BofA's View: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: The Importance of Long-Term Growth Potential

BofA's optimistic stock market forecast rests on a strong belief in long-term economic growth. They assess the current economic climate, considering factors beyond immediate market fluctuations. This positive economic outlook is fueled by several key drivers:

- Technological Innovation: Rapid advancements in technology across various sectors continue to drive productivity gains and create new market opportunities, contributing significantly to long-term corporate earnings growth.

- Demographic Shifts: Global demographic trends, such as a growing middle class in emerging markets, are expected to fuel sustained consumer demand and further stimulate economic expansion.

- Global Economic Growth: While regional variations exist, the overall global economic picture suggests a continued, albeit perhaps slower, growth trajectory, offering a supportive backdrop for stock market valuations.

This positive long-term view is supported by several factors:

- Strong corporate earnings growth projections: BofA's analysis indicates robust profit growth potential for many companies, suggesting that current valuations may be justified by future earnings.

- Positive industry-specific outlooks: BofA is particularly bullish on sectors like technology, healthcare, and renewable energy, anticipating strong growth in these areas.

- Government policies supporting economic expansion: Supportive government policies (where applicable, specifying examples would strengthen this point) can further bolster economic growth and underpin the positive long-term growth outlook.

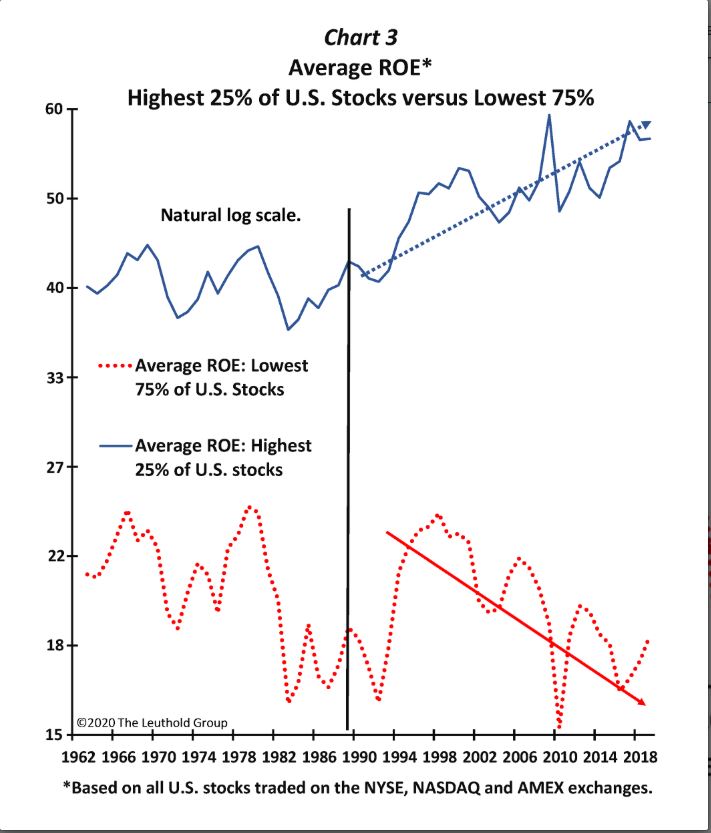

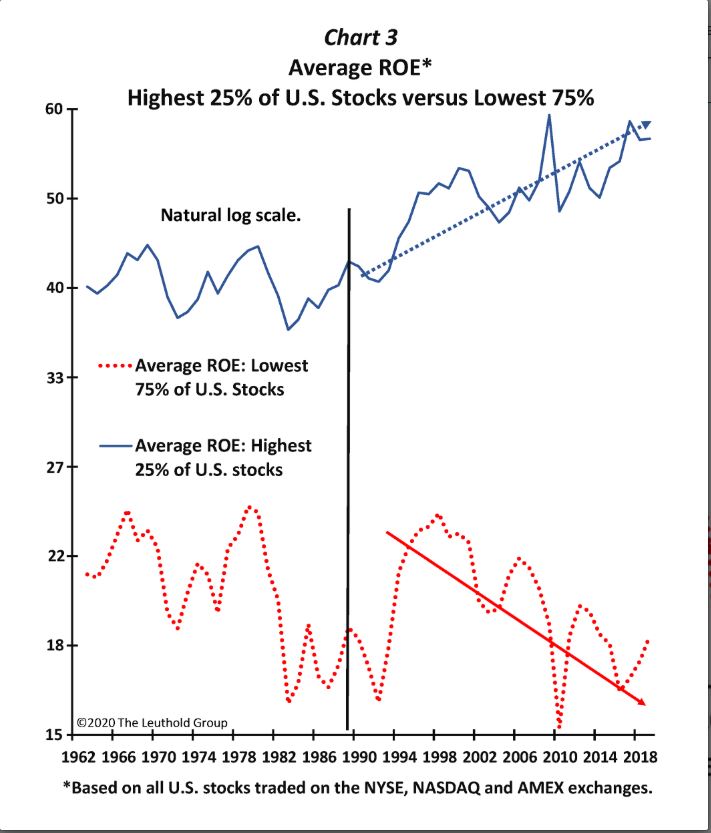

Addressing Valuation Concerns: Why Current Metrics Aren't the Whole Story

It's undeniable that current valuation metrics, such as high P/E ratios and overall market capitalization, have raised concerns among investors. Many worry that the stock market valuations are inflated. However, BofA argues these metrics don't tell the whole story. They highlight several factors that could justify current valuations:

- Low interest rates: Persistently low interest rates impact the discount rates used in valuation models, resulting in higher present values for future earnings streams. This can partially explain elevated P/E ratios.

- Strong corporate cash flows and balance sheets: Many companies possess strong balance sheets and generate substantial cash flows, mitigating some of the risks associated with higher valuations. This improved risk assessment contributes to investor confidence.

- Inflationary pressures: The potential for moderate inflation could further justify higher valuations, as investors may demand higher returns to compensate for the erosion of purchasing power.

These factors suggest that while market capitalization might appear high based on traditional metrics, the underlying strength of many companies and the broader economic environment offer a more nuanced perspective on stock market valuations.

Strategic Portfolio Adjustments: BofA's Recommendations for Investors

BofA advocates a proactive approach to portfolio diversification and long-term investing in the current market environment. They suggest investors consider:

- Sector-specific recommendations: Maintaining exposure to high-growth sectors like technology and healthcare, while also considering diversification into more defensive sectors.

- Guidance on asset allocation: BofA might recommend a strategic balance between stocks and bonds, adjusting the allocation based on individual risk tolerance and investment goals. This aspect of asset allocation is crucial for risk management.

- Importance of risk tolerance and long-term investment horizons: Emphasizing the importance of aligning investment strategies with individual risk profiles and maintaining a long-term perspective crucial for successful long-term investing.

Conclusion: Don't Let Stock Market Valuations Deter You – BofA's Perspective

BofA's analysis suggests that while current stock market valuations might appear high at first glance, a thorough assessment reveals a positive long-term outlook supported by strong economic fundamentals, technological innovation, and corporate strength. Their analysis emphasizes the importance of considering factors beyond traditional valuation metrics and adopting a well-diversified, long-term investment strategy. By understanding the nuances of the current market environment and aligning their portfolios accordingly, investors can mitigate risks and capitalize on long-term growth opportunities.

Don't let perceived high stock market valuations deter you from achieving your long-term financial goals. Explore BofA's insights and resources to develop a robust investment strategy aligned with your risk tolerance. Learn more about BofA Global Research for deeper dives into market analysis and financial planning.

Featured Posts

-

Sally Hawkins In Bring Her Back A New Kind Of Resurrection

May 29, 2025

Sally Hawkins In Bring Her Back A New Kind Of Resurrection

May 29, 2025 -

Ftc Challenges Microsofts Activision Acquisition The Future Of Gaming

May 29, 2025

Ftc Challenges Microsofts Activision Acquisition The Future Of Gaming

May 29, 2025 -

Frances Le Pen Condemns Rally Ban As A Politically Motivated Witch Hunt

May 29, 2025

Frances Le Pen Condemns Rally Ban As A Politically Motivated Witch Hunt

May 29, 2025 -

Starbase Texas A Cidade Construida Por Musk Para A Space X

May 29, 2025

Starbase Texas A Cidade Construida Por Musk Para A Space X

May 29, 2025 -

Whats App On I Pad 15 Years In The Making

May 29, 2025

Whats App On I Pad 15 Years In The Making

May 29, 2025

Latest Posts

-

Sanofi Croissance Continue Et Potentiel Boursier Analyse De Loeil Du Loup

May 31, 2025

Sanofi Croissance Continue Et Potentiel Boursier Analyse De Loeil Du Loup

May 31, 2025 -

Sanofi Etend Son Expertise En Immunologie Avec L Acquisition De Dren Bio

May 31, 2025

Sanofi Etend Son Expertise En Immunologie Avec L Acquisition De Dren Bio

May 31, 2025 -

Sanofi Acquiert L Anticorps Bispecifique De Dren Bio Un Portefeuille Immunologie Renforce

May 31, 2025

Sanofi Acquiert L Anticorps Bispecifique De Dren Bio Un Portefeuille Immunologie Renforce

May 31, 2025 -

Sanofis Strategic Acquisition Dren Bios Myeloid Cell Engager Boosts Immunology Research

May 31, 2025

Sanofis Strategic Acquisition Dren Bios Myeloid Cell Engager Boosts Immunology Research

May 31, 2025 -

Boxer Munguia Rejects Doping Claims After Adverse Analytical Finding

May 31, 2025

Boxer Munguia Rejects Doping Claims After Adverse Analytical Finding

May 31, 2025