BofA On Stock Market Valuations: Reasons For Investor Calm

Table of Contents

BofA's Assessment of Current Stock Market Valuations

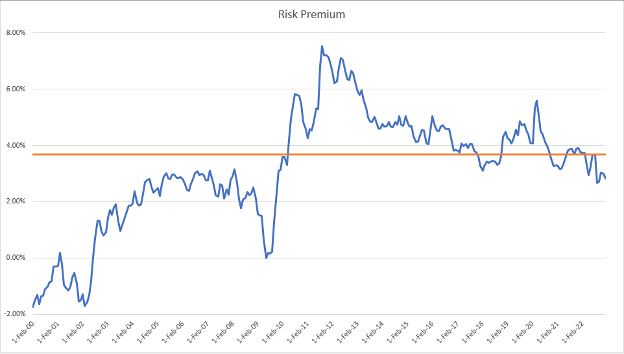

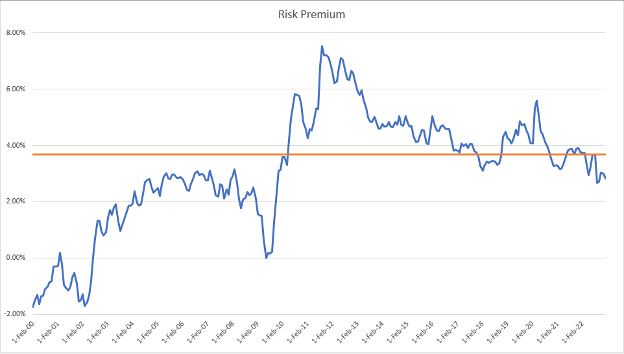

BofA's latest report on stock market valuations provides a crucial framework for understanding current investor behavior. The report employs various valuation metrics, including the widely used Price-to-Earnings ratio (P/E), to assess the market's overall health.

- BofA's findings: While precise figures vary depending on the specific index and methodology, BofA's analysis suggests that current valuations, while not dramatically cheap, are not excessively high compared to historical averages, particularly when considering the current interest rate environment (discussed further below). The report likely considers factors like market capitalization and earnings per share to arrive at its conclusions.

- Market valuation assessment: While the exact classification (overvalued, undervalued, or fairly valued) would need to be referenced from the original BofA report, the analysis likely indicates a nuanced perspective, acknowledging some sector-specific overvaluations while others might appear more reasonably priced.

- Sector-specific analysis: BofA likely identifies specific sectors, possibly technology or certain consumer discretionary stocks, as potentially overvalued due to high growth expectations. Conversely, sectors considered more defensive, such as utilities or healthcare, might be deemed relatively undervalued, offering a potentially safer investment option.

The Role of Interest Rates and Monetary Policy in Investor Calm

Interest rates and the Federal Reserve's (Fed) monetary policy play a pivotal role in shaping investor sentiment and stock market valuations. The Fed's actions directly impact borrowing costs, influencing corporate investment and consumer spending.

- Interest rate impact: Current interest rate levels, while higher than in recent years, may be perceived by some as already factoring in anticipated economic slowdown and inflation control measures. This could contribute to a sense of stability, even if rates remain elevated.

- Inflation and stock valuations: Although persistent inflation erodes purchasing power, the market may already be pricing in a scenario where the Fed successfully manages inflation without triggering a severe recession. This expectation, supported by BofA’s analysis, can influence investor behaviour and overall market sentiment.

- Bond yields and stock market performance: The relationship between bond yields and stock market performance is crucial. BofA's report likely analyzes the current yield curve and its implications for risk appetite. If bond yields are considered relatively attractive compared to stock market returns, investors might shift their allocation, impacting stock prices. However, if the perceived risk in bonds is higher, stocks might remain a relatively attractive option.

Factors Driving Corporate Earnings and Profitability

Corporate earnings and profitability are fundamental drivers of stock market performance. BofA's report likely delves into various factors influencing corporate earnings growth.

- Earnings growth analysis: BofA probably examines projected earnings growth across different sectors, taking into account factors such as revenue growth, cost controls, and profit margins. Strong earnings projections can bolster investor confidence.

- Contributing factors: Supply chain disruptions, although still a concern, have eased in some sectors, potentially contributing to improved profitability. Consumer spending, a major driver of economic growth, could be showing resilience, further underpinning positive corporate earnings.

- Investor confidence: Positive earnings projections, coupled with the above factors, foster investor confidence and contribute to the observed market calm. Investors may believe that corporate profits can withstand current economic headwinds.

Geopolitical Factors and Their Influence on Investor Sentiment

Geopolitical events significantly influence investor sentiment and market volatility. BofA's analysis likely assesses the impact of various global uncertainties.

- Geopolitical risk assessment: The ongoing war in Ukraine, tensions between the US and China, and other geopolitical hotspots are carefully considered by BofA in its valuation assessments. The report likely quantifies the potential impact of these events on market stability.

- Investor risk appetite: BofA's report may suggest that investors have either priced in a certain level of geopolitical risk or have developed strategies to mitigate it, contributing to their overall calm. Diversification and hedging strategies could be playing a significant role.

- Market volatility: While geopolitical risks persist, the market’s relative calm could suggest investors believe these risks are either manageable or already reflected in current valuations.

Conclusion

BofA's report on stock market valuations offers a compelling explanation for the current market calm amidst economic uncertainty. The analysis, encompassing valuations, interest rates, corporate earnings, and geopolitical factors, suggests a complex interplay of factors contributing to investor composure. While risks remain, BofA's assessment might indicate that these risks are either already priced into the market or are viewed as manageable by investors. However, it's crucial to remember that market conditions are dynamic and subject to change.

Call to Action: Stay informed about BofA's insights on stock market valuations and other economic indicators to navigate the complexities of the current market. Learn more about navigating the current market conditions based on BofA's analysis, and understand the reasons behind investor calm based on BofA's assessment of stock market valuations. This will empower you to make more informed investment decisions.

Featured Posts

-

John Wick 5 Confirmation And Production Details

May 11, 2025

John Wick 5 Confirmation And Production Details

May 11, 2025 -

Crazy Rich Asians Tv Show What We Know So Far

May 11, 2025

Crazy Rich Asians Tv Show What We Know So Far

May 11, 2025 -

Celtics Clinch Division With Magic Blowout Win

May 11, 2025

Celtics Clinch Division With Magic Blowout Win

May 11, 2025 -

How To Watch The Celtics Vs Knicks Game Live Stream And Tv Guide

May 11, 2025

How To Watch The Celtics Vs Knicks Game Live Stream And Tv Guide

May 11, 2025 -

Repetitive Documents Let Ai Create Your Next Podcast Hit

May 11, 2025

Repetitive Documents Let Ai Create Your Next Podcast Hit

May 11, 2025