Bond Forward Market Reform: The Indian Insurers' Perspective

Table of Contents

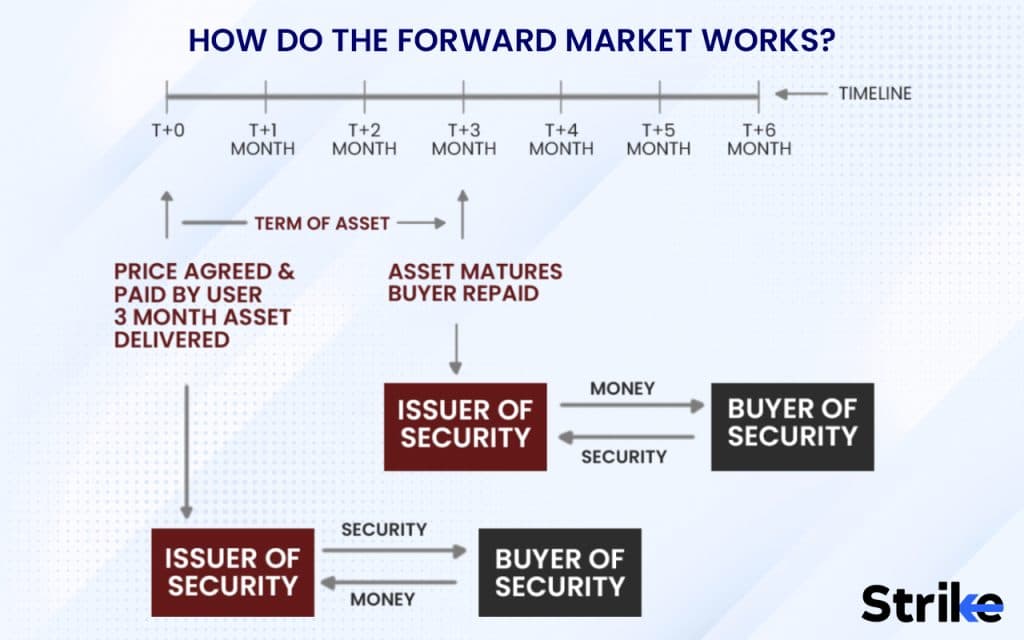

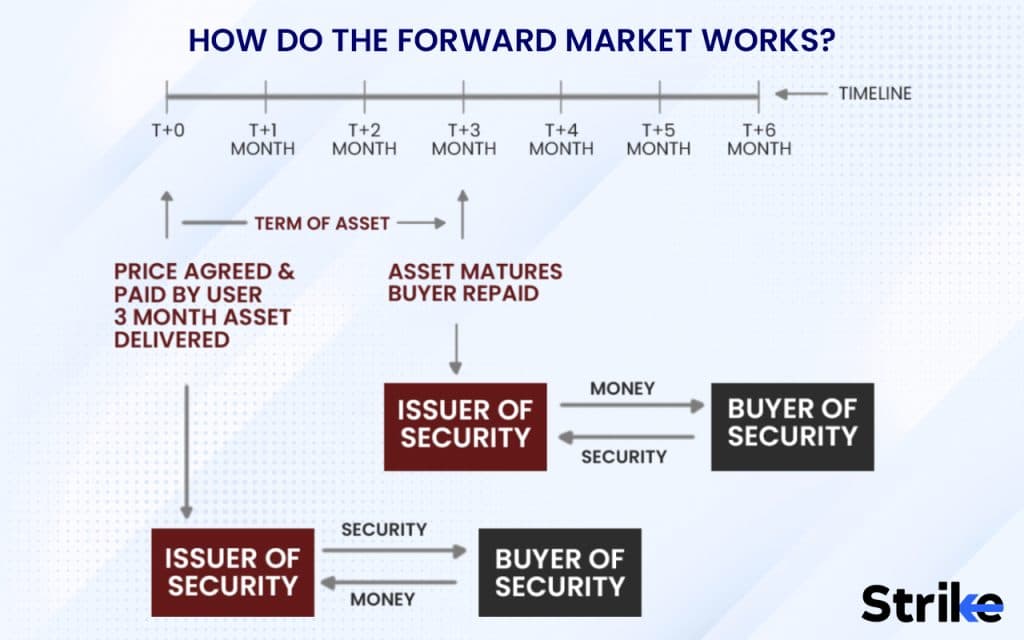

Current State of the Bond Forward Market in India

The existing structure of the Indian bond forward market presents several limitations and inefficiencies that hinder its optimal functioning. The current regulatory framework, while aiming to provide oversight, often lacks the granularity needed to address the specific challenges of this market segment. This leads to several key issues:

- Lack of standardization in contracts: Inconsistent contract terms create complexities in trading and settlement, increasing operational risks and hindering efficient price discovery.

- Limited transparency and liquidity: The lack of a centralized trading platform and robust reporting mechanisms limits transparency, leading to lower liquidity and potentially inflated spreads.

- High counterparty risk: The absence of a robust clearing and settlement system increases the risk of default by counterparties, potentially causing significant financial losses for insurers.

- Regulatory gaps and challenges: Ambiguity in certain regulatory aspects and a lack of harmonization with international best practices create uncertainty and hinder market development.

The existing regulatory framework primarily relies on existing regulations governing the broader derivatives market, often leaving specific aspects of the bond forward market inadequately addressed. This necessitates a more focused and comprehensive regulatory approach tailored to the unique characteristics of this market segment.

Impact of Reforms on Indian Insurers' Risk Management

Proposed reforms in the bond forward market are expected to significantly enhance risk management capabilities for Indian insurers. By addressing the existing limitations, these reforms aim to create a more robust and efficient market environment. The key improvements include:

- Improved hedging capabilities against interest rate risk: Standardized contracts and increased liquidity will allow insurers to effectively hedge their interest rate risk exposures, improving their portfolio stability.

- Enhanced transparency leading to better risk assessment: Greater transparency in pricing and trading activity will facilitate more accurate risk assessment and improve the effectiveness of risk mitigation strategies.

- Reduced counterparty risk through standardized contracts and clearing mechanisms: The introduction of a centralized clearinghouse will significantly reduce counterparty risk, enhancing the overall stability of the market.

- Potential impact on ALM (Asset-Liability Management) strategies: Improved hedging capabilities will allow insurers to optimize their asset-liability management strategies, improving their long-term financial stability.

The role of credit derivatives and other risk mitigation tools will also be strengthened by these reforms, further enhancing the risk management capabilities of Indian insurers.

Opportunities for Investment Strategies Under the Reformed Market

A reformed bond forward market unlocks numerous opportunities for Indian insurers to enhance their investment strategies. The increased efficiency and transparency will create new avenues for generating returns and managing risk. Key opportunities include:

- Increased access to a wider range of fixed-income instruments: A more liquid and transparent market will facilitate access to a more diverse range of fixed-income instruments, allowing insurers to diversify their portfolios.

- Potential for higher returns through efficient hedging and arbitrage strategies: Improved hedging capabilities and increased liquidity will allow insurers to pursue more sophisticated investment strategies, potentially leading to higher returns.

- Improved liquidity enabling easier portfolio adjustments: Increased liquidity will enable insurers to adjust their portfolios more easily in response to changing market conditions.

- Attracting foreign investment into the Indian bond market: A more efficient and transparent market will attract more foreign investment, increasing liquidity and further enhancing market depth.

Examples of specific investment strategies that could benefit include enhanced carry trades, more effective duration management, and sophisticated arbitrage opportunities across different segments of the fixed-income market.

Challenges and Concerns of Indian Insurers Regarding Bond Forward Market Reforms

While the reforms offer significant benefits, Indian insurers also face several challenges and concerns during the transition:

- Operational challenges in adapting to new systems and regulations: Implementing new systems and procedures can be operationally complex and require substantial investment in technology and training.

- Potential for increased compliance costs: New regulations and reporting requirements may lead to increased compliance costs for insurers.

- Concerns regarding the impact on existing investment portfolios: Insurers may need to re-evaluate and adjust their existing investment portfolios to align with the new market dynamics.

- Need for upskilling and training for insurance professionals: Insurance professionals will need adequate training to understand and effectively utilize the new tools and instruments available in the reformed market.

Addressing these concerns requires proactive collaboration between regulatory bodies and insurers. Adequate support in terms of technical assistance, training programs, and phased implementation will be crucial for a smooth transition.

The Role of Technology and Innovation in the Reformed Market

Technology will play a pivotal role in driving the efficiency and transparency of the reformed bond forward market. Several technological advancements are crucial for its success:

- Use of electronic trading platforms: Electronic trading platforms will improve transparency, efficiency, and liquidity in the market.

- Blockchain technology for improved transparency and security: Blockchain technology can enhance the security and transparency of transactions, reducing the risk of fraud and manipulation.

- Artificial intelligence for risk management and algorithmic trading: AI-powered tools can enhance risk management capabilities and enable more sophisticated algorithmic trading strategies.

- Data analytics for better informed investment decisions: Data analytics can provide insurers with valuable insights into market trends and risk factors, enabling better-informed investment decisions.

Conclusion

This article has explored the multifaceted implications of Bond Forward Market reform in India from the perspective of Indian insurers. The reforms offer substantial opportunities for improved risk management, innovative investment strategies, and greater stability within the financial sector. However, successfully navigating the transition requires addressing the associated challenges through adequate support, comprehensive training, and the strategic adoption of technological advancements. Indian insurers must actively engage with the evolving regulatory landscape and embrace technological innovation to fully leverage the potential of a reformed bond forward market. Understanding and adapting to these Bond Forward Market reforms in India is not merely an adaptation; it is a crucial step towards the future success and competitiveness of the Indian insurance industry.

Featured Posts

-

Palantir Stock 40 Up In 2025 Investment Risks And Opportunities

May 09, 2025

Palantir Stock 40 Up In 2025 Investment Risks And Opportunities

May 09, 2025 -

Hertls Hat Trick Leads Golden Knights Past Red Wings

May 09, 2025

Hertls Hat Trick Leads Golden Knights Past Red Wings

May 09, 2025 -

Dijon Agresssion Au Lac Kir Enquete En Cours Apres Trois Victimes

May 09, 2025

Dijon Agresssion Au Lac Kir Enquete En Cours Apres Trois Victimes

May 09, 2025 -

Elizabeth Line Strike Dates Planned Action And Route Impacts Feb Mar

May 09, 2025

Elizabeth Line Strike Dates Planned Action And Route Impacts Feb Mar

May 09, 2025 -

Red Bulls Driver Dilemma Colapintos Rise And Lawsons Uncertain Future

May 09, 2025

Red Bulls Driver Dilemma Colapintos Rise And Lawsons Uncertain Future

May 09, 2025