Bitcoin Mining Power: Exploring The Recent Uptrend

Table of Contents

Factors Contributing to the Uptrend in Bitcoin Mining Power

Several key factors have converged to propel Bitcoin mining power to new heights. These include increased institutional investment, advancements in mining hardware, growing adoption and price appreciation, and geographic shifts in mining activity.

Increased Institutional Investment

Large-scale mining operations and institutional investors are playing a significant role in boosting Bitcoin's hash rate. The entry of major players into the Bitcoin mining space signifies a growing level of confidence and institutional acceptance.

- Examples: Companies like MicroStrategy and Tesla have made substantial investments in Bitcoin, indirectly supporting the mining ecosystem by increasing demand and stability.

- Impact: These large-scale mining farms possess immense computing power, significantly contributing to the overall hash rate and network security. Their consistent operation ensures a stable and reliable network.

- Influence: Institutional investment fosters stability and reduces volatility within the mining sector, making it more attractive to other investors and miners. This increased "Institutional Bitcoin mining" is a major driver of the uptrend.

Advancements in Mining Hardware

The development of increasingly efficient and powerful ASIC (Application-Specific Integrated Circuit) miners is another key driver of the increased hash rate. These specialized chips are designed solely for Bitcoin mining, leading to significant improvements in efficiency and profitability.

- ASIC Manufacturers: Companies like Bitmain and Canaan continue to release new generations of ASIC miners with enhanced hashing power and improved energy efficiency.

- Improvements: Newer ASIC miners boast significantly higher hash rates per unit of power consumed, making Bitcoin mining more profitable even with fluctuating Bitcoin prices.

- Impact on Profitability: "Bitcoin ASIC miners" with higher efficiency translate directly to increased profitability for miners, incentivizing further investment and expansion of mining operations. This increased efficiency is a major factor in the recent uptrend in Bitcoin mining power.

Growing Adoption and Price Appreciation

The relationship between Bitcoin's price, increased adoption, and mining profitability is undeniable. A higher Bitcoin price directly increases the incentive for miners to join the network.

- Correlation: Historically, there's a strong positive correlation between Bitcoin's price and its hash rate. As the price rises, so does the profitability of mining, attracting new miners and boosting the overall hash rate.

- Transaction Fees: Increased transaction volume on the Bitcoin network leads to higher transaction fees, providing an additional revenue stream for miners, further incentivizing participation.

- Network Effects: The growth in "Bitcoin adoption" creates a positive feedback loop. More users mean more transactions, higher fees, and increased demand for Bitcoin, driving up the price and attracting more miners.

Geographic Shifts in Mining Activity

Regulatory changes and energy costs play a crucial role in determining the geographic distribution of Bitcoin mining activity. Some regions are experiencing significant growth while others see a decline.

- Regional Growth: Countries with low electricity costs and favorable regulatory environments, like Kazakhstan and parts of the United States, have witnessed a surge in Bitcoin mining activity.

- Energy Costs: The cost of electricity is a critical factor influencing "energy costs for Bitcoin mining" profitability. Regions with cheaper energy sources are naturally more attractive to miners.

- Regulatory Impact: "Bitcoin mining regulations" vary widely across jurisdictions. Some countries have embraced Bitcoin mining, while others have imposed restrictions or outright bans, impacting the global distribution of mining power.

Implications of the Increased Bitcoin Mining Power

The dramatic increase in Bitcoin mining power has significant implications for the network's security, decentralization, and the environment.

Enhanced Network Security

A higher hash rate strengthens Bitcoin's security, making it exponentially more difficult for malicious actors to launch attacks like 51% attacks.

- Hash Rate and Security: The hash rate represents the collective computing power securing the Bitcoin network. A higher hash rate means a more robust and resilient network.

- Difficulty Adjustment: Bitcoin's difficulty adjustment mechanism automatically adjusts the difficulty of mining to maintain a consistent block generation time, ensuring network stability even with fluctuating hash rate.

- 51% Attack Resistance: The vastly increased "Bitcoin network security" due to the high hash rate makes a 51% attack – where a single entity controls more than half of the network's computing power – virtually impossible.

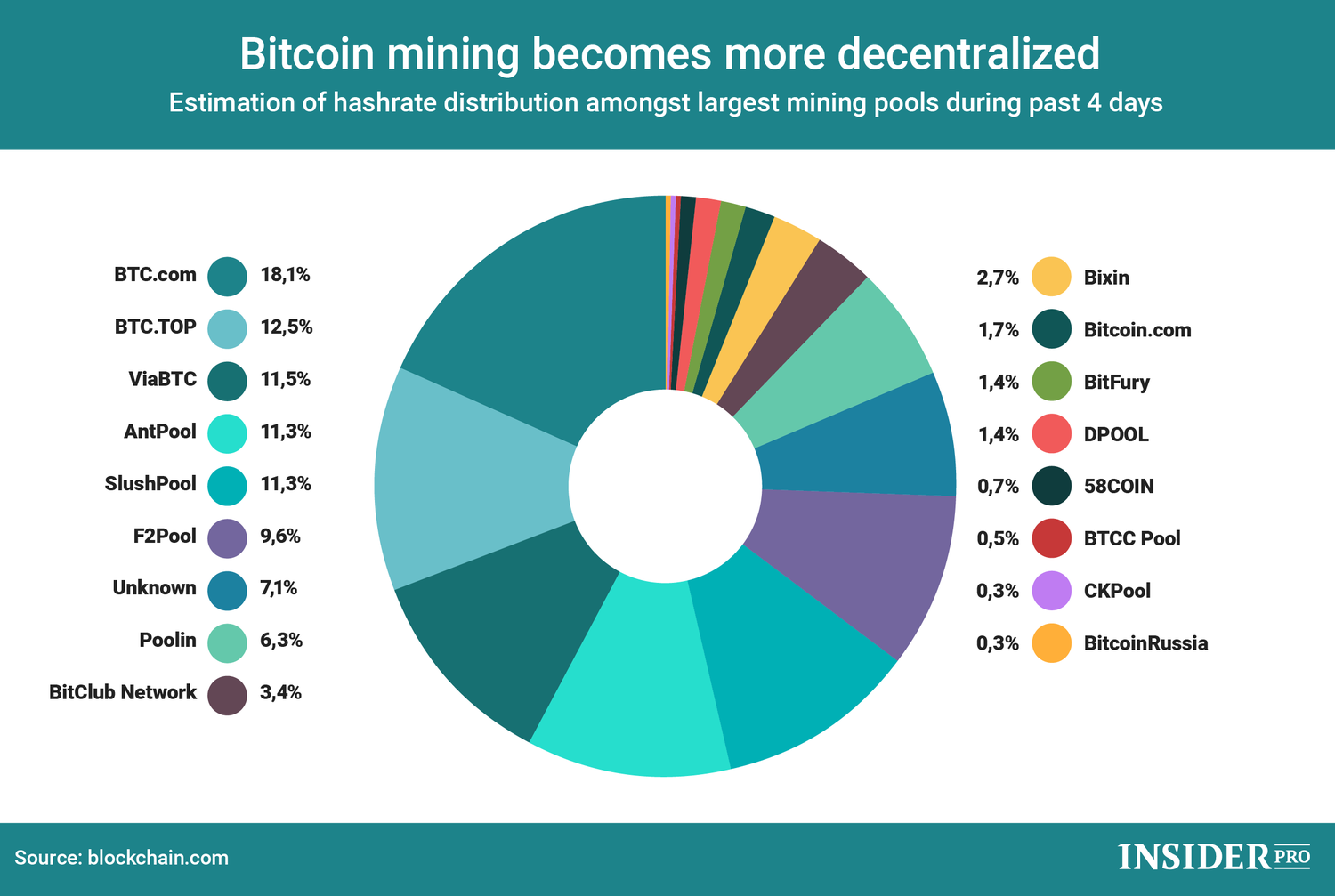

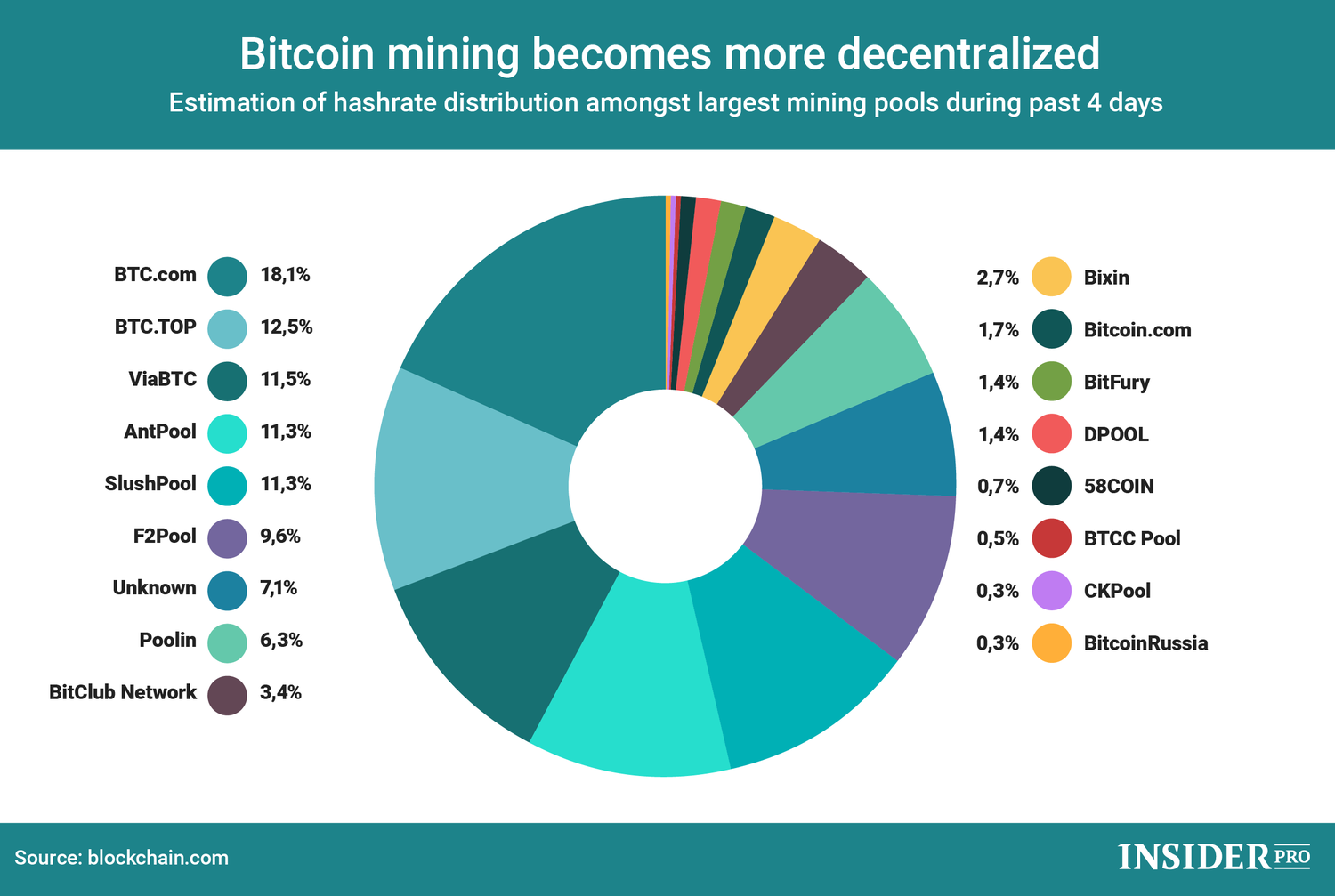

Decentralization Debate

While increased mining power enhances security, it also raises concerns about decentralization. The concentration of mining power in specific regions or entities could potentially threaten the network's decentralized nature.

- Mining Centralization: The dominance of a few large mining pools raises concerns about the potential for centralization and the risk of manipulation.

- Decentralized Mining: Maintaining a diverse and geographically distributed network of miners is crucial to preserving Bitcoin's decentralized ethos.

- Bitcoin Mining Pools: While mining pools offer advantages like increased efficiency and profitability for smaller miners, their consolidation could pose a risk to the network's decentralization. The ongoing debate regarding "Bitcoin decentralization" and its preservation is critical.

Environmental Considerations

The energy consumption of Bitcoin mining remains a significant environmental concern. However, ongoing efforts are focused on implementing more sustainable practices.

- Bitcoin Mining Energy Consumption: The high energy consumption associated with Bitcoin mining is a major point of criticism.

- Renewable Energy: Increasingly, miners are adopting renewable energy sources like solar and hydro to reduce their carbon footprint. Initiatives promoting "renewable energy for Bitcoin mining" are gaining traction.

- Sustainable Bitcoin Mining: The industry is actively exploring solutions to minimize the environmental impact of mining, including improved energy efficiency and the adoption of cleaner energy sources.

Conclusion

The recent uptrend in Bitcoin mining power is a multifaceted phenomenon driven by institutional investment, hardware advancements, growing adoption, and geographic shifts. This surge significantly enhances network security but also raises important questions about decentralization and environmental sustainability. Understanding "Bitcoin mining power" and its various implications is vital for navigating the evolving landscape of this crucial aspect of the Bitcoin ecosystem. Stay informed about the evolving landscape of Bitcoin mining power and its implications for the future of Bitcoin. Continue your research to deepen your understanding of this crucial aspect of the Bitcoin ecosystem.

Featured Posts

-

Psg Nantes Berabere Kaldi Macin Oezeti Ve Analizi

May 08, 2025

Psg Nantes Berabere Kaldi Macin Oezeti Ve Analizi

May 08, 2025 -

Who Could Replace Taj Gibson On The Charlotte Hornets

May 08, 2025

Who Could Replace Taj Gibson On The Charlotte Hornets

May 08, 2025 -

Jugadores De Flamengo Y Botafogo Protagonizan Violenta Batalla Campal

May 08, 2025

Jugadores De Flamengo Y Botafogo Protagonizan Violenta Batalla Campal

May 08, 2025 -

New Psg Labs In Doha Signal Global Innovation Push

May 08, 2025

New Psg Labs In Doha Signal Global Innovation Push

May 08, 2025 -

Xrps Future The Role Of Etfs And The Secs Influence On Price And Adoption

May 08, 2025

Xrps Future The Role Of Etfs And The Secs Influence On Price And Adoption

May 08, 2025