BofA Reassures Investors: Why Current Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Rationale: Underlying Economic Strength

BofA's confidence in current stock market valuations stems from a positive assessment of the underlying economic strength. Their analysis points to several key indicators suggesting a healthy and robust economy. This positive economic outlook forms the bedrock of their reassuring message to investors.

-

Robust GDP Growth: BofA cites continued GDP growth as a primary driver of their optimism. This sustained expansion indicates a healthy economy capable of supporting current market levels. Specific data points from BofA's reports on projected GDP growth for the coming quarters should be referenced here (assuming access to such data). The inclusion of this data would significantly strengthen the argument.

-

Strong Consumer Spending: Resilient consumer spending continues to fuel economic growth. This demonstrates confidence in the economy and suggests that consumers are comfortable with current spending levels, indicating ongoing economic health and supporting future market growth.

-

Improving Corporate Earnings: BofA's analysis highlights improving corporate earnings across various sectors. This positive trend signifies strong profitability, which directly influences stock prices and justifies, to some extent, current valuations. Specific examples of high-performing sectors should be included, further emphasizing BofA's reasoning.

-

Future Economic Growth Potential: BofA's outlook extends beyond current figures, anticipating further economic growth in the coming years. This projected growth trajectory, supported by their economic models, significantly bolsters their argument that current stock market valuations are sustainable.

Addressing Valuation Concerns: A Deeper Dive

While concerns about high price-to-earnings ratios (P/E) and other valuation multiples are understandable, BofA offers counterarguments. Their analysis goes beyond superficial metrics, incorporating a nuanced understanding of the current economic landscape.

-

Low Interest Rates: BofA likely acknowledges that low interest rates contribute to higher valuations. Lower borrowing costs incentivize investment, leading to increased demand for equities and potentially justifying higher P/E ratios in the context of the low-interest environment.

-

Anticipated Future Earnings Growth: BofA's assessment likely factors in anticipated future earnings growth. Their analysis probably projects substantial earnings growth in coming years, thus supporting current valuations, even if they appear high based on current earnings alone.

-

Risk Assessment and Mitigation: BofA’s approach to risk assessment is crucial. They likely employ sophisticated models to analyze various potential risks, such as inflation, geopolitical instability, and changes in interest rate policies. Understanding how they incorporate these risks into their valuation analysis provides crucial context to investors.

-

Sector-Specific Analysis: BofA's analysis isn't a one-size-fits-all approach. They likely provide sector-specific assessments, identifying sectors where valuations are justified by robust growth prospects and those where caution may be warranted. High growth sectors, supported by strong fundamentals and positive future projections, would serve as good examples.

BofA's Investment Strategy Recommendations

Based on their assessment of stock market valuations and the broader economic outlook, BofA likely offers tailored investment strategies. These strategies aim to navigate the market effectively while minimizing risk.

-

Diversification: BofA undoubtedly emphasizes the importance of diversification across different asset classes and sectors. This strategy reduces portfolio volatility and protects against potential market downturns.

-

Long-Term Investment Horizon: A long-term investment approach is crucial, according to BofA's perspective. They likely advise against making impulsive decisions based on short-term market fluctuations. Holding investments through market cycles reduces the impact of volatility.

-

Adjusting Portfolios Based on Risk Tolerance: BofA's recommendations consider individual investor risk tolerance. This implies that they offer diverse options catering to different risk profiles.

-

Sector Rotation Strategies: BofA’s investment recommendations likely include sector rotation strategies. They may suggest shifting investments from sectors with high valuations to those presenting stronger future growth potential. Specific examples of potential sector rotation moves could increase the practical value of this advice. (Note: This is not financial advice).

Conclusion

BofA's reassuring message regarding current stock market valuations rests on a strong foundation of underlying economic strength and a nuanced understanding of valuation metrics. Their counterarguments to concerns about high valuations incorporate factors such as low interest rates, projected future earnings growth, and a robust risk assessment framework. BofA's generally optimistic outlook encourages a long-term investment strategy focusing on diversification and careful portfolio management. To gain a more comprehensive understanding of BofA's perspective on current stock market valuations, we recommend researching their full reports and analyses. However, remember to consult with a qualified financial advisor before making any investment decisions. Stay informed about BofA's insights into stock market valuations and navigate the market with confidence.

Featured Posts

-

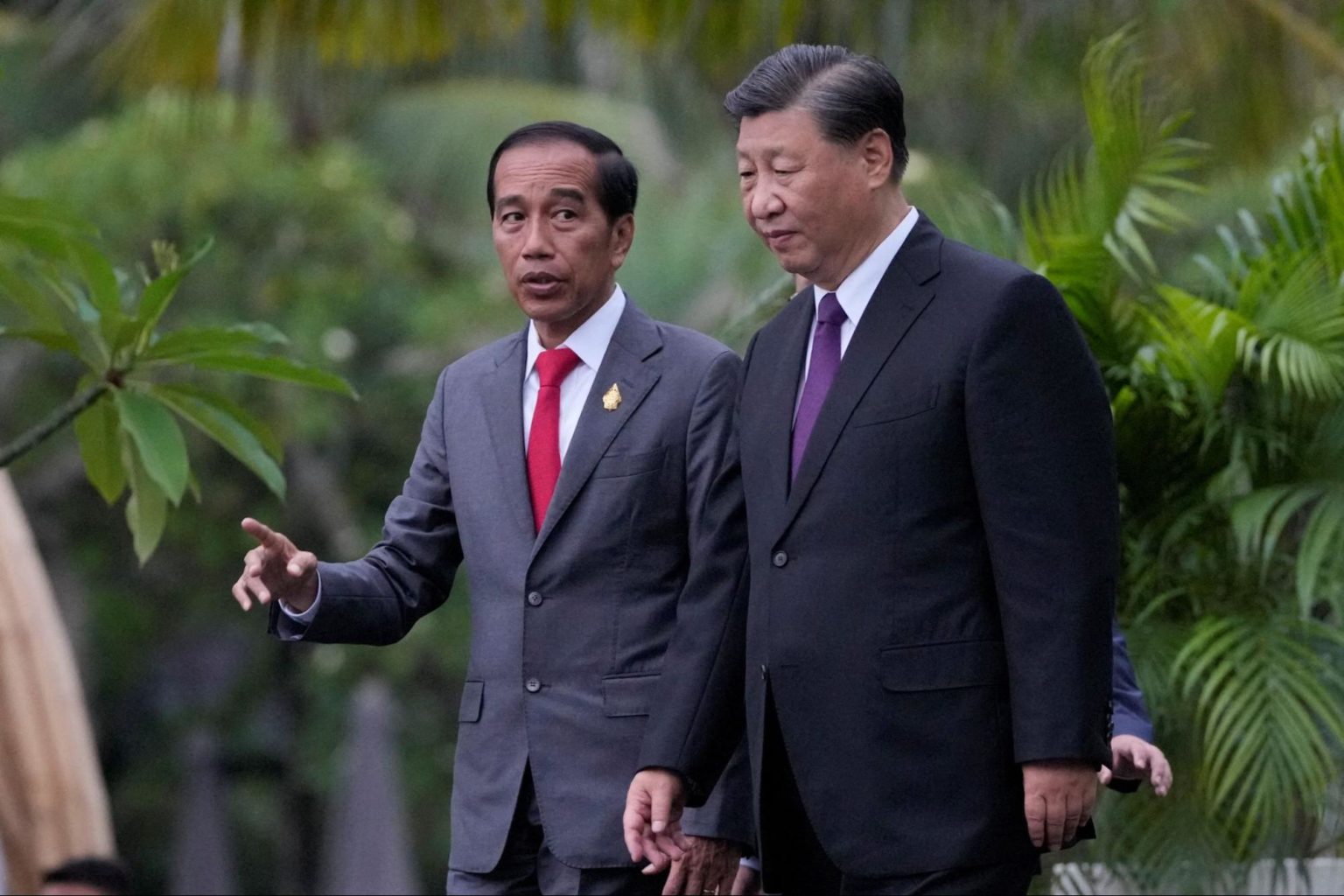

Closer Security Cooperation Between China And Indonesia

Apr 22, 2025

Closer Security Cooperation Between China And Indonesia

Apr 22, 2025 -

Dow Futures Dollar Decline Live Stock Market Updates And Analysis

Apr 22, 2025

Dow Futures Dollar Decline Live Stock Market Updates And Analysis

Apr 22, 2025 -

Death Of Pope Francis Legacy And Impact On The Catholic Church

Apr 22, 2025

Death Of Pope Francis Legacy And Impact On The Catholic Church

Apr 22, 2025 -

Metas Future Under The Shadow Of The Trump Administration

Apr 22, 2025

Metas Future Under The Shadow Of The Trump Administration

Apr 22, 2025 -

The Growing Movement To Break Up Google Examining The Arguments

Apr 22, 2025

The Growing Movement To Break Up Google Examining The Arguments

Apr 22, 2025