Bitcoin Golden Cross: A Once-a-Cycle Event And Its Implications

Table of Contents

Understanding the Bitcoin Golden Cross: A Technical Deep Dive

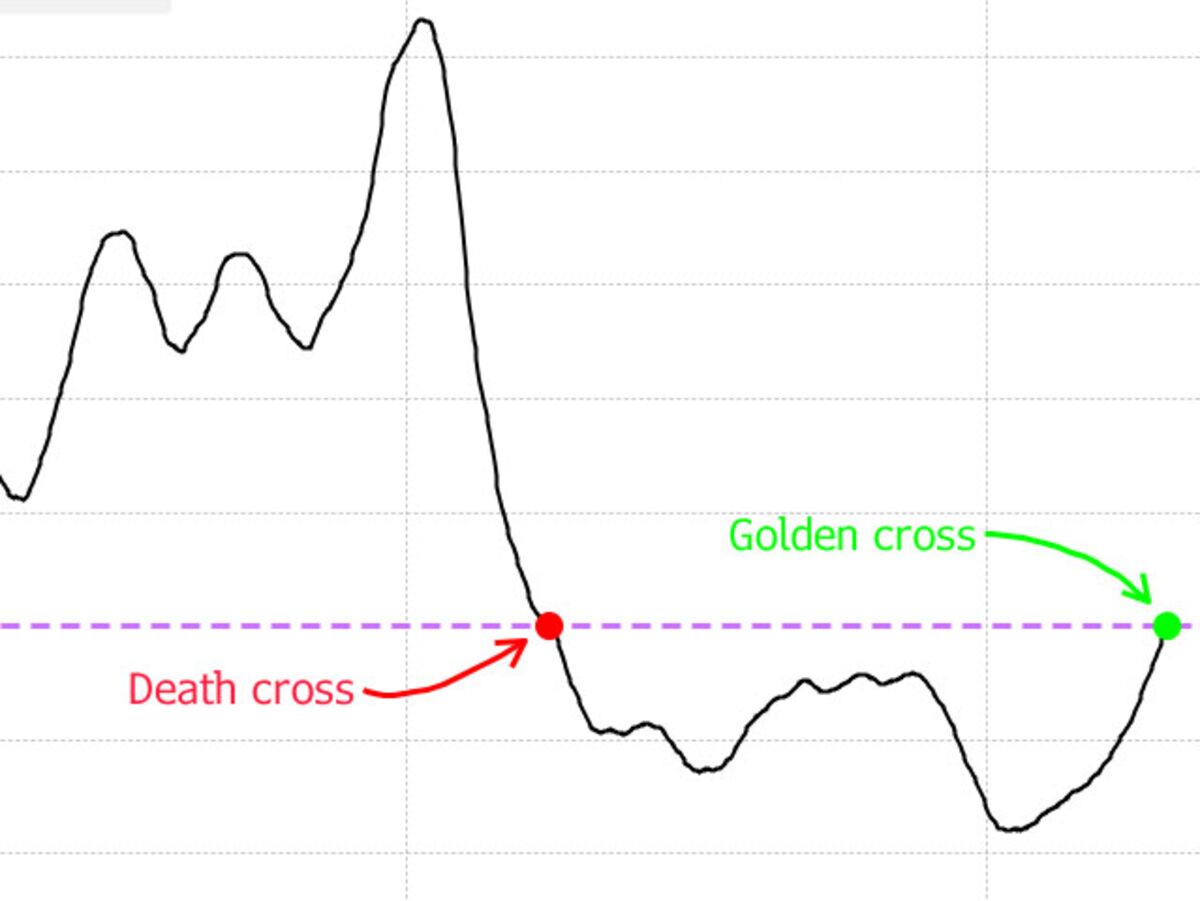

Technical analysis uses various indicators to predict future price movements. Two crucial components of this analysis are the 50-day and 200-day moving averages. The 50-day MA represents short-term price trends, while the 200-day MA reflects long-term trends. A "Golden Cross" occurs when the faster-moving 50-day MA crosses above the slower 200-day MA. This crossover is considered a bullish signal, suggesting a potential shift from a bearish to a bullish market.

[Insert a chart here clearly depicting a Golden Cross formation]

The bullish sentiment stems from the interpretation that the short-term trend is now exceeding the long-term trend, indicating growing positive momentum.

- Significance of Short-Term and Long-Term Trends: The intersection of these MAs suggests a potential change in market sentiment, with buyers gaining dominance over sellers.

- Potential for Sustained Price Increase: Historically, Golden Crosses have often preceded periods of increased Bitcoin prices. However, it's crucial to remember this is not a guarantee.

- Limitations of the Golden Cross: Relying solely on the Golden Cross for investment decisions is risky. It should be used in conjunction with other technical indicators and fundamental analysis.

Historical Occurrences of the Bitcoin Golden Cross: Lessons from the Past

Examining past Bitcoin Golden Cross events reveals valuable insights. While not every occurrence has resulted in a massive price surge, a clear pattern of increased bullish activity emerges.

- Specific Dates and Price Data: [Insert a table here detailing dates of past Golden Cross events, subsequent price movements, and duration of the bullish trend. Include percentage changes for clarity].

- Market Context: Analyzing the surrounding market conditions – regulatory changes, Bitcoin adoption rates, macroeconomic factors (like inflation or economic recessions) – provides a more comprehensive understanding of the Golden Cross's impact. For example, a Golden Cross during a period of widespread cryptocurrency adoption might lead to a more significant price increase than one during a period of regulatory uncertainty.

- Variability in Price Response: The magnitude and duration of price increases after a Golden Cross have varied considerably. This highlights the importance of considering other factors beyond just the Golden Cross itself.

Implications and Potential Outcomes of a Bitcoin Golden Cross

A Bitcoin Golden Cross doesn't guarantee a specific price movement, but it significantly alters the market sentiment.

- Potential Price Scenarios: Following a Golden Cross, we might see a gradual, sustained price increase, a sharp spike followed by consolidation, or even a temporary surge followed by a pullback. Understanding these possibilities is crucial for effective Bitcoin price prediction.

- Implications for Investors: Short-term traders may look for opportunities to enter positions, while long-term holders may see it as confirmation of an ongoing uptrend.

- Risks and Downsides: Investing solely based on the Golden Cross is extremely risky. Market conditions can change rapidly, invalidating technical indicators.

- Alternative Indicators and Fundamental Analysis: Supplementing the Golden Cross with other technical indicators (like RSI, MACD) and fundamental analysis (assessing Bitcoin's underlying technology and adoption) provides a more robust investment strategy.

- Other Relevant Factors: Mining difficulty adjustments, Bitcoin halving events, and overall market sentiment all play crucial roles in Bitcoin's price.

Strategic Approaches for Navigating the Bitcoin Golden Cross

The Bitcoin Golden Cross should be viewed as one piece of a larger puzzle. Actionable strategies should incorporate risk management and individual investment goals.

- Entry and Exit Points: Traders might consider setting entry points slightly above the Golden Cross confirmation, using stop-loss orders to limit potential losses. Exit strategies should be planned based on other indicators or price targets.

- Position Sizing and Stop-Loss Orders: Never invest more than you can afford to lose. Stop-loss orders help minimize losses if the price moves against your prediction.

- Further Research and Due Diligence: Before making any investment decisions, thoroughly research the Bitcoin Golden Cross and its implications. Consult with financial advisors if necessary.

Capitalizing on the Bitcoin Golden Cross – A Call to Action

The Bitcoin Golden Cross is a significant technical indicator, but it's not a crystal ball. Historical data suggests a potential for increased Bitcoin prices following a Golden Cross, but the extent and duration are unpredictable. Successful Bitcoin Golden Cross trading and investment requires a comprehensive approach, incorporating diverse analytical tools and a robust risk management strategy. Conduct thorough research into the Bitcoin Golden Cross, considering both its potential benefits and inherent risks. Develop a well-informed Bitcoin Golden Cross strategy that aligns with your personal risk tolerance and investment goals. The Bitcoin Golden Cross can be a valuable tool in your Bitcoin Golden Cross investment journey, but only with careful planning and execution.

Featured Posts

-

2025 Ptt Personel Alim Tarihleri Kpss Ile Veya Kpsssiz Basvuru

May 08, 2025

2025 Ptt Personel Alim Tarihleri Kpss Ile Veya Kpsssiz Basvuru

May 08, 2025 -

Psg Nin Nantes Karsisindaki Berabere Sonucu Detayli Inceleme

May 08, 2025

Psg Nin Nantes Karsisindaki Berabere Sonucu Detayli Inceleme

May 08, 2025 -

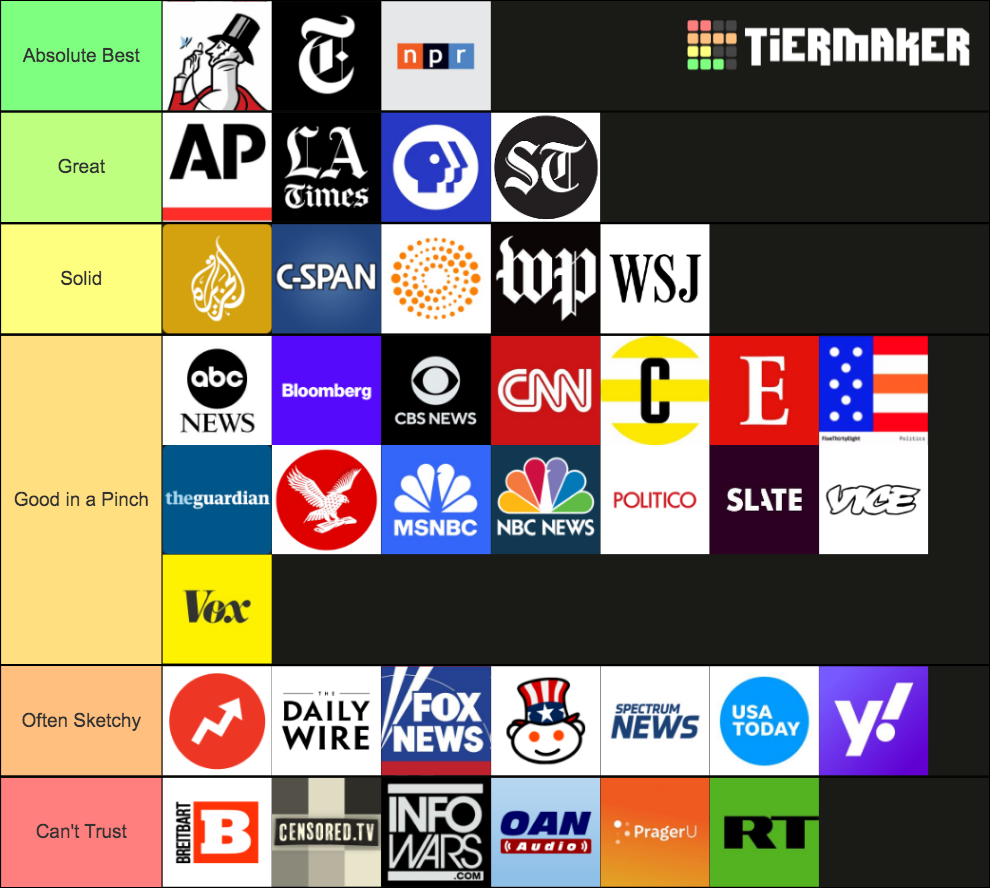

Finding Truth In Crypto The Growing Need For Reliable News

May 08, 2025

Finding Truth In Crypto The Growing Need For Reliable News

May 08, 2025 -

Liga De Quito Y Flamengo Igualan En Emocionante Encuentro De Libertadores

May 08, 2025

Liga De Quito Y Flamengo Igualan En Emocionante Encuentro De Libertadores

May 08, 2025 -

Zielinskis Calf Injury Inter Milan Midfielder Faces Weeks Out

May 08, 2025

Zielinskis Calf Injury Inter Milan Midfielder Faces Weeks Out

May 08, 2025