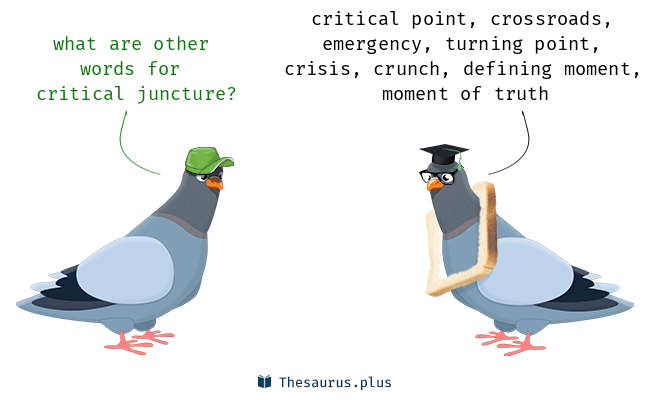

Bitcoin Price Analysis: A Critical Juncture And Crucial Levels

Table of Contents

Current Market Sentiment and Indicators

Currently, the market sentiment surrounding Bitcoin is cautiously optimistic. While recent news of [insert recent relevant news, e.g., regulatory developments or institutional adoption] has injected some bullishness, lingering macroeconomic uncertainties temper overall investor confidence. Social media sentiment is mixed, with both bullish and bearish narratives circulating. To gain a clearer picture, we need to analyze key technical indicators:

-

Moving Averages (MA): The 50-day moving average (MA) is currently [insert current value and position relative to the price], while the 200-day MA sits at [insert current value]. A bullish crossover (50-day MA crossing above the 200-day MA) would signal a strong upward trend, while the opposite suggests bearish momentum. [Insert chart showing 50-day and 200-day MAs]

-

Relative Strength Index (RSI): The RSI is currently at [insert current value]. Readings above 70 generally indicate overbought conditions, suggesting a potential price correction, while readings below 30 suggest oversold conditions, potentially signaling a price bounce. [Insert chart showing RSI]

-

MACD (Moving Average Convergence Divergence): The MACD histogram is currently [insert current state – e.g., above the zero line, indicating bullish momentum, or below, indicating bearish momentum]. A bullish divergence (price making lower lows while the MACD forms higher lows) can be a strong bullish signal. [Insert chart showing MACD]

Crucial Support and Resistance Levels

Identifying key support and resistance levels is crucial for predicting potential price movements. These levels represent psychological barriers for traders, often leading to buying or selling pressure at specific price points. Based on historical price action and technical analysis, we've identified the following crucial levels for Bitcoin:

-

Level 1: $20,000: This level represents a significant psychological support level and a previous price floor. A break below this level could trigger a more substantial price decline, potentially leading to further selling pressure.

-

Level 2: $25,000: This acts as a key resistance level. A decisive break above this level could signal a renewed bullish trend, potentially leading to further price increases. [Insert chart highlighting these levels]

-

Level 3: $30,000: This is a strong psychological resistance level, representing a previous all-time high for many investors. Overcoming this level would be a significant bullish signal, potentially opening the path to higher price targets. [Insert chart highlighting these levels]

Potential Catalysts for Price Movement

Several factors could significantly influence Bitcoin's price in the coming weeks and months:

-

Regulatory Developments: Changes in Bitcoin regulations in major economies could dramatically impact investor sentiment and price. Positive news could lead to increased adoption and price appreciation, while negative news could trigger selling pressure.

-

Institutional Adoption: Increased investment from institutional players, such as hedge funds and corporations, would inject significant capital into the market, potentially driving prices higher.

-

Macroeconomic Factors: Global inflation rates, interest rate hikes, and overall economic uncertainty significantly impact the cryptocurrency market. A global economic downturn could lead to Bitcoin price declines, while economic stability could support higher prices.

-

Technological Advancements: Upgrades to the Bitcoin network, like Lightning Network improvements, enhance scalability and efficiency, potentially boosting investor confidence and driving price appreciation.

-

Bitcoin Halving: The upcoming Bitcoin halving event [mention date if applicable] is expected to reduce the rate of new Bitcoin creation, potentially creating a scarcity effect that drives up prices.

Risk Assessment and Volatility

Bitcoin is inherently volatile. Investors should always be mindful of the significant risks associated with investing in cryptocurrencies. Risk management strategies, including diversification, position sizing, and stop-loss orders, are crucial to mitigate potential losses. Different investors have different risk tolerances; some might be comfortable with higher risk for potentially higher returns, while others prefer lower-risk, lower-return strategies. Diversification across a variety of asset classes, including both cryptocurrencies and traditional assets, is a prudent approach to managing risk.

Conclusion

This Bitcoin Price Analysis highlights the current critical juncture for Bitcoin. The crucial support and resistance levels identified, combined with an understanding of market sentiment and potential catalysts, provide a framework for navigating the volatile Bitcoin market. While bullish indicators exist, macroeconomic uncertainties and regulatory risks remain. Stay informed on future Bitcoin price movements by regularly checking our updated Bitcoin Price Analysis and make informed decisions based on thorough market research and risk assessment. Understanding crucial levels is key to navigating the volatile world of Bitcoin.

Featured Posts

-

Uk Households Receive Dwp Letters Benefits At Risk

May 08, 2025

Uk Households Receive Dwp Letters Benefits At Risk

May 08, 2025 -

Arsenal News Collymores Pressure Mounts On Arteta

May 08, 2025

Arsenal News Collymores Pressure Mounts On Arteta

May 08, 2025 -

Intelligence Geometrique Des Corneilles Une Analyse Comparee Avec Les Babouins

May 08, 2025

Intelligence Geometrique Des Corneilles Une Analyse Comparee Avec Les Babouins

May 08, 2025 -

The Case For Rogue Avengers Vs X Men

May 08, 2025

The Case For Rogue Avengers Vs X Men

May 08, 2025 -

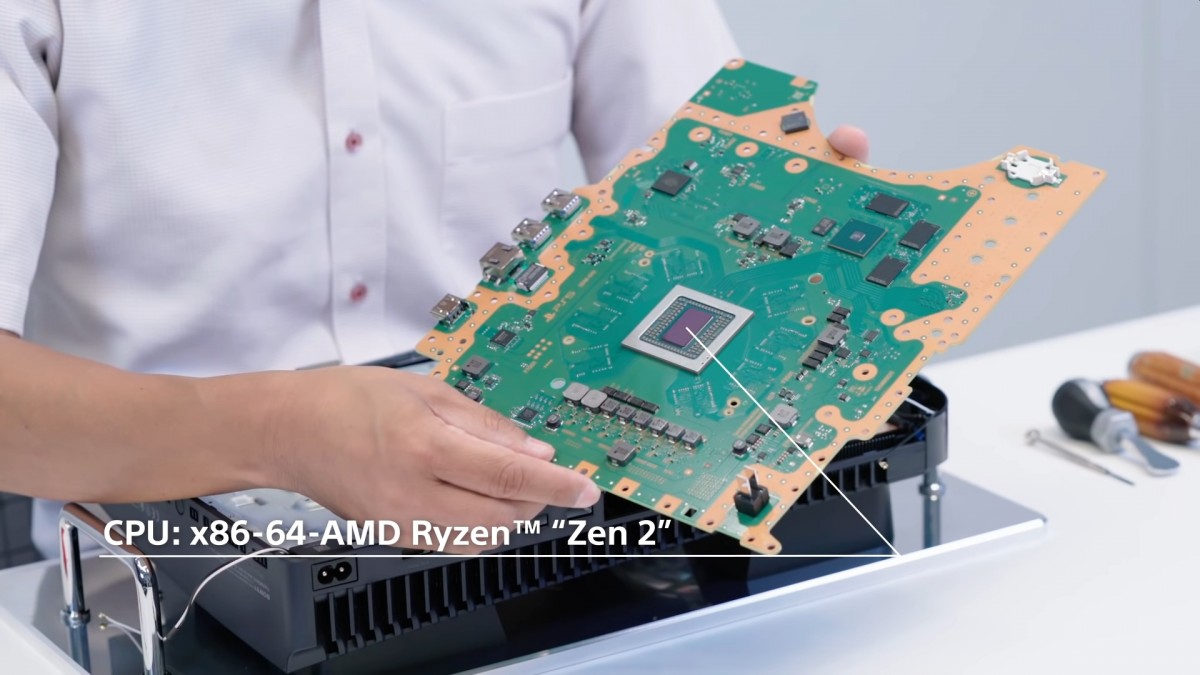

Inside The Ps 5 Pro A Detailed Teardown And Analysis Of Its Liquid Metal Cooling

May 08, 2025

Inside The Ps 5 Pro A Detailed Teardown And Analysis Of Its Liquid Metal Cooling

May 08, 2025