Bitcoin Surges Past 10-Week High, Nears US$100,000 Mark

Table of Contents

Factors Fueling the Bitcoin Price Surge

Several converging factors appear to be fueling this remarkable Bitcoin price surge. Let's examine the key contributors:

Increased Institutional Investment

The growing acceptance of Bitcoin by large financial institutions and corporations is a significant catalyst. Institutional Bitcoin adoption is no longer a niche phenomenon; it's rapidly becoming mainstream.

- Examples: BlackRock's recent filing for a Bitcoin ETF signals a major shift in institutional interest. Other significant players, including Fidelity and MicroStrategy, have already made substantial investments in Bitcoin, boosting its market credibility and price.

- Impact: These large-scale investments inject significant capital into the Bitcoin market, increasing demand and driving up the price. The sheer size of institutional portfolios means even relatively small allocations can have a substantial impact on Bitcoin's price.

- Future: We can expect further institutional involvement as more firms seek diversification and exposure to the burgeoning crypto market. Institutional Bitcoin investment strategies are becoming increasingly sophisticated, further fueling the upward trend.

Positive Regulatory Developments

Positive regulatory shifts are also playing a crucial role. While regulatory uncertainty has often plagued the cryptocurrency market, recent developments suggest a more favorable environment.

- Examples: Some jurisdictions are developing clearer regulatory frameworks for cryptocurrencies, reducing ambiguity and fostering investor confidence. This includes the exploration of Bitcoin ETFs in various countries.

- Impact: Positive regulatory news reassures investors, reducing risk perception and encouraging more investment. Favorable Bitcoin regulation creates a more stable and predictable market environment, attracting both institutional and retail investors.

- Future: Further positive developments in crypto regulation could significantly boost Bitcoin's price and solidify its position as a mainstream asset. The evolving regulatory landscape will undoubtedly shape the Bitcoin market’s trajectory.

Growing Adoption and Usage

The expanding use of Bitcoin for everyday transactions is another key driver of the price surge. Bitcoin adoption rate is steadily increasing, broadening its appeal beyond speculative investment.

- Examples: An increasing number of businesses, from large corporations to small retailers, are accepting Bitcoin as a form of payment. The rise of Bitcoin payment processors and Lightning Network solutions is also contributing to its wider adoption.

- Impact: The increased utility of Bitcoin as a transactional currency fuels demand, driving price appreciation. Higher Bitcoin transaction volume directly correlates with its increasing acceptance as a viable alternative to traditional payment systems.

- Future: Continued global adoption will strengthen Bitcoin's position as a global currency, leading to further price appreciation. The Bitcoin utility extends beyond simple payments; it’s increasingly used for various applications, including decentralized finance (DeFi) and NFTs.

Macroeconomic Factors

Global macroeconomic conditions are playing a significant role in Bitcoin's price fluctuations. Bitcoin is often seen as a hedge against inflation and economic uncertainty.

- Examples: High inflation rates in various countries are pushing investors to seek alternative stores of value, including Bitcoin. Concerns about the stability of fiat currencies further boost Bitcoin's appeal.

- Impact: Bitcoin's status as a potential inflation hedge drives demand during periods of economic uncertainty. Bitcoin is increasingly viewed as a safe haven asset, attracting investors seeking to protect their portfolios from market volatility.

- Future: If macroeconomic conditions continue to be unstable, we might see sustained high demand for Bitcoin as investors seek to diversify and protect their assets. Bitcoin’s position as a macroeconomic factor is becoming increasingly relevant.

Analyzing the Path to US$100,000

While the Bitcoin price surge is impressive, reaching the US$100,000 mark isn't guaranteed. Let's examine several factors that will play a role:

Technical Analysis

Technical indicators offer insights into potential price movements. Bitcoin chart analysis reveals key support and resistance levels that can influence price fluctuations.

- Examples: Technical indicators, such as moving averages and RSI, can suggest potential price corrections or continued upward momentum.

- Impact: Analyzing Bitcoin price prediction based on technical indicators can give investors a better understanding of potential market trends. However, technical analysis is not foolproof, and market sentiment can override technical signals.

- Future: Careful monitoring of technical indicators is crucial for navigating market volatility and making informed investment decisions. Bitcoin technical analysis should be used in conjunction with fundamental analysis for a more complete picture.

Market Sentiment

Investor sentiment significantly influences Bitcoin's price. Positive Bitcoin news sentiment can drive prices up, while negative sentiment can lead to price corrections.

- Examples: Social media trends, news coverage, and overall investor confidence all contribute to market sentiment. Bitcoin social media sentiment, in particular, can be a leading indicator of short-term price movements.

- Impact: Market volatility often reflects shifting investor sentiment. Positive news can trigger buying pressure, driving the price higher. Conversely, negative news can cause panic selling and a price decline.

- Future: Monitoring Bitcoin market sentiment is crucial for understanding potential price swings. Sudden shifts in sentiment can lead to sharp price fluctuations, making it essential for investors to stay informed.

Potential Challenges and Risks

While the prospects are promising, several challenges and risks could hinder Bitcoin's ascent to US$100,000.

- Examples: Regulatory uncertainty in certain jurisdictions, the potential for significant market corrections, competition from other cryptocurrencies, and potential security concerns remain significant risks.

- Impact: These factors could negatively impact investor confidence and create volatility in the market. Bitcoin volatility is a key characteristic of this asset class, and investors must be prepared for potential price swings.

- Future: Investors need to carefully consider Bitcoin risks before making any investment decisions. Thorough due diligence and risk management strategies are crucial for navigating the complexities of the crypto market.

Conclusion

Bitcoin's recent surge past its 10-week high, nearing the US$100,000 mark, is a result of a confluence of factors: increased institutional investment, positive regulatory developments, growing adoption, and favorable macroeconomic conditions. While the potential upside is significant, investors must also acknowledge the inherent risks, including regulatory uncertainty, market corrections, and competition. Stay updated on the Bitcoin price and understand its potential path to US$100,000, but remember to conduct thorough research and carefully assess your risk tolerance before investing. Learn more about Bitcoin investing and monitor the Bitcoin market closely. Tracking the Bitcoin surge requires constant vigilance and informed decision-making in this rapidly evolving market.

Featured Posts

-

Investigating The Use Of Apple Watches By Nhl Referees

May 07, 2025

Investigating The Use Of Apple Watches By Nhl Referees

May 07, 2025 -

Gewinnzahlen Lotto 6aus49 Vom 19 April 2025

May 07, 2025

Gewinnzahlen Lotto 6aus49 Vom 19 April 2025

May 07, 2025 -

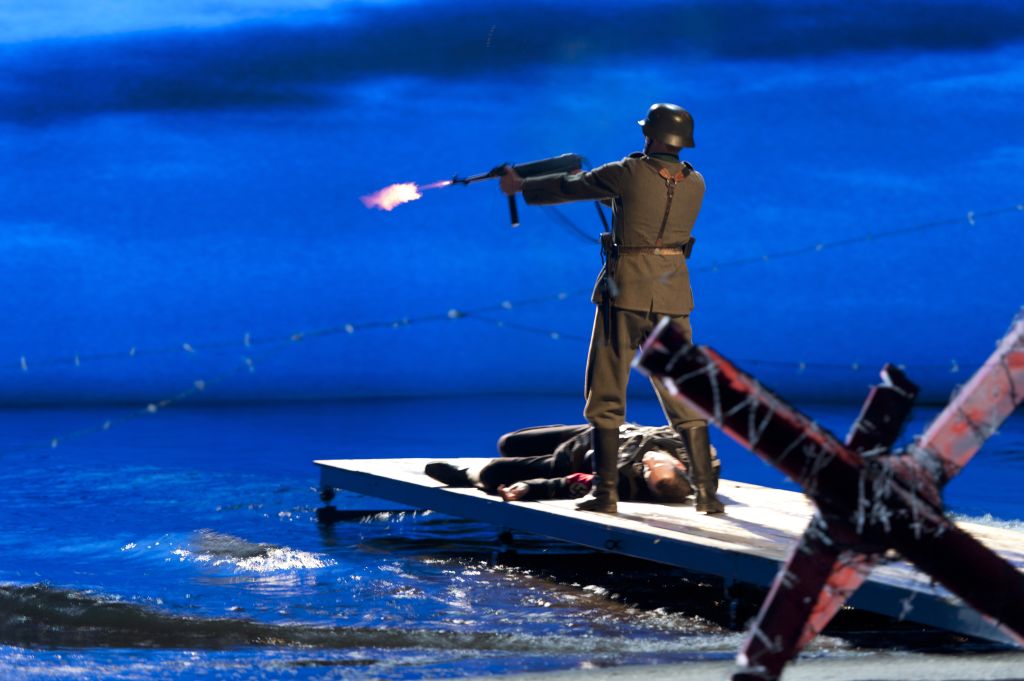

Peter Tazelaar De Onvertelde Verhalen Van Een Soldaat Van Oranje

May 07, 2025

Peter Tazelaar De Onvertelde Verhalen Van Een Soldaat Van Oranje

May 07, 2025 -

Alkhtwt Almlkyt Almghrbyt Tezz Rhlatha Byn Saw Bawlw Waldar Albydae

May 07, 2025

Alkhtwt Almlkyt Almghrbyt Tezz Rhlatha Byn Saw Bawlw Waldar Albydae

May 07, 2025 -

Altwtrat Ttzayd Albwlysaryw Wwaqet Iyqaf Altyar

May 07, 2025

Altwtrat Ttzayd Albwlysaryw Wwaqet Iyqaf Altyar

May 07, 2025

Latest Posts

-

Re Examining The Thunder Bulls Offseason Trade A Deeper Look

May 08, 2025

Re Examining The Thunder Bulls Offseason Trade A Deeper Look

May 08, 2025 -

Thunder Bulls Offseason Trade Separating Fact From Fiction

May 08, 2025

Thunder Bulls Offseason Trade Separating Fact From Fiction

May 08, 2025 -

New The Life Of Chuck Trailer Receives Acclaim From Stephen King

May 08, 2025

New The Life Of Chuck Trailer Receives Acclaim From Stephen King

May 08, 2025 -

The Life Of Chuck Movie Trailer Released Earns Stephen Kings Praise

May 08, 2025

The Life Of Chuck Movie Trailer Released Earns Stephen Kings Praise

May 08, 2025 -

Dont Let Revisionist History Fool You The Thunder Bulls Offseason Trade

May 08, 2025

Dont Let Revisionist History Fool You The Thunder Bulls Offseason Trade

May 08, 2025