial sectors. They leverage cutting-edge technologies like machine learning, data analytics, and artificial intelligence to deliver mission-critical insights and solutions. Their offerings include data analytics, predictive modeling, and AI-driven decision support systems.

BigBear.ai faces a competitive landscape populated by both established tech giants and smaller, specialized AI firms. While competition is fierce, BigBear.ai possesses several key advantages:

-

Strengths:

- Proprietary Technology: BigBear.ai boasts a portfolio of proprietary AI algorithms and technologies providing a competitive edge.

- Government Contracts: A significant portion of their revenue stream comes from lucrative government contracts, offering a degree of stability.

- Experienced Team: The company employs a highly skilled workforce with extensive experience in AI development and national security.

-

Weaknesses:

- Reliance on Government Contracts: This dependence exposes them to the risks associated with government funding cycles and potential policy changes.

- Competition from Larger Tech Companies: BigBear.ai competes with larger, better-funded companies that may have broader market reach and resources.

-

Opportunities:

- Expanding into New Markets: Exploring new commercial applications for their AI technologies can significantly broaden their revenue streams.

- Developing Innovative AI Solutions: Investing in R&D to stay ahead of the technological curve is crucial for maintaining a competitive edge.

-

Threats:

- Changing Government Regulations: Shifts in government policies and regulations could impact their ability to secure and maintain contracts.

- Technological Disruptions: Rapid advancements in AI could render existing technologies obsolete, demanding continuous adaptation.

Financial Performance and Valuation of BigBear.ai Stock

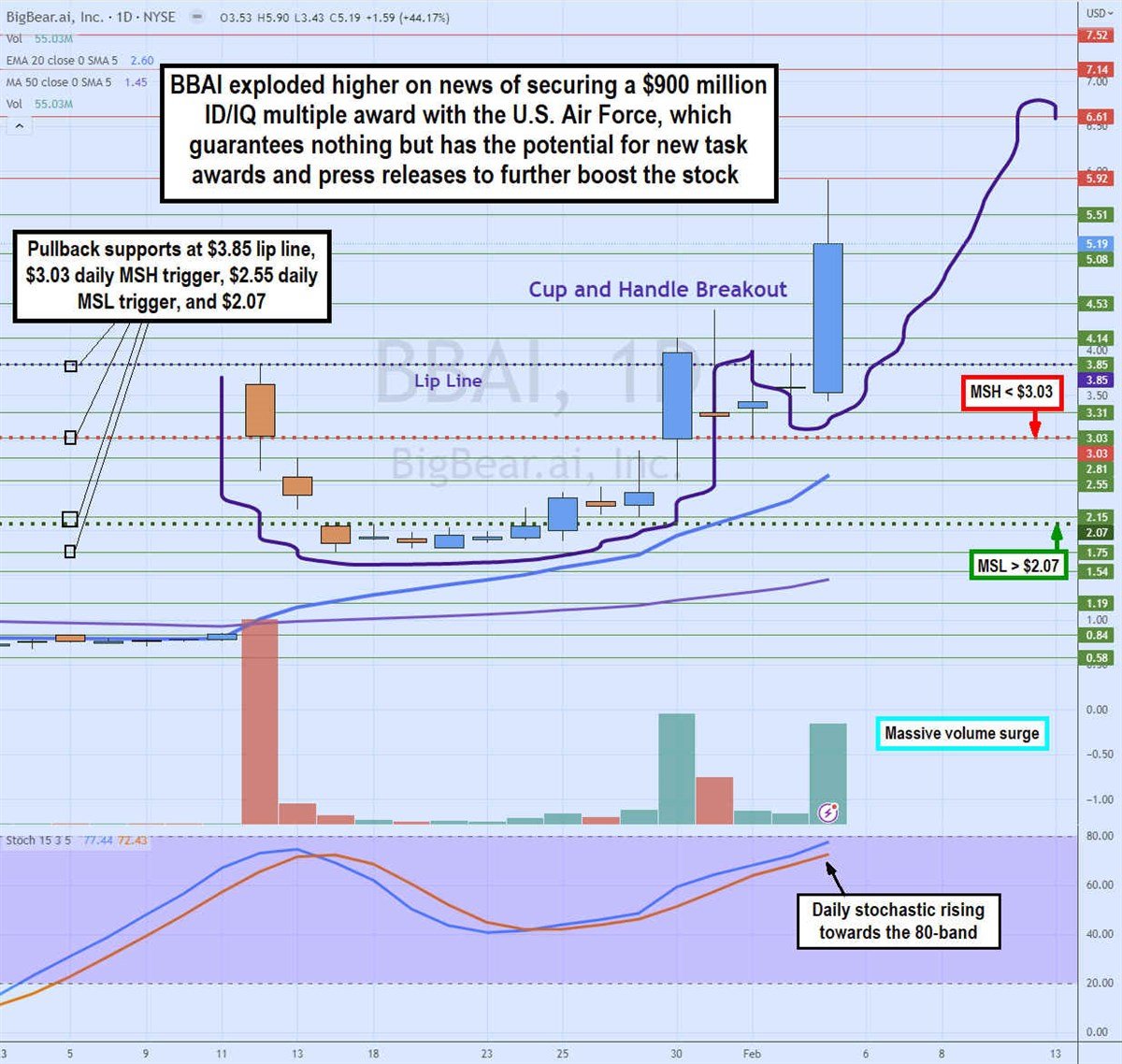

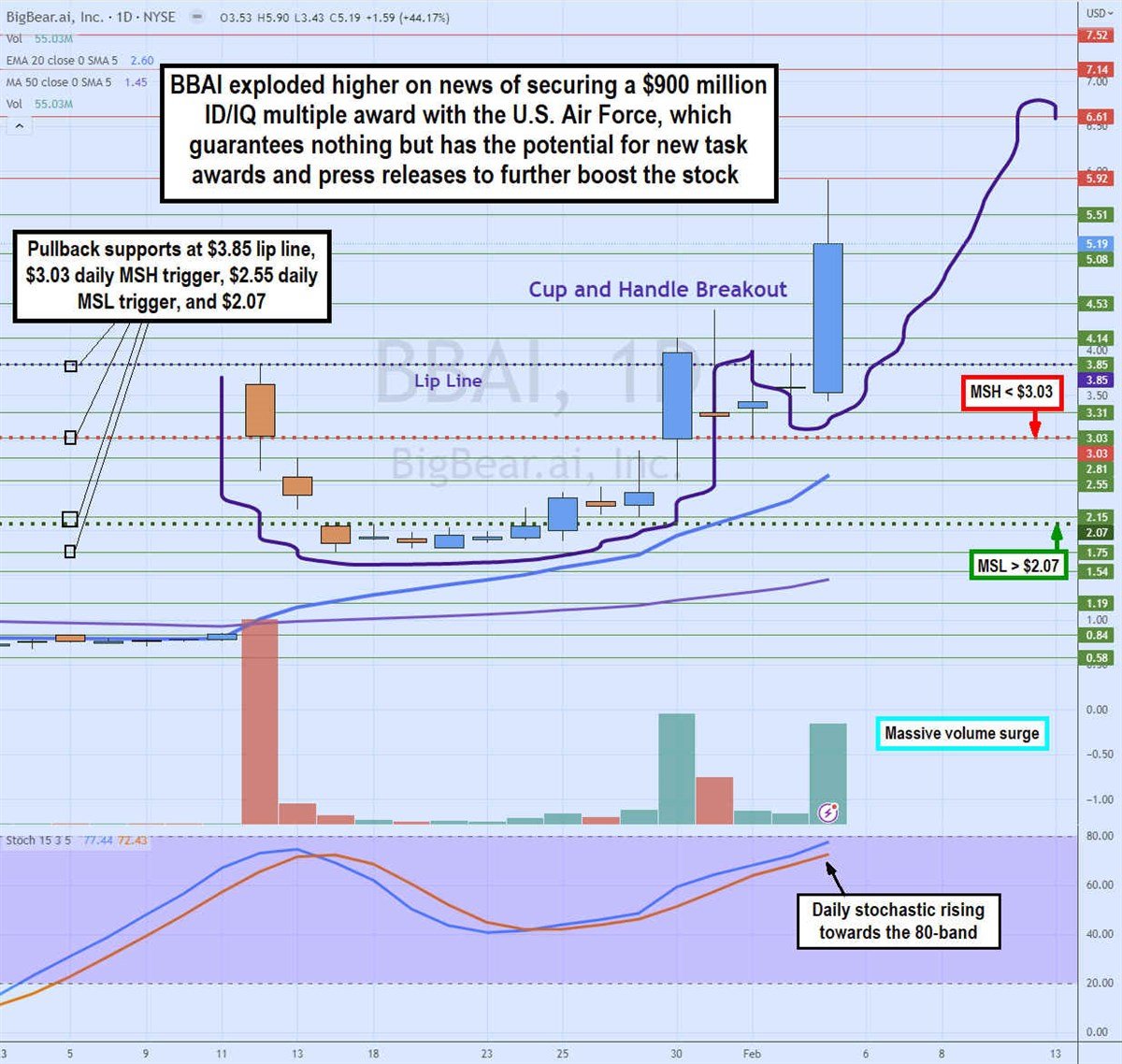

Analyzing BigBear.ai's financial performance is crucial for assessing its investment potential. Investors should scrutinize key metrics like revenue growth, profitability margins, and debt levels. A review of historical stock price trends and analyst ratings provides further insight into market sentiment.

-

Key Financial Figures: (Note: This section would require up-to-date financial data from BigBear.ai's financial reports. Replace the placeholders below with actual figures.)

- Revenue: $[Insert Revenue Figure]

- Profit Margins: $[Insert Profit Margin Percentage]

- Debt-to-Equity Ratio: $[Insert Debt-to-Equity Ratio]

-

Stock Price Trends and Historical Performance: [Insert analysis of stock price trends, including highs, lows, and overall performance.]

-

Analyst Ratings and Price Targets: [Summarize analyst ratings and their price targets for BigBear.ai stock.]

Comparing BigBear.ai's valuation metrics (P/E ratio, market capitalization) to those of its competitors offers valuable context and helps determine whether its stock is currently overvalued or undervalued.

Risk Factors Associated with Investing in BigBear.ai Stock

Investing in BigBear.ai stock carries inherent risks, and understanding these risks is paramount before making an investment decision.

-

Market Risk: The overall performance of the stock market significantly impacts BigBear.ai's stock price. Market downturns can lead to substantial losses.

-

Company-Specific Risk: The company's failure to secure new contracts or experience technological setbacks could negatively impact its financial performance.

-

Regulatory Risk: Changes in government regulations, particularly concerning national security and data privacy, could pose significant challenges.

-

Technological Risk: The rapid pace of innovation in the AI industry necessitates continuous adaptation. Failure to keep pace could lead to technological obsolescence.

Future Outlook and Growth Potential for BigBear.ai

BigBear.ai's future prospects depend on several factors, including its ability to secure new contracts, expand into new markets, and maintain its technological leadership.

-

Projected Revenue Growth: [Insert projections for revenue growth based on available data and analyst predictions.]

-

Expansion Plans into New Markets: [Discuss any expansion plans into new commercial sectors or geographical regions.]

-

Potential for Technological Breakthroughs: BigBear.ai's ability to develop innovative AI solutions and maintain a technological lead is critical for its long-term success.

-

Long-Term Competitive Advantage: [Analyze the sustainability of BigBear.ai's competitive advantages in the long term.]

Conclusion: BigBear.ai Stock: A Final Verdict?

BigBear.ai operates in a high-growth sector with significant potential. However, investing in its stock carries risks associated with market volatility, dependence on government contracts, and intense competition. While the company possesses strengths like proprietary technology and government contracts, weaknesses such as reliance on government funding and competition from larger players need consideration. A thorough review of the financial performance and future prospects, alongside a careful assessment of the risks, is essential. Therefore, a balanced approach is crucial in determining whether BigBear.ai stock is a smart investment for your portfolio. Before making any investment decisions regarding BigBear.ai stock, consult with a qualified financial advisor.

Featured Posts

-

Sahrana Andelke Milivojevic Tadic Milica Milsa U Suzama Oprostaj Na Groblju

May 20, 2025

Sahrana Andelke Milivojevic Tadic Milica Milsa U Suzama Oprostaj Na Groblju

May 20, 2025 -

The Hamilton Leclerc Equation Navigating Ferraris Driver Dynamics

May 20, 2025

The Hamilton Leclerc Equation Navigating Ferraris Driver Dynamics

May 20, 2025 -

Will Big Bear Ai Bbai Skyrocket Analyzing The Penny Stocks Future

May 20, 2025

Will Big Bear Ai Bbai Skyrocket Analyzing The Penny Stocks Future

May 20, 2025 -

Find The Answers Nyt Mini Crossword March 22

May 20, 2025

Find The Answers Nyt Mini Crossword March 22

May 20, 2025 -

Monday Severe Weather Assessing The Overnight Storm Chance

May 20, 2025

Monday Severe Weather Assessing The Overnight Storm Chance

May 20, 2025