Bitcoin Price Prediction: Analyzing The Potential Of A $100,000 BTC Price After Trump's Speech

Table of Contents

H2: Trump's Speech and its Impact on the Crypto Market

Trump's speeches often carry significant weight in the financial markets, and his recent address was no exception. Understanding its influence on the BTC price prediction requires a careful examination of his statements and their subsequent market reactions.

H3: Analyzing Trump's Statements:

Trump's commentary on several key areas could have indirectly impacted Bitcoin’s value. For example:

- Regulatory stance: Any explicit or implicit mention of cryptocurrency regulation, even if tangential, can trigger market reactions. A positive stance might boost investor confidence, while negative comments could lead to uncertainty.

- Economic policies: Announcements concerning fiscal or monetary policies can indirectly affect Bitcoin's price. For instance, inflationary pressures might increase demand for Bitcoin as a hedge against inflation, pushing the $100,000 Bitcoin price target closer.

- Dollar strength: Trump's comments on the US dollar's strength or weakness could influence Bitcoin's value, as the two are often inversely correlated. A weakening dollar might bolster Bitcoin's appeal.

The immediate market reaction to Trump's speech involved a noticeable price fluctuation. Tracking trading volume during and after the speech provides valuable insight into the immediate market sentiment.

H3: Market Sentiment and Fear, Uncertainty, and Doubt (FUD):

The post-speech market sentiment was a crucial factor influencing the Bitcoin price prediction. Did the speech generate Fear, Uncertainty, and Doubt (FUD), or did it foster confidence?

- Sources of FUD could include ambiguous statements about regulation, concerns about broader economic instability, or even unrelated geopolitical tensions.

- Analyzing trading volumes and price fluctuations immediately following the speech provides valuable data. A significant surge in trading volume coupled with a sharp price increase would suggest confidence, while the opposite might indicate FUD.

H2: Factors Contributing to a Potential $100,000 Bitcoin Price

Reaching a $100,000 Bitcoin price isn't solely reliant on a single event like Trump's speech. Several fundamental factors contribute to this potential scenario:

H3: Adoption and Institutional Investment:

Institutional adoption is a significant driver of Bitcoin's price appreciation.

- Several large corporations and financial institutions have recently invested in Bitcoin, signaling growing acceptance.

- The rise of Bitcoin ETFs and other investment vehicles offers broader access to Bitcoin for institutional investors, further fueling demand. This increased institutional interest strongly supports a positive BTC price prediction.

H3: Supply and Demand Dynamics:

Bitcoin's limited supply is a key factor in its potential for price appreciation.

- Halving events, which reduce the rate of new Bitcoin creation, contribute to its scarcity.

- Growing demand from developing countries, where Bitcoin offers an alternative to unstable fiat currencies, further strengthens the argument for a higher Bitcoin price prediction.

H3: Technological Advancements:

Technological improvements enhance Bitcoin's efficiency and usability, driving adoption.

- The Lightning Network and other second-layer scaling solutions address scalability concerns, improving transaction speeds and reducing fees.

- These advancements enhance Bitcoin's usability and make it more attractive to a wider range of users, contributing to a more optimistic Bitcoin price prediction.

H2: Factors That Could Hinder a $100,000 Bitcoin Price

While a $100,000 Bitcoin price is a possibility, several factors could hinder its achievement:

H3: Regulatory Uncertainty:

Global regulatory uncertainty remains a significant hurdle.

- Different countries adopt varying approaches to regulating cryptocurrencies, creating uncertainty for investors.

- Stricter regulations could dampen investor enthusiasm and limit Bitcoin's growth, potentially impacting the BTC price prediction negatively.

H3: Market Volatility and Corrections:

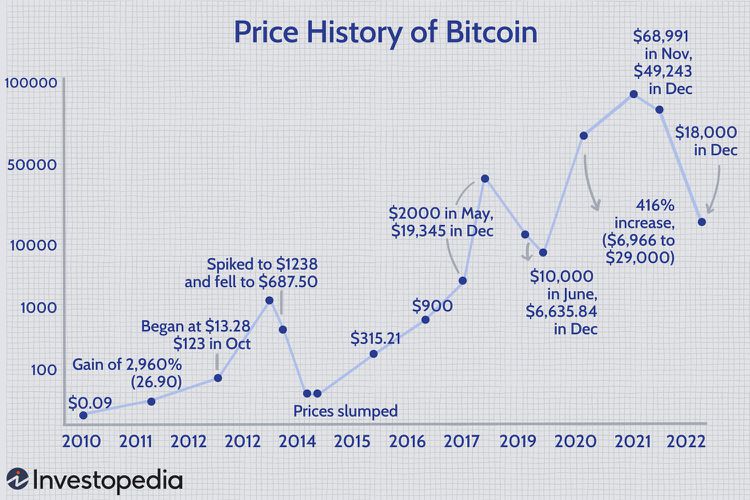

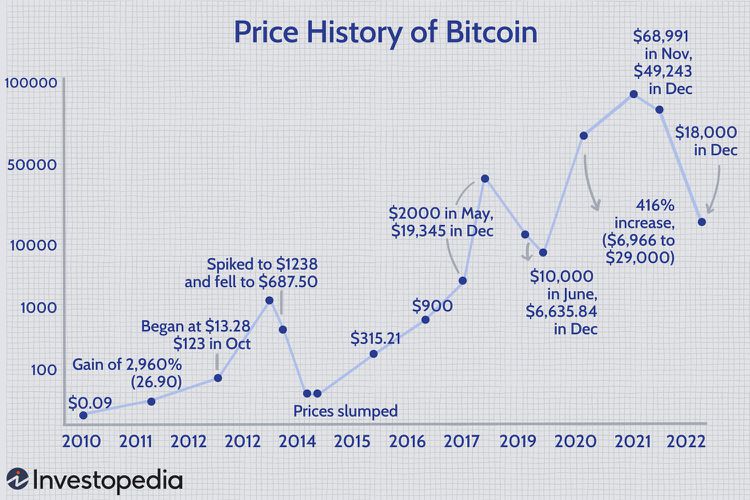

The cryptocurrency market is inherently volatile, and sharp price corrections are common.

- History shows Bitcoin has experienced significant price swings, including substantial corrections.

- Bear markets can erode investor confidence, leading to price declines and hindering the realization of a $100,000 Bitcoin price.

H3: Competition from Altcoins:

Competition from alternative cryptocurrencies presents a challenge to Bitcoin's dominance.

- Several altcoins offer unique features and functionalities, potentially attracting investment away from Bitcoin.

- This competition could impact Bitcoin's market share and, consequently, its price, affecting the overall Bitcoin price prediction.

H3: Conclusion: Bitcoin Price Prediction – The Verdict

Analyzing Trump's speech alongside fundamental factors reveals that a $100,000 Bitcoin price is a possibility, driven by increasing institutional adoption, limited supply, and technological advancements. However, regulatory uncertainty, market volatility, and competition from altcoins present significant challenges. Reaching this ambitious target isn't guaranteed; the cryptocurrency market remains inherently unpredictable. Therefore, a balanced approach is crucial. Stay informed on Bitcoin price prediction and developments, continue to monitor the Bitcoin market, and conduct thorough due diligence before investing in Bitcoin. Remember that any BTC price prediction is inherently speculative, and responsible investment practices always prioritize risk management.

Featured Posts

-

Superman In Minecraft 5 Minute Thailand Theater Preview

May 08, 2025

Superman In Minecraft 5 Minute Thailand Theater Preview

May 08, 2025 -

Discover The Best Ps 5 Exclusives With Ps 5 Pro Enhancements

May 08, 2025

Discover The Best Ps 5 Exclusives With Ps 5 Pro Enhancements

May 08, 2025 -

Saving Private Ryans Reign Ends A New Best War Film

May 08, 2025

Saving Private Ryans Reign Ends A New Best War Film

May 08, 2025 -

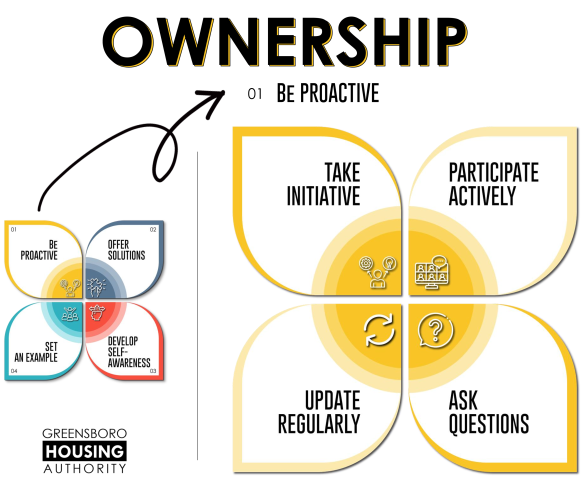

Gha Opposes Jhl Privatization Plan

May 08, 2025

Gha Opposes Jhl Privatization Plan

May 08, 2025 -

Bitcoin Seoul 2025 Shaping The Future Of Bitcoin In Asia

May 08, 2025

Bitcoin Seoul 2025 Shaping The Future Of Bitcoin In Asia

May 08, 2025