Blockchain Analytics Leader Chainalysis Expands With Alterya Acquisition

Table of Contents

Enhanced Data Integration Capabilities for Improved Blockchain Analytics

Alterya's expertise in data integration perfectly complements Chainalysis's existing blockchain analysis platform. This acquisition means Chainalysis now possesses an even more robust and efficient system for collecting, processing, and analyzing data from various sources relevant to cryptocurrency transactions. This enhanced data integration is crucial for delivering comprehensive and timely insights.

- Streamlined data ingestion from diverse sources: The integration allows for seamless data ingestion from various sources including cryptocurrency exchanges, digital wallets, decentralized finance (DeFi) protocols, and traditional financial institutions. This holistic approach ensures a more complete picture of cryptocurrency flows.

- Faster and more efficient data processing for quicker insights: Alterya's technology accelerates data processing, allowing Chainalysis to deliver actionable intelligence significantly faster. This speed is critical for timely responses to emerging threats and investigations.

- Improved data quality and accuracy for more reliable investigations: By improving data quality and reducing inconsistencies, the combined platform ensures more reliable and accurate investigative findings. This leads to more effective tracing of illicit funds and improved risk assessment.

- Enhanced ability to connect on-chain and off-chain data for a holistic view: The acquisition enables a more complete understanding of transactions by connecting on-chain data (transaction data on the blockchain) with off-chain data (information from outside the blockchain, such as KYC/AML data). This holistic view is essential for comprehensive financial crime investigations.

Alterya's proprietary technology focuses on simplifying complex data integration processes. Its ability to connect disparate data sources with minimal manual intervention is a game-changer for Chainalysis, enhancing the speed and efficiency of its blockchain analytics platform significantly.

Strengthening Chainalysis's Fight Against Financial Crime

The combined capabilities of Chainalysis and Alterya significantly improve the detection and prevention of illicit activities involving cryptocurrencies. This enhanced ability is crucial in the ongoing fight against financial crime, a key area of focus for regulatory bodies worldwide.

- Improved AML/KYC compliance for financial institutions: The enhanced data integration and analysis capabilities help financial institutions meet stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulatory requirements more effectively.

- Enhanced investigation capabilities for law enforcement agencies: Law enforcement agencies can leverage the improved analytical capabilities to trace cryptocurrency flows used in criminal activities, leading to more successful investigations and prosecutions.

- More effective tracing of cryptocurrency flows used in criminal activities: The combined platform allows for more efficient tracing of funds used in ransomware attacks, money laundering schemes, and other illicit activities.

- Reduced risk of exposure to sanctions violations: By identifying and flagging suspicious transactions linked to sanctioned entities or jurisdictions, Chainalysis helps its clients mitigate the risks associated with sanctions violations.

For example, the improved data integration can help trace cryptocurrency payments made to ransomware operators, leading to faster identification and apprehension of criminals. Similarly, the platform's enhanced capabilities can be crucial in uncovering and dismantling sophisticated money laundering operations involving cryptocurrencies.

Expanding Chainalysis's Market Reach and Client Base

The acquisition expands Chainalysis's market reach into new industries and customer segments. Alterya's existing client base brings a wealth of new opportunities, significantly strengthening Chainalysis’s position in the market.

- Access to Alterya's existing client base, broadening Chainalysis's market reach: This immediately expands Chainalysis's client network, allowing them to serve a wider range of businesses and organizations.

- Ability to offer a more comprehensive suite of data analytics solutions: The combined entity offers a more comprehensive suite of solutions, attracting clients seeking a more complete and integrated approach to data analytics.

- Potential for increased revenue and market share for Chainalysis: The acquisition is expected to lead to significant revenue growth and a stronger market share for Chainalysis in the blockchain analytics space.

- Strengthened competitive position within the blockchain analytics landscape: This merger solidifies Chainalysis's leadership position, giving them a significant advantage over competitors.

New markets now accessible to Chainalysis include those requiring sophisticated data integration capabilities across various sectors, not just the cryptocurrency industry itself.

Regulatory Compliance and its Significance

Blockchain analytics plays a crucial role in navigating the complex regulatory landscape of the cryptocurrency industry. Chainalysis's enhanced capabilities help its clients comply with evolving regulations.

The acquisition directly supports compliance with regulations such as the Financial Action Task Force (FATF) Travel Rule, which requires crypto businesses to collect and share information about the originators and beneficiaries of cryptocurrency transactions. The improved data integration streamlines the process of collecting and reporting this information, greatly assisting clients in meeting their regulatory obligations. The combined platform helps organizations navigate the increasing scrutiny from regulatory bodies globally.

Conclusion

The acquisition of Alterya by Chainalysis marks a significant step forward for the blockchain analytics industry. By combining Chainalysis's leading blockchain analysis platform with Alterya's powerful data integration capabilities, the combined entity is better positioned to combat financial crime, enhance regulatory compliance, and provide clients with more comprehensive data-driven insights. This merger signals a significant advancement in the fight against illicit activities within the cryptocurrency ecosystem.

Call to Action: Learn more about how Chainalysis's enhanced blockchain analytics solutions, strengthened by the Alterya acquisition, can help your organization fight financial crime and achieve regulatory compliance. Visit the Chainalysis website today to explore their expanded offerings and discover how advanced blockchain analytics can improve your security and risk management strategies.

Featured Posts

-

Sinner Returns To Tennis In Hamburg After Doping Ban

May 28, 2025

Sinner Returns To Tennis In Hamburg After Doping Ban

May 28, 2025 -

Predicting The Cubs Vs Diamondbacks Game Can The Cubs Win

May 28, 2025

Predicting The Cubs Vs Diamondbacks Game Can The Cubs Win

May 28, 2025 -

Peringatan Dini Cuaca Hujan Di Jawa Timur 6 Mei 2024

May 28, 2025

Peringatan Dini Cuaca Hujan Di Jawa Timur 6 Mei 2024

May 28, 2025 -

Voici Les 5 Smartphones Avec La Meilleure Autonomie En 2024

May 28, 2025

Voici Les 5 Smartphones Avec La Meilleure Autonomie En 2024

May 28, 2025 -

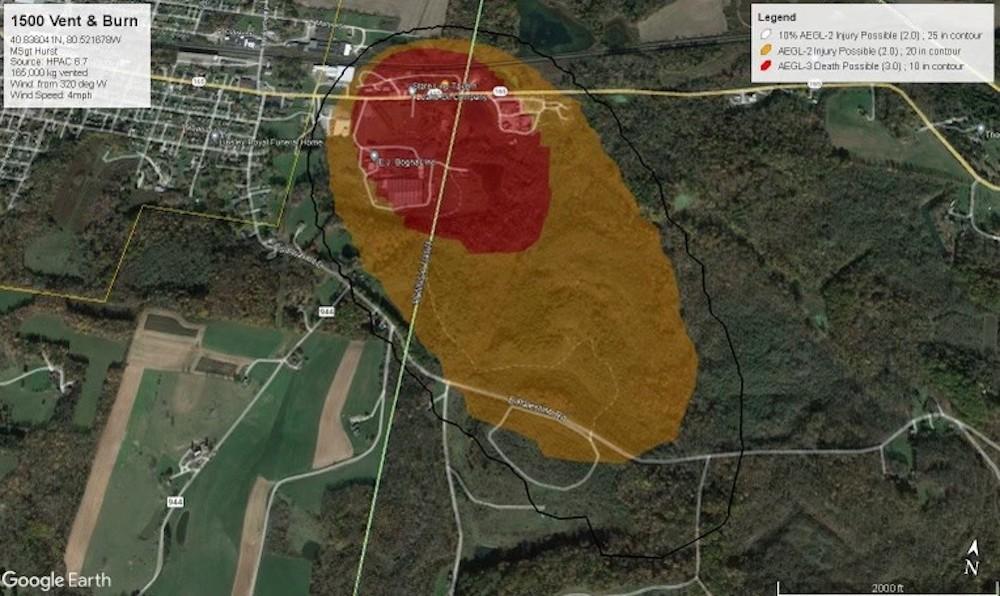

Months Long Chemical Residue From Ohio Train Derailment Building Contamination

May 28, 2025

Months Long Chemical Residue From Ohio Train Derailment Building Contamination

May 28, 2025

Latest Posts

-

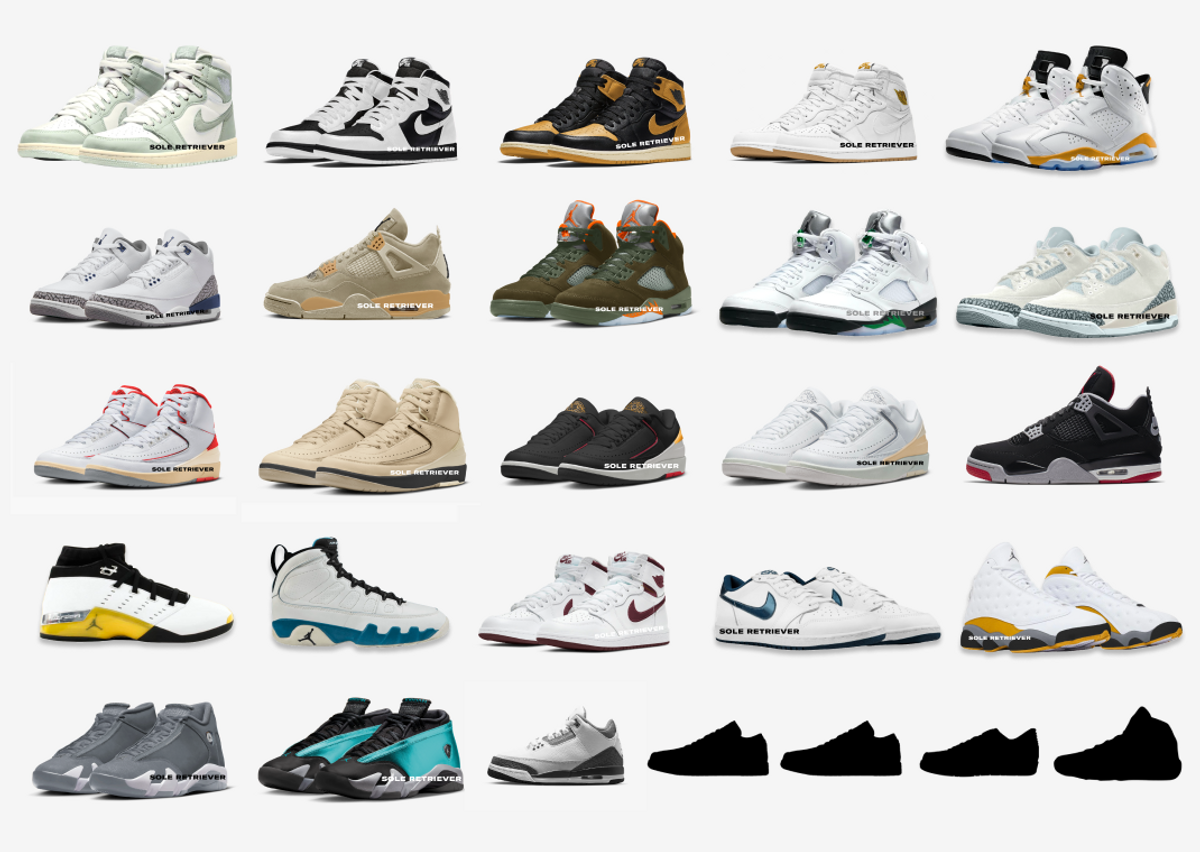

Complete List Air Jordans Dropping In June 2025

May 30, 2025

Complete List Air Jordans Dropping In June 2025

May 30, 2025 -

Air Jordan June 2025 Release Dates Must Know Info For Sneakerheads

May 30, 2025

Air Jordan June 2025 Release Dates Must Know Info For Sneakerheads

May 30, 2025 -

Lw Ansf Alqwmu Dhkra Astqlal Nstlhm Mnha Alebr

May 30, 2025

Lw Ansf Alqwmu Dhkra Astqlal Nstlhm Mnha Alebr

May 30, 2025 -

Every Air Jordan Sneaker Releasing In June 2025 A Complete Guide

May 30, 2025

Every Air Jordan Sneaker Releasing In June 2025 A Complete Guide

May 30, 2025 -

Kenin Out Pegula And Alexandrova To Clash In Charleston Final

May 30, 2025

Kenin Out Pegula And Alexandrova To Clash In Charleston Final

May 30, 2025