BOE Should Consider Smaller QE In Future Economic Shocks: Greene's Proposal

Table of Contents

1. The Limitations of Large-Scale QE Programs:

Large-scale QE, while effective in injecting liquidity into the system, carries inherent risks. The sheer magnitude of previous programs has raised valid concerns about their long-term sustainability and overall impact on the UK economy.

1.1 Inflationary Pressures:

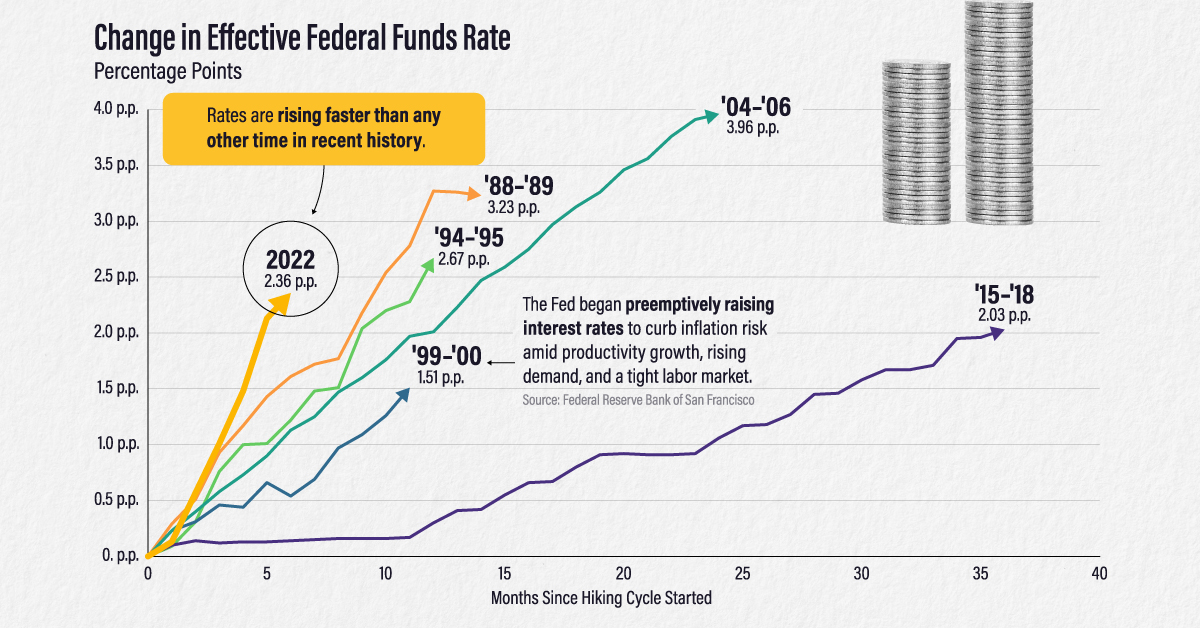

Large-scale QE programs can fuel inflationary pressures. By injecting vast sums of money into the economy, the BOE risks increasing demand without a corresponding increase in supply, leading to price increases.

- Example: The inflation spike following the 2008-2009 financial crisis, partially attributed to QE measures, highlights the potential for unintended inflationary consequences.

- This erosion of consumer spending power can stifle economic growth and negatively impact living standards.

- Increased inflation also forces the BOE to raise interest rates, potentially hindering economic recovery.

1.2 Asset Bubbles:

QE can inflate asset bubbles, particularly in the housing and stock markets. The influx of liquidity can drive up asset prices beyond their fundamental value, creating a precarious situation.

- Example: Concerns exist regarding the potential for another housing bubble in the UK, fueled by low interest rates and increased liquidity resulting from past QE programs.

- The bursting of these bubbles can trigger sharp economic downturns, causing significant financial losses and impacting investor confidence.

- This volatility undermines the long-term stability of the financial system.

1.3 Reduced Effectiveness Over Time:

Repeated QE interventions can lose their effectiveness over time. The economy becomes less responsive to further injections of liquidity, leading to diminishing returns.

- This phenomenon, often referred to as "QE fatigue," indicates a decreasing marginal benefit from each subsequent round of QE.

- Market participants may become less sensitive to changes in the money supply, reducing the program's impact on economic activity.

- The efficacy of QE as a tool to stimulate economic growth may decline over time, necessitating the exploration of alternative strategies.

2. Greene's Proposal for Targeted QE:

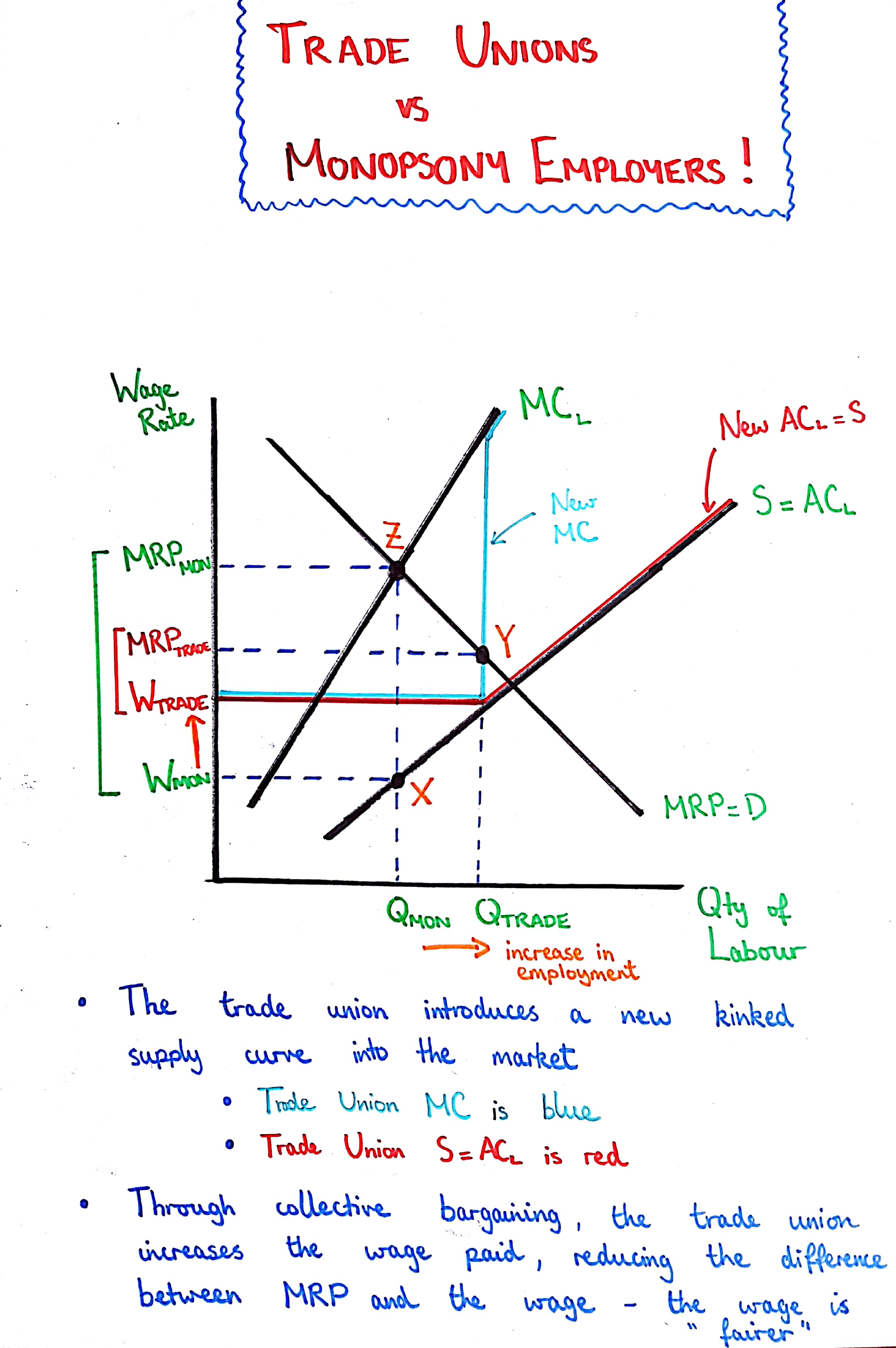

[Greene's Name]'s proposal offers a compelling alternative to large-scale QE. It advocates for smaller, more targeted interventions focused on specific sectors or economic needs.

2.1 Key Features of the Proposal:

The core elements of Greene's proposal include:

- Smaller Scale: Significantly reducing the overall size of QE programs.

- Targeted Sectors: Focusing QE on specific sectors facing acute economic challenges, rather than a broad-based approach.

- Conditional Implementation: Tying QE deployment to specific economic indicators or conditions to ensure its effectiveness.

2.2 Advantages of a Targeted Approach:

A targeted approach offers several advantages:

- Enhanced Effectiveness: By focusing on specific economic problems, targeted QE can address them more directly and efficiently.

- Minimized Side Effects: Smaller-scale interventions reduce the risk of unintended consequences, such as excessive inflation or asset bubbles.

- Sector-Specific Support: Targeted QE can provide crucial support to struggling industries or sectors, preventing job losses and promoting economic recovery.

2.3 Addressing Concerns about Smaller QE:

Critics might argue that smaller QE programs lack the power to effectively stimulate the economy during significant downturns. However, Greene's proposal addresses this by:

- Combining with other policy tools: Integrating smaller QE with other fiscal and monetary policies to maximize overall impact.

- Strategic timing: Deploying QE strategically at critical moments to maximize its effectiveness.

- Data-driven approach: Using detailed economic data to inform QE decisions and optimize their impact.

3. The Economic Context in the UK and the Need for Adaptive Policies:

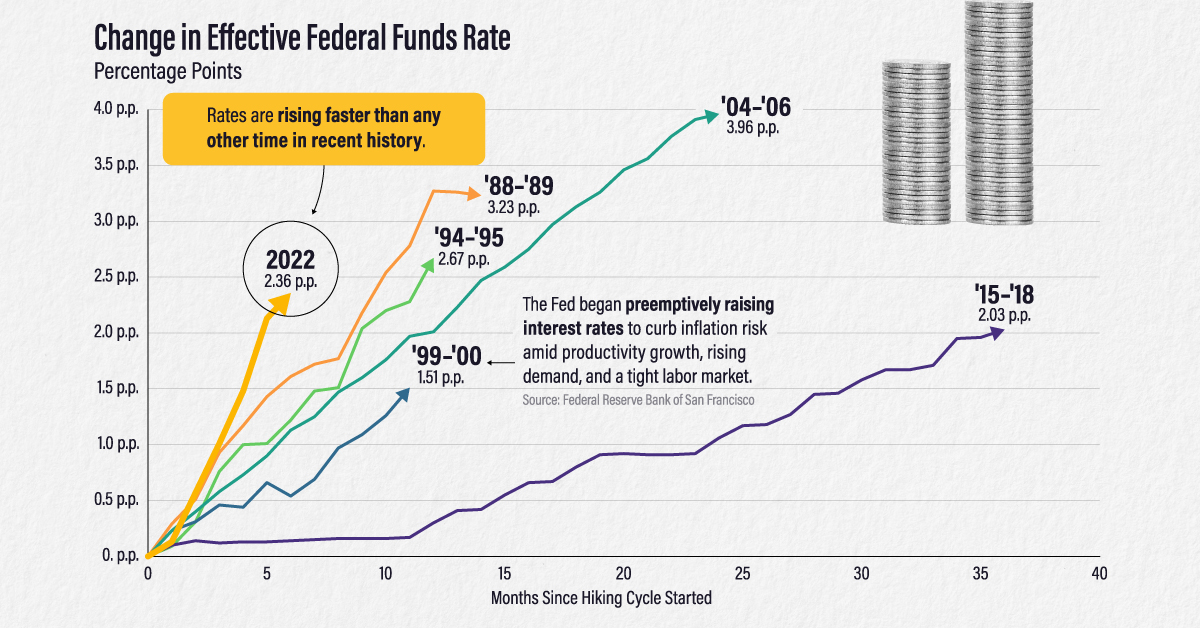

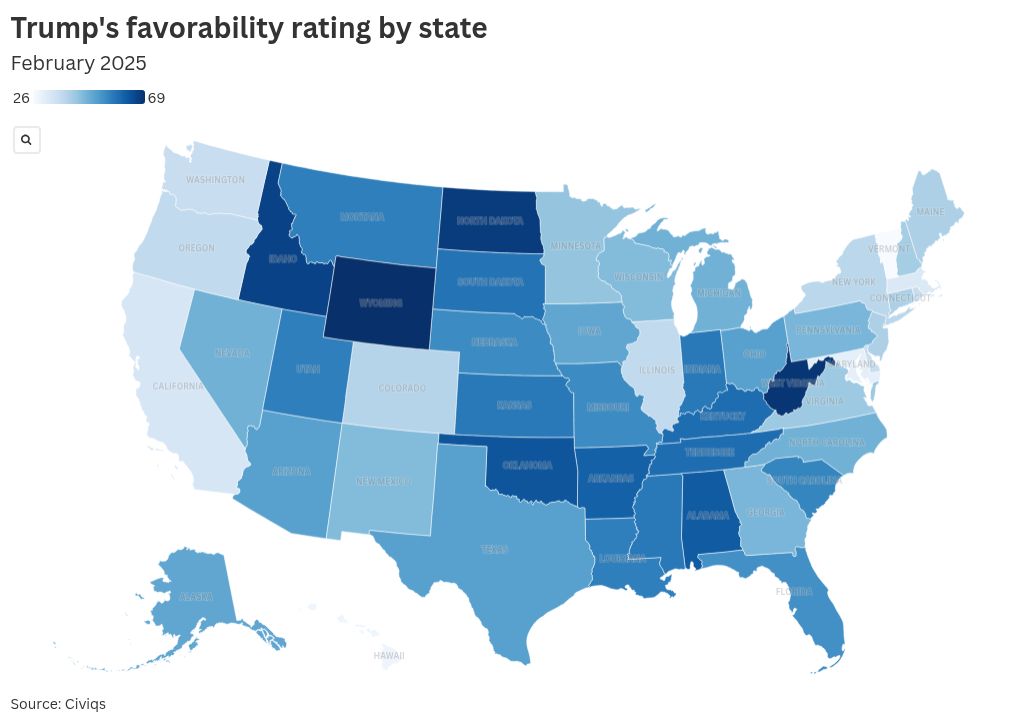

The current economic landscape in the UK demands adaptive monetary policies.

3.1 Current Economic Challenges:

The UK currently faces several significant economic challenges, including:

- Elevated inflation rates

- Fluctuating interest rates

- Concerns regarding economic growth

3.2 The Importance of Flexibility in Monetary Policy:

The BOE must adapt its policies based on evolving circumstances. A rigid approach to QE may prove ineffective in a rapidly changing economic environment.

- Data-driven decision-making is crucial for effective monetary policy.

- The BOE should prioritize flexibility and agility in its responses to economic shocks.

- Avoiding a "one-size-fits-all" approach to QE is essential for ensuring its long-term effectiveness.

4. Conclusion: Rethinking QE for a More Resilient UK Economy

Adopting Greene's proposal for smaller, more targeted QE interventions offers a more resilient and sustainable approach to monetary policy in the UK. The limitations of large-scale QE, including inflationary pressures, asset bubbles, and diminishing returns, necessitate a rethink of the BOE's strategy. A flexible, data-driven approach that prioritizes targeted support and minimizes risk is crucial for navigating future economic shocks. Learn more about the implications of smaller QE strategies, discuss the future of BOE monetary policy, and explore alternative approaches to quantitative easing. The BOE should seriously consider Greene's proposal to build a more robust and resilient UK economy.

Featured Posts

-

How Netflix Defied The Big Tech Slump And Attracted Wall Street Investment

Apr 23, 2025

How Netflix Defied The Big Tech Slump And Attracted Wall Street Investment

Apr 23, 2025 -

New Survey Reveals Trump Era Dashed Canadian Hopes Of Moving To The Us

Apr 23, 2025

New Survey Reveals Trump Era Dashed Canadian Hopes Of Moving To The Us

Apr 23, 2025 -

Le Pitch Hipli Des Emballages Reutilisables Pour Un E Commerce Responsable

Apr 23, 2025

Le Pitch Hipli Des Emballages Reutilisables Pour Un E Commerce Responsable

Apr 23, 2025 -

Analyse Du 17 Fevrier Performances De Fdj Et Schneider Electric A Paris

Apr 23, 2025

Analyse Du 17 Fevrier Performances De Fdj Et Schneider Electric A Paris

Apr 23, 2025 -

Changes To Ontarios Internal Trade Impact On Alcohol And Labour Markets

Apr 23, 2025

Changes To Ontarios Internal Trade Impact On Alcohol And Labour Markets

Apr 23, 2025