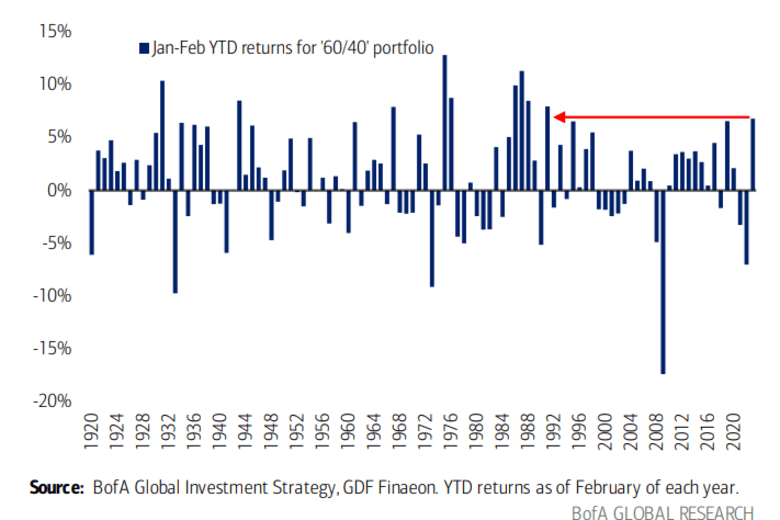

BofA's Perspective On High Stock Market Valuations And Investor Concerns

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's research provides valuable insights into the current state of the market, helping investors understand the prevailing high stock market valuations and potential risks.

Identifying Overvalued Sectors

BofA's sector analysis identifies several areas as potentially overvalued, primarily based on their price-to-earnings ratio (P/E) and market capitalization relative to fundamental performance. Overvaluation, in this context, signifies that stock prices may not accurately reflect the underlying value of the company.

- Technology: Many technology companies, especially those in the growth sector, have seen significant price increases, leading BofA to flag potential overvaluation in this sector. High growth expectations are not always supported by current fundamentals, creating a risk of correction.

- Consumer Discretionary: Companies in the consumer discretionary sector, particularly those reliant on consumer spending, may be vulnerable to changes in economic conditions and interest rates. BofA's analysis suggests that some companies in this sector may be trading at inflated valuations.

- Real Estate: The real estate sector, particularly in specific geographic regions, has exhibited robust growth, leading to concerns about potential overvaluation in certain segments. BofA's research suggests careful consideration of specific market dynamics is necessary.

These assessments are supported by BofA's proprietary valuation models, which consider various factors impacting market capitalization.

Factors Contributing to High Valuations

Several factors contribute to the current high stock market valuations. BofA highlights the interplay of these elements in shaping market sentiment and investor appetite.

- Low Interest Rates: Historically low interest rates have encouraged investors to seek higher returns in the stock market, pushing up valuations. This low-cost borrowing environment fuels speculation and increases demand for equities.

- Quantitative Easing (QE): Monetary policies like QE have injected significant liquidity into the market, further boosting stock prices and contributing to higher valuations. This influx of capital increases the buying power, driving prices up.

- Inflation: While inflation can negatively impact certain sectors, it can also contribute to higher valuations if investors anticipate companies passing increased costs onto consumers. BofA's analysis considers the varying impact of inflation across different sectors.

- Strong Market Sentiment: Positive investor sentiment and expectations of continued economic growth contribute to higher valuations. This optimistic outlook fuels demand, pushing stock prices upward.

However, BofA acknowledges that these factors are not without counterarguments. Geopolitical instability and potential supply chain disruptions represent countervailing forces that could impact market valuations.

BofA's Valuation Models and Methodology

BofA utilizes a combination of quantitative and qualitative methods for its valuations. Transparency and rigor are key to their approach.

- Discounted Cash Flow (DCF) Analysis: BofA employs DCF models to estimate the intrinsic value of companies based on their projected future cash flows. This fundamental analysis is a cornerstone of their valuation process.

- Relative Valuation: BofA also uses relative valuation techniques, comparing a company's valuation metrics to those of its peers within the same sector. This comparative analysis helps identify potential over- or undervaluation relative to the market.

While BofA's models are sophisticated, it's crucial to acknowledge that all valuation methods have limitations. Future events and unforeseen circumstances can impact the accuracy of any prediction.

Addressing Investor Concerns About Market Corrections

BofA acknowledges the potential for a market correction and offers insights into potential risks and recommends strategies for investors.

Potential Risks and Downside Scenarios

BofA's risk assessment includes several potential downside scenarios. While predicting the timing and magnitude of a market correction is impossible, they provide insights into potential triggers and impacts.

- Interest Rate Hikes: Increased interest rates could negatively impact stock valuations, particularly for growth companies reliant on cheap debt. This could lead to a market correction or a period of increased volatility.

- Inflationary Pressures: Persistently high inflation could erode corporate profits and investor confidence, potentially leading to a market downturn.

- Geopolitical Uncertainty: Global geopolitical events can significantly impact market sentiment and lead to increased volatility.

BofA emphasizes that these are potential scenarios and not definitive predictions. The likelihood and impact of these risks depend on various interconnected factors.

BofA's Recommendations for Investors

BofA advises investors to take a proactive approach to managing risk in the current market environment.

- Portfolio Diversification: BofA recommends diversifying investments across different asset classes to mitigate risk. Spreading investments reduces the impact of any single investment's underperformance.

- Risk Management: Investors should carefully assess their risk tolerance and adjust their portfolio accordingly. Conservative investors may consider reducing their equity exposure.

- Strategic Asset Allocation: BofA encourages investors to review and adjust their asset allocation strategies based on their risk profile and long-term investment goals.

Specific investment opportunities highlighted by BofA often depend on the current market conditions and are typically available through their wealth management services.

Long-Term Outlook and Growth Potential

Despite the current high stock market valuations and investor concerns, BofA maintains a cautiously optimistic long-term outlook for the market.

- Long-Term Growth: BofA believes that long-term economic growth will continue, albeit potentially at a slower pace than in recent years. This suggests a gradual rather than immediate market correction is more likely.

- Sector-Specific Opportunities: BofA identifies specific sectors with promising long-term growth potential, even amidst current market uncertainties. These opportunities often require a longer-term investment horizon.

Their long-term view accounts for various economic indicators, technological advancements, and demographic shifts which all play a role in long-term investment strategies.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis highlights the complexities of the current market, emphasizing both the potential risks associated with high stock market valuations and the opportunities for long-term investors. Their recommendations underscore the importance of diversification, risk management, and a well-defined investment strategy. Understanding the factors contributing to high stock market valuations and investor concerns is crucial for making informed investment decisions. We encourage you to conduct your own thorough research, consult with financial advisors, and stay informed about BofA's ongoing market analysis to make informed decisions regarding high stock market valuations and investor concerns.

Featured Posts

-

Kanye Wests Ex Julia Fox Accused Of Copying Bianca Censoris Style

May 18, 2025

Kanye Wests Ex Julia Fox Accused Of Copying Bianca Censoris Style

May 18, 2025 -

Netflix Series Reveals Key Phone Call In Bin Laden Capture

May 18, 2025

Netflix Series Reveals Key Phone Call In Bin Laden Capture

May 18, 2025 -

Tony Gonsolins Strong Return Dodgers Extend Winning Streak To Five

May 18, 2025

Tony Gonsolins Strong Return Dodgers Extend Winning Streak To Five

May 18, 2025 -

Moodys Us Downgrade White House Condemnation And Economic Fallout

May 18, 2025

Moodys Us Downgrade White House Condemnation And Economic Fallout

May 18, 2025 -

Will A Canadian Tire And Hudsons Bay Partnership Succeed Analysis Of Potential Challenges

May 18, 2025

Will A Canadian Tire And Hudsons Bay Partnership Succeed Analysis Of Potential Challenges

May 18, 2025

Latest Posts

-

Understanding The Dying For Sex Clasp Michelle Williams Perspective

May 18, 2025

Understanding The Dying For Sex Clasp Michelle Williams Perspective

May 18, 2025 -

Snls Signal Group Chat Sketch Features Mikey Madison And Government Officials

May 18, 2025

Snls Signal Group Chat Sketch Features Mikey Madison And Government Officials

May 18, 2025 -

Snl Spoofs Signal Leak With Mikey Madison Texting Government Officials

May 18, 2025

Snl Spoofs Signal Leak With Mikey Madison Texting Government Officials

May 18, 2025 -

Michelle Williams Clarifies Dying For Sex Scene With Marcello Hernandez

May 18, 2025

Michelle Williams Clarifies Dying For Sex Scene With Marcello Hernandez

May 18, 2025 -

Michelle Williams On Dying For Sex Clasp Scene Unanswered Questions

May 18, 2025

Michelle Williams On Dying For Sex Clasp Scene Unanswered Questions

May 18, 2025