BofA's Reassurance: Addressing Concerns About High Stock Market Valuations

Table of Contents

Keywords: BofA, Bank of America, stock market valuation, high stock valuations, market outlook, investment strategy, stock market concerns, economic outlook, market analysis, reassurance, investor confidence

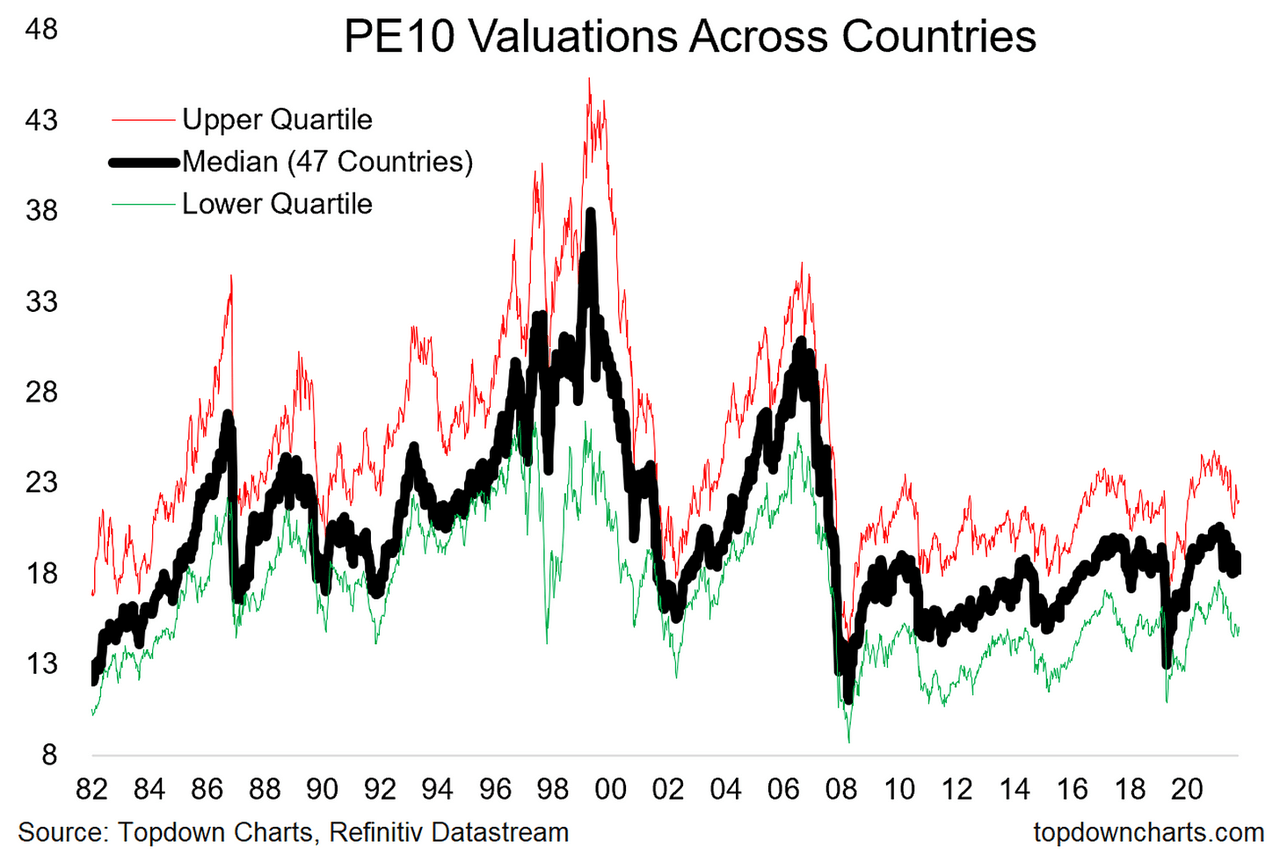

High stock valuations are understandably causing concern for many investors. The seemingly lofty prices of many assets lead to questions about potential market corrections and future returns. However, Bank of America (BofA) recently offered a reassuring analysis, providing a framework for understanding the current market landscape and navigating potential risks. This article will delve into BofA's assessment, addressing key investor concerns and outlining actionable steps for managing your investment strategy in this environment.

BofA's Current Market Assessment & Rationale

BofA currently maintains a cautiously optimistic outlook on the market, leaning towards a neutral stance. While acknowledging the high valuations, they believe the current environment isn't necessarily indicative of an imminent crash. This assessment is underpinned by several key factors:

-

Strong corporate earnings reports: Many companies have reported robust earnings, demonstrating resilience and underlying strength despite macroeconomic headwinds. This positive performance contributes to the justification of current valuations for some sectors.

-

Positive economic indicators: While inflation remains a concern, certain economic indicators suggest underlying strength. For example, [insert specific positive economic indicator cited by BofA, e.g., strong consumer spending data or a low unemployment rate]. These indicators suggest a degree of resilience within the economy, mitigating the risk of a sharp downturn.

-

Potential for further interest rate hikes and their impact: The Federal Reserve's actions regarding interest rates are a major influencing factor. BofA's analysis likely incorporates potential scenarios for further rate hikes and their subsequent impacts on market valuations and economic growth. [Mention BofA's predicted impact - positive or negative - and the rationale behind it].

-

Geopolitical factors and their influence: Global events, such as geopolitical instability and supply chain disruptions, continue to impact the market. BofA's analysis incorporates assessments of these factors and their potential influence on various sectors and the overall market. [ Briefly mention the geopolitical factors and BofA's assessment of their potential impact]

BofA's sector-specific analysis [mention specific sectors BofA highlights as particularly strong or weak and the reasoning behind it, e.g., Technology sector showing continued growth potential, while certain consumer discretionary sectors facing pressure].

Addressing Specific Investor Concerns Regarding High Valuations

Many investors are understandably anxious about high valuations. Common concerns include the risk of a market correction and the potential overvaluation of specific sectors. BofA's analysis attempts to alleviate these anxieties:

The Case for Continued Growth

BofA argues against an imminent market crash by highlighting several crucial factors:

-

Long-term growth potential of the market: Despite short-term volatility, the long-term growth potential of the market remains significant. Technological innovation and increasing global economic integration continue to drive growth.

-

Technological advancements driving innovation and value creation: Rapid technological advancements are driving innovation across various sectors, creating new opportunities and boosting long-term value creation. This is a key component in BofA’s rationale for continued market growth, offsetting concerns about high valuations.

-

Resilience of the economy despite inflation and other headwinds: Despite inflationary pressures and geopolitical uncertainties, the economy has shown surprising resilience, suggesting a degree of underlying strength that supports market valuations.

Managing Risk in a High-Valuation Market

BofA suggests several strategies to mitigate risk in this market environment:

-

Diversification across asset classes: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) can help reduce the overall risk of your investments.

-

Focusing on quality companies with strong fundamentals: Prioritize investments in companies with strong balance sheets, consistent earnings growth, and a proven track record. This approach helps to reduce the vulnerability of your portfolio to market downturns.

-

Employing defensive investment strategies: Consider defensive investment strategies like value investing or dividend investing, which can help protect your portfolio during periods of market uncertainty.

BofA's Recommendations for Investors

Based on their analysis, BofA offers the following key recommendations:

-

Consider sector-specific opportunities based on BofA's insights: BofA’s analysis may identify specific sectors poised for outperformance. Carefully consider these insights when adjusting your portfolio allocation.

-

Reassess your portfolio allocation based on risk tolerance: Review your current portfolio allocation and adjust it to align with your individual risk tolerance and investment goals. This includes reevaluating your risk profile in light of the high stock valuations.

-

Maintain a long-term investment horizon: Avoid making impulsive decisions based on short-term market fluctuations. Maintaining a long-term perspective is crucial for weathering market volatility and achieving your investment objectives.

BofA may also suggest specific investment products or strategies tailored to different risk profiles [mention if relevant and available].

Conclusion

BofA's analysis offers a reassuring perspective on the current market environment, acknowledging high stock valuations but highlighting several factors that mitigate the risk of an imminent crash. Their cautious optimism is grounded in strong corporate earnings, positive economic indicators, and an assessment of the impacts of interest rate hikes and geopolitical factors. Investors should focus on diversification, quality companies, and a long-term perspective to navigate this market. Don't let high stock market valuations deter you. Learn more about BofA's comprehensive market analysis and refine your investment strategy today. Understand the nuances of high stock valuations and make informed decisions with confidence. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Understanding Our Great Yorkshire Life People And Traditions

Apr 25, 2025

Understanding Our Great Yorkshire Life People And Traditions

Apr 25, 2025 -

Canakkale Savasindan Guenuemueze Dostluk Fotograf Sergisi Acildi

Apr 25, 2025

Canakkale Savasindan Guenuemueze Dostluk Fotograf Sergisi Acildi

Apr 25, 2025 -

Bayern Munich Drop Points In Draw With Union Berlin

Apr 25, 2025

Bayern Munich Drop Points In Draw With Union Berlin

Apr 25, 2025 -

The Dnieper River A Path Towards Peace And Regional Stability

Apr 25, 2025

The Dnieper River A Path Towards Peace And Regional Stability

Apr 25, 2025 -

Godzilla X Kong 3 Jack O Connell Joins The Cast

Apr 25, 2025

Godzilla X Kong 3 Jack O Connell Joins The Cast

Apr 25, 2025

Latest Posts

-

Charlie Kirk Claims Gavin Newsoms Podcast Will Derail His Political Ambitions

Apr 26, 2025

Charlie Kirk Claims Gavin Newsoms Podcast Will Derail His Political Ambitions

Apr 26, 2025 -

Governor Newsom Targets Judgmental Democrats In Latest Remarks

Apr 26, 2025

Governor Newsom Targets Judgmental Democrats In Latest Remarks

Apr 26, 2025 -

California Governor Calls Out Intra Party Toxicity

Apr 26, 2025

California Governor Calls Out Intra Party Toxicity

Apr 26, 2025 -

Newsoms Sharp Rebuke Of Toxic Democrats

Apr 26, 2025

Newsoms Sharp Rebuke Of Toxic Democrats

Apr 26, 2025 -

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025