BlackRock ETF: Billionaire Investment Strategy For 2025 And Beyond

Table of Contents

H2: Understanding BlackRock's Dominance in the ETF Market

BlackRock's iShares platform is the undisputed leader in the ETF market. Their sheer size and influence have profound implications for investors.

H3: Market Share and Asset Under Management:

BlackRock commands a significant portion of the global ETF market share. Their assets under management (AUM) in ETFs are staggering, reflecting investor confidence and the popularity of their product offerings.

- Market Share: BlackRock holds a dominant market share, consistently exceeding [Insert current market share percentage]% globally.

- AUM: Their ETF AUM surpasses [Insert current AUM figure in trillions], showcasing their significant presence in the investment landscape.

- Growth Trajectory: The consistent growth of BlackRock's ETF AUM demonstrates strong investor demand and the continued success of their product strategy. This dominance translates to stability and trust for investors, knowing they are investing in a well-established and reputable firm.

H3: Diversified Product Offerings:

BlackRock offers an extensive range of ETFs covering diverse asset classes and market sectors, catering to various investment strategies. This impressive breadth allows for personalized portfolio construction.

- Equity ETFs: iShares Core S&P 500 (IVV), iShares Russell 2000 (IWM), iShares MSCI EAFE (EFA) – providing exposure to large-cap, small-cap, and international equities respectively.

- Bond ETFs: iShares Core U.S. Aggregate Bond ETF (AGG), iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) – offering diversified exposure to the U.S. bond market.

- Commodity ETFs: iShares Gold Trust (IAU) – providing exposure to gold as a safe haven asset.

- International ETFs: A wide range of ETFs focused on specific countries or regions, facilitating global diversification.

This variety allows investors to create highly customized portfolios tailored to their risk tolerance, investment timeframe, and financial goals. The ability to easily access different asset classes within a single platform enhances efficiency and simplifies portfolio management.

H2: BlackRock ETF Strategies for Long-Term Growth (2025 and Beyond)

BlackRock ETFs are particularly well-suited for long-term investment strategies, offering several key advantages for navigating the future.

H3: Long-Term Investment Horizons:

BlackRock ETFs are ideal for long-term goals such as retirement planning. Their passive investment approach, low costs, and diversification offer significant advantages for wealth accumulation.

- Dollar-Cost Averaging: Regularly investing in BlackRock ETFs, regardless of market fluctuations, minimizes risk and allows you to benefit from the power of compounding.

- Passive Investing: BlackRock ETFs typically track specific market indices, providing diversified exposure without the need for active management, often resulting in lower fees.

- Compounding Returns: The power of compounding, combined with consistent long-term investment in BlackRock ETFs, can lead to substantial growth over time.

H3: Adapting to Market Volatility:

The inherent diversification of BlackRock ETFs helps investors navigate market fluctuations effectively.

- Diversification Benefits: Investing across multiple asset classes via BlackRock ETFs significantly mitigates risk compared to investing in individual stocks or sectors.

- Low Expense Ratios: BlackRock ETFs typically have low expense ratios, meaning more of your investment goes towards returns rather than fees.

- Hedging Strategies: The range of BlackRock ETF offerings allows for the implementation of hedging strategies to protect against potential market downturns.

H3: ESG Investing with BlackRock ETFs:

Environmental, Social, and Governance (ESG) investing is gaining increasing traction, and BlackRock offers a growing selection of ETFs aligning with these principles.

- ESG-focused ETFs: BlackRock provides several ETFs that invest in companies with strong ESG ratings, enabling investors to align their investments with their values.

- Sustainable Investing: These ETFs contribute to a more sustainable future while potentially delivering competitive returns.

- Long-Term Financial Advantages: Evidence suggests that companies with strong ESG profiles can outperform their counterparts in the long run.

H2: BlackRock ETF vs. Other Investment Vehicles:

H3: Comparison with Mutual Funds:

BlackRock ETFs offer several advantages over mutual funds.

- Expense Ratios: ETFs generally have lower expense ratios than mutual funds.

- Trading Mechanisms: ETFs trade throughout the day on exchanges, offering greater flexibility compared to mutual funds that are priced only at the end of the trading day.

- Tax Efficiency: ETFs are typically more tax-efficient than mutual funds due to their lower trading activity.

H3: Comparison with Individual Stock Picking:

BlackRock ETFs provide significant diversification benefits compared to the risk associated with picking individual stocks.

- Diversification: ETFs inherently provide diversification across numerous companies, industries, and asset classes, minimizing the risk associated with investing in individual stocks that may underperform.

- Risk Mitigation: This diversification significantly reduces the overall portfolio volatility and improves risk-adjusted returns.

- Time Efficiency: ETF investing is less time-consuming than actively managing a portfolio of individual stocks.

3. Conclusion:

Incorporating BlackRock ETFs into your long-term investment strategy offers numerous advantages: diversification across asset classes, low-cost access to broad market exposure, and the opportunity to align investments with ESG values. These advantages are particularly relevant for navigating the complexities of the market in 2025 and beyond. BlackRock ETFs provide a robust foundation for building a portfolio designed for long-term growth and stability. To further explore how BlackRock ETFs can fit your investment goals and risk tolerance, research specific ETFs on BlackRock's website or consult a financial advisor. By leveraging the power and diversification of BlackRock ETFs, you can position yourself for long-term financial success.

Featured Posts

-

Elon Musks Net Worth A Comprehensive Analysis Of His Business Acumen

May 09, 2025

Elon Musks Net Worth A Comprehensive Analysis Of His Business Acumen

May 09, 2025 -

Report Jayson Tatum Suffers Bone Bruise Unlikely For Game 2

May 09, 2025

Report Jayson Tatum Suffers Bone Bruise Unlikely For Game 2

May 09, 2025 -

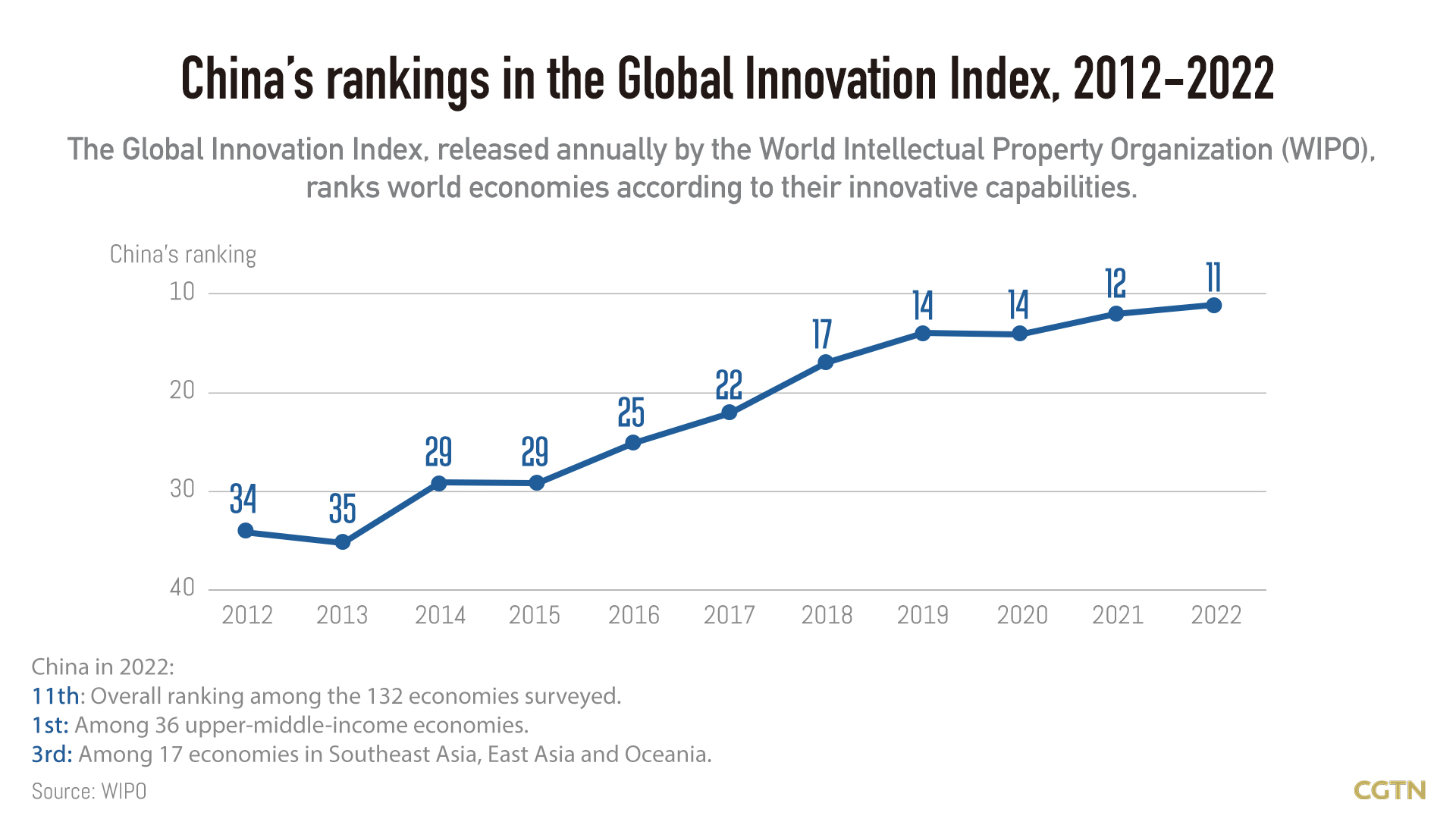

Edmonton Unlimiteds Scaled Tech Strategy A Focus On Global Innovation

May 09, 2025

Edmonton Unlimiteds Scaled Tech Strategy A Focus On Global Innovation

May 09, 2025 -

Tidlig Sesongslutt For Skisentre Pa Grunn Av Varm Vinter

May 09, 2025

Tidlig Sesongslutt For Skisentre Pa Grunn Av Varm Vinter

May 09, 2025 -

Nov Rimeyk Na Stivn King Ot Netflix

May 09, 2025

Nov Rimeyk Na Stivn King Ot Netflix

May 09, 2025