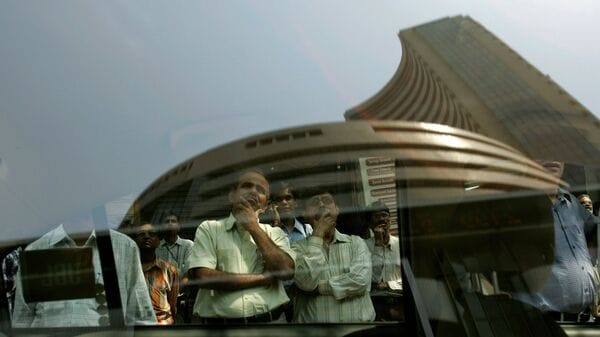

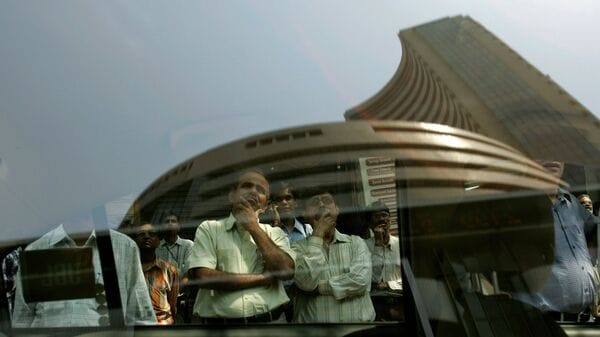

BofA's Reassuring View: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA Global Research provides a nuanced analysis of current stock market valuations, arguing that a simple assessment based solely on metrics like the Price-to-Earnings ratio (P/E) is insufficient. Their positive outlook is rooted in a more comprehensive evaluation incorporating several key factors.

-

BofA's Valuation Models and Strong Earnings Growth: BofA's sophisticated valuation models consider not just current prices but also the projected trajectory of earnings growth. Their findings suggest that robust earnings growth, fueled by a number of factors, can justify current, seemingly high, P/E ratios. This contrasts with simplistic interpretations that solely focus on the high valuation multiples without considering the underlying growth potential.

-

Incorporating Interest Rates and Inflation: Unlike simpler analyses, BofA's market analysis incorporates the impact of interest rate expectations and inflation. Their models account for how these macroeconomic factors influence both corporate earnings and investor discount rates, providing a more accurate picture than focusing solely on historical P/E comparisons. Understanding these interdependencies is crucial for a comprehensive assessment of stretched stock market valuations.

-

BofA's Research Highlights: BofA's research reports consistently highlight the resilience of corporate earnings and the potential for continued expansion in several key sectors. Their analysts emphasize the importance of considering long-term growth prospects rather than focusing solely on short-term market fluctuations driven by sentiment. For example, a recent BofA report stated [insert relevant quote from a BofA research report, properly cited].

-

Historical Context: It's important to put current valuations into historical context. BofA's analysis compares current P/E ratios to previous periods of high valuations and examines the subsequent market performance. This historical perspective helps to temper overly pessimistic interpretations and provides a more balanced assessment of the current situation. While past performance isn't indicative of future results, a comprehensive review of history provides valuable context.

Addressing Investor Concerns: Managing Risk in a High-Valuation Environment

While BofA's outlook is positive, it's understandable that investors remain apprehensive about high stock market valuations. Managing risk in this environment is crucial. Here are some key strategies:

-

Portfolio Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors is paramount. This reduces the impact of any single asset's underperformance and helps to mitigate overall risk. Spreading your investments helps to smooth out returns and protects against market downturns.

-

Defensive Investment Strategies: Consider incorporating defensive stocks into your portfolio. These are companies with strong balance sheets, consistent dividend payouts, and less sensitivity to economic cycles. Defensive stocks offer relative stability during periods of market uncertainty.

-

Long-Term Investment Horizon: Maintaining a long-term investment perspective is key to weathering short-term market fluctuations. Focusing on long-term growth potential rather than reacting to daily market noise allows you to ride out short-term volatility and benefit from the long-term compounding effect of your investments.

-

Dollar-Cost Averaging: Dollar-cost averaging is a risk mitigation strategy that involves investing a fixed amount of money at regular intervals, regardless of market price. This approach reduces the risk of investing a large sum at a market peak.

The Role of Innovation and Technological Growth

BofA's positive outlook implicitly incorporates the transformative impact of technological innovation. This ongoing technological revolution fuels growth and creates new opportunities.

-

Technological Innovation and Sector Growth: Many sectors are poised for continued growth driven by technological advancements. This includes areas like artificial intelligence, cloud computing, and renewable energy, creating opportunities for significant long-term investment growth.

-

Emerging Markets and Future Growth: Emerging markets represent a significant source of future economic growth. BofA's analysis likely considers the contribution of these markets to global economic expansion, adding another layer of optimism to their overall assessment. Investing in companies poised to benefit from growth in these regions can offer high-growth potential.

Conclusion

BofA's reassuring view on stretched stock market valuations highlights the importance of considering long-term growth prospects and employing sound risk management strategies. While high valuations exist, BofA's analysis suggests that strong earnings growth and macroeconomic factors justify a more optimistic outlook than a simple valuation metric might imply. The key takeaways are the need for diversification, a long-term investment horizon, and a thorough understanding of the factors influencing market dynamics. Don't let concerns about stretched stock market valuations deter you from making informed investment decisions. Learn more about BofA's insights and build a strong investment portfolio today!

Featured Posts

-

Harrogate Spring Flower Show Melissa Mortons Show Garden

Apr 25, 2025

Harrogate Spring Flower Show Melissa Mortons Show Garden

Apr 25, 2025 -

Convicted Cardinals Challenge A Vatican Standoff Over Papal Conclave Participation

Apr 25, 2025

Convicted Cardinals Challenge A Vatican Standoff Over Papal Conclave Participation

Apr 25, 2025 -

30 Stone Weight Loss Journey One Mans Inspiring Story

Apr 25, 2025

30 Stone Weight Loss Journey One Mans Inspiring Story

Apr 25, 2025 -

Ankara Emniyet Mueduerluegue Nuen Yeni Yerleskesi Hizmete Acildi

Apr 25, 2025

Ankara Emniyet Mueduerluegue Nuen Yeni Yerleskesi Hizmete Acildi

Apr 25, 2025 -

Bayern Munich From Behind To Bundesliga Dominance Against Stuttgart

Apr 25, 2025

Bayern Munich From Behind To Bundesliga Dominance Against Stuttgart

Apr 25, 2025

Latest Posts

-

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025 -

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025 -

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025 -

Analyzing The Trend People Betting On The Los Angeles Wildfires

Apr 26, 2025

Analyzing The Trend People Betting On The Los Angeles Wildfires

Apr 26, 2025