Bitcoin's Critical Juncture: Price Levels And Analysis

Table of Contents

Current Bitcoin Price Levels and Market Sentiment

Analyzing the current Bitcoin price across major exchanges like Coinbase, Binance, and Kraken reveals a dynamic picture. At the time of writing, Bitcoin is trading around [Insert Current Bitcoin Price] USD. This represents a [percentage change] compared to [previous time period, e.g., last week, last month]. Prevailing market sentiment is currently [bullish/bearish/neutral], influenced by a complex interplay of factors.

The impact of recent news events on Bitcoin's price is undeniable. For example:

- Regulatory Changes: Increased regulatory scrutiny in certain jurisdictions can lead to price drops, while positive regulatory developments in others might trigger price increases. The recent [cite a specific regulatory event and its impact] exemplifies this.

- Adoption Rates: Growing adoption by institutional investors and mainstream businesses fuels bullish sentiment and often pushes the price upwards. Conversely, decreased adoption can lead to a bearish market. The recent [cite a specific example of adoption or lack thereof] is a case in point.

Key Indicators of Market Sentiment:

- Specific Price Levels: Support levels around [price] and resistance levels around [price] are currently being observed.

- Social Media Sentiment: A surge in positive sentiment on platforms like Twitter and Reddit often correlates with price increases. Conversely, negative sentiment can signal a potential downturn.

- Fear & Greed Index: This indicator reflects the overall market sentiment, with higher readings indicating greed (bullish) and lower readings indicating fear (bearish). Currently, the Fear & Greed Index is at [insert current index value].

Technical Analysis of Bitcoin Price Charts

Technical analysis provides valuable insights into potential Bitcoin price movements. It involves studying historical price charts, using various indicators to identify trends and predict future price action.

Common Technical Indicators:

- Moving Averages (MA): These smooth out price fluctuations, helping identify trends. A commonly used MA is the 50-day and 200-day moving average. Currently, the 50-day MA is [insert value] and the 200-day MA is [insert value], indicating [interpret the relationship].

- Relative Strength Index (RSI): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 suggests an overbought market, while below 30 suggests an oversold market.

- Moving Average Convergence Divergence (MACD): This indicator identifies changes in momentum by comparing two moving averages. A bullish crossover (MACD line crossing above the signal line) suggests upward momentum.

Chart Patterns: [Insert description or image link of a relevant chart pattern, e.g., head and shoulders, triangle, etc. and its interpretation]. Based on these patterns, potential price targets could be [insert price targets with caveats]. Identifying key support and resistance levels remains critical for risk management.

On-Chain Metrics and Bitcoin Network Activity

Analyzing on-chain metrics provides a deeper understanding of Bitcoin's network health and investor behavior. These metrics are independent of price and can offer valuable insights into future price movements.

Key On-Chain Metrics:

- Transaction Volume: Higher transaction volume generally indicates increased network activity and potential price appreciation. Currently, the daily transaction volume is [insert current data].

- Hash Rate: This metric represents the computational power securing the Bitcoin network. A higher hash rate signifies a more secure network and often correlates with price increases. The current hash rate is [insert current data].

- Active Addresses: The number of unique addresses interacting with the Bitcoin network. A rise in active addresses suggests growing adoption and potential price appreciation. Current data shows [insert current data].

These on-chain metrics, when analyzed in conjunction with price action, offer a more holistic Bitcoin price analysis. For example, a rising hash rate alongside increased transaction volume suggests a healthy and potentially bullish market.

Macroeconomic Factors Influencing Bitcoin Price

Bitcoin's price is not immune to macroeconomic factors. Global economic conditions significantly influence investor sentiment and capital flows.

- Inflation: Bitcoin is often viewed as a hedge against inflation. During periods of high inflation, investors may flock to Bitcoin as a store of value, driving up its price. Current global inflation rates are [insert current data], which [explain the potential impact on Bitcoin].

- Interest Rates: Rising interest rates can negatively impact Bitcoin's price as investors may shift their capital towards higher-yielding assets. Conversely, low interest rates might boost Bitcoin's appeal.

- Geopolitical Instability: Periods of geopolitical uncertainty can drive investors towards safe-haven assets, including Bitcoin, leading to potential price increases.

Bitcoin's Correlation with Traditional Asset Classes: Bitcoin's correlation with traditional assets like gold and the US dollar varies. During periods of economic uncertainty, its correlation with gold often increases.

Conclusion

This analysis of Bitcoin's price reveals a complex interplay of technical, on-chain, and macroeconomic factors. Current price levels, while volatile, offer both opportunities and risks. Understanding the nuances of technical indicators, on-chain activity, and global economic conditions is crucial for navigating this critical juncture.

Call to Action: Stay informed on the latest developments in the Bitcoin market by regularly reviewing Bitcoin price analysis and by following reputable sources for insightful commentary. Understanding the dynamics of Bitcoin price fluctuations will empower you to make more informed decisions regarding this evolving asset class. Continue your Bitcoin price analysis journey by exploring further resources and staying updated on market trends.

Featured Posts

-

Stephen King Adaptation Dystopian Horror Trailer Released

May 08, 2025

Stephen King Adaptation Dystopian Horror Trailer Released

May 08, 2025 -

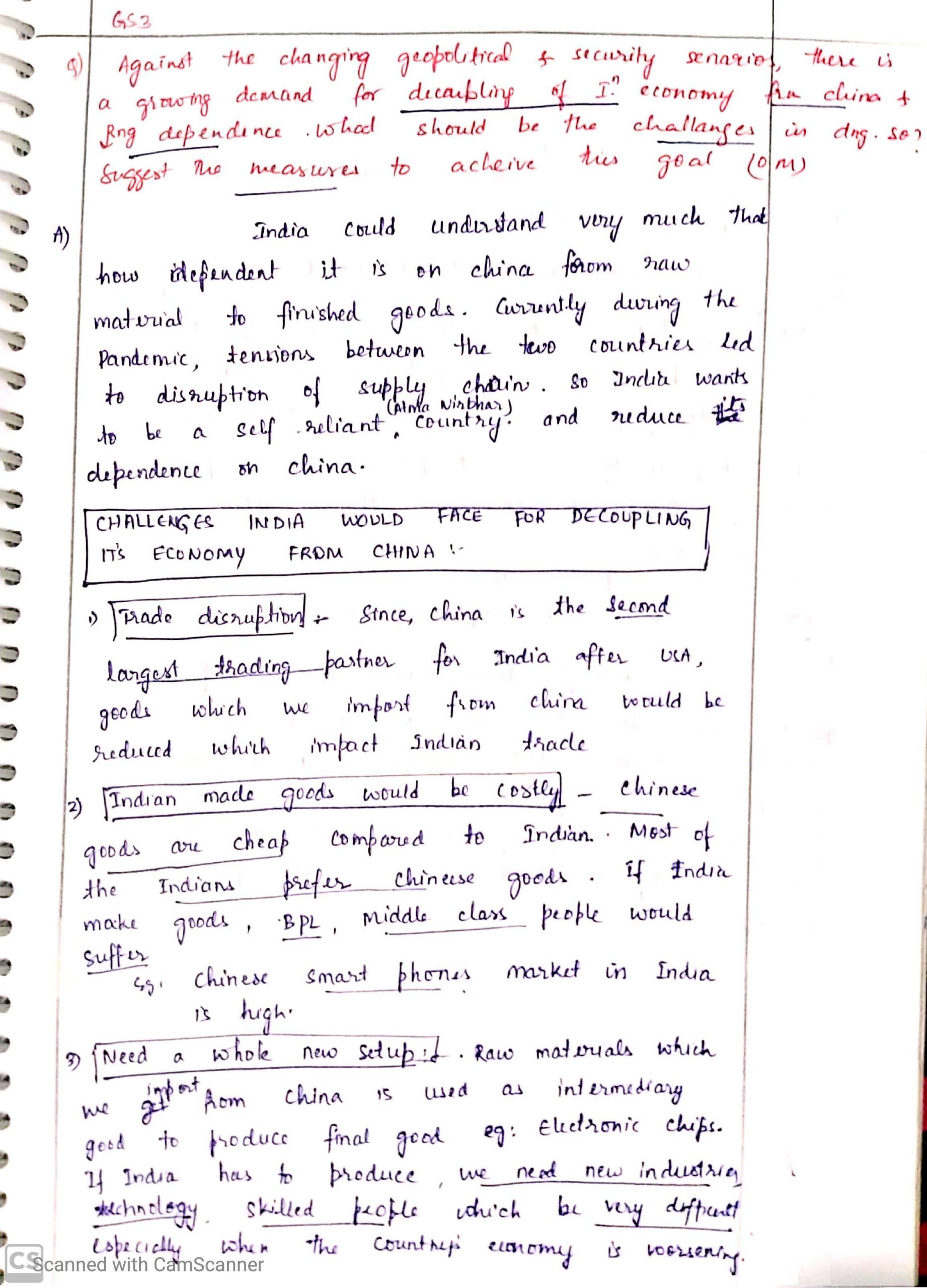

Is The Great Decoupling Inevitable Exploring Potential Scenarios

May 08, 2025

Is The Great Decoupling Inevitable Exploring Potential Scenarios

May 08, 2025 -

The Life Of Chuck Movie Trailer Released Earns Stephen Kings Praise

May 08, 2025

The Life Of Chuck Movie Trailer Released Earns Stephen Kings Praise

May 08, 2025 -

Thunder Grizzlies Showdown Preview And Prediction

May 08, 2025

Thunder Grizzlies Showdown Preview And Prediction

May 08, 2025 -

The Future Of Xrp Etf Potential Sec Decisions And Market Predictions

May 08, 2025

The Future Of Xrp Etf Potential Sec Decisions And Market Predictions

May 08, 2025