BofA's Take: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

Strong Corporate Earnings Justify Current Valuations

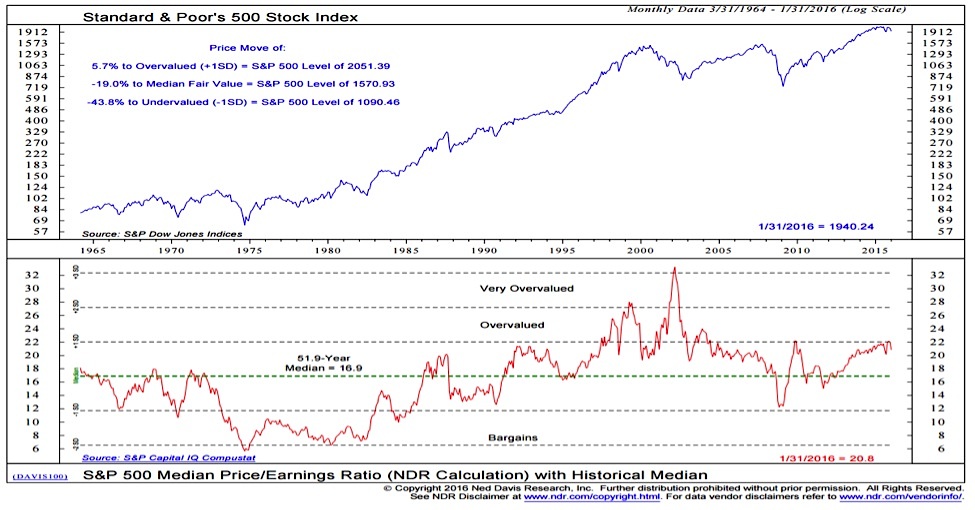

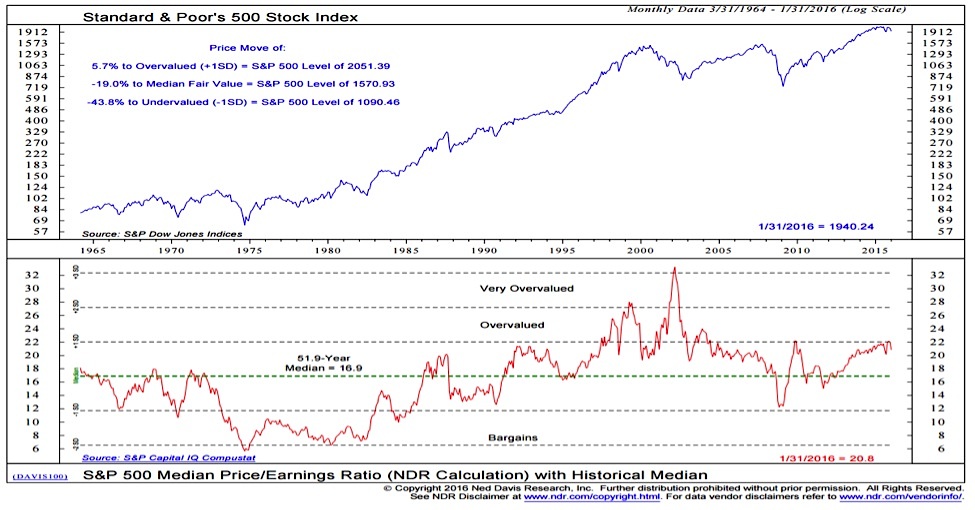

Many investors are fixated on seemingly high price-to-earnings ratios. However, a deeper dive reveals that these valuations are largely justified by strong corporate earnings and positive future projections.

Profitability Remains Robust

The overall health of corporate earnings remains surprisingly robust. Many sectors are demonstrating impressive performance, fueled by sustained earnings growth and healthy profit margins. This isn't just a temporary surge; consistent and diverse revenue streams are underpinning this strength.

- Examples of companies exceeding earnings expectations: Several tech giants, including Apple and Microsoft, have consistently surpassed analysts' predictions, demonstrating the strength of the sector. Similarly, companies in the consumer staples and healthcare sectors have shown resilient profitability.

- Data points illustrating overall market profitability: Aggregate data shows that S&P 500 companies are exhibiting strong profit margins, exceeding pre-pandemic levels in many cases. This indicates a healthy and resilient corporate sector.

Future Earnings Projections Remain Positive

Looking forward, analyst forecasts paint a positive picture for future earnings growth. While the forward P/E ratio might appear high in comparison to historical averages, the projected earnings per share (EPS) growth is expected to justify these valuations.

- Summaries of major financial institutions' outlook on future corporate earnings: Major investment banks, including Goldman Sachs and Morgan Stanley, maintain positive outlooks on corporate earnings, anticipating continued growth driven by various economic factors.

- Discussion of factors contributing to positive future earnings: Technological innovation across sectors, coupled with ongoing global expansion opportunities, are key drivers of anticipated future earnings growth.

Interest Rates Remain Supportive of Stock Market Growth

The current macroeconomic environment plays a significant role in supporting stock market valuations. Low interest rates are a major contributing factor.

Low Interest Rate Environment

The prevailing low interest rate environment, largely a result of interest rate policy decisions by the Federal Reserve, makes the stock market a more attractive investment compared to bonds. Lower bond yields push investors toward higher-return alternatives, boosting demand for equities.

- Current interest rate levels and historical context: Current interest rates remain historically low, providing a significant incentive for investors to seek higher returns in the stock market. This is in sharp contrast to periods of higher interest rates, where bonds offered a more competitive alternative.

- Explanation of the relationship between interest rates and stock valuations: Lower interest rates reduce the discount rate used to value future cash flows, thereby increasing the present value of future earnings and justifying higher stock valuations.

Quantitative Easing and Monetary Policy

Quantitative easing and other monetary policy measures implemented in recent years have significantly impacted market liquidity and investor behavior.

- Explanation of how these policies affect investor behavior and market liquidity: These policies have injected significant liquidity into the market, making it easier for companies to raise capital and for investors to participate. This increased liquidity can help support higher valuations.

- Analysis of the potential long-term effects of these policies: While the long-term effects are still unfolding, the increased liquidity and low interest rates have undeniably played a role in the current market conditions.

Long-Term Growth Potential Outweighs Short-Term Volatility

While short-term market fluctuations are inevitable, the long-term growth potential of the market significantly outweighs these temporary dips.

Technological Innovation and Disruption

The pace of technological innovation is accelerating, creating new industries and transforming existing ones. These disruptive technologies are driving significant long-term growth opportunities.

- Examples of innovative sectors driving growth: Artificial intelligence (AI), renewable energy, and biotechnology are just a few examples of sectors poised for substantial growth in the coming years.

- Analysis of how these innovations translate to long-term market potential: These innovations lead to increased productivity, efficiency gains, and the creation of entirely new markets, ultimately boosting overall economic growth and supporting higher stock valuations.

Global Economic Growth Prospects

The global economic landscape, while presenting some challenges, also presents significant opportunities for growth. While we must acknowledge risks, the overall global economic growth prospects, particularly in emerging markets, remain positive.

- Key indicators of global economic health: While inflation remains a concern, other key indicators suggest continued economic expansion, offering support for continued stock market growth.

- Analysis of risks and opportunities in different global markets: While some regions might face headwinds, others offer significant growth opportunities, contributing to the overall positive global outlook.

BofA's Take on Stock Market Valuations: Don't Let Fear Dictate Your Investments

In summary, BofA's analysis suggests that current stock market valuations, while appearing high on the surface, are largely supported by strong corporate earnings, a supportive interest rate environment, and the substantial long-term growth potential fueled by technological innovation and global economic expansion. Don't let anxieties over current market conditions cloud your long-term investment strategy. BofA's analysis suggests a robust outlook; consult a financial advisor to discuss how to navigate these market valuation concerns effectively and build a portfolio aligned with your long-term financial goals.

Featured Posts

-

Analyzing The Net Worth Changes Of Elon Musk Jeff Bezos And Mark Zuckerberg Since Donald Trumps Presidency

May 09, 2025

Analyzing The Net Worth Changes Of Elon Musk Jeff Bezos And Mark Zuckerberg Since Donald Trumps Presidency

May 09, 2025 -

Draisaitls Hart Trophy Finalist Nod Highlights Stellar Oilers Season

May 09, 2025

Draisaitls Hart Trophy Finalist Nod Highlights Stellar Oilers Season

May 09, 2025 -

Serious Data Breach Nottingham Attack Victim Records Accessed By 90 Nhs Employees

May 09, 2025

Serious Data Breach Nottingham Attack Victim Records Accessed By 90 Nhs Employees

May 09, 2025 -

Go Compare Advert Wynne Evans Removal Following Strictly Incident

May 09, 2025

Go Compare Advert Wynne Evans Removal Following Strictly Incident

May 09, 2025 -

Bitcoin Madenciligi Eskisi Gibi Karli Degil Nedenleri Ve Gelecegi

May 09, 2025

Bitcoin Madenciligi Eskisi Gibi Karli Degil Nedenleri Ve Gelecegi

May 09, 2025