BofA's Rationale: Why Current Stock Market Valuations Are Not A Concern

Table of Contents

BofA's Macroeconomic Outlook: A Foundation for Valuation Justification

BofA's macroeconomic outlook forms the bedrock of their valuation assessment. While acknowledging inherent uncertainties, their overall view leans towards cautious optimism. They foresee continued, albeit moderated, economic growth, tempered by inflationary pressures and geopolitical risks. This balanced perspective influences their assessment of current stock market valuations.

- Projected GDP Growth: BofA's GDP growth predictions for the US and globally generally indicate moderate expansion, albeit slower than in previous years. Specific figures will vary depending on the report and timeframe, but the overall trend suggests sustainable, if not robust, growth.

- Inflation Forecasts and Interest Rate Impact: BofA's inflation forecast suggests a gradual decline from current levels, although elevated inflation is expected to persist for some time. This outlook informs their expectations regarding interest rate hikes by central banks, anticipating a more measured approach compared to earlier predictions of aggressive tightening. Their analysis considers the impact on corporate profitability and consumer spending.

- Geopolitical Risks: BofA's analysis acknowledges significant geopolitical risks, including the ongoing conflict in Ukraine and rising tensions in other parts of the world. However, their assessment generally suggests that while these risks pose challenges, they are not expected to derail the overall economic recovery.

- Supporting Data: To understand the nuances of BofA's macroeconomic outlook, it is crucial to refer to their regularly published research reports and analyst commentaries. These resources provide detailed breakdowns of their forecasts and the underlying data supporting their conclusions. Look for keywords like "BofA economic outlook," "BofA inflation forecast," and "BofA GDP growth prediction" in their publications.

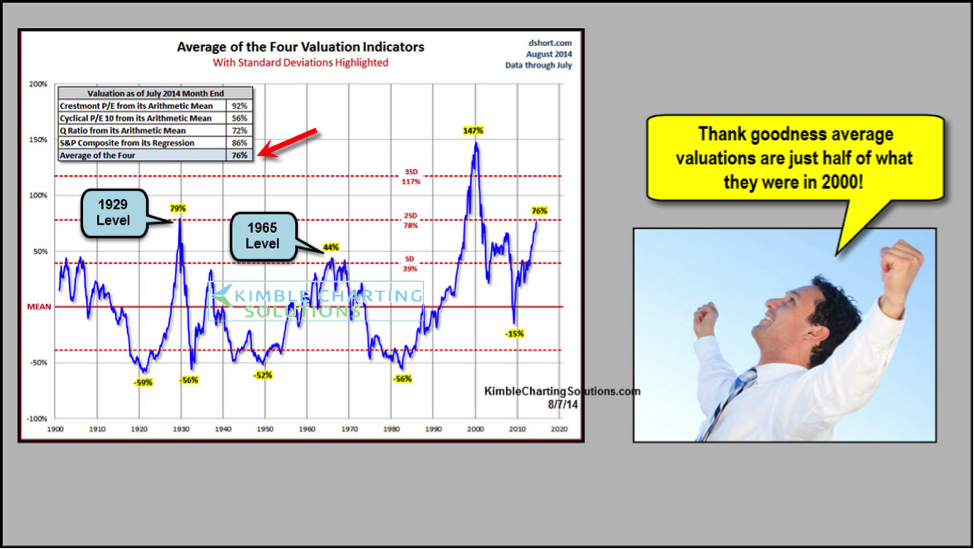

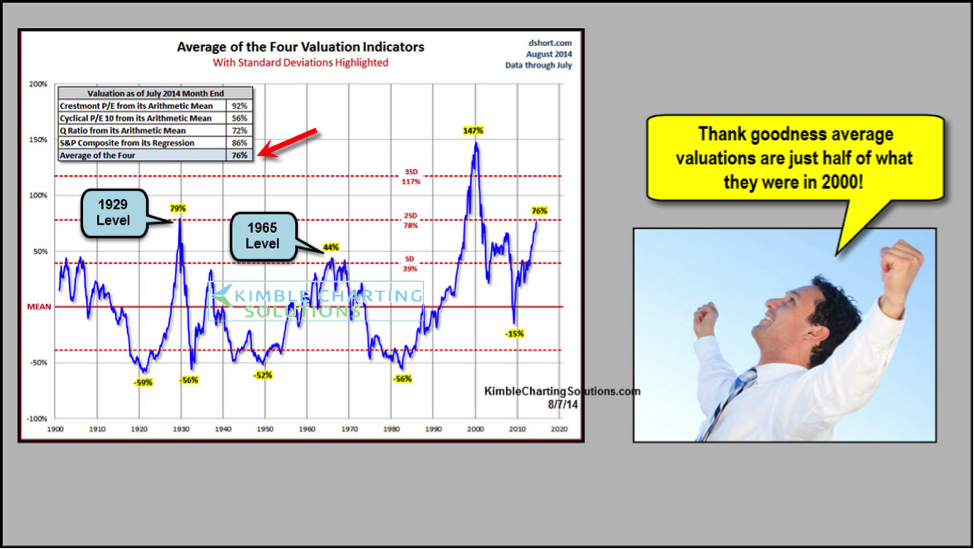

Analyzing Current Stock Market Valuation Metrics

BofA's assessment of stock market valuations goes beyond simple price observation. They employ a range of key valuation metrics, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and other relevant indicators, to gauge the attractiveness of the market.

- Specific Valuation Metrics: BofA utilizes a sophisticated approach incorporating multiple valuation metrics. Their analysis includes a comparison of current P/E ratios across different sectors to historical averages and projected future earnings.

- Comparison to Historical Averages: BofA's analysts likely compare current valuation metrics to their historical averages, accounting for economic cycles and market sentiment shifts. This provides context and helps determine whether current levels are exceptionally high, low, or within a reasonable range.

- Justification Based on Future Earnings Growth: A central component of BofA's rationale is their forecast for future earnings growth. Their belief in moderate economic expansion and controlled inflation supports the expectation of sustainable corporate profit growth, justifying current valuations in their view.

- Sectoral Analysis: BofA's market analysis likely identifies specific sectors they believe are either fairly valued or undervalued, providing a more nuanced picture beyond a blanket assessment of the entire market. This sector-specific analysis allows for more targeted investment strategies. Look for keyword phrases like "BofA P/E ratio analysis" and "BofA market analysis" for deeper insights.

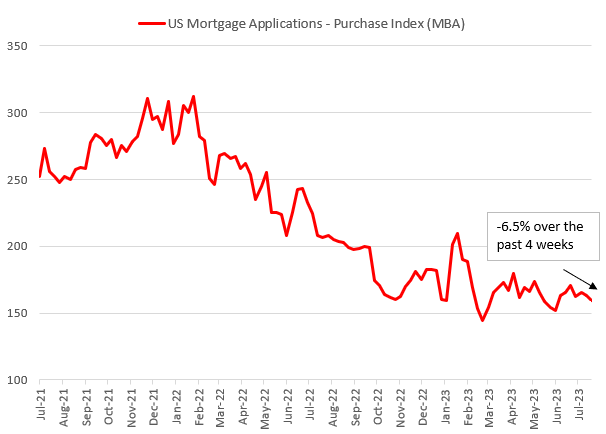

The Role of Interest Rates in BofA's Valuation Assessment

Interest rates play a crucial role in BofA's valuation assessment. The relationship between interest rates, bond yields, and stock valuations is a key element of their analysis.

- BofA's Interest Rate Predictions: BofA's interest rate predictions are integral to their overall economic outlook. Their forecasts inform their assessment of how interest rate changes will impact corporate profitability and investor behavior.

- Impact on Corporate Profitability: Rising interest rates increase borrowing costs for companies, potentially squeezing profit margins. Conversely, lower rates can stimulate investment and growth. BofA's analysis accounts for these impacts on different sectors.

- Stocks vs. Bonds: Interest rate changes significantly affect the attractiveness of stocks versus bonds. Higher rates generally increase bond yields, potentially making bonds a more appealing investment compared to stocks. BofA's analysis considers this dynamic in determining the relative valuations of stocks. Search for "BofA interest rate forecast," "interest rates and stock valuations," and "bond yields vs stock market" to find related information.

Addressing Potential Counterarguments: Why BofA Might Dismiss Certain Concerns

Many investors express concerns about high inflation and the potential for a recession. BofA's valuation rationale addresses these concerns directly.

- High Inflation is Transitory (or Managed): BofA may argue that current inflationary pressures are largely transitory or that central bank actions will effectively manage inflation without triggering a significant economic downturn. Their analysis would likely cite specific data points to support this position.

- Recessionary Risks are Limited: BofA might downplay the likelihood of a severe recession, emphasizing the resilience of the economy and the mitigating effects of government policies. Search for "BofA recession predictions" and "BofA inflation concerns" to learn more about their specific arguments.

- Risk Assessment and Mitigation: A thorough risk assessment is crucial. BofA likely incorporates various risk scenarios into its analysis, acknowledging potential downsides while emphasizing the overall positive outlook and the potential for risk mitigation. The keyword phrase "BofA risk assessment" can help find relevant details.

BofA's Stock Market Valuation Rationale: A Summary and Call to Action

In summary, BofA's stock market valuation rationale rests on a cautiously optimistic macroeconomic outlook, a detailed analysis of valuation metrics, and a considered view on the impact of interest rates. Their perspective acknowledges risks but emphasizes the potential for continued, albeit moderated, economic growth and sustainable corporate earnings. They likely address concerns about inflation and recession by presenting data-driven counterarguments and emphasizing risk mitigation strategies.

To gain a deeper understanding of BofA's comprehensive analysis and investment strategies, explore their publicly available research reports and financial insights. Understanding BofA's stock market valuation rationale is crucial for informed investment decisions in today's dynamic market.

Featured Posts

-

Enexis En Kampen In Juridisch Conflict Aansluiting Duurzaam Schoolgebouw Vertraagd

May 01, 2025

Enexis En Kampen In Juridisch Conflict Aansluiting Duurzaam Schoolgebouw Vertraagd

May 01, 2025 -

Navigating The Chinese Market The Struggles Faced By Bmw Porsche And Other Automakers

May 01, 2025

Navigating The Chinese Market The Struggles Faced By Bmw Porsche And Other Automakers

May 01, 2025 -

Offre Exceptionnelle Chocolat Pour Le Nouveau Ne De L Annee En Normandie

May 01, 2025

Offre Exceptionnelle Chocolat Pour Le Nouveau Ne De L Annee En Normandie

May 01, 2025 -

Legendary Dallas Star Dies At Age 100

May 01, 2025

Legendary Dallas Star Dies At Age 100

May 01, 2025 -

Kshmyrywn Ke Hqwq Jnwby Ayshyae Myn Amn Ky Shrt

May 01, 2025

Kshmyrywn Ke Hqwq Jnwby Ayshyae Myn Amn Ky Shrt

May 01, 2025

Latest Posts

-

Ryys Shbab Bn Jryr Amam Alqdae Abrz Mhtat Alqdyt Walhkm Alsadr

May 01, 2025

Ryys Shbab Bn Jryr Amam Alqdae Abrz Mhtat Alqdyt Walhkm Alsadr

May 01, 2025 -

Binh Duong Tu Hao Tien Linh Dai Su Tinh Nguyen Voi Tam Long Vang

May 01, 2025

Binh Duong Tu Hao Tien Linh Dai Su Tinh Nguyen Voi Tam Long Vang

May 01, 2025 -

La Flaminia Conquista La Seconda Posizione Una Rimonta Spettacolare

May 01, 2025

La Flaminia Conquista La Seconda Posizione Una Rimonta Spettacolare

May 01, 2025 -

Alqdae Ysdr Hkma Dd Ryys Shbab Bn Jryr Tfasyl Alqdyt

May 01, 2025

Alqdae Ysdr Hkma Dd Ryys Shbab Bn Jryr Tfasyl Alqdyt

May 01, 2025 -

Tien Linh Tai Binh Duong Nhiem Vu Va Hoat Dong Cua Dai Su Tinh Nguyen

May 01, 2025

Tien Linh Tai Binh Duong Nhiem Vu Va Hoat Dong Cua Dai Su Tinh Nguyen

May 01, 2025