BofA's View: Why Current Stock Market Valuations Are Not A Red Flag

Table of Contents

BofA's Rationale: Considering the Macroeconomic Landscape

BofA's assessment of current stock market valuations isn't made in a vacuum; it's deeply rooted in a comprehensive analysis of the broader macroeconomic landscape. Several key factors contribute to their optimistic outlook.

Strong Corporate Earnings Growth

BofA points to robust corporate earnings growth as a significant justification for their position. This strong performance isn't across the board, but concentrated in key sectors, underpinning the current valuation levels.

- Examples of strong performing sectors: Technology, healthcare, and consumer staples have shown particularly impressive earnings growth, contributing significantly to overall market performance.

- Projected earnings growth: BofA's analysts project continued, albeit potentially moderated, earnings growth for the coming quarters, supporting their view that current valuations are sustainable.

- Comparison to previous economic cycles: While current P/E ratios might seem high compared to historical averages, BofA argues that these comparisons must account for the unique circumstances of the current economic environment, including low interest rates and technological advancements. This contrasts with previous cycles where high valuations were often followed by sharp corrections. Keyword integration: corporate earnings, earnings growth, profitability, valuation multiples.

Low Interest Rates and Monetary Policy

The current low-interest rate environment plays a crucial role in BofA's analysis of stock market valuations. These low rates encourage investment and borrowing, pushing up asset prices, including stocks.

- Analysis of current interest rates: The current low interest rate environment is seen by BofA as supportive of stock valuations.

- Potential future rate hikes: While future rate hikes are anticipated, BofA suggests these are likely to be gradual, minimizing their immediate impact on stock market valuations.

- Impact on investment strategies: The low-interest-rate environment makes equities a relatively more attractive investment compared to bonds, influencing investment decisions and further supporting stock prices. Keyword integration: interest rates, monetary policy, quantitative easing, investment decisions.

Technological Innovation and Future Growth Potential

BofA emphasizes the transformative impact of technological innovation on long-term economic growth and its influence on stock market valuations.

- Examples of innovative sectors driving growth: The rise of Artificial Intelligence (AI), cloud computing, and biotechnology are highlighted as key drivers of future growth, justifying higher valuations for companies in these sectors.

- Long-term projections: BofA's projections incorporate the continued expansion of these innovative sectors, suggesting a positive outlook for long-term growth.

- Risk assessment: While acknowledging the inherent risks associated with investing in growth stocks, BofA suggests that the potential returns from these sectors outweigh the risks, given their transformative potential. Keyword integration: technological innovation, growth stocks, future growth, disruptive technologies.

Addressing Common Valuation Concerns

While BofA's perspective is optimistic, they acknowledge the concerns surrounding current stock market valuations. Let's address some key anxieties.

Price-to-Earnings Ratios (P/E): A Nuanced Perspective

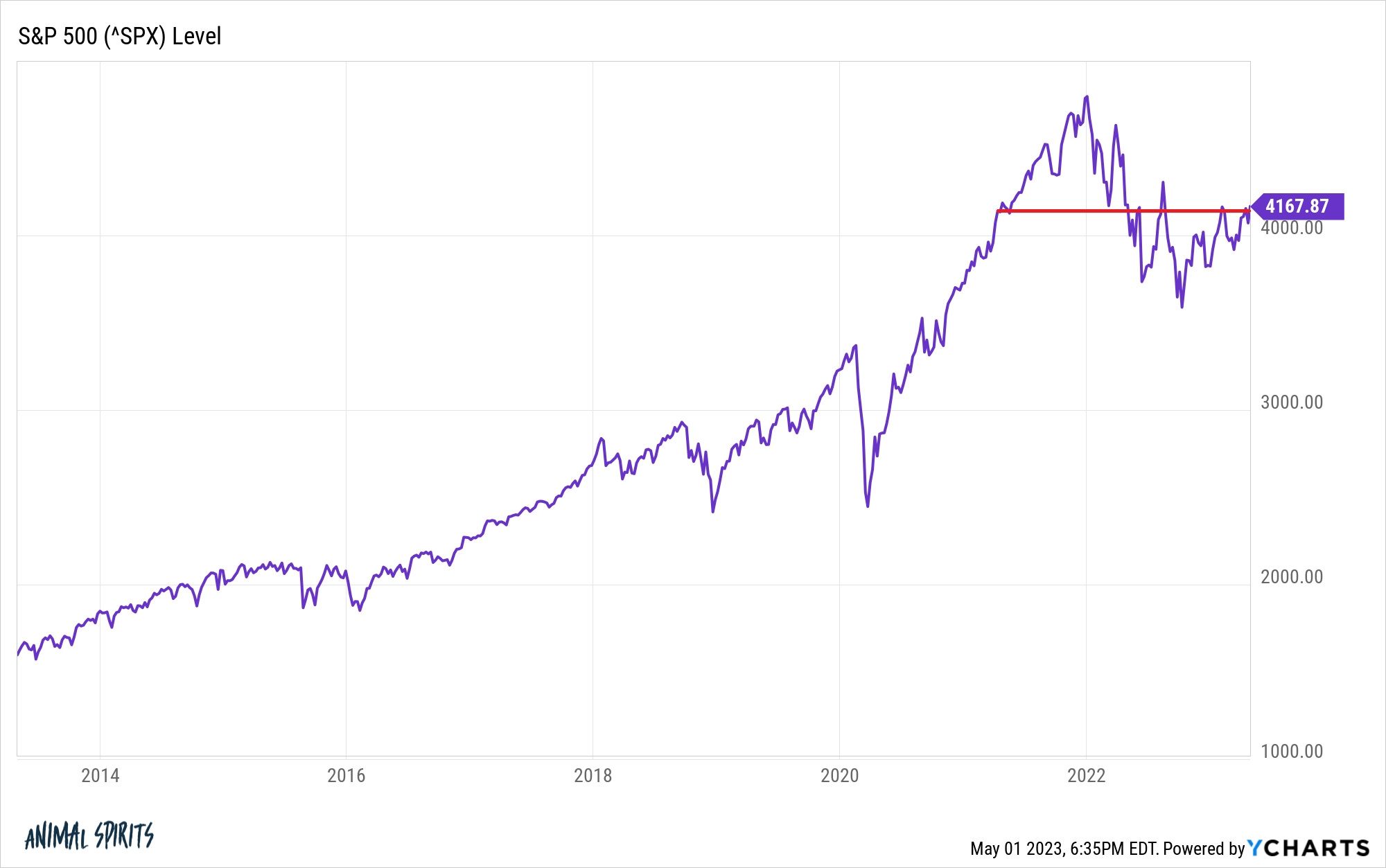

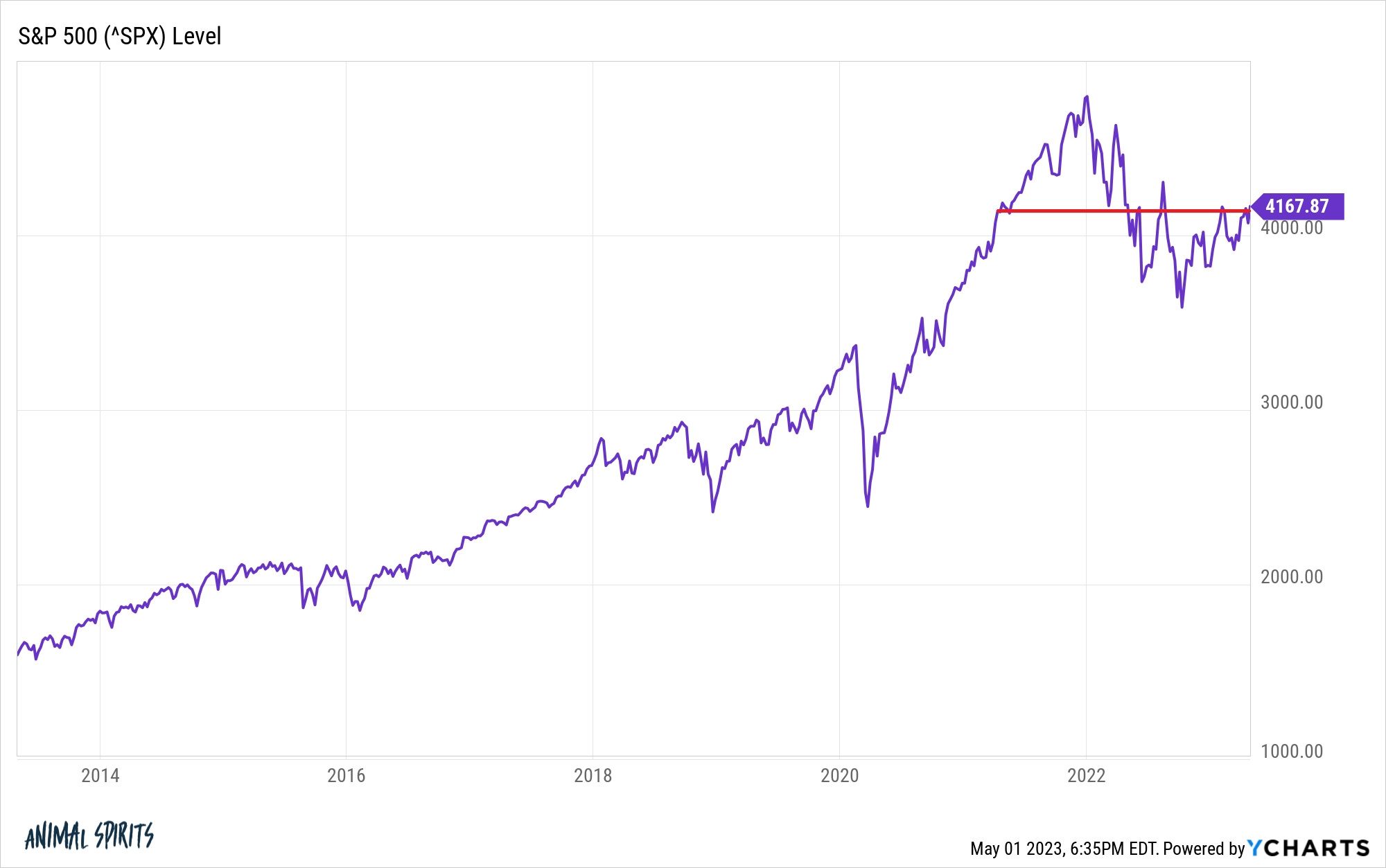

One of the most common valuation metrics, the Price-to-Earnings ratio (P/E ratio), is often cited as an indicator of overvaluation. However, BofA argues for a more nuanced interpretation.

- Comparison of current P/E ratios to historical averages: While current P/E ratios are higher than historical averages in some sectors, BofA suggests this is partly due to the factors mentioned earlier, such as low interest rates and the impact of technological innovation, and therefore, not necessarily an indication of overvaluation.

- Considering factors impacting P/E beyond just price: BofA's analysis takes into account factors beyond just the price of the stock, including earnings growth and the overall macroeconomic environment. Keyword integration: Price-to-Earnings ratio, P/E ratio, valuation metrics, market multiples.

Addressing the Risk of a Market Correction

BofA acknowledges the possibility of a market correction, but doesn't view it as imminent or necessarily catastrophic.

- Discussion of potential triggers for correction: Geopolitical instability, unexpected economic downturns, or an abrupt shift in monetary policy could trigger a correction.

- BofA's assessment of market resilience: BofA highlights the underlying strength of the economy and corporate earnings as factors that could mitigate the severity of any potential correction.

- Risk mitigation strategies: They emphasize the importance of diversification and risk management to mitigate potential losses during periods of market volatility. Keyword integration: market correction, market volatility, risk management, portfolio diversification.

Conclusion

BofA's analysis presents a compelling counterpoint to the prevailing anxieties surrounding current stock market valuations. Their argument rests on the pillars of strong corporate earnings, a supportive low-interest-rate environment, the transformative power of technological innovation, and a nuanced interpretation of valuation metrics like the P/E ratio. While acknowledging the ever-present risk of market corrections, they emphasize the underlying strength of the economy and suggest that current valuations, while high, are not necessarily a red flag.

While BofA's analysis offers a compelling counterpoint to prevalent concerns, a thorough understanding of your own risk tolerance and a careful analysis of current stock market valuations remain crucial for informed investment decisions. Remember to conduct your own thorough research before making any investment decisions related to stock market valuations.

Featured Posts

-

Karate Kid 6 And Beyond Ralph Macchios Next Move

May 23, 2025

Karate Kid 6 And Beyond Ralph Macchios Next Move

May 23, 2025 -

Eric Andre Rejected Kieran Culkin For A Real Pain Role

May 23, 2025

Eric Andre Rejected Kieran Culkin For A Real Pain Role

May 23, 2025 -

Erik Ten Hag Praises Arsenal Defender After Real Madrid Victory Hes A Soldier

May 23, 2025

Erik Ten Hag Praises Arsenal Defender After Real Madrid Victory Hes A Soldier

May 23, 2025 -

University Of Maryland Commencement Famous Amphibian To Deliver Speech

May 23, 2025

University Of Maryland Commencement Famous Amphibian To Deliver Speech

May 23, 2025 -

Rezultat Devastator In Liga Natiunilor Georgia Armenia 6 1

May 23, 2025

Rezultat Devastator In Liga Natiunilor Georgia Armenia 6 1

May 23, 2025

Latest Posts

-

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 23, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 23, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 23, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 23, 2025 -

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 23, 2025

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 23, 2025 -

2025 Umd Graduation Kermit The Frog To Deliver Commencement Address

May 23, 2025

2025 Umd Graduation Kermit The Frog To Deliver Commencement Address

May 23, 2025 -

University Of Maryland Graduation A Notable Amphibians Inspiring Speech

May 23, 2025

University Of Maryland Graduation A Notable Amphibians Inspiring Speech

May 23, 2025