BlackRock ETF: Billionaire Investments And The 2025 Market Forecast

Table of Contents

Understanding BlackRock ETFs and Their Appeal

What are BlackRock ETFs?

BlackRock, a global investment management corporation, is a dominant force in the ETF market. Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, offering diversified exposure to a basket of assets. Unlike mutual funds, ETFs can be bought and sold throughout the trading day like individual stocks. BlackRock's iShares brand is synonymous with ETFs, offering a vast range of options catering to diverse investment strategies. Their dominance stems from their extensive product offerings, robust research capabilities, and strong brand recognition.

-

Types of BlackRock ETFs: BlackRock offers a diverse range of ETFs, including:

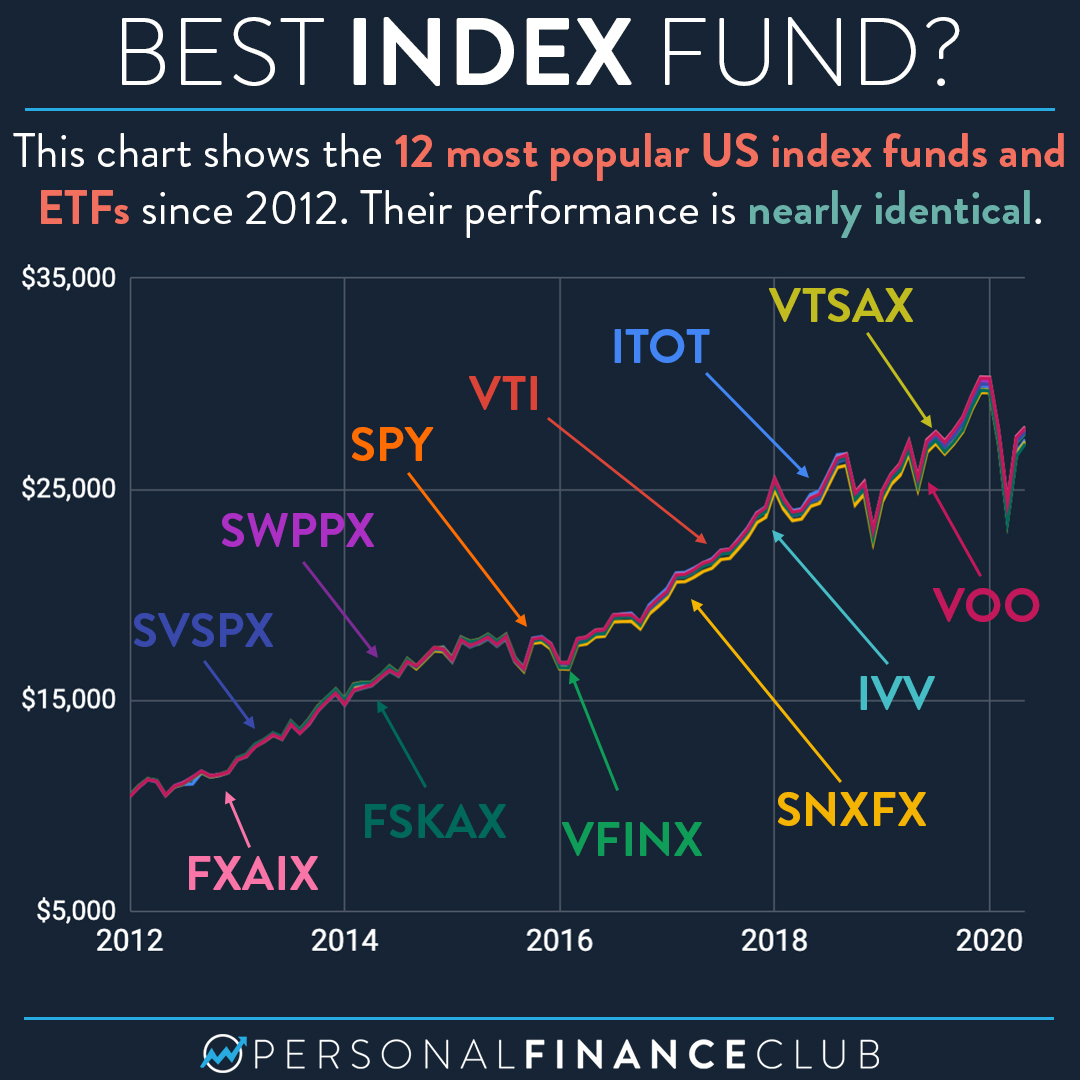

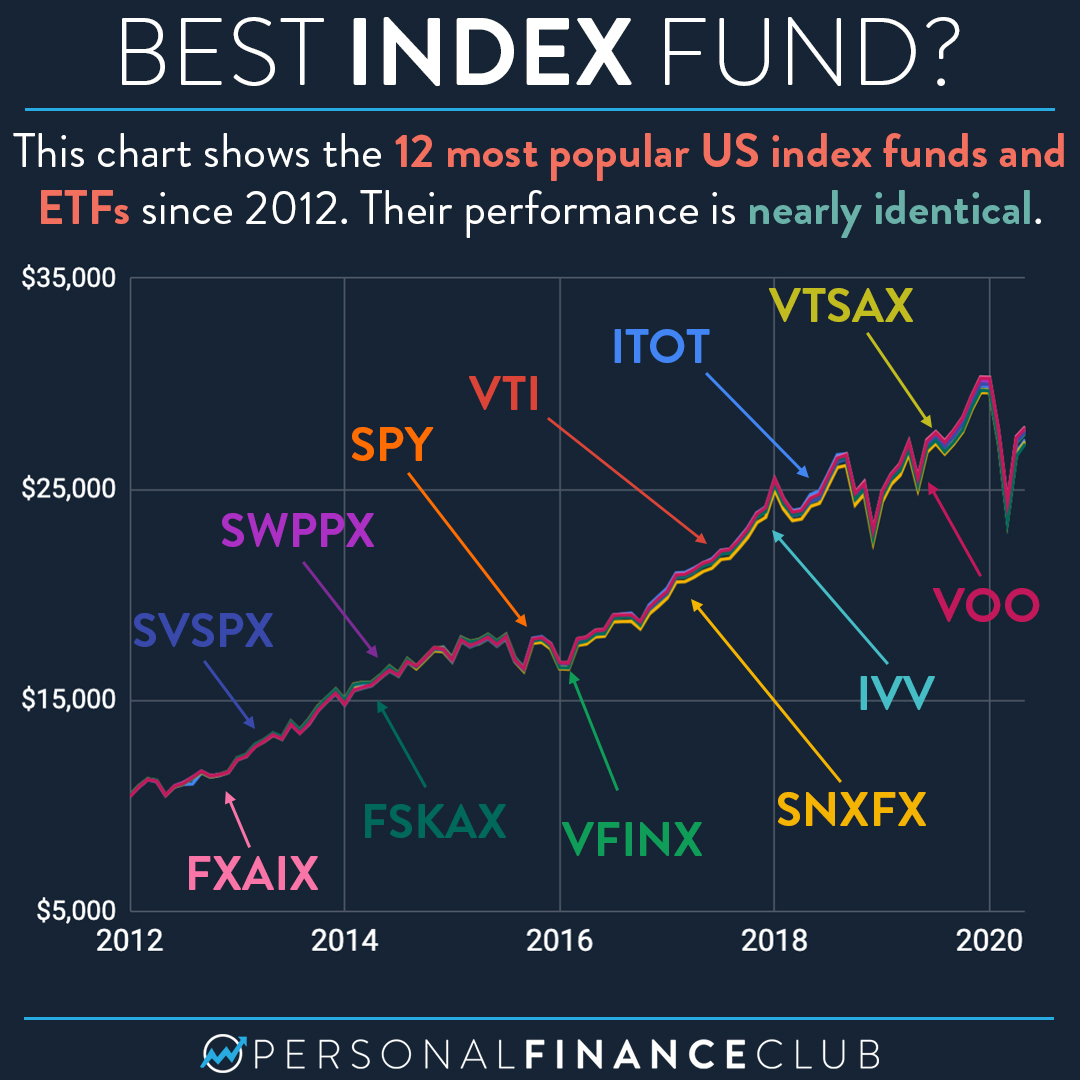

- Broad Market ETFs: Tracking major market indices like the S&P 500 (e.g., iShares Core S&P 500 ETF (IVV)).

- Sector-Specific ETFs: Focusing on particular industries (e.g., technology, healthcare, energy).

- International ETFs: Providing exposure to global markets beyond the US.

- Bond ETFs: Investing in various fixed-income securities.

-

Advantages of BlackRock ETFs over Individual Stocks:

- Lower Fees: ETFs generally have lower expense ratios than actively managed mutual funds.

- Diversification: Investing in an ETF instantly diversifies your portfolio across multiple assets.

- Ease of Trading: ETFs trade like stocks, offering flexibility and ease of buying and selling.

Why Billionaires Invest in BlackRock ETFs

Billionaires, known for their sophisticated investment strategies, are drawn to BlackRock ETFs for several reasons:

- Diversification: ETFs allow for efficient diversification across asset classes and geographies, minimizing risk.

- Passive Investment Strategy: Many billionaires favor passive investment strategies, aligning with the low-cost, index-tracking nature of many BlackRock ETFs.

- Access to Specific Markets: BlackRock offers ETFs covering a wide range of markets and sectors, allowing for targeted exposure.

While specific holdings of individual billionaires are often private, the popularity of BlackRock ETFs among high-net-worth individuals is widely acknowledged. The iShares Core S&P 500 ETF (IVV), for example, is frequently cited as a significant holding in many large institutional portfolios, which often reflect billionaire investment strategies. The sheer volume traded and assets under management for BlackRock ETFs underscores their prominence in institutional and high-net-worth portfolios.

Analyzing BlackRock ETF Performance and Trends

Historical Performance of Key BlackRock ETFs

Analyzing the historical performance of key BlackRock ETFs offers valuable insights. For example, the iShares Core S&P 500 ETF (IVV) has historically mirrored the performance of the S&P 500 index, providing a benchmark for broad market performance over various timeframes. (Note: Specific data and charts would be included here in a published article).

- Factors Influencing Past Performance: Historical performance has been influenced by a range of factors, including:

- Economic growth and recessionary cycles.

- Interest rate changes.

- Geopolitical events.

- Inflationary pressures.

Predicting BlackRock ETF Performance in 2025

Predicting the future is inherently challenging, and any forecast should be viewed with caution. However, analyzing current trends and expert opinions offers potential insights:

-

Potential Market Factors:

- Inflation: Persistently high inflation could impact market valuations.

- Interest Rates: Changes in interest rates influence borrowing costs and investment returns.

- Geopolitical Events: Global instability can create volatility in the markets.

-

Cautious Outlook for 2025: Based on current trends, a moderate growth scenario for many BlackRock ETFs seems plausible, but significant uncertainty remains. Factors such as technological disruption, regulatory changes, and unforeseen global events could significantly impact performance.

Disclaimer: Market predictions are inherently uncertain. This analysis is for informational purposes only and does not constitute financial advice.

Risks and Considerations for BlackRock ETF Investments

Market Volatility and Risk Management

Investing in ETFs, even those with seemingly stable historical performance, carries inherent risk.

-

Market Downturns: Market corrections or bear markets can lead to substantial losses.

-

Sector-Specific Risks: Sector-specific ETFs are exposed to the risks associated with that particular sector.

-

Risk Management Strategies:

- Diversification: Spreading investments across different asset classes and sectors mitigates risk.

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals reduces the impact of market volatility.

Fees and Expenses Associated with BlackRock ETFs

While BlackRock ETFs generally have lower expense ratios than actively managed funds, it's crucial to consider these costs:

- Expense Ratios: These are annual fees charged as a percentage of assets under management.

- Comparison Across ETFs: Expense ratios vary across different BlackRock ETFs, so comparison is essential.

Conclusion: Investing in BlackRock ETFs for the 2025 Market

BlackRock ETFs have gained significant popularity, particularly among high-net-worth investors, reflecting their role in sophisticated investment strategies. While their historical performance provides valuable insights, predicting future performance, especially for 2025, remains uncertain. Understanding the advantages, such as diversification and lower fees, alongside the inherent risks associated with market volatility, is crucial.

Key Takeaways: BlackRock ETFs offer a powerful tool for diversification and passive investing but require careful consideration of market risks and associated fees.

Ready to explore the potential of BlackRock ETFs for your portfolio in 2025? Start your research today! Remember to consult a qualified financial advisor before making any investment decisions.

Featured Posts

-

Billionaire Investment Strategy The Black Rock Etf Set To Explode

May 08, 2025

Billionaire Investment Strategy The Black Rock Etf Set To Explode

May 08, 2025 -

Angels Pari Hits Game Winning Homer In Rain Affected Match Against White Sox

May 08, 2025

Angels Pari Hits Game Winning Homer In Rain Affected Match Against White Sox

May 08, 2025 -

Nantes Psg Yi Deplasmanda 1 1 Le Tuttu Mac Raporu

May 08, 2025

Nantes Psg Yi Deplasmanda 1 1 Le Tuttu Mac Raporu

May 08, 2025 -

Inters 2026 Contract Situation Which Four Players Are Leaving

May 08, 2025

Inters 2026 Contract Situation Which Four Players Are Leaving

May 08, 2025 -

Hot Toys New Galen Erso Rogue One 1 6 Figure A Japan Exclusive Release

May 08, 2025

Hot Toys New Galen Erso Rogue One 1 6 Figure A Japan Exclusive Release

May 08, 2025