Bitcoin And Ethereum Options: Billions Expiring, Impact On Market Volatility

Table of Contents

Understanding Bitcoin and Ethereum Options Contracts

Options contracts are derivative financial instruments that give the buyer the right, but not the obligation, to buy or sell an underlying asset (in this case, Bitcoin or Ethereum) at a predetermined price (the strike price) on or before a specific date (the expiry date). There are two main types of options:

- Call Option: Gives the buyer the right to buy the underlying asset at the strike price.

- Put Option: Gives the buyer the right to sell the underlying asset at the strike price.

The price of an option contract is influenced by several factors:

- Underlying Asset Price: The current market price of Bitcoin or Ethereum.

- Volatility: The expected price fluctuations of the underlying asset. Higher volatility generally means higher option prices.

- Time to Expiry: Options with longer expiry dates generally have higher prices.

- Interest Rates: Interest rates influence the cost of carrying the asset, affecting option pricing.

Bitcoin and Ethereum options markets differ slightly in terms of liquidity, trading volume, and the types of contracts offered. Major exchanges offering these options include Deribit, CME Group (Chicago Mercantile Exchange), Kraken, and Binance. The Bitcoin options market, being older and more established, generally boasts higher liquidity than the Ethereum options market, though Ethereum's options market is rapidly growing.

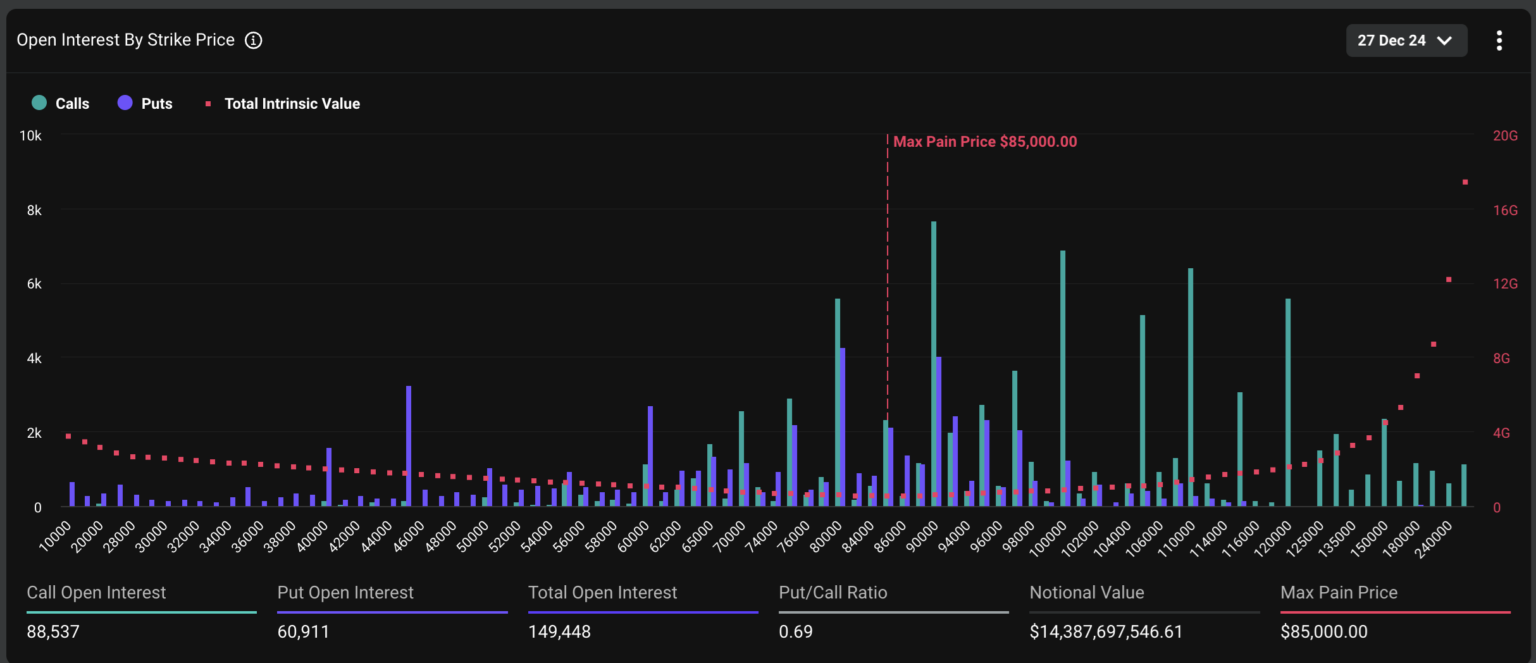

The Upcoming Expiry and its Potential Impact

Several major Bitcoin and Ethereum options expiry dates are approaching, with a significant concentration of contracts expiring in [Insert Specific Dates/Periods Here]. The total notional value of these expiring contracts is estimated to be in the billions of dollars. Such large expirations can significantly influence market price due to:

- High open interest nearing expiry dates: A large number of outstanding contracts create potential for substantial buying or selling pressure as traders close their positions.

- Potential for large-scale buying or selling pressure: Depending on market sentiment and the price of the underlying asset relative to the strike price, a wave of buying or selling can drastically affect the price.

- Impact on market liquidity: A sudden influx of sell orders might temporarily reduce market liquidity, leading to increased price volatility.

Historical examples demonstrate that large option expirations have often been associated with significant price swings. Sometimes this results in sharp price surges, other times in crashes, and occasionally, the price remains relatively unchanged. Scenarios range from a sharp increase in price if many call options are in the money to a sharp decrease if many put options are in the money.

Factors Influencing Market Volatility Beyond Options Expiry

Market volatility isn't solely driven by options expiry. Several other factors can significantly contribute:

- Regulatory news: Government announcements and regulations concerning cryptocurrencies can drastically impact investor sentiment and price.

- Macroeconomic events: Global economic events, like inflation rates or interest rate changes, can influence overall investor risk appetite, affecting crypto markets.

- Bitcoin halving: The halving event, reducing Bitcoin's block reward, can impact its scarcity and price.

- Technological developments in Ethereum: Major upgrades to the Ethereum network, like the transition to proof-of-stake, can affect its price and market dynamics.

These factors interact with option expiry events. For example, if negative regulatory news coincides with a large options expiry, the combined effect could lead to amplified downward pressure on prices.

Analyzing Historical Data and Market Trends

Analyzing historical data from past option expiry events reveals a correlation between expiry dates and price movement in Bitcoin and Ethereum. However, predicting the exact impact with certainty remains challenging. While historical data provides valuable insights, it’s crucial to remember that past performance isn't indicative of future results. Predictive models offer potential insights, but their accuracy is limited due to the complexity of the crypto market and the multitude of influencing factors.

- Correlation between option expiry and price movement in historical data: Statistical analysis can reveal trends but not guarantee future outcomes.

- Statistical analysis of past events: This helps identify patterns but cannot eliminate uncertainty.

Strategies for Navigating Market Volatility

Navigating the potential volatility requires a robust risk management strategy:

- Hedging strategies using options: Investors can use options to hedge against potential price drops or capitalize on price increases.

- Diversification across different crypto assets: Spreading investments across various cryptocurrencies can reduce overall portfolio risk.

- Importance of risk management in volatile markets: Careful position sizing and stop-loss orders are essential to limit potential losses.

Investors with a higher risk tolerance might consider short-term trading strategies around expiry dates, aiming to profit from price fluctuations. Conversely, long-term investors might choose to hold their positions and ride out the volatility.

Conclusion: Bitcoin and Ethereum Options: Preparing for Market Volatility

The upcoming expiry of billions of dollars in Bitcoin and Ethereum options presents a significant potential for market volatility. While predicting the precise impact is impossible, understanding the mechanics of options contracts, analyzing historical trends, and implementing sound risk management strategies are crucial for navigating this period. Remember that various factors beyond options expiry contribute to market fluctuations.

Stay informed about the upcoming Bitcoin and Ethereum options expirations and develop a robust strategy to manage your portfolio during this period of heightened market volatility. Continue researching and exploring different options trading strategies to refine your approach and make informed decisions. The cryptocurrency market offers both significant opportunities and substantial risks; effective risk management is paramount.

Featured Posts

-

The Ripple Effect Assessing Xrps Potential For Long Term Growth And Financial Freedom

May 08, 2025

The Ripple Effect Assessing Xrps Potential For Long Term Growth And Financial Freedom

May 08, 2025 -

Futbolli Luis Enrique Ben Pastrimin Ne Psg Largohen Pese Yje

May 08, 2025

Futbolli Luis Enrique Ben Pastrimin Ne Psg Largohen Pese Yje

May 08, 2025 -

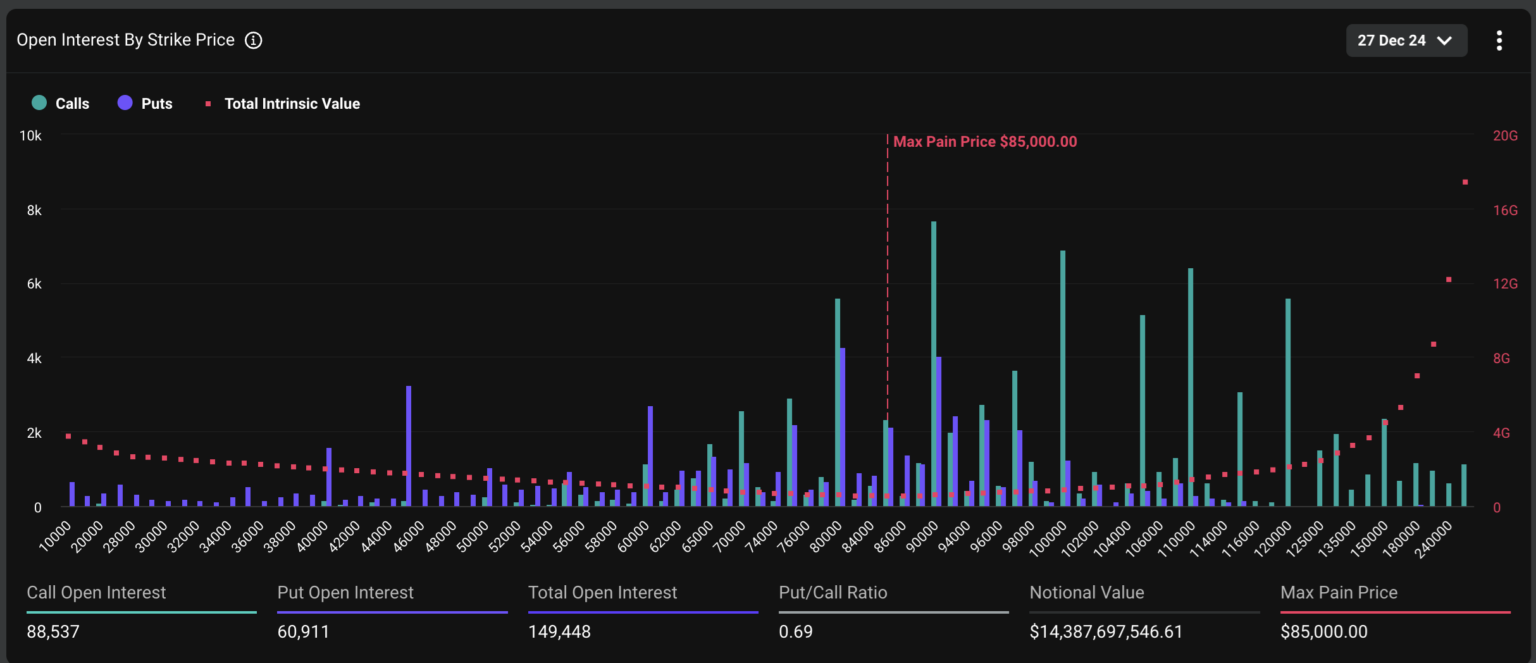

Catholic Church Conclave A New Pope To Be Chosen

May 08, 2025

Catholic Church Conclave A New Pope To Be Chosen

May 08, 2025 -

The Long Journey Back To Yavin 4 A Star Wars Production Perspective

May 08, 2025

The Long Journey Back To Yavin 4 A Star Wars Production Perspective

May 08, 2025 -

Check Your Entitlement Universal Credit Hardship Payment Refunds

May 08, 2025

Check Your Entitlement Universal Credit Hardship Payment Refunds

May 08, 2025