Bitcoin Price Prediction: Trump's 100-Day Speech And The $100,000 BTC Target

Table of Contents

Trump's Political Actions and Their Historical Impact on Bitcoin

Analyzing Past Presidential Speeches and Bitcoin's Response

Examining past instances where Trump's speeches or announcements significantly affected market sentiment reveals interesting insights into Bitcoin's price reaction. Understanding this historical context is crucial for any Bitcoin price prediction.

- Example 1: Trump's unexpected 2017 announcement on Twitter regarding cryptocurrency regulation saw a short-term dip in Bitcoin's price, followed by a swift recovery. Charts from this period show a brief price correction before resuming its upward trend.

- Example 2: Conversely, periods of heightened political uncertainty during Trump's presidency often led to a flight to safety, potentially boosting Bitcoin's price as investors sought alternative assets. This suggests a correlation between political instability and increased demand for Bitcoin.

- Example 3: Specific policy announcements impacting the US dollar or economic regulations often correlated with shifts in Bitcoin's price, illustrating the cryptocurrency’s sensitivity to macroeconomic factors.

This demonstrates the significant influence of Trump's actions on Bitcoin price reaction, highlighting the intricate relationship between political uncertainty, market volatility, and Trump's influence on crypto.

Economic Policies and Bitcoin's Sensitivity

Trump's economic policies, both fiscal and monetary, have demonstrably impacted Bitcoin's price. This sensitivity stems from several factors:

- Inflationary Pressure: Expansionary fiscal policies could lead to increased inflationary pressure, potentially driving investors towards Bitcoin as a hedge against inflation.

- Regulatory Uncertainty: Changes in regulatory frameworks for cryptocurrencies, directly or indirectly influenced by Trump's administration, introduced periods of uncertainty, affecting investor sentiment and BTC value.

- US Dollar Strength: Fluctuations in the US dollar's strength, often impacted by Trump's economic policies, directly correlate with Bitcoin's price, as it's priced in USD.

The $100,000 Bitcoin Price Prediction: Realistic or Hype?

Factors Contributing to the $100,000 Target

The $100,000 Bitcoin prediction is fueled by several factors:

- Increasing Institutional Adoption: Major financial institutions are increasingly embracing Bitcoin, signifying growing acceptance and legitimization.

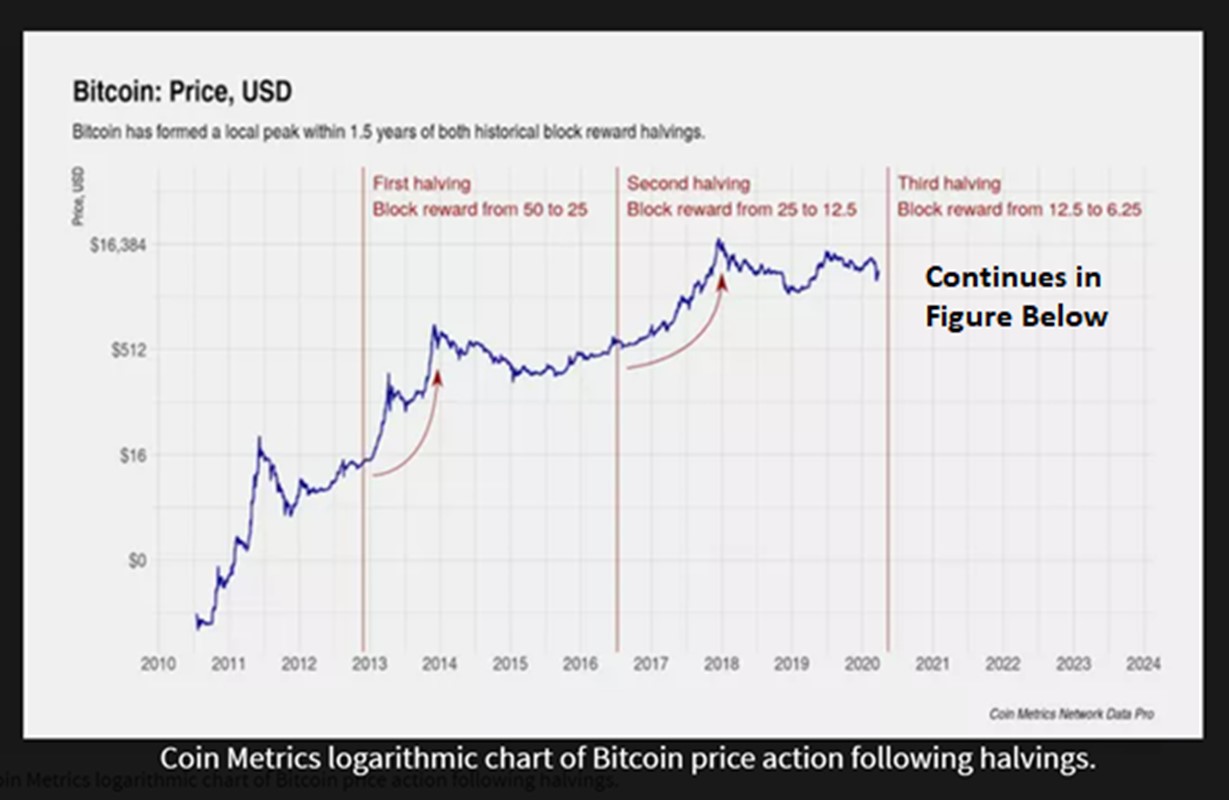

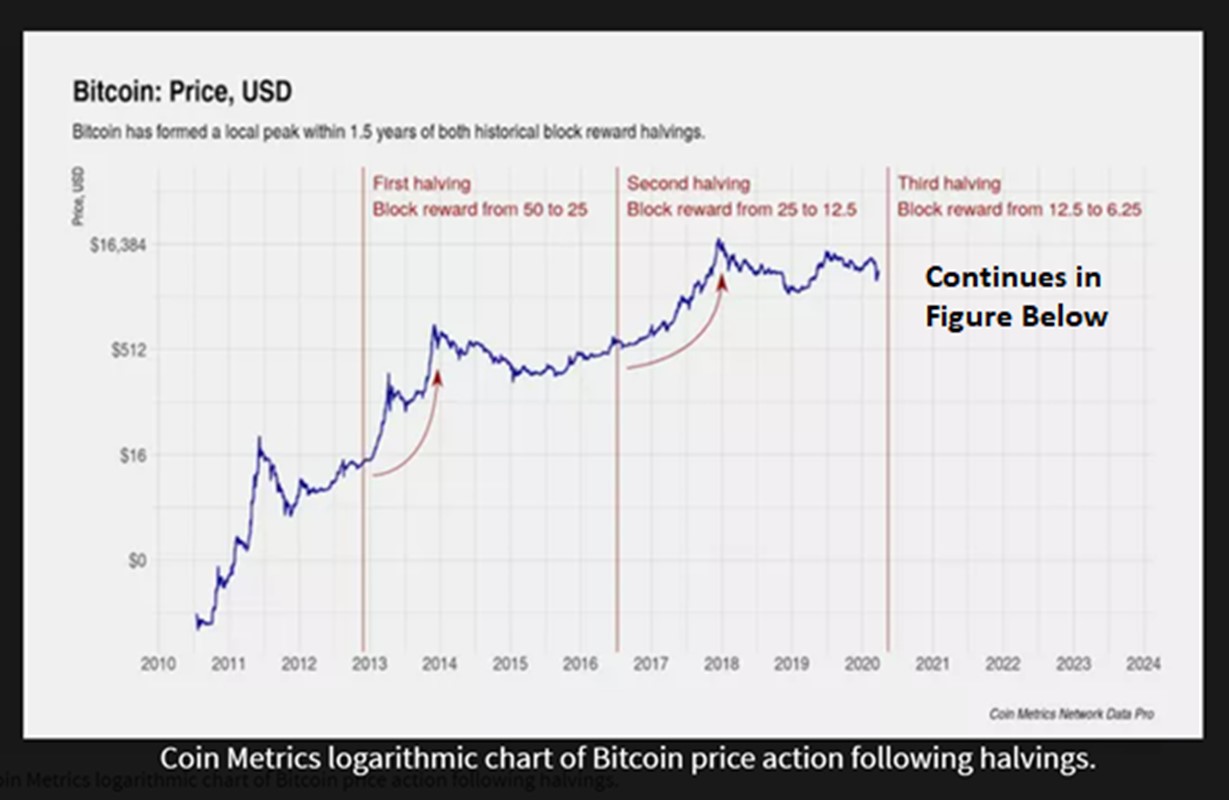

- Bitcoin Scarcity: The limited supply of Bitcoin (21 million coins) is a key factor driving up its potential value.

- Growing Global Demand: The increasing adoption of Bitcoin globally, especially in developing economies, fuels the demand and consequently, the price.

Challenges and Risks to Reaching $100,000

Despite the bullish factors, several challenges threaten the $100,000 Bitcoin price prediction:

- Regulatory Hurdles: Stringent regulations in various jurisdictions could hinder Bitcoin's widespread adoption.

- Bitcoin Market Risks: Market corrections and volatility remain inherent risks that can significantly impact the price.

- Competition from Altcoins: The emergence of other cryptocurrencies (altcoins) presents a competitive landscape, potentially diverting investment away from Bitcoin.

- Market Manipulation: The potential for market manipulation, though constantly combatted, presents a risk to price stability and long-term growth.

Connecting Trump's 100-Day Speech to the Bitcoin Price Prediction

Analyzing the Specific Content

To analyze the potential impact of Trump's 100-day speech on Bitcoin, we need to examine the specific policies and pronouncements. For example, any mentions of deregulation, fiscal policy, or international trade could have a direct bearing on Bitcoin's price trajectory. Expert analysis of these speeches and their implications for financial markets is crucial for informed prediction.

Short-Term vs. Long-Term Implications

The impact of Trump's announcements on Bitcoin's price could differ significantly in the short-term and long-term:

- Short-Term Bitcoin Price: Immediate reactions might be volatile, driven by market sentiment and speculative trading based on interpretations of the speech.

- Long-Term Bitcoin Outlook: Long-term effects depend on the actual implementation of the policies outlined, their overall economic impact, and the subsequent response from investors.

Conclusion: Bitcoin Price Prediction: Trump's Influence and the $100,000 Target

This article explored the potential correlation between Trump's political actions, especially his 100-day speech, and Bitcoin's price movement, examining the factors contributing to – and potentially hindering – the $100,000 BTC target. While several factors suggest potential for growth, significant risks and challenges remain. Trump's influence on the market, while demonstrably present historically, must be weighed against macroeconomic conditions and inherent crypto market volatility.

To effectively navigate the crypto market, stay updated on Bitcoin price predictions, follow Bitcoin's price movements, and research the $100,000 BTC target. Continuously monitor Trump's influence on the crypto market and other global political and economic developments that could impact Bitcoin's value. Remember, Bitcoin price predictions remain inherently uncertain, and careful consideration is crucial before making any investment decisions.

Featured Posts

-

Ihsayyat Fyraty Me Alerby Alqtry Mqarnt Badayh Me Alahly Almsry

May 09, 2025

Ihsayyat Fyraty Me Alerby Alqtry Mqarnt Badayh Me Alahly Almsry

May 09, 2025 -

Go Compare Parts Ways With Wynne Evans Amidst Strictly Fallout

May 09, 2025

Go Compare Parts Ways With Wynne Evans Amidst Strictly Fallout

May 09, 2025 -

U S Federal Reserve Maintains Rates Inflation And Job Market Outlook

May 09, 2025

U S Federal Reserve Maintains Rates Inflation And Job Market Outlook

May 09, 2025 -

Why Bitcoin Mining Activity Exploded This Week

May 09, 2025

Why Bitcoin Mining Activity Exploded This Week

May 09, 2025 -

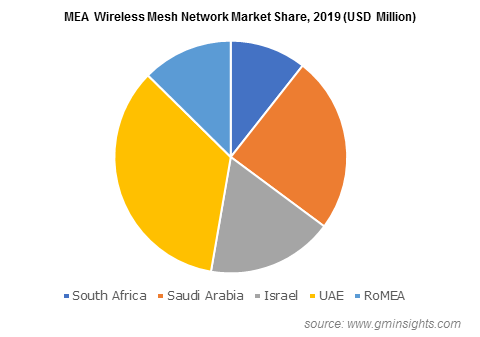

8 Cagr Projected For Wireless Mesh Networks Market Growth

May 09, 2025

8 Cagr Projected For Wireless Mesh Networks Market Growth

May 09, 2025