BofA On Stock Market Valuations: Reasons For Investor Optimism

Table of Contents

BofA's Bullish Stance on Stock Market Valuations

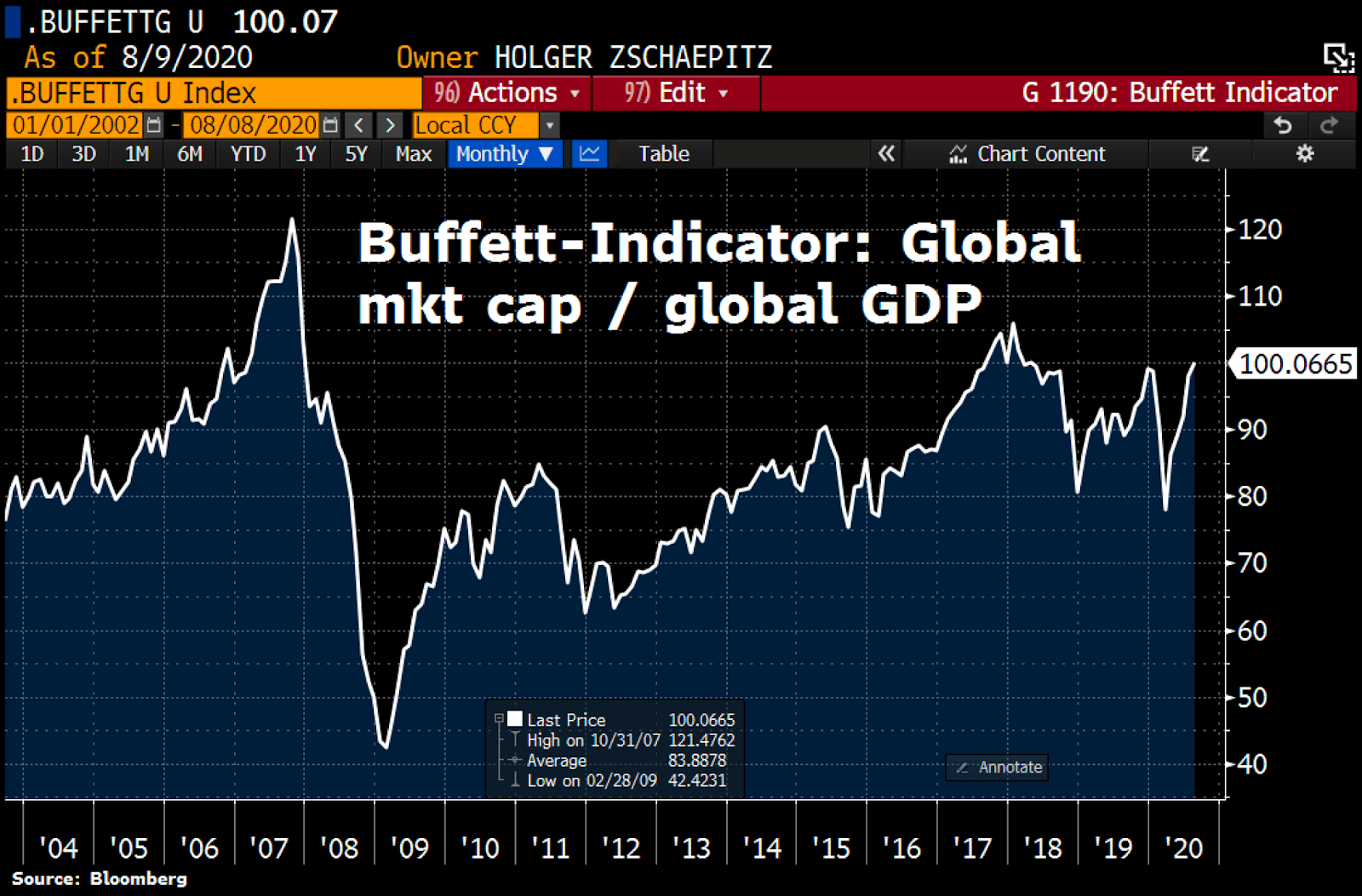

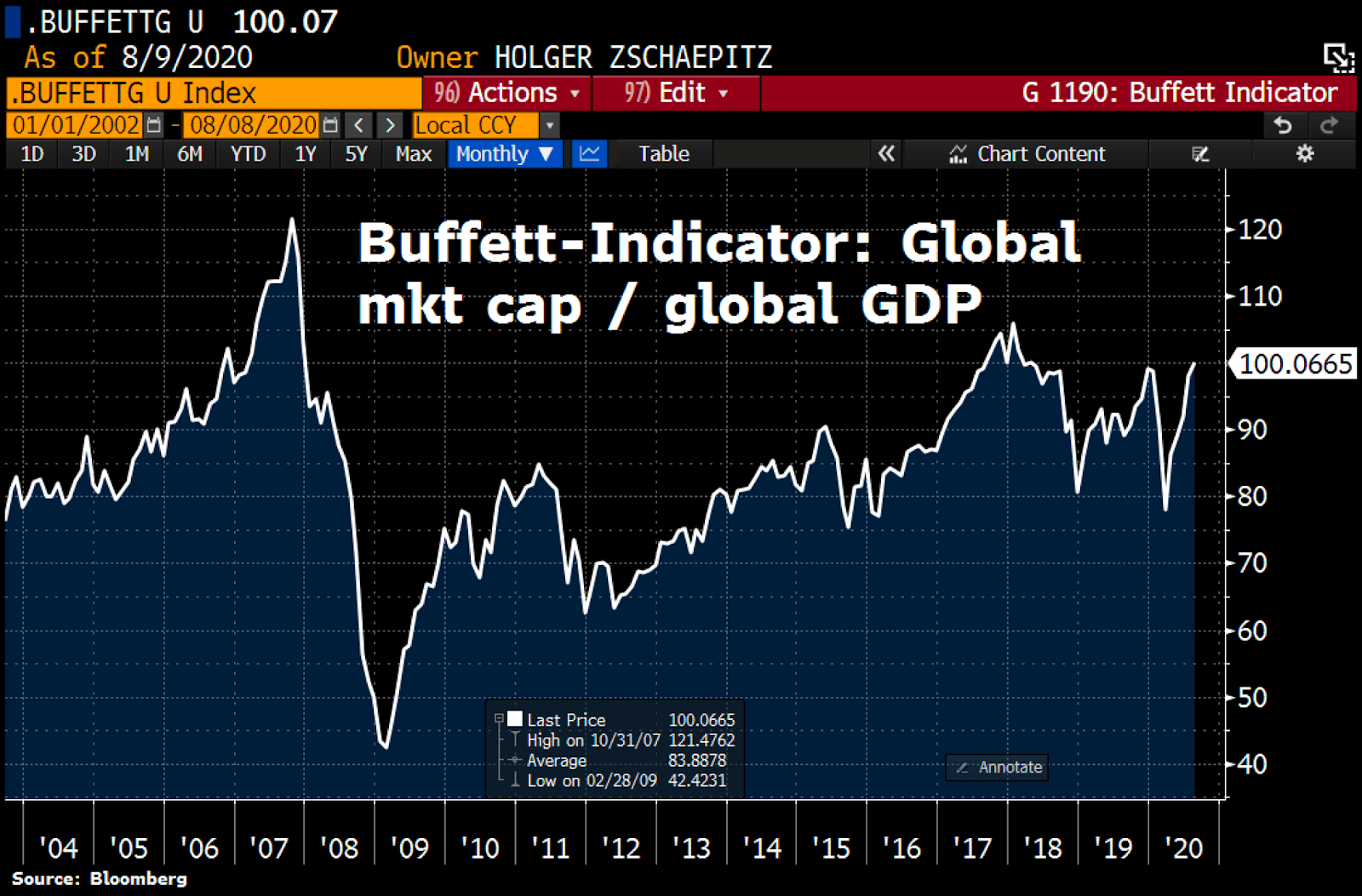

BofA's recent reports suggest that while not dirt cheap, current stock market valuations are not excessively expensive, considering the projected future earnings growth. They view the market as fairly valued, presenting a compelling case for continued investment. This assessment is largely based on their optimistic forecasts across several key economic indicators.

Earnings Growth Projections

BofA projects robust corporate earnings growth in the coming quarters. This positive outlook is fueled by several factors:

- Strong Revenue Growth: Many sectors are experiencing significant revenue expansion, driven by factors like increased consumer spending and robust global demand.

- Improving Profit Margins: Despite inflationary pressures, many companies are successfully managing costs and improving their profit margins, leading to higher earnings per share (EPS).

- Key Sectors Driving Growth: BofA specifically highlights the technology, energy, and healthcare sectors as major contributors to overall earnings growth. Their projections indicate above-average revenue and EPS growth for these sectors. However, these projections are contingent on sustained economic growth and manageable inflation.

Interest Rate Outlook and its Impact

BofA's analysis considers the impact of interest rate adjustments by the Federal Reserve (Fed). While acknowledging potential rate hikes to combat inflation, they believe that the current rate trajectory is sustainable and won't significantly hamper corporate earnings or investment sentiment.

- Controlled Rate Increases: BofA anticipates moderate interest rate increases, avoiding a sharp shock to the financial system.

- Impact on Borrowing Costs: While higher rates will increase borrowing costs for businesses, this effect is expected to be manageable, not stifling growth.

- Positive Effects on Banking Sector: Rising interest rates typically boost the profitability of banks, creating a positive ripple effect across the market.

Inflationary Pressures and Their Mitigation

BofA acknowledges the ongoing inflationary pressures but anticipates a gradual cooling down of the inflation rate. They highlight the proactive measures companies are taking to mitigate inflationary impact.

- Supply Chain Stabilization: Supply chain disruptions are slowly resolving, easing commodity price pressures and improving corporate profitability.

- Pricing Power: Many companies are successfully passing on increased costs to consumers, protecting their profit margins.

- CPI Slowdown: BofA’s analysts predict a steady decline in the Consumer Price Index (CPI) over the next year, reducing the overall pressure on corporate earnings.

Specific Sectors Identified by BofA for Strong Performance

BofA's research points to several sectors poised for strong performance. Their analysis provides a granular view of various market segments.

Technology Sector Analysis

The technology sector remains a focal point for BofA, with particular emphasis on specific sub-sectors.

- Artificial Intelligence (AI): BofA sees significant growth potential in AI-related companies, anticipating substantial investment and innovation in this space.

- Cloud Computing: The continued shift towards cloud-based solutions drives substantial growth in this sub-sector, supporting BofA's optimistic view.

- Software-as-a-Service (SaaS): The SaaS model's recurring revenue streams provide stability and predictability, making it an attractive investment for BofA.

Other High-Growth Sectors

Beyond technology, BofA identifies several other high-growth sectors:

- Renewable Energy: The global push for sustainable energy sources fuels significant investment and growth opportunities in this sector.

- Healthcare: An aging global population and advances in medical technology are driving substantial demand and innovation in the healthcare sector.

- Consumer Discretionary: As consumer confidence improves and inflation moderates, BofA anticipates robust growth in the consumer discretionary sector.

Potential Risks and Cautions Highlighted by BofA

While presenting a generally optimistic outlook, BofA acknowledges potential risks that could impact stock market valuations.

Geopolitical Risks

Geopolitical uncertainties, such as ongoing conflicts and trade tensions, remain a significant concern.

- Global Economic Growth: Geopolitical instability could disrupt global supply chains and negatively impact overall economic growth.

- Market Volatility: Geopolitical events can trigger increased market volatility, affecting investor sentiment and stock prices.

- Risk Mitigation: BofA advises investors to diversify their portfolios and carefully monitor geopolitical developments.

Market Volatility

BofA anticipates periods of market volatility, emphasizing the need for prudent risk management strategies.

- Market Corrections: Periodic market corrections are considered normal, and investors should not panic during these periods.

- Portfolio Diversification: A diversified portfolio is crucial to mitigate the impact of market fluctuations.

- Long-Term Perspective: BofA emphasizes the importance of maintaining a long-term investment horizon, weathering short-term market volatility.

Conclusion

BofA's analysis presents a compelling case for investor optimism regarding stock market valuations. Their projections of robust earnings growth, coupled with a manageable interest rate outlook and anticipated easing of inflationary pressures, paint a positive picture. While acknowledging the ever-present risks of geopolitical uncertainty and market volatility, BofA's research underscores the potential for continued growth and positive returns. Understand BofA's insights on stock market valuations and make informed investment decisions. Learn more about BofA's stock market valuation analysis and optimize your investment portfolio.

Featured Posts

-

Jiskefet Ere Zilveren Nipkowschijf Winnaars

May 15, 2025

Jiskefet Ere Zilveren Nipkowschijf Winnaars

May 15, 2025 -

Dodgers Offseason Review Key Moves And Future Outlook

May 15, 2025

Dodgers Offseason Review Key Moves And Future Outlook

May 15, 2025 -

Kogda Ovechkin Pobet Rekord Grettski N Kh L Daet Prognoz

May 15, 2025

Kogda Ovechkin Pobet Rekord Grettski N Kh L Daet Prognoz

May 15, 2025 -

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Palace Ta Tanitim

May 15, 2025

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Palace Ta Tanitim

May 15, 2025 -

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Career

May 15, 2025

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Career

May 15, 2025