Bitcoin Mining Hashrate: Explaining The Recent Increase

Table of Contents

Factors Contributing to the Increased Bitcoin Mining Hashrate

Several interconnected factors have driven the recent increase in Bitcoin's mining hashrate. Let's examine the key contributors:

Increased Miner Adoption

A significant influx of new miners has joined the Bitcoin network, boosting the overall hashrate. This increase is fueled by several factors:

-

Lower Electricity Costs: Regions with abundant and cheap hydropower or other renewable energy sources, such as parts of Kazakhstan, the United States (specifically areas with low-cost hydro power), and some regions of China before the mining ban, offer significant cost advantages to Bitcoin miners. These lower operational expenses make mining more profitable. The reduced cost of electricity directly impacts the profitability of mining operations and encourages participation.

-

Improved Mining Hardware Efficiency (ASICs): Advancements in Application-Specific Integrated Circuit (ASIC) technology have led to the development of significantly more efficient mining hardware. These new ASICs boast higher hash rates per unit of power consumed, making mining more profitable even with fluctuating electricity prices. The release of new, more powerful ASICs regularly disrupts the market, forcing older hardware to become less competitive and driving miners to upgrade.

-

Increased Institutional Investment: Institutional investors, including large corporations and investment funds, are increasingly allocating capital to Bitcoin mining operations. This influx of capital allows for the creation of large-scale mining farms with substantial computing power, adding significantly to the network's overall hashrate.

Technological Advancements

Beyond hardware, technological advancements in software and related infrastructure play a critical role.

-

Release of New, More Efficient ASIC Miners: Companies like Bitmain and MicroBT continuously release new ASIC miners with increased hash rates and improved energy efficiency. These improvements enable miners to maximize their returns while reducing their environmental impact.

-

Development of Improved Mining Software and Pools: Sophisticated mining software and pool management systems optimize mining efficiency, minimizing downtime and maximizing profitability. Pools also play a key role in coordinating and aggregating the mining power of individual miners.

-

Advancements in Cooling Technology: Efficient cooling systems are essential for maintaining the optimal operating temperature of mining hardware. Advancements in this area, such as improved liquid cooling methods, allow miners to push their hardware to higher hash rates without risking overheating and damage.

Bitcoin Price Appreciation

The price of Bitcoin has a direct correlation with mining profitability.

-

Higher Bitcoin Price Incentivizes More Miners: When the price of Bitcoin rises, the revenue generated from mining increases, making it more attractive for individuals and businesses to enter the market. This positive feedback loop accelerates the growth of the Bitcoin mining hashrate.

-

Increased Revenue Compensates for Higher Electricity Costs and Equipment Investments: Even with rising electricity costs and the substantial upfront investment in mining hardware, a higher Bitcoin price ensures that mining operations remain profitable, incentivizing further investment. The relationship between Bitcoin price, difficulty adjustment, and hashrate is complex and dynamic.

(Insert chart or graph illustrating the relationship between Bitcoin price and hashrate if available)

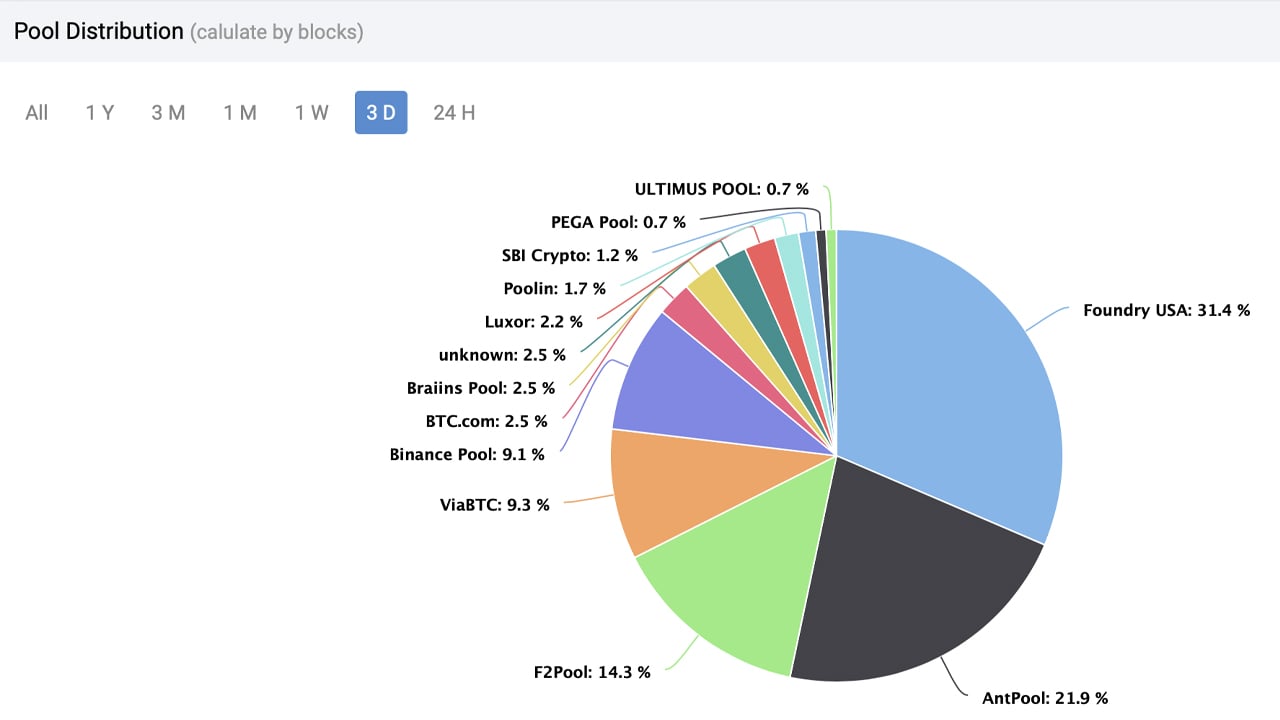

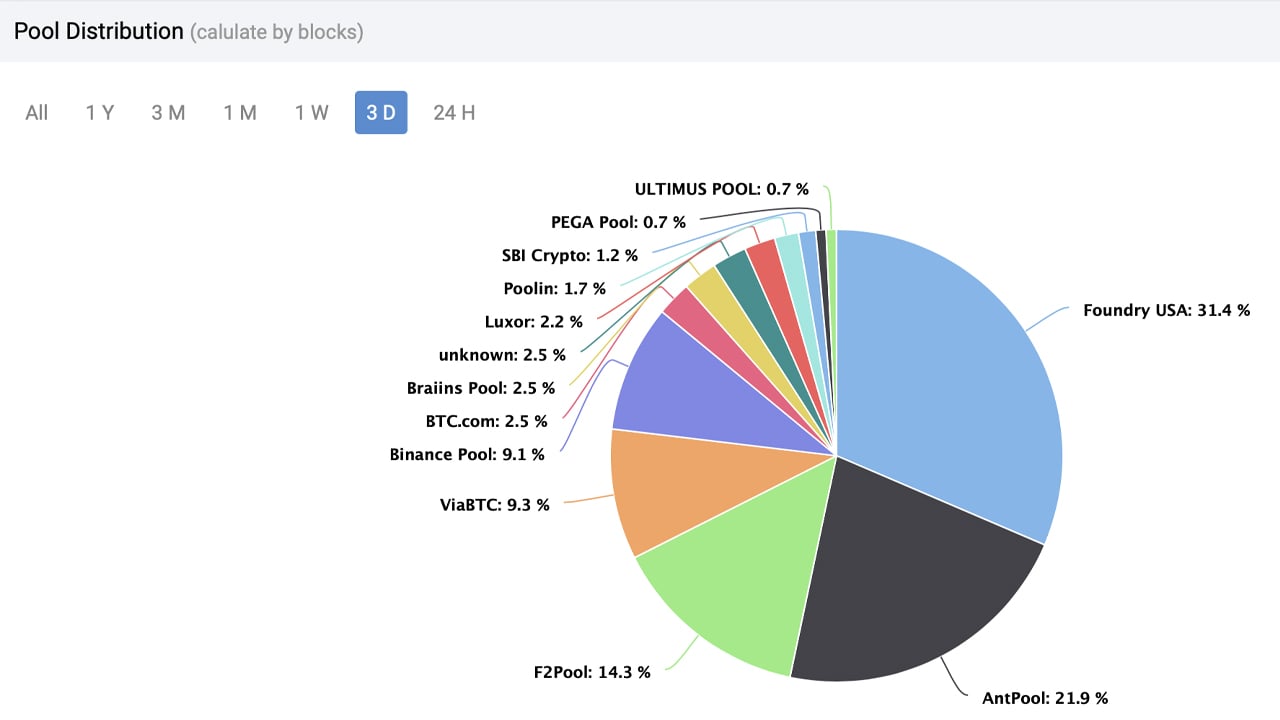

Mining Pool Dynamics

Mining pools play a crucial role in shaping the Bitcoin hashrate.

-

Consolidation of Mining Pools: The consolidation of mining pools means that fewer, larger pools control a more significant percentage of the hashrate. This consolidation can, in some cases, lead to increased efficiency and economies of scale.

-

Improved Pool Infrastructure: Advancements in pool infrastructure, including improved network connectivity and software, contribute to better overall mining efficiency.

-

Competition Among Pools Driving Efficiency: Competition among mining pools can incentivize them to improve their services and offer more competitive fees and mining rewards, leading to increased participation and consequently, higher overall hashrate.

Implications of the Increased Bitcoin Mining Hashrate

The significant rise in Bitcoin's mining hashrate has profound implications for the network and its ecosystem.

Enhanced Network Security

The increased hashrate significantly strengthens the Bitcoin network's security.

-

Increased Difficulty of Manipulating the Blockchain: A higher hashrate makes it exponentially more difficult for attackers to perform a 51% attack, where a malicious actor controls over half of the network's computing power to manipulate the blockchain.

-

Improved Resistance to Malicious Attacks: The enhanced security translates into a more resilient and trustworthy network, bolstering confidence among users and investors.

Potential Impact on Bitcoin Price

The impact of the increased hashrate on Bitcoin's price is complex and multifaceted.

-

Increased Security Could Boost Investor Confidence: The enhanced security resulting from the increased hashrate can positively impact investor sentiment, potentially leading to price appreciation.

-

Increased Energy Consumption Concerns: However, the increased energy consumption associated with a higher hashrate raises environmental concerns, which could negatively affect investor perception and potentially put downward pressure on the price. This is a key ongoing debate in the crypto community.

Environmental Concerns

The environmental impact of Bitcoin mining remains a significant concern.

-

Increased Energy Consumption: The surge in hashrate inevitably leads to an increase in overall energy consumption. This raises environmental concerns, particularly if mining operations rely heavily on fossil fuels.

-

Potential Solutions Like Renewable Energy Adoption: The industry is actively exploring and implementing solutions such as transitioning to renewable energy sources for mining operations to mitigate the environmental impact.

Conclusion

The recent surge in Bitcoin mining hashrate is a multifaceted phenomenon driven by a combination of increased miner adoption, technological advancements, Bitcoin price appreciation, and mining pool dynamics. This increase significantly enhances the network's security, potentially impacting Bitcoin's price. However, the associated environmental concerns necessitate the adoption of sustainable energy solutions. Understanding the dynamics of the Bitcoin mining hashrate is crucial for navigating the ever-evolving cryptocurrency landscape. Stay tuned for further updates on this vital metric and its influence on the future of Bitcoin, including analysis of Bitcoin hashrate trends and the impact of Bitcoin hashrate analysis on investment strategies.

Featured Posts

-

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025 -

Young Thugs Back Outside Album What We Know So Far

May 09, 2025

Young Thugs Back Outside Album What We Know So Far

May 09, 2025 -

New Uk Visa Policy Potential Restrictions For Pakistan Nigeria And Sri Lanka

May 09, 2025

New Uk Visa Policy Potential Restrictions For Pakistan Nigeria And Sri Lanka

May 09, 2025 -

The Future Of Apple Navigating The Ai Revolution

May 09, 2025

The Future Of Apple Navigating The Ai Revolution

May 09, 2025 -

Why Bitcoin Mining Activity Exploded This Week

May 09, 2025

Why Bitcoin Mining Activity Exploded This Week

May 09, 2025