BofA Reassures Investors: Why Stretched Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Rationale: Strong Corporate Earnings and Growth Prospects

BofA's primary argument rests on the foundation of robust corporate earnings and promising growth prospects. They contend that strong earnings are currently justifying the seemingly high valuations observed in the market. This isn't just a general assertion; it's backed by concrete data and analysis.

- Specific Sectors Showing Strength: BofA's research highlights significant earnings growth in key sectors, including technology, healthcare, and consumer staples. These sectors demonstrate resilience even amidst economic uncertainties.

- Positive Economic Indicators: The bank points to projected growth in key economic indicators, such as GDP and consumer spending, as further justification. These forecasts suggest a sustained period of economic expansion, supporting continued corporate profitability.

- Data from BofA Reports: BofA's reports cite projected EPS (earnings per share) growth exceeding expectations for many companies, and revenue forecasts remain positive across a broad spectrum of industries. This data underpins their belief that current valuations are sustainable. Keywords used include "corporate earnings," "earnings growth," "stock market growth," "economic indicators," "BofA research," and "valuation justification."

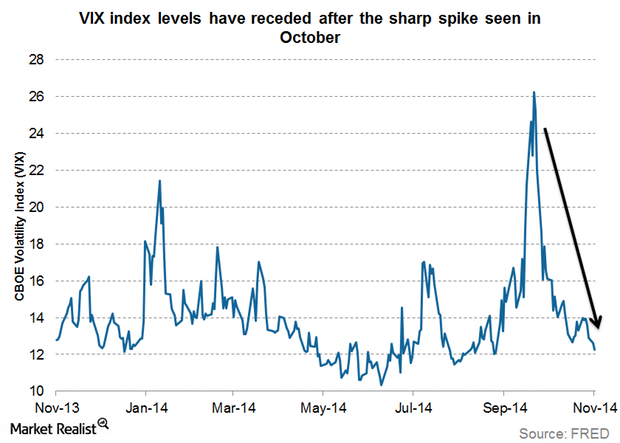

The Role of Low Interest Rates and Monetary Policy

Low interest rates and accommodative monetary policies play a significant role in supporting current high stock market valuations. This supportive environment encourages investment and fuels market growth.

- Impact on Investment Decisions: Low interest rates reduce the cost of borrowing, making it more attractive for companies to invest in expansion and for individuals to invest in the stock market. This increased investment activity naturally pushes valuations higher.

- Influence of Monetary Policy: While quantitative easing (QE) may have tapered off in many economies, the lingering effects of previous accommodative monetary policies continue to support market valuations.

- Central Bank Statements: Statements from central banks like the Federal Reserve regarding their intention to maintain a supportive interest rate environment for the foreseeable future further bolster BofA's argument. Keywords included: "Low interest rates," "monetary policy," "quantitative easing," "interest rate environment," "central bank policies," and "investment decisions."

Addressing Inflation Concerns and Their Impact on Valuations

Acknowledging the valid concern of inflation, BofA addresses its potential impact on stock market valuations. While inflation erodes purchasing power and can impact profitability, BofA's analysis suggests a nuanced perspective.

- BofA's Inflation Outlook: BofA believes current inflation levels, while elevated, are likely to moderate in the coming months. They don't foresee runaway inflation that would significantly derail market growth.

- Managing Inflationary Pressures: BofA anticipates companies effectively managing inflationary pressures through pricing strategies and operational efficiencies. This mitigates the negative impact of rising costs.

- Hedging Strategies: Many companies are employing various hedging strategies to protect against future price increases and volatility, further reducing the risk posed by inflation. Keywords used: "Inflation," "inflationary pressures," "price increases," "hedging strategies," "risk management," and "BofA inflation outlook."

Long-Term Growth Potential and Future Market Outlook (According to BofA)

BofA's long-term outlook for the stock market remains positive, driven by several key factors. They believe the current valuations reflect not just present earnings but also significant future growth potential.

- Technological Advancements: Technological advancements, particularly in areas such as artificial intelligence and renewable energy, are expected to fuel significant economic growth and create new investment opportunities.

- Emerging Markets: BofA highlights the growth potential of emerging markets, anticipating their continued contribution to global economic expansion.

- BofA's Market Forecast: BofA's market forecast incorporates these factors, suggesting continued, albeit potentially moderated, market growth over the long term. Keywords utilized: "Long-term growth," "market outlook," "future market predictions," "technological advancements," "emerging markets," and "BofA market forecast."

Conclusion: Why You Shouldn't Panic About Stretched Stock Market Valuations (Based on BofA's Analysis)

In conclusion, BofA's analysis suggests that while stock market valuations might appear stretched, several factors – strong corporate earnings, supportive monetary policy, manageable inflation, and significant long-term growth potential – mitigate the risks. The bank's optimistic outlook emphasizes the importance of considering long-term growth prospects rather than reacting solely to short-term market fluctuations. Don't let the headlines scare you. Understand the full picture by exploring BofA's in-depth analysis of stretched stock market valuations. [Link to BofA research - replace bracketed information with actual link] A well-informed long-term investment strategy considers all facets of the market, including BofA's insights on stretched stock market valuations and their implications for investor confidence and the overall market outlook.

Featured Posts

-

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025 -

Ftc To Appeal Microsoft Activision Merger Decision

Apr 29, 2025

Ftc To Appeal Microsoft Activision Merger Decision

Apr 29, 2025 -

Louisville Representative Challenges Usps On Mail Delivery Transparency

Apr 29, 2025

Louisville Representative Challenges Usps On Mail Delivery Transparency

Apr 29, 2025 -

European Power Prices Plunge Solar Surge Sends Prices Below Zero

Apr 29, 2025

European Power Prices Plunge Solar Surge Sends Prices Below Zero

Apr 29, 2025 -

Minnesota Faces Pressure Attorney Generals Transgender Athlete Ban Warning

Apr 29, 2025

Minnesota Faces Pressure Attorney Generals Transgender Athlete Ban Warning

Apr 29, 2025

Latest Posts

-

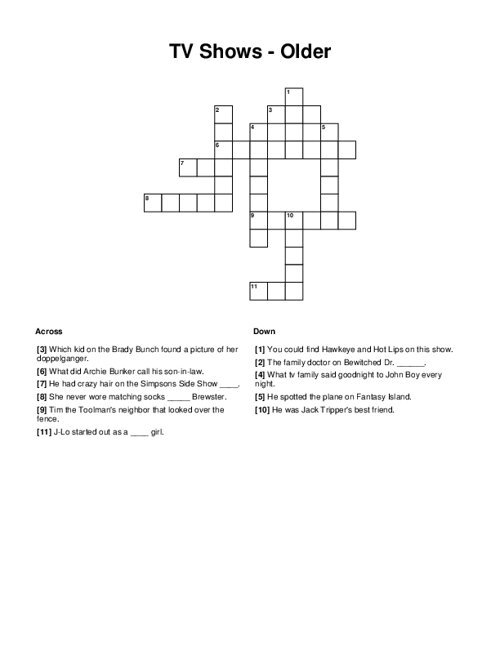

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Content

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Content

Apr 29, 2025 -

Older Viewers Rediscovering Favorite Shows On You Tube

Apr 29, 2025

Older Viewers Rediscovering Favorite Shows On You Tube

Apr 29, 2025 -

Netflixs Sirens Trailer Supergirl Milly Alcock And Julianne Moores Cult

Apr 29, 2025

Netflixs Sirens Trailer Supergirl Milly Alcock And Julianne Moores Cult

Apr 29, 2025