Bitcoin Price Prediction: Can Trump's Policies Push BTC Above $100,000?

Table of Contents

Main Points:

2.1. Trump's Economic Policies and Their Potential Impact on Bitcoin

H3: Fiscal Stimulus and Inflation: A Trump administration might favor expansive fiscal policies, involving increased government spending and potentially tax cuts. This could fuel inflation, eroding the purchasing power of fiat currencies like the US dollar. Bitcoin, often viewed as a hedge against inflation, could see increased demand as investors seek to preserve their wealth. Historically, periods of high inflation have shown a positive correlation with Bitcoin's price growth. For example, the inflation surge in 2021 coincided with Bitcoin reaching its all-time high. However, it's crucial to remember correlation doesn't equal causation; other factors also play a significant role.

- Increased Government Spending: Could lead to higher inflation.

- Inflationary Hedge: Bitcoin's potential appeal as a store of value during inflationary periods.

- Data Points: Analyzing historical data to illustrate the relationship (or lack thereof) between inflation and Bitcoin price.

H3: Regulation and Taxation of Cryptocurrencies: Trump's past statements on cryptocurrency regulation have been mixed. A more favorable regulatory environment could encourage wider adoption, potentially boosting Bitcoin's price. Conversely, stricter regulations or increased taxes could stifle growth and negatively impact its value. The uncertainty surrounding future regulatory decisions adds to the complexity of Bitcoin price prediction.

- Favorable Regulations: Could stimulate increased adoption and investment.

- Unfavorable Regulations: Could hinder growth and decrease investor confidence.

- Regulatory Uncertainty: A key factor adding volatility to Bitcoin price forecasts.

H3: Trade Policies and Global Economic Uncertainty: Trump's "America First" trade policies might lead to increased global economic uncertainty. During times of uncertainty, investors often seek safe haven assets, and Bitcoin, with its decentralized nature, could benefit from this flight to safety. However, trade wars and protectionist measures could also negatively impact global economic growth, potentially dampening demand for risk assets like Bitcoin.

- Global Economic Uncertainty: Can drive investors towards Bitcoin as a safe haven asset.

- Trade Wars: Potential negative impact on global economic growth and Bitcoin demand.

- Historical Examples: Analyzing past instances where economic uncertainty influenced Bitcoin's price.

2.2. Other Factors Influencing Bitcoin Price Prediction

H3: Technological Advancements in the Bitcoin Ecosystem: Technological improvements within the Bitcoin ecosystem are crucial for its long-term viability and price appreciation. Scaling solutions like the Lightning Network enhance transaction speed and reduce fees, improving usability and attracting more users. Institutional adoption, with large corporations and investment firms entering the market, adds legitimacy and stability.

- Lightning Network: Improved scalability and transaction efficiency.

- Institutional Adoption: Increased legitimacy and market stability.

- Bitcoin Upgrades: Enhancements to the underlying technology impacting performance and security.

H3: Global Macroeconomic Conditions: Broader macroeconomic factors significantly influence Bitcoin's price. Global interest rates, economic growth rates, and geopolitical events all play a role. Higher interest rates can reduce the appeal of riskier assets like Bitcoin, while strong economic growth might increase investor confidence and boost demand. Unexpected geopolitical events ("black swan" events) can create extreme volatility.

- Interest Rates: Influence investor appetite for risk assets.

- Economic Growth: Impacts overall investor sentiment and market conditions.

- Geopolitical Events: Potential for extreme market fluctuations.

H3: Market Sentiment and Speculation: Market sentiment, heavily influenced by social media, news coverage, and the actions of "whales" (large Bitcoin holders), can drive significant price swings. Fear of missing out (FOMO) and fear, uncertainty, and doubt (FUD) can create speculative bubbles and rapid price corrections.

- Social Media Influence: Sentiment analysis of social media platforms.

- Whale Activity: Impact of large trades on market price.

- FOMO/FUD: The psychological aspects driving price volatility.

Conclusion: Bitcoin Price Prediction – A Complex Equation

The potential impact of Trump's policies on Bitcoin's price is multifaceted and intertwined with numerous other factors. While a return to power might increase inflation, potentially driving Bitcoin's price higher, his stance on regulation and trade could introduce significant uncertainty. Reaching the $100,000 mark remains highly speculative and depends on a complex interplay of economic, technological, and psychological factors. Thorough research and careful consideration of all these factors are essential before making any investment decisions. Continue researching "Bitcoin price prediction," stay updated on market developments, and form your own informed opinion on Bitcoin's potential to reach $100,000 or beyond. Understanding the intricacies of Bitcoin price prediction is key to navigating this dynamic market.

Featured Posts

-

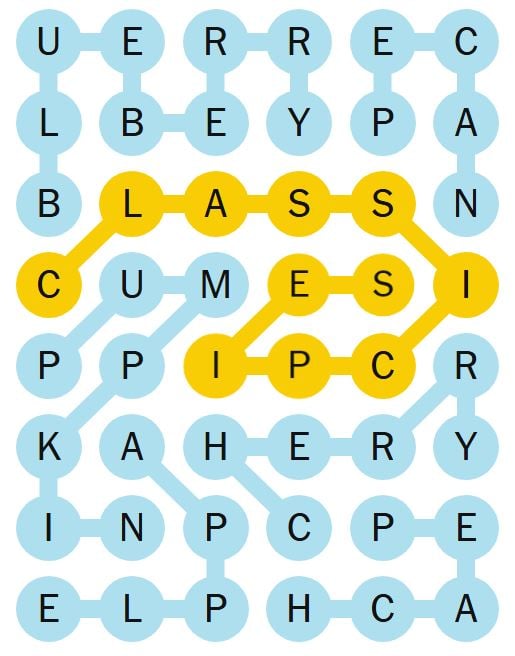

Nyt Strands Game 376 Hints And Solutions For Friday March 14

May 09, 2025

Nyt Strands Game 376 Hints And Solutions For Friday March 14

May 09, 2025 -

Pakistan Stock Market Portal Downtime Reflects Current Geopolitical Climate

May 09, 2025

Pakistan Stock Market Portal Downtime Reflects Current Geopolitical Climate

May 09, 2025 -

Solving The Nyt Strands April 12 2025 A Comprehensive Guide

May 09, 2025

Solving The Nyt Strands April 12 2025 A Comprehensive Guide

May 09, 2025 -

New Report Potential Changes To Uk Visa Application Process

May 09, 2025

New Report Potential Changes To Uk Visa Application Process

May 09, 2025 -

10 Adn Pas Selangor Bantu Mangsa Tragedi Putra Heights Bantuan And Sokongan Dihulurkan

May 09, 2025

10 Adn Pas Selangor Bantu Mangsa Tragedi Putra Heights Bantuan And Sokongan Dihulurkan

May 09, 2025