BofA's View: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale Behind Dismissing Valuation Concerns

BofA's market outlook incorporates a nuanced understanding of stock valuation metrics and their context. Instead of solely focusing on headline numbers, BofA's analysis considers the broader economic landscape and historical trends. Their arguments against undue concern regarding stretched stock market valuations hinge on several key points:

-

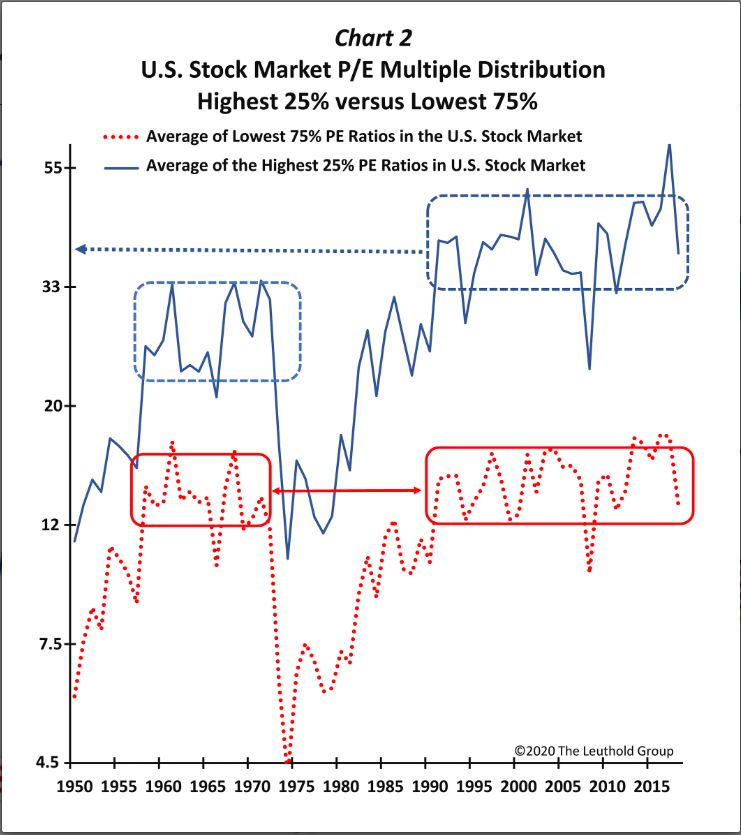

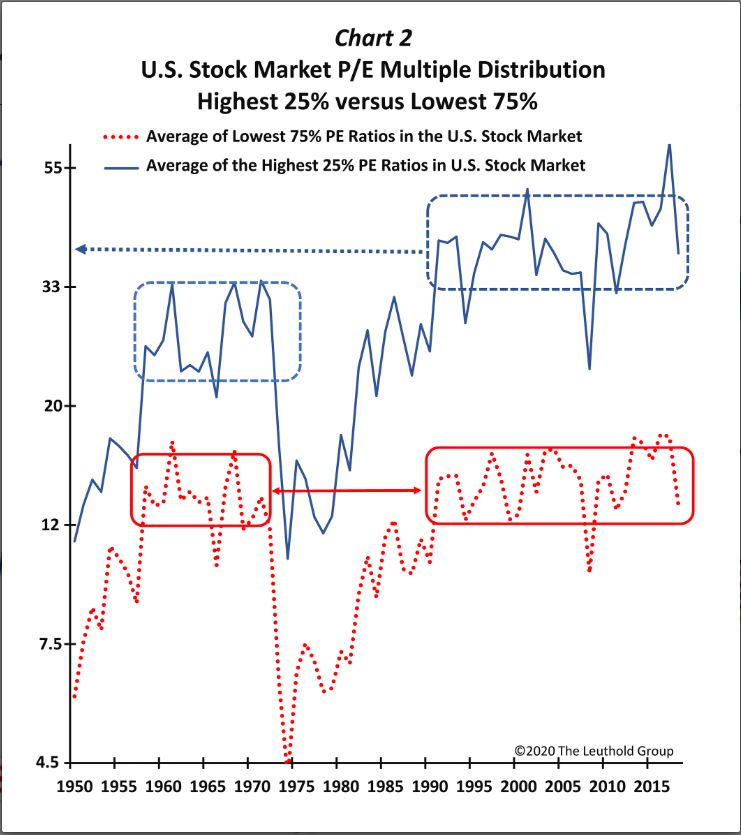

Contextualizing Valuation Metrics: BofA likely avoids relying solely on a single metric like the Price-to-Earnings Ratio (P/E). They probably compare current P/E ratios to historical averages, adjusting for factors such as inflation and interest rate environments. They might also look at more sophisticated metrics like the cyclically adjusted price-to-earnings ratio (Shiller P/E), which smooths out short-term market fluctuations to provide a more stable picture of long-term valuation.

-

Accounting for Inflation and Interest Rates: A key component of BofA's analysis likely involves considering the impact of low interest rates and inflation on valuation models. Low interest rates generally support higher valuations, as discussed in the next section. Similarly, inflation needs to be factored into earnings projections when assessing the real value of future cash flows.

-

Sector-Specific Analysis: BofA's assessment likely isn't a blanket statement about the entire market. They likely identify specific sectors or companies less vulnerable to valuation concerns based on their growth prospects, competitive advantages, and resilience to economic downturns. High-growth technology companies, for example, might justify higher P/E ratios if their earnings are expected to grow substantially.

The Role of Low Interest Rates in Supporting Higher Valuations

Low interest rates play a crucial role in supporting seemingly high stock market valuations. This is because interest rates directly impact the discount rate used in valuation models, which is essentially the return an investor expects on their investment.

-

Impact on Discount Rates: Lower interest rates translate to lower discount rates. A lower discount rate means that future earnings are worth more in today's dollars. This is because the opportunity cost of investing in a stock is lower when interest rates are low, making future earnings more valuable.

-

Present Value of Future Earnings: Consequently, a lower discount rate leads to higher present values for future earnings streams. This explains why companies with strong future earnings potential can command higher valuations even if current earnings are not exceptionally high.

-

Bond Yields vs. Equity Returns: BofA likely compares current bond yields to expected equity returns. When bond yields are low, the relative attractiveness of stocks (which carry higher risk but offer the potential for higher returns) increases, potentially justifying higher stock market valuations.

-

Investor Risk Appetite: Low interest rates often stimulate investor appetite for riskier assets, including stocks. This increased demand can further push up stock prices and valuations.

Long-Term Growth Prospects and Future Earnings Potential

BofA's optimistic outlook on stock market valuations is partly based on a positive assessment of long-term economic growth and corporate earnings potential.

-

Economic Growth and Sectoral Outlooks: BofA's analysis likely includes projections for long-term economic growth, considering factors like technological innovation, demographic trends, and global economic conditions. Specific sectors poised for significant growth would be given higher weight.

-

Technological Innovation and Future Earnings: The impact of technological advancements is crucial. BofA likely highlights industries and companies benefiting from technological innovation, predicting strong future earnings growth that justifies current valuations.

-

Corporate Profit Growth: BofA's assessment anticipates corporate profit growth to outpace current valuation levels. This growth expectation, combined with factors like low interest rates, makes current valuations appear more reasonable from a long-term perspective.

-

Geopolitical Considerations: BofA's long-term outlook wouldn’t neglect geopolitical factors. The potential impact of global events on economic growth and corporate profits is surely factored into their analysis.

Addressing the Risk of a Market Correction

While BofA's view is relatively optimistic, it acknowledges the possibility of a market correction. However, their perspective might suggest that such a correction wouldn't necessarily negate the positive long-term outlook.

-

Likelihood and Severity of a Correction: BofA might assess the likelihood and potential severity of a market correction based on various factors, such as valuation levels, economic indicators, and geopolitical risks.

-

Risk Management Strategies: The report likely emphasizes the importance of risk management, including portfolio diversification across different asset classes and sectors.

-

Benefits from a Market Dip: A potential market correction could be viewed as an opportunity for long-term investors to acquire quality assets at lower prices, further supporting BofA’s long-term positive outlook.

Conclusion

BofA's analysis suggests that while stretched stock market valuations might appear concerning at first glance, a deeper examination reveals several mitigating factors. Low interest rates, strong long-term growth prospects, and the importance of considering valuations within their historical context support BofA’s relatively optimistic outlook. While a market correction remains a possibility, understanding these factors is crucial for informed investment decisions. While BofA's analysis suggests that stretched stock market valuations shouldn't cause undue worry, it's crucial to conduct thorough research and consult a financial advisor before making any investment decisions. Understand your risk tolerance and develop an investment strategy that aligns with your goals. Don't let the fear of high stock market valuations prevent you from exploring opportunities in a potentially growing market. Learn more about BofA's market insights and develop a sound approach to navigating stretched stock market valuations.

Featured Posts

-

Dzho Bayden Vartist Vistupu Na Zakhodakh 300 000

May 16, 2025

Dzho Bayden Vartist Vistupu Na Zakhodakh 300 000

May 16, 2025 -

Padres Historic Mlb Win Streak A Record Breaking Achievement

May 16, 2025

Padres Historic Mlb Win Streak A Record Breaking Achievement

May 16, 2025 -

893 Goals Ovechkins Historic Pursuit Of Gretzkys Nhl Record

May 16, 2025

893 Goals Ovechkins Historic Pursuit Of Gretzkys Nhl Record

May 16, 2025 -

Why Gordon Ramsay Wasnt Surprised By Chandlers Loss To Pimblett

May 16, 2025

Why Gordon Ramsay Wasnt Surprised By Chandlers Loss To Pimblett

May 16, 2025 -

Boil Water Advisory In Pulaski Update For Residents

May 16, 2025

Boil Water Advisory In Pulaski Update For Residents

May 16, 2025