BOJ Slashes Growth Outlook: Trade Disputes Take Toll On Japanese Economy

Table of Contents

Revised GDP Growth Forecasts and Their Implications

The BOJ's revised GDP growth forecasts paint a concerning picture for the Japanese economy. The central bank has slashed its projection for the current fiscal year (ending March 2024) from an already modest 1.4% to a mere 0.9%, reflecting a significant downward revision. For the following fiscal year, the forecast has also been reduced, indicating a continued slowdown. This downward revision carries significant implications across various sectors.

-

Specific numbers for revised GDP growth predictions: The exact figures will vary depending on the latest BOJ announcements, but the trend consistently shows a substantial reduction. Consult reputable financial news sources for the most up-to-date data.

-

Impact on key economic indicators (inflation, unemployment): The reduced growth outlook may lead to subdued inflation, potentially delaying the BOJ's target of achieving sustainable price stability. Moreover, it might result in a slight increase in unemployment, particularly within export-oriented industries.

-

Potential ripple effects on related Asian economies: Japan's economic slowdown could have knock-on effects on its regional trading partners, impacting supply chains and overall economic performance in Asia.

-

Comparison with previous growth forecasts: Comparing the current revision with previous forecasts highlights the increasing pessimism surrounding Japan's economic prospects in the face of persistent global uncertainties.

The Role of Trade Disputes in the Slowdown

The ongoing trade disputes, especially the protracted US-China trade war, are directly contributing to Japan's economic slowdown. These disputes have disrupted global supply chains, leading to increased uncertainty and reduced export demand for Japanese businesses. The impact is felt across various sectors.

-

Examples of specific trade disputes impacting Japanese exports: The automotive and electronics industries are among those significantly affected, facing reduced demand and increased production costs due to tariffs and trade barriers.

-

Analysis of the impact on Japanese businesses involved in global supply chains: Japanese companies deeply integrated into global supply chains face significant challenges in maintaining production schedules and profitability amidst trade uncertainties.

-

Discussion on the potential for further escalation and its consequences: Any further escalation of trade tensions could exacerbate the situation, leading to deeper economic contraction and increased uncertainty for businesses.

BOJ's Monetary Policy Response and its Effectiveness

In response to the slowing economy, the BOJ has maintained its current monetary policy stance, including negative interest rates and quantitative easing. However, the effectiveness of these measures in boosting growth is debatable in the current environment.

-

Description of current BOJ monetary policy: The BOJ continues to pursue a policy of ultra-loose monetary policy, aiming to stimulate demand and inflation.

-

Analysis of the potential effectiveness of current measures: The effectiveness of further quantitative easing is questioned given already low interest rates and the limited impact on investment and consumption.

-

Discussion of alternative policy options the BOJ could consider: Other policy options, such as fiscal stimulus coordinated with government initiatives, may be necessary to supplement monetary policy.

-

Potential limitations of monetary policy in addressing trade-related issues: Monetary policy alone cannot fully address issues stemming from external trade disputes, which require broader diplomatic and economic solutions.

Government Intervention and Fiscal Stimulus

The Japanese government has implemented some fiscal stimulus measures to counteract the economic slowdown, focusing on increased public works spending and infrastructure projects. However, the scale and impact of these measures are subject to debate. The effectiveness of fiscal stimulus often depends on the speed and efficiency of government implementation, as well as the overall economic climate.

Conclusion

The BOJ's significant downward revision of Japan's growth outlook underscores the substantial impact of escalating trade disputes on the Japanese economy. The challenges facing both the BOJ and the Japanese government are considerable, requiring a multifaceted approach that combines monetary and fiscal policies with diplomatic efforts to resolve global trade tensions. The reduced GDP growth forecasts and the inherent uncertainties surrounding trade relations highlight the need for close monitoring of the situation.

Call to Action: Stay informed about the evolving situation and the BOJ's response to the ongoing trade disputes impacting the Japanese economy. Regularly check reputable financial news sources for updates on the BOJ's growth outlook and related economic developments. Understanding the BOJ's growth outlook is crucial for making informed decisions in the current complex economic landscape.

Featured Posts

-

Footballer Georgia Stanway Honors Girl Killed In Kendal Pitch Accident

May 02, 2025

Footballer Georgia Stanway Honors Girl Killed In Kendal Pitch Accident

May 02, 2025 -

Is A Valorant Mobile Game Coming From The Pubg Mobile Developers

May 02, 2025

Is A Valorant Mobile Game Coming From The Pubg Mobile Developers

May 02, 2025 -

Rechtszaak Gemeente Kampen Eist Stroomnetaansluiting Van Enexis

May 02, 2025

Rechtszaak Gemeente Kampen Eist Stroomnetaansluiting Van Enexis

May 02, 2025 -

Rm 36 45 Juta Disalurkan Kemaskini Tabung Baitulmal Sarawak Untuk Asnaf March 2025

May 02, 2025

Rm 36 45 Juta Disalurkan Kemaskini Tabung Baitulmal Sarawak Untuk Asnaf March 2025

May 02, 2025 -

Chocolat Pour Bebe Offre Speciale De La Boulangerie Normande

May 02, 2025

Chocolat Pour Bebe Offre Speciale De La Boulangerie Normande

May 02, 2025

Latest Posts

-

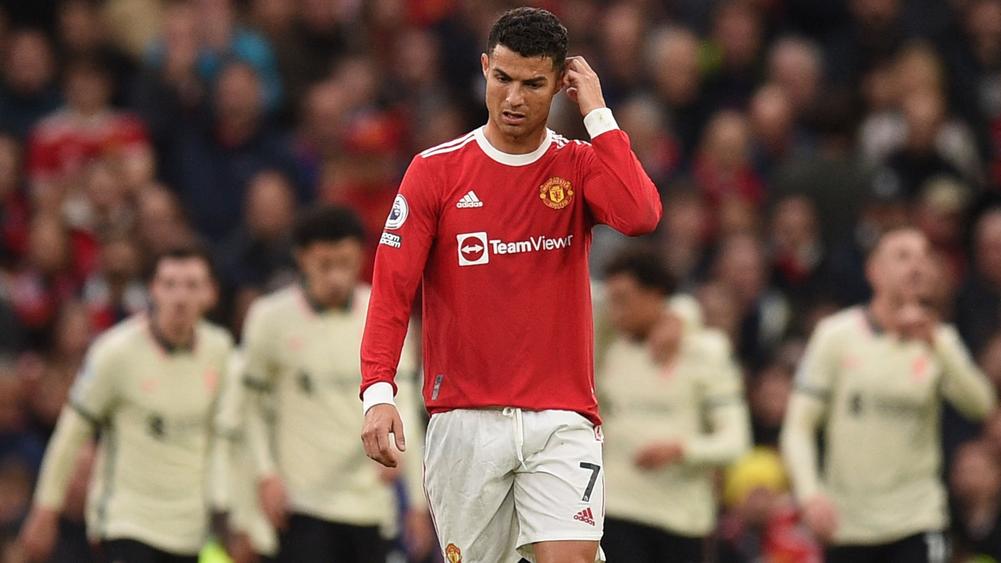

Mn Hm Akthr Laeby Krt Alqdm Mkrwht Qaymt Mwqe Bkra Lakthr 30 Shkhsyt

May 03, 2025

Mn Hm Akthr Laeby Krt Alqdm Mkrwht Qaymt Mwqe Bkra Lakthr 30 Shkhsyt

May 03, 2025 -

Shkhsyat Krwyt Mthyrt Lljdl 30 Asma Fy Qaymt Mwqe Bkra

May 03, 2025

Shkhsyat Krwyt Mthyrt Lljdl 30 Asma Fy Qaymt Mwqe Bkra

May 03, 2025 -

Mwqe Bkra Ykshf 30 Shkhsyt Ryadyt Mkrwht Mn Qbl Aljmahyr

May 03, 2025

Mwqe Bkra Ykshf 30 Shkhsyt Ryadyt Mkrwht Mn Qbl Aljmahyr

May 03, 2025 -

The Costly Error Souness On Arsenals Title Failure

May 03, 2025

The Costly Error Souness On Arsenals Title Failure

May 03, 2025 -

Aedae Aljmahyr Qaymt B 30 Shkhsyt Krt Qdm Mthyrt Lljdl Fy Mwqe Bkra

May 03, 2025

Aedae Aljmahyr Qaymt B 30 Shkhsyt Krt Qdm Mthyrt Lljdl Fy Mwqe Bkra

May 03, 2025