BOE Rate Cut Probabilities Decline Following UK Inflation Figures: Pound Gains

Table of Contents

UK Inflation Figures Exceed Expectations

CPI Data and its Significance

The recently released Consumer Price Index (CPI) data revealed a far more stubborn inflation picture than analysts had predicted. The UK inflation rate significantly exceeded forecasts, fueling concerns about the persistence of inflationary pressures.

- CPI (Year-on-Year): [Insert actual figure, e.g., 7.2%] – considerably higher than the predicted [Insert predicted figure, e.g., 6.8%].

- CPI (Month-on-Month): [Insert actual figure, e.g., 0.5%] – indicating a continued upward trend in consumer prices.

This persistent inflation can be attributed to several factors, including: rising energy prices, stubbornly high food costs, and persistent wage growth. These factors collectively contribute to the elevated UK inflation and challenge the Bank of England's efforts to bring inflation back to its target of 2%.

Impact on Market Sentiment

The immediate market reaction to the higher-than-expected inflation figures was swift and decisive. Investor sentiment took a hit, with a clear shift towards a less dovish outlook for the Bank of England. Trading activity reflected this altered sentiment.

- GBP/USD: The Pound experienced a noticeable strengthening against the US dollar, rising from [Insert starting exchange rate] to [Insert ending exchange rate].

- GBP/EUR: Similarly, the GBP appreciated against the Euro, moving from [Insert starting exchange rate] to [Insert ending exchange rate].

- Bond Yields: Government bond yields rose, reflecting market expectations of higher interest rates in the future to combat inflation.

BOE Rate Cut Probabilities Reduced – Implications for Monetary Policy

Shifting Expectations for Future Interest Rates

The unexpectedly high inflation data significantly alters the market's expectations for future Bank of England interest rate decisions. The likelihood of a BOE rate cut has drastically decreased, with some analysts even predicting a potential interest rate hike.

- The higher-than-expected inflation directly contradicts the BOE's mandate to maintain price stability.

- The reduced probability of a rate cut stems from the concern that further monetary easing could exacerbate inflationary pressures.

- Higher interest rates, if implemented, will inevitably lead to increased borrowing costs for businesses and consumers, potentially dampening economic activity.

Analysis of BOE's Likely Response

The Bank of England now faces a difficult balancing act. The strong inflation figures challenge the previous assumption that further rate cuts were imminent. The upcoming MPC (Monetary Policy Committee) meetings will be crucial in determining the BOE's next steps.

- The BOE's response will likely depend on the evolution of inflation data and other economic indicators in the coming months.

- The central bank might maintain its current stance, or they might opt for a rate hike to cool down the overheating economy.

- The inflation figures will undoubtedly impact the BOE's future inflation forecasts, which will guide their monetary policy decisions.

Pound Sterling Strengthens on Inflation Surprise

GBP Gains Against Major Currencies

The release of the surprisingly high inflation data triggered a surge in the Pound Sterling against major international currencies. This reflects the market's renewed confidence in the UK's economic resilience, particularly in the face of persistent inflation.

- The GBP experienced significant appreciation against the US dollar (GBP/USD), gaining [Insert percentage] in value.

- Similarly, the GBP strengthened against the Euro (GBP/EUR), registering a gain of approximately [Insert percentage].

- While the immediate reaction was strong, some volatility in the exchange rate is expected as markets continue to process the new data.

Implications for UK Economy

The strengthening of the Pound has both positive and negative implications for the UK economy.

- A stronger Pound makes imports cheaper, potentially reducing inflationary pressures on certain goods.

- However, it can negatively affect UK exports, making them less competitive in global markets.

- The net effect on UK economic growth is complex and will depend on the interplay of these factors and other economic conditions.

Conclusion: Inflation Data Shifts Focus Away from BOE Rate Cuts – Implications for the Pound

In summary, the unexpected surge in UK inflation has dramatically reduced the BOE rate cut probabilities. This shift in market expectations has led to a noticeable strengthening of the Pound Sterling against major currencies. It's crucial to closely monitor UK inflation data and its impact on the Bank of England's monetary policy decisions. Stay informed on "BOE Rate Cut Probabilities" and other related economic developments to make informed investment and financial decisions. Follow us for further updates and insights, and visit the Bank of England website ([insert link to BOE website]) for official data and announcements.

Featured Posts

-

Improving Otter Habitats A Turning Point In Wyomings Conservation Efforts

May 22, 2025

Improving Otter Habitats A Turning Point In Wyomings Conservation Efforts

May 22, 2025 -

Swiss Chinese Talks A Push For Tariff De Escalation

May 22, 2025

Swiss Chinese Talks A Push For Tariff De Escalation

May 22, 2025 -

Huizen Betaalbaar Geen Stijl En Abn Amro Hebben Een Andere Mening

May 22, 2025

Huizen Betaalbaar Geen Stijl En Abn Amro Hebben Een Andere Mening

May 22, 2025 -

Half Dome Wins Abn Group Victoria Pitch A New Era Of Design

May 22, 2025

Half Dome Wins Abn Group Victoria Pitch A New Era Of Design

May 22, 2025 -

The Goldbergs A Deep Dive Into The Shows Humor And Themes

May 22, 2025

The Goldbergs A Deep Dive Into The Shows Humor And Themes

May 22, 2025

Latest Posts

-

Vstup Ukrayini Do Nato Zapobigannya Podalshiy Rosiyskiy Agresiyi Chi Ilyuziya

May 22, 2025

Vstup Ukrayini Do Nato Zapobigannya Podalshiy Rosiyskiy Agresiyi Chi Ilyuziya

May 22, 2025 -

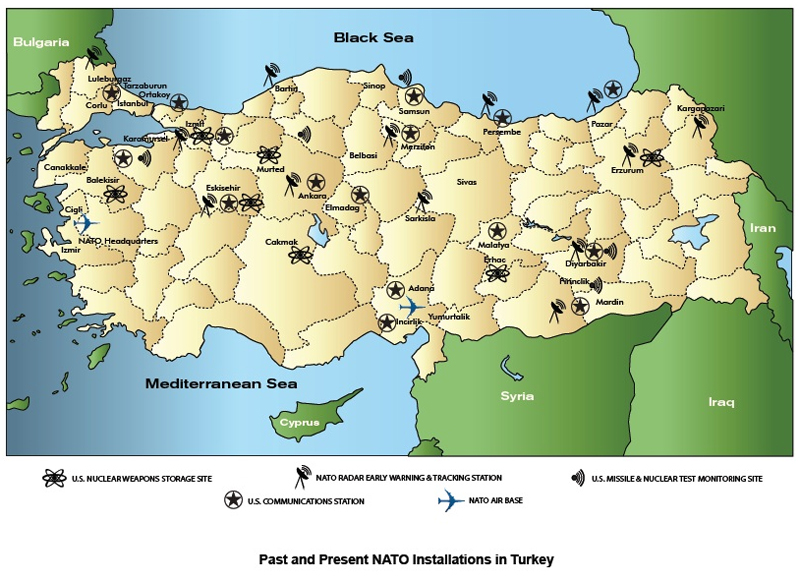

Tuerkiye Ve Italya Ya Ayni Goerev Nato Planini Paylastilar

May 22, 2025

Tuerkiye Ve Italya Ya Ayni Goerev Nato Planini Paylastilar

May 22, 2025 -

Naslidki Vidmovi Ukrayini U Vstupi Do Nato Posilennya Rosiyskoyi Agresiyi

May 22, 2025

Naslidki Vidmovi Ukrayini U Vstupi Do Nato Posilennya Rosiyskoyi Agresiyi

May 22, 2025 -

Nato Protiv Rossii Patrushev O Planakh Zakhvata Kaliningrada

May 22, 2025

Nato Protiv Rossii Patrushev O Planakh Zakhvata Kaliningrada

May 22, 2025 -

Ispanya Ve Nato Elektrik Kesintileri Uezerine Kritik Goeruesme

May 22, 2025

Ispanya Ve Nato Elektrik Kesintileri Uezerine Kritik Goeruesme

May 22, 2025