BofA's View: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale Behind a Positive Outlook Despite High Valuations

BofA's research paints a picture of continued economic growth, supporting their positive stock market outlook despite seemingly high valuations. Their analysis considers several key economic indicators and factors:

-

Strong Corporate Earnings Growth: BofA projects robust corporate earnings growth for the coming quarters, driven by factors such as increased consumer spending and ongoing technological innovation. This strong earnings growth helps to justify current valuations, making them appear less inflated when considered relative to future profits.

-

Favorable Economic Indicators: Positive indicators like steady GDP growth and sustained consumer spending underpin BofA's optimistic forecast. These indicators suggest a healthy economic environment capable of supporting current market levels.

-

Interest Rate Considerations: While interest rate hikes can impact valuations, BofA's analysis suggests that the current rate environment, while rising, is still manageable and won't trigger a significant market downturn. They factor in the impact of interest rate changes on corporate profitability and investor behavior in their projections.

-

Inflationary Pressures: BofA acknowledges the impact of inflation, but their analysis indicates that corporate earnings growth can outpace inflationary pressures, thereby mitigating the negative impact on valuations.

-

Addressing Counterarguments: BofA acknowledges concerns about potential overvaluation. However, they argue that historical comparisons must consider unique factors like the current low interest rate environment and the significant impact of technological advancements on corporate profitability and future growth potential.

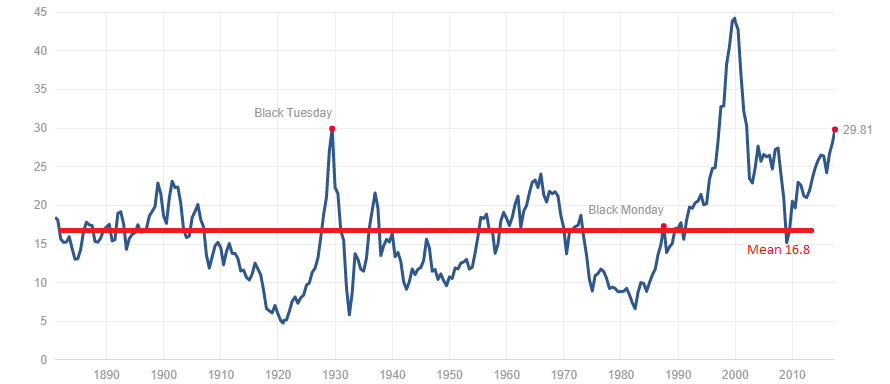

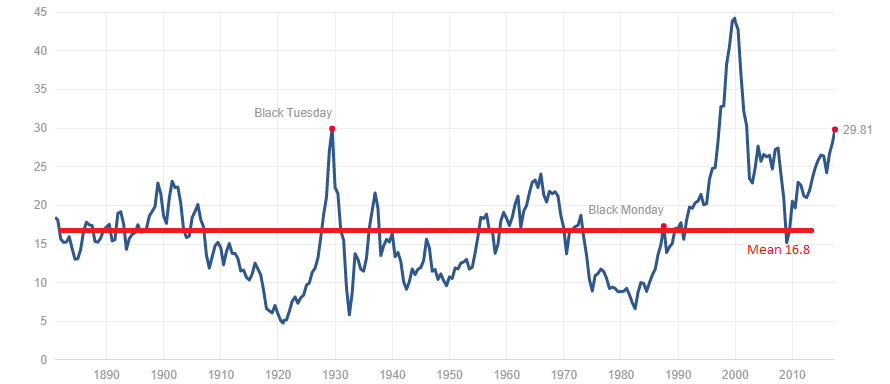

Understanding Current Valuation Metrics – A Deeper Dive

Several valuation metrics are used to assess the stock market's overall value. Understanding these metrics is crucial for interpreting the significance of "high valuations":

-

Price-to-Earnings Ratio (P/E): The P/E ratio compares a company's stock price to its earnings per share. A high P/E ratio can signal potential overvaluation, but it needs to be considered in context, comparing it to historical averages and industry benchmarks.

-

Price-to-Sales Ratio (P/S): This metric compares a company's stock price to its revenue. It’s useful for valuing companies with negative earnings, but like P/E, it needs a comparative analysis.

-

Dividend Yield: This represents the annual dividend payment relative to the stock price. A high dividend yield can suggest a potentially undervalued stock.

-

Market Capitalization: The total market value of a company's outstanding shares. While useful for understanding overall market size, it doesn't directly reflect overvaluation.

-

Valuation Multiples: Analyzing various multiples together provides a more comprehensive picture than relying on any single metric. Furthermore, comparing current multiples to historical averages and those of other market cycles provides valuable context.

Currently, while some valuation metrics suggest elevated levels compared to historical averages, factors like low interest rates and the rapid pace of technological innovation are considered by BofA to be influencing these multiples. It's vital to remember that focusing solely on broad market indices can be misleading. Analyzing individual companies and their fundamental strengths is crucial for a more nuanced understanding of valuations. High valuations don't automatically translate to an imminent market crash.

The Importance of Long-Term Investing Strategies

Navigating market volatility, particularly when concerns about high stock market valuations are prevalent, requires a long-term perspective:

-

Long-Term Perspective: Market fluctuations are inherent; short-term market movements shouldn't dictate long-term investment strategies. Focusing on a long-term horizon minimizes the impact of short-term volatility.

-

Diversification: A diversified portfolio reduces risk by spreading investments across different asset classes, sectors, and geographies. This approach mitigates the potential negative impact of any single investment performing poorly.

-

Portfolio Management: Regularly review and rebalance your portfolio to align with your risk tolerance and investment goals. This ensures your portfolio stays aligned with your long-term objectives.

-

Active vs. Passive Investing: Both approaches have their merits. Active investors aim to outperform the market, while passive investors seek to match market returns. The best choice depends on your individual circumstances and risk tolerance.

-

Fundamental Analysis: Concentrate on a company's financial health, competitive landscape, and growth potential rather than solely reacting to market sentiment.

Addressing Common Investor Concerns Related to High Valuations

Many investors fear a market correction or even a crash when valuations are high. BofA addresses these anxieties:

-

Market Correction/Crash: While corrections are a normal part of market cycles, BofA believes the likelihood of a significant market crash is relatively low given the current economic fundamentals.

-

Recession Fears: BofA's economic analysis doesn't currently point towards a significant recession.

-

Managing Investor Anxiety: Avoid making impulsive decisions based on fear. Stick to your long-term investment plan, and if necessary, seek professional financial advice.

Conclusion

BofA's optimistic outlook stems from strong corporate earnings, favorable economic indicators, and a belief that the current high stock market valuations are justifiable in the long term. Don't let anxieties surrounding high stock market valuations dictate your investment decisions. Maintain a long-term perspective, diversify your portfolio, and focus on fundamental analysis. While understanding high stock market valuations is crucial, remember that a well-defined long-term strategy is your best defense against short-term market fluctuations. Consider reviewing BofA's research for further insights and consult with a financial advisor for personalized guidance to navigate this market effectively. Remember, understanding high stock market valuations is key to successful long-term investing.

Featured Posts

-

Memorial Day Observances And Celebrations In Des Moines

May 30, 2025

Memorial Day Observances And Celebrations In Des Moines

May 30, 2025 -

Sierra Leone Fallout Following Immigration Chiefs Dismissal

May 30, 2025

Sierra Leone Fallout Following Immigration Chiefs Dismissal

May 30, 2025 -

The Impact Of Us Solar Tariffs Hanwha And Ocis Market Position

May 30, 2025

The Impact Of Us Solar Tariffs Hanwha And Ocis Market Position

May 30, 2025 -

Those British Faces Uncovering The Story Of Anna Neagle

May 30, 2025

Those British Faces Uncovering The Story Of Anna Neagle

May 30, 2025 -

Is Jon Jones Avoiding Tom Aspinall The Diaz Fight Confirmed

May 30, 2025

Is Jon Jones Avoiding Tom Aspinall The Diaz Fight Confirmed

May 30, 2025

Latest Posts

-

Wang And Sun Secure Third Straight Mixed Doubles World Title

May 31, 2025

Wang And Sun Secure Third Straight Mixed Doubles World Title

May 31, 2025 -

District Championship Baseball Thursday Night Highlights And College Tennis Update

May 31, 2025

District Championship Baseball Thursday Night Highlights And College Tennis Update

May 31, 2025 -

Wang Suns Table Tennis Dominance Third Consecutive Mixed Doubles World Championship

May 31, 2025

Wang Suns Table Tennis Dominance Third Consecutive Mixed Doubles World Championship

May 31, 2025 -

Thursday Night Baseball District Championships And Playoff Berths Decided

May 31, 2025

Thursday Night Baseball District Championships And Playoff Berths Decided

May 31, 2025 -

Tuesday March 11th Complete Orange County Game Results And Player Stats

May 31, 2025

Tuesday March 11th Complete Orange County Game Results And Player Stats

May 31, 2025