BofA's View: Why Current Stock Market Valuations Are Not A Cause For Alarm

Table of Contents

BofA's Rationale Behind a Cautiously Optimistic Outlook

BofA's cautiously optimistic outlook on stock market valuations stems from a detailed analysis of various economic indicators and corporate performance. Their reasoning avoids simple extrapolation and considers the nuances of the current market climate.

-

Strong Corporate Earnings: BofA points to robust corporate earnings as a key supporting factor. Many companies are exceeding expectations, demonstrating resilience despite economic headwinds. This strong performance helps justify, to some degree, the current elevated price levels.

-

Positive Economic Indicators (Relative to Expectations): While challenges remain, certain key economic indicators have shown more strength than initially anticipated. This relative outperformance suggests a degree of underlying economic stability that supports continued market growth.

-

Low Interest Rates (Historically): While interest rates have risen recently, they remain relatively low compared to historical averages. This lower borrowing cost supports continued investment and business expansion, which indirectly supports stock valuations.

-

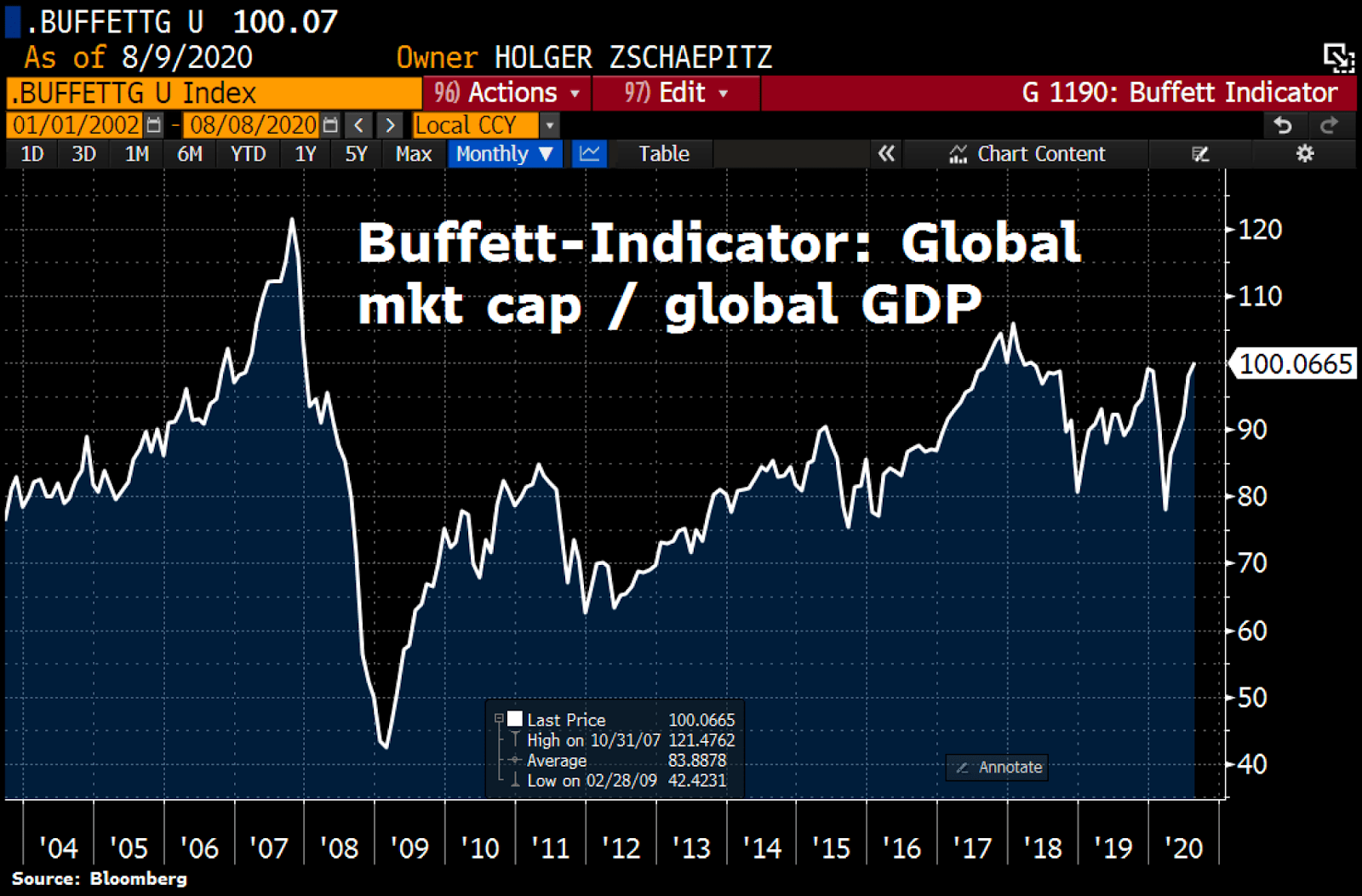

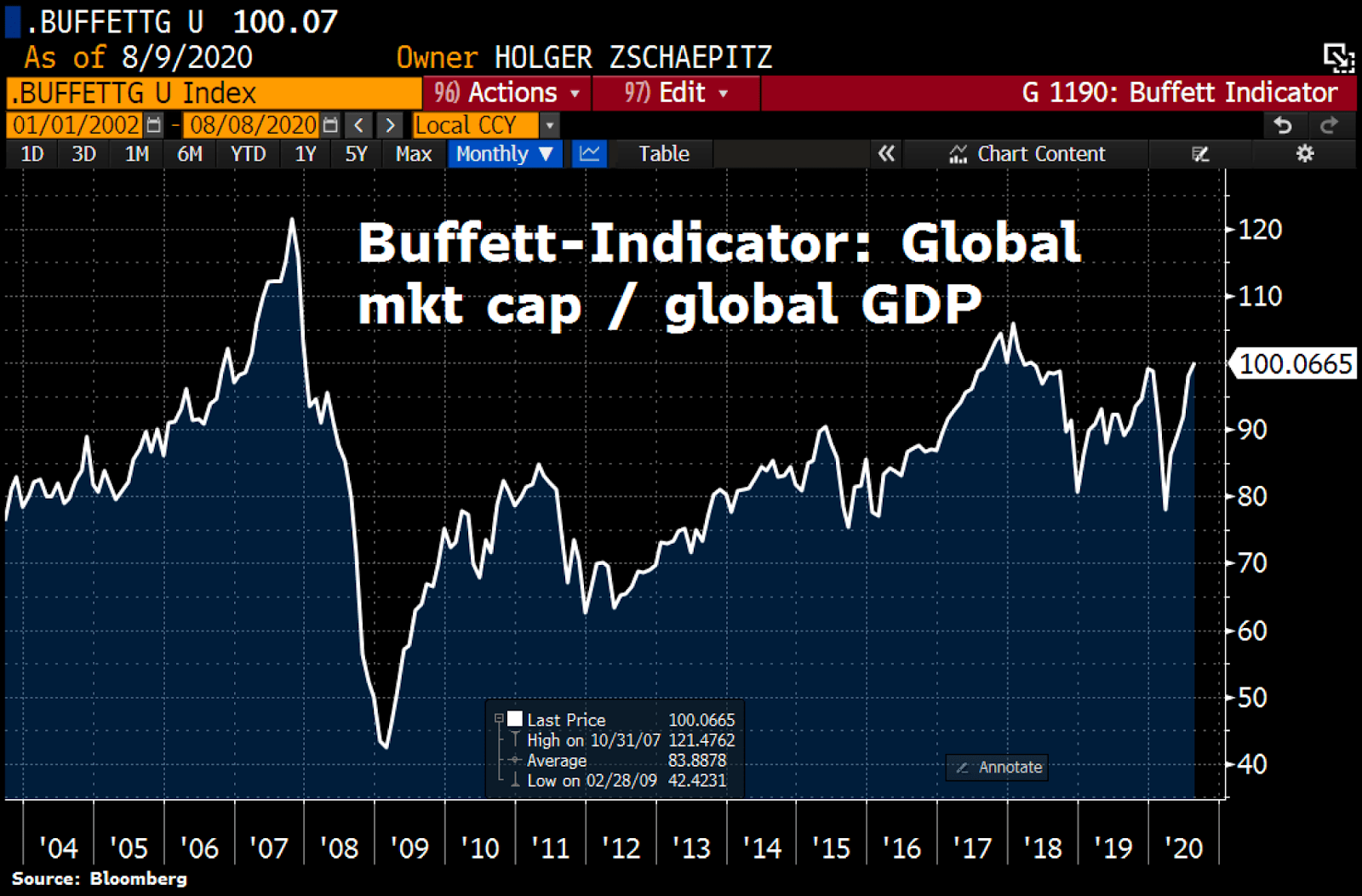

Key Metrics: BofA utilizes several key metrics in its valuation analysis, including Price-to-Earnings (P/E) ratios and dividend yields. While acknowledging that P/E ratios may appear high compared to historical averages in some sectors, they contend that these figures need to be viewed within the context of robust earnings growth and low interest rates. A thorough examination of BofA's published research reports – readily available on their website (link to relevant BofA report here, if available) – provides further detail on their specific methodology and data.

Addressing Common Concerns About High Stock Market Valuations

Many investors fear an impending market crash due to perceived overvaluation. BofA directly addresses these concerns:

-

Countering the Crash Argument: BofA's analysis suggests that while a correction is always possible, a significant market crash isn't necessarily inevitable. Their projections, backed by their economic models, consider factors such as sustained earnings growth and the potential for further interest rate adjustments.

-

Irrelevance of Historical Comparisons: BofA cautions against relying solely on historical comparisons. The current economic landscape, shaped by unique factors such as technological advancements and geopolitical shifts, differs significantly from past cycles. Direct comparisons may, therefore, be misleading.

-

Growth Potential and Innovation: BofA emphasizes the potential for future growth driven by technological innovation and emerging industries. This potential for future earnings growth contributes to justifying, at least partially, current valuations. Sectors such as renewable energy, artificial intelligence, and biotechnology are highlighted as drivers of future growth.

BofA's Recommended Investment Strategies Given Current Market Conditions

Based on their valuation analysis, BofA recommends a strategic approach to investing:

-

Promising Asset Classes: BofA suggests focusing on sectors demonstrating strong earnings growth and future potential, such as technology, healthcare, and select areas of the consumer discretionary sector. However, this is not an exhaustive list and requires further individual research.

-

Risk Management: Given the inherent market volatility, BofA emphasizes the importance of robust risk management strategies. This includes diversifying investments across different asset classes and geographies to mitigate potential losses.

-

Diversification: Diversification remains a cornerstone of sound investment strategy. BofA advocates for a well-diversified portfolio that balances risk and reward, tailored to individual investor risk tolerance and financial goals.

The Importance of Long-Term Investing in the Face of Market Volatility

Short-term market fluctuations are inherent in the investment cycle. BofA underscores the critical importance of long-term investing:

-

Volatility as Normal: Short-term volatility is a normal part of the market, and attempting to time the market is often detrimental.

-

Long-Term Historical Performance: Historically, the stock market has delivered positive returns over the long term, despite experiencing periodic downturns.

-

Resist Panic Selling: BofA strongly advises against panic selling during market downturns. Maintaining a disciplined, long-term investment strategy is key to weathering short-term volatility.

BofA's Perspective on Stock Market Valuations – A Call to Action

In conclusion, while BofA acknowledges the seemingly high stock market valuations, their analysis suggests that these valuations are not necessarily a cause for immediate alarm. Their cautiously optimistic view is grounded in strong corporate earnings, positive (relative) economic indicators, and the potential for future growth driven by technological innovation. BofA's recommended investment strategies emphasize diversification, risk management, and the importance of a long-term perspective.

We urge you to consider BofA's insights when making your own investment decisions. Remember that this information is for general knowledge and doesn't constitute financial advice. Conduct thorough research, consult with a qualified financial advisor, and create a sound investment strategy tailored to your individual risk tolerance and financial goals before making any investment decisions. Understand your own personal approach to current Stock Market Valuations and plan accordingly. Remember that maintaining a long-term perspective is crucial for navigating the inevitable ups and downs of the market.

Featured Posts

-

Anna Wongs Warning Prepare For Empty Shelves

Apr 26, 2025

Anna Wongs Warning Prepare For Empty Shelves

Apr 26, 2025 -

Toename Steun Voor Nederlandse Koninklijke Familie 59

Apr 26, 2025

Toename Steun Voor Nederlandse Koninklijke Familie 59

Apr 26, 2025 -

Tom Cruises Risky Stunt Takes Center Stage In New Mission Impossible Film

Apr 26, 2025

Tom Cruises Risky Stunt Takes Center Stage In New Mission Impossible Film

Apr 26, 2025 -

Neighbours A Shocking Return After 38 Years

Apr 26, 2025

Neighbours A Shocking Return After 38 Years

Apr 26, 2025 -

The Nepo Baby Debate Amanda Seyfrieds F Bomb Response

Apr 26, 2025

The Nepo Baby Debate Amanda Seyfrieds F Bomb Response

Apr 26, 2025