Boeing's China Jet Deliveries At Risk Amid Airline Acceptance Concerns

Table of Contents

Airline Concerns Regarding Boeing 737 MAX Safety and Reliability in China

Lingering safety concerns surrounding the Boeing 737 MAX, following two fatal crashes in 2018 and 2019, continue to cast a shadow over its acceptance in China. While the aircraft has been recertified globally, Chinese airlines remain hesitant. This reluctance stems from several factors:

-

Increased scrutiny from Chinese aviation authorities: Chinese regulators are meticulously reviewing the 737 MAX's safety modifications and operational procedures, demanding a higher level of assurance than in some other regions. This rigorous process adds significant time and cost to the certification and delivery timeline.

-

Pilot training requirements and potential cost implications: Extensive pilot retraining is required for Chinese pilots to operate the re-engineered 737 MAX. This adds a significant financial burden for airlines already dealing with the economic fallout of the pandemic.

-

Public perception and passenger confidence issues: Negative public perception following the accidents continues to impact passenger confidence in the 737 MAX. Restoring public trust is crucial for airlines to maximize the aircraft's operational efficiency.

-

Comparison with competitor aircraft (e.g., Airbus A320neo) and market share: The delay in 737 MAX deliveries has allowed competitors like Airbus, with its A320neo family, to gain market share in China. This competitive pressure further complicates Boeing's efforts to regain its foothold in the market.

Geopolitical Tensions and Their Impact on Boeing-China Relations

The broader geopolitical landscape significantly impacts Boeing's operations in China. US-China trade relations, marked by periods of tension, directly affect aircraft sales and delivery schedules. Government regulations and potential import restrictions add layers of complexity to the process.

-

US-China trade relations and their impact on Boeing: Escalating trade disputes can lead to tariffs or sanctions, increasing the cost of aircraft and potentially delaying deliveries. This uncertainty makes it difficult for airlines to commit to long-term purchases.

-

Potential for sanctions or trade barriers: The possibility of further sanctions or trade barriers creates a volatile environment, adding significant risk to Boeing's investments and operations in China. This uncertainty impacts both short-term and long-term planning.

-

Increased costs associated with navigating geopolitical complexities: Boeing faces increased costs in navigating the complex regulatory and political landscape in China. This includes legal fees, lobbying efforts, and the need for specialized expertise.

Financial Implications for Boeing and the Wider Aviation Industry

Delays or cancellations of Boeing's China jet deliveries will have substantial financial implications for Boeing and the wider aviation industry.

-

Projected revenue losses due to delayed deliveries: Each delayed or canceled delivery represents a significant loss in revenue for Boeing, impacting its profitability and financial stability.

-

Impact on Boeing's stock price and investor confidence: The uncertainty surrounding China deliveries directly affects investor confidence, leading to potential volatility in Boeing's stock price.

-

Consequences for jobs within Boeing and its supply chain: Delays could lead to job losses within Boeing and throughout its extensive global supply chain, causing ripple effects across various economies.

-

Shift in market dynamics and potential gains for competitors: The prolonged delays allow Airbus and other competitors to capitalize on the situation, potentially shifting market dynamics in China's favor.

Potential Solutions and Future Outlook for Boeing in China

To address airline acceptance concerns and navigate geopolitical complexities, Boeing needs a multi-pronged approach:

-

Strengthening communication with Chinese airlines and regulatory bodies: Open and transparent communication is essential to rebuilding trust and fostering a collaborative approach to resolving outstanding issues.

-

Investing in enhanced safety features and pilot training programs: Further investment in safety features and tailored pilot training programs specifically addressing Chinese regulatory requirements can improve confidence.

-

Adapting strategies to navigate the complex geopolitical environment: Developing strategies to effectively navigate the fluctuating geopolitical environment is crucial for Boeing's long-term success in China.

-

Long-term forecasts for Boeing's China market share: While the challenges are significant, the long-term outlook for Boeing in China remains dependent on successful adaptation to these complexities.

Conclusion: Navigating the Challenges of Boeing's China Jet Deliveries

The challenges impacting Boeing's China jet deliveries are multifaceted, encompassing safety concerns, geopolitical tensions, and significant financial repercussions. The Chinese market remains critically important for Boeing's global success. While overcoming these obstacles will require strategic adaptation and considerable effort, the potential for a positive resolution remains. To stay informed on further developments regarding Boeing's China jet deliveries and their implications for the global aviation industry, follow reputable industry news sources and analysis.

Featured Posts

-

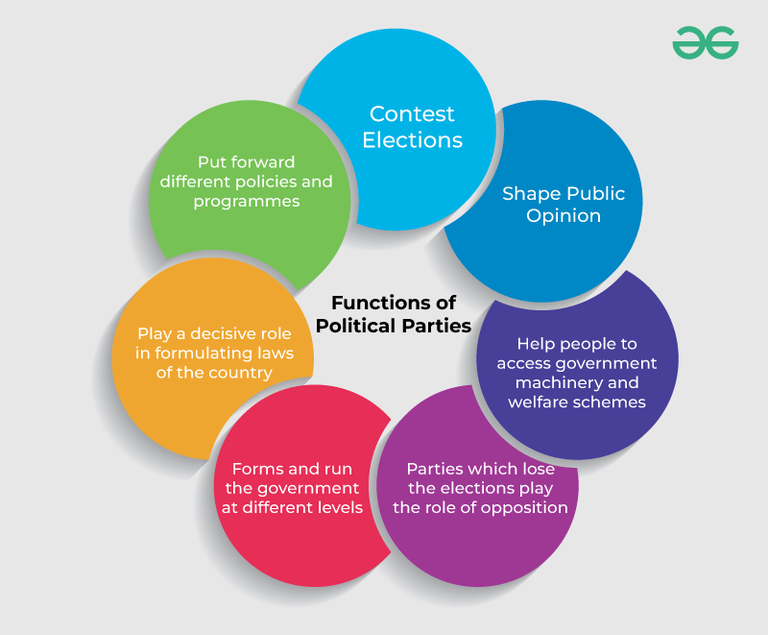

The Tough Times Test Analyzing The Responses Of Political Parties

Apr 25, 2025

The Tough Times Test Analyzing The Responses Of Political Parties

Apr 25, 2025 -

Assessing The Feasibility Of A China Canada Anti Us Alliance

Apr 25, 2025

Assessing The Feasibility Of A China Canada Anti Us Alliance

Apr 25, 2025 -

Eurovision 2025 Who Are The Frontrunners

Apr 25, 2025

Eurovision 2025 Who Are The Frontrunners

Apr 25, 2025 -

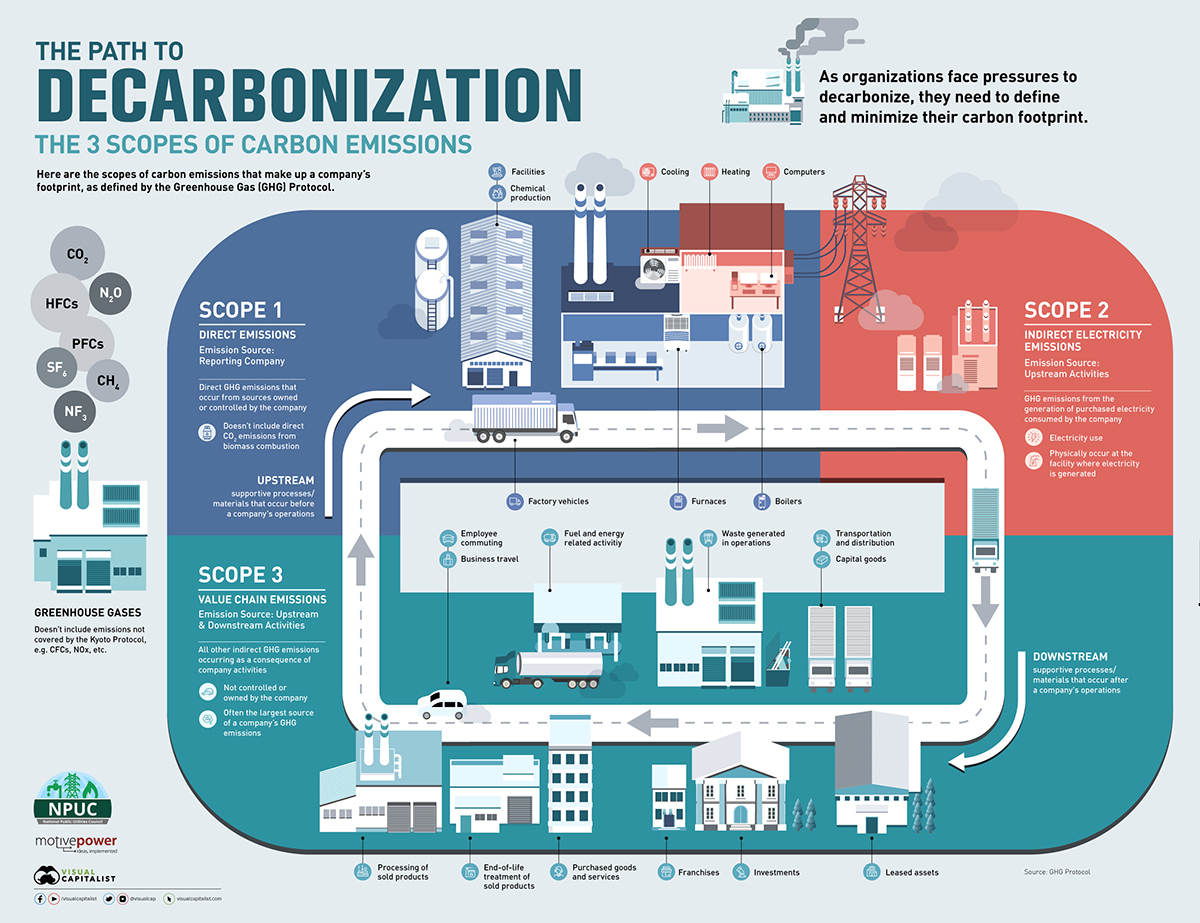

Xis Climate Strategy Chinas Independent Path To Emissions Reduction

Apr 25, 2025

Xis Climate Strategy Chinas Independent Path To Emissions Reduction

Apr 25, 2025 -

Cellnex Telecom Network Transformation And Uk Market Expansion Plans

Apr 25, 2025

Cellnex Telecom Network Transformation And Uk Market Expansion Plans

Apr 25, 2025

Latest Posts

-

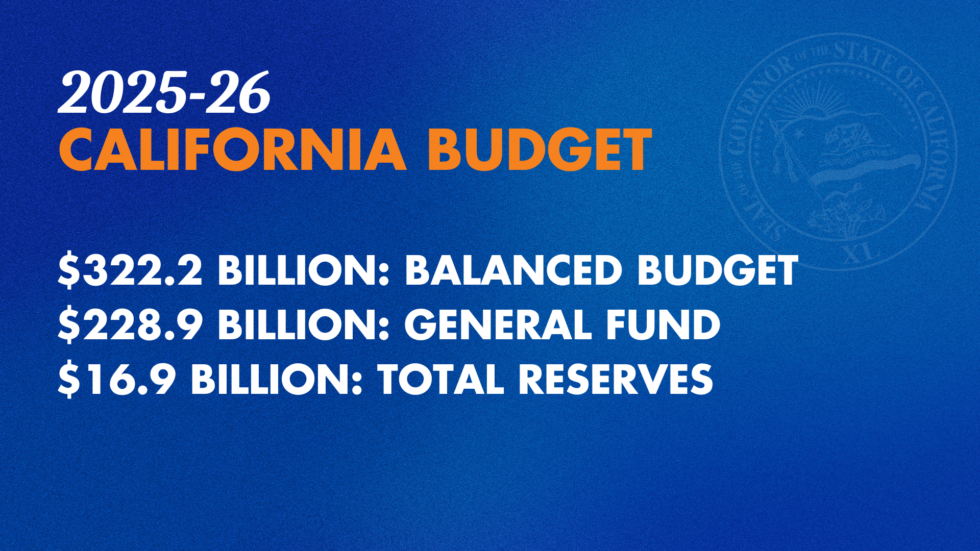

The Portnoy Newsom Feud What You Need To Know

Apr 26, 2025

The Portnoy Newsom Feud What You Need To Know

Apr 26, 2025 -

Dave Portnoy Unloads On Gavin Newsom The Full Story

Apr 26, 2025

Dave Portnoy Unloads On Gavin Newsom The Full Story

Apr 26, 2025 -

Portnoy Slams Newsom A Detailed Look At The Controversy

Apr 26, 2025

Portnoy Slams Newsom A Detailed Look At The Controversy

Apr 26, 2025 -

Understanding The Controversy Surrounding Gavin Newsom

Apr 26, 2025

Understanding The Controversy Surrounding Gavin Newsom

Apr 26, 2025 -

Newsoms Policies A Balanced Perspective

Apr 26, 2025

Newsoms Policies A Balanced Perspective

Apr 26, 2025