Boeing Sells Jeppesen To Thoma Bravo: $5.6 Billion Deal

Table of Contents

Jeppesen's Significance in the Aviation Industry

Jeppesen holds a legendary status in the aviation world, synonymous with reliable and comprehensive aviation navigation data. For decades, it has been a leading provider of crucial information and technology, shaping how the industry operates. Its influence spans numerous facets of air travel.

- A Legacy of Innovation: Jeppesen's long history is marked by continuous innovation in delivering crucial aeronautical data. From its origins in paper charts, it has transitioned to become a dominant force in digital navigation, flight planning, and air traffic management.

- Comprehensive Portfolio: Jeppesen's extensive portfolio includes digital charts, navigation databases (essential for precise GPS navigation), sophisticated flight planning software, and comprehensive training solutions for pilots and air traffic controllers. These tools are not just convenient; they are fundamental to safe and efficient operations.

- Safety and Efficiency: Jeppesen's data and software directly contribute to enhanced safety and efficiency in air travel. Accurate navigation data reduces the risk of errors, while efficient flight planning optimizes fuel consumption and reduces travel times, leading to significant cost savings for airlines.

- Market Leadership: Jeppesen's market dominance is undeniable. Its products and services are used by a vast majority of airlines, pilots, and air navigation service providers globally, establishing it as a critical player in maintaining the integrity and safety of the global air traffic system. This widespread adoption underscores the importance of its role in the broader aviation ecosystem.

Thoma Bravo's Acquisition Strategy and Future Plans for Jeppesen

Thoma Bravo, a prominent private equity firm specializing in software and technology investments, is known for its strategic acquisitions and successful portfolio management. This acquisition aligns perfectly with their investment strategy.

- Proven Track Record: Thoma Bravo boasts a history of successful investments in technology companies, showcasing their expertise in scaling and enhancing software businesses. Their experience in navigating complex technological landscapes makes them well-suited to manage Jeppesen’s future growth.

- Strategic Goals: Thoma Bravo's likely strategic goals for Jeppesen include expanding its product offerings, investing in technological upgrades (including advancements in data analytics and artificial intelligence), and penetrating new markets. This could involve the development of innovative new aviation data solutions or expanding into related fields.

- Impact on Jeppesen: Private equity ownership could lead to significant changes within Jeppesen. While some worry about potential job cuts or shifts in product focus, others anticipate increased investment in research and development, ultimately benefiting clients through enhanced products and services.

- Industry Expertise: Thoma Bravo's previous investments in similar sectors demonstrate their understanding of the aviation technology market and their capability to support Jeppesen's continued success. Their portfolio showcases a pattern of nurturing and growing companies in the technology sector.

Impact of the Sale on Boeing and its Future Strategies

Boeing's decision to sell Jeppesen reflects a strategic shift towards focusing on its core competencies.

- Strategic Focus: By divesting Jeppesen, Boeing aims to sharpen its strategic focus on its core aerospace manufacturing and services business. This allows them to allocate resources more effectively to their primary areas of expertise.

- Financial Implications: The $5.6 billion sale brings significant financial benefits to Boeing, providing capital that can be reinvested in research and development of its core aircraft manufacturing operations or used to reduce debt.

- Future Direction: This divestment will undeniably reshape Boeing's future strategic direction, allowing them to consolidate efforts and concentrate investments in areas considered crucial for their long-term growth and competitiveness in the aerospace manufacturing market.

- Market Position: While shedding Jeppesen might seem like a loss, focusing on its core business should ultimately enhance Boeing's competitiveness in its primary market, potentially leading to increased efficiency and profitability.

Industry Reactions and Future Outlook for Aviation Data

The Boeing-Jeppesen-Thoma Bravo deal has sparked considerable discussion within the aviation industry.

- Industry Analysis: Industry analysts largely view the acquisition as a positive development, acknowledging Thoma Bravo's expertise in managing technology companies and its potential to further develop Jeppesen's innovative aviation data solutions. The sale highlights a trend of increased investment in aviation technology.

- Competitive Landscape: The sale may slightly shift the competitive landscape, with other aviation data providers potentially vying to fill any niche left by Jeppesen. However, Jeppesen’s long-established dominance is unlikely to be easily challenged.

- Future Trends: The future of aviation data is closely tied to advancements in data analytics, artificial intelligence, and machine learning. We can expect to see increasingly sophisticated tools for flight planning, air traffic management, and predictive maintenance.

- Technological Advancements: The deal could accelerate technological advancements in aviation data solutions, leading to enhanced safety, efficiency, and cost-effectiveness across the industry. This opens the door for innovative applications of data to address future challenges in aviation.

Conclusion

The Boeing-Jeppesen-Thoma Bravo deal represents a significant turning point in the aviation data landscape. Thoma Bravo's acquisition of Jeppesen signals a commitment to further innovation in this vital sector, while Boeing's strategic divestment allows it to focus on its core business. The long-term impact of this transaction will be felt across the aviation industry, shaping the future of navigation, flight operations, and the overall efficiency of air travel. Stay informed about the evolving landscape of aviation data and the impact of the Boeing Jeppesen transaction—follow us for continued updates on this and other crucial developments in the aerospace industry.

Featured Posts

-

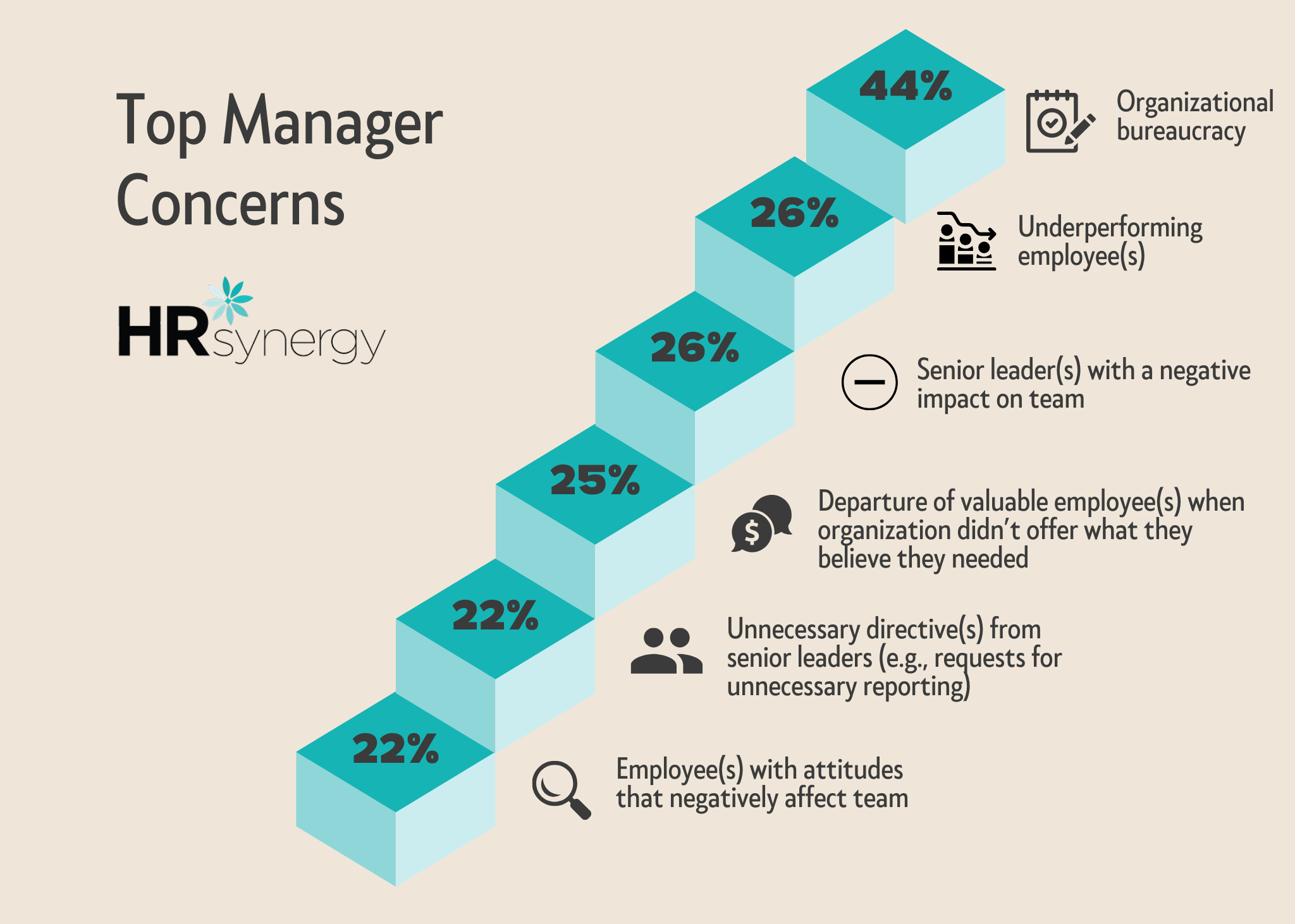

Why Middle Managers Are Essential For Company And Employee Success

Apr 23, 2025

Why Middle Managers Are Essential For Company And Employee Success

Apr 23, 2025 -

Unpacking Shota Imanagas Deceptive Splitter Mlb Pitching Technique

Apr 23, 2025

Unpacking Shota Imanagas Deceptive Splitter Mlb Pitching Technique

Apr 23, 2025 -

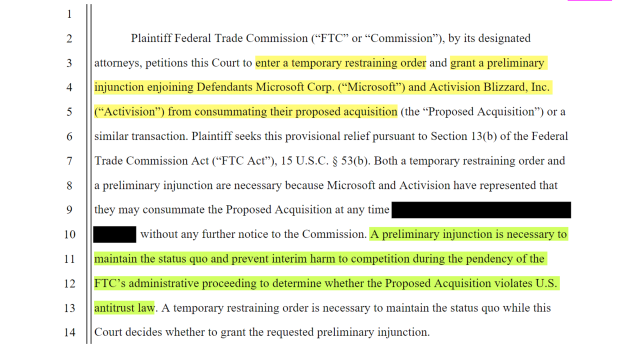

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 23, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 23, 2025 -

Die 50 2025 Teilnehmer Rausgeworfen Stream Folgen Alle Infos Zur 2 Staffel

Apr 23, 2025

Die 50 2025 Teilnehmer Rausgeworfen Stream Folgen Alle Infos Zur 2 Staffel

Apr 23, 2025 -

Lehigh Valley Faces Widespread Power Outages Due To Strong Winds

Apr 23, 2025

Lehigh Valley Faces Widespread Power Outages Due To Strong Winds

Apr 23, 2025