BlackRock ETF: A Billionaire Investment Poised For Massive Growth In 2025

Table of Contents

BlackRock's Market Leadership and Reputation

BlackRock's dominance in the ETF market is undeniable. With decades of experience and a massive asset base, they've established themselves as a trusted name among sophisticated investors. Their influence extends far beyond simply managing assets; they shape market trends and set industry benchmarks. BlackRock boasts robust research capabilities and employs teams of highly experienced investment professionals. This combination of size, expertise, and reputation translates to consistent, strong performance for their ETFs.

- Market Share: BlackRock commands a significant portion of the global ETF market, consistently ranking as the top provider.

- Top Performers: iShares Core US Aggregate Bond ETF (AGG) and iShares Core S&P 500 ETF (IVV) are just two examples of consistently high-performing BlackRock ETFs.

- Awards and Recognition: BlackRock's ETFs regularly receive industry awards for innovation, performance, and investor satisfaction.

Favorable Market Conditions for ETF Growth in 2025

Several factors point towards a favorable investment climate for ETFs in 2025. Predictions suggest continued growth in specific sectors, influencing ETF performance across the board. The increasing popularity of passive investing strategies further fuels the demand for ETFs, offering diversification and cost-effectiveness compared to actively managed funds.

- Market Sector Forecasts: Analysts predict robust growth in technology, healthcare, and renewable energy sectors – all sectors well-represented in BlackRock's ETF offerings.

- Interest Rate Changes: While interest rate fluctuations are always a consideration, BlackRock offers a diverse range of ETFs to help navigate varying economic climates.

- Global Economic Growth: Moderate global economic growth projections support continued investor confidence and a positive outlook for ETF performance.

Specific BlackRock ETFs Poised for Growth

Several BlackRock ETFs stand out as particularly promising for growth in 2025. These ETFs offer strategic exposure to key sectors and benefit from BlackRock's innovative management strategies. It is crucial to remember that past performance is not indicative of future results.

- iShares CORE MSCI EAFE ETF (IEFA): Provides diversified exposure to developed international markets outside of North America.

- Ticker Symbol: IEFA

- Expense Ratio: Low

- Asset Allocation: Diversified across multiple developed international markets.

- Past Performance: Historically strong, though past performance does not guarantee future results.

- iShares Global Clean Energy ETF (ICLN): Focuses on the burgeoning renewable energy sector.

- Ticker Symbol: ICLN

- Expense Ratio: Competitive

- Asset Allocation: Concentrated in clean energy companies.

- Past Performance: High growth potential, but subject to sector-specific risks.

Technological Advantages and Innovation in BlackRock's ETF Offerings

BlackRock leverages cutting-edge technology to optimize its ETF management and trading processes. This contributes to better returns and lower costs for investors.

- Algorithmic Trading: BlackRock utilizes sophisticated algorithms to execute trades efficiently and minimize slippage.

- Data Analytics: Advanced data analytics inform investment strategies and risk management.

- Competitive Advantage: These technological advancements provide a significant competitive advantage over firms with less sophisticated technology.

Risk Mitigation and Diversification Strategies Within BlackRock ETFs

BlackRock employs robust risk management strategies and promotes diversification within its ETFs. This reduces the impact of potential losses and helps investors to manage risk effectively.

- Geographic Diversification: Many BlackRock ETFs offer exposure to multiple countries and regions, reducing reliance on any single economy.

- Sector Diversification: ETFs often spread investments across different sectors, mitigating risk associated with a single industry's underperformance.

- Risk Tolerance: Investors should carefully consider their risk tolerance when selecting BlackRock ETFs. Consult a financial advisor if needed.

Conclusion: Investing in BlackRock ETFs for 2025 and Beyond

BlackRock ETFs offer a compelling investment opportunity for 2025 and beyond. Their market leadership, favorable market conditions, technological innovation, and robust risk management strategies position them for significant growth. A diversified portfolio of BlackRock ETFs can provide exposure to various market sectors and potentially deliver high returns. Learn more about BlackRock ETF investment strategies today! Explore the world of BlackRock ETFs and secure your financial future by researching and considering these investment options for potential high returns in 2025. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Analysis Indias Deep Incursion Into Pakistan And Its Implications

May 08, 2025

Analysis Indias Deep Incursion Into Pakistan And Its Implications

May 08, 2025 -

Prelista De Brasil Neymar Figura Y Podria Enfrentar A Argentina

May 08, 2025

Prelista De Brasil Neymar Figura Y Podria Enfrentar A Argentina

May 08, 2025 -

All 2025 Game Release Dates Ps 5 Ps 4 Xbox Pc And Nintendo Switch

May 08, 2025

All 2025 Game Release Dates Ps 5 Ps 4 Xbox Pc And Nintendo Switch

May 08, 2025 -

The Unforeseen Consequences Of Liberation Day Tariffs For Stock Investments

May 08, 2025

The Unforeseen Consequences Of Liberation Day Tariffs For Stock Investments

May 08, 2025 -

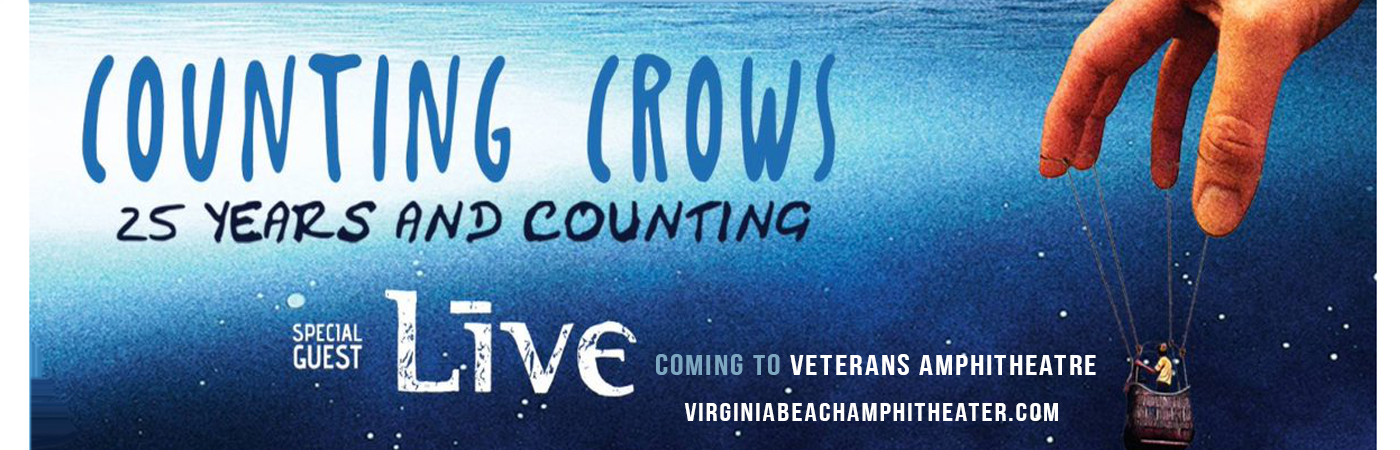

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025