Bond Market Crisis: Are Investors Missing The Warning Signs?

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The relationship between interest rates and bond prices is inversely proportional. When interest rates rise, the value of existing bonds falls, as newly issued bonds offer higher yields. This poses significant risks for investors holding fixed-income portfolios.

- Increased Duration Risk: Longer-term bonds are more sensitive to interest rate changes, experiencing greater price fluctuations. This duration risk increases the potential for substantial capital losses during periods of rising interest rates.

- Potential Capital Losses: As interest rates climb, the market value of existing bonds declines, leading to potential capital losses if investors need to sell their bonds before maturity.

- Reduced Yields: While newly issued bonds may offer higher yields, existing bonds with lower coupon rates become less attractive, reducing their overall return.

Bonds most vulnerable to rising interest rates include long-term bonds and high-yield bonds. The recent aggressive interest rate hikes by central banks worldwide, coupled with yield curve inversions in several major economies, underscore this escalating risk. For example, the US Federal Reserve's rate increases in 2022 caused a significant sell-off in the bond market, highlighting the sensitivity of bond prices to interest rate changes.

Inflationary Pressures and Their Effect on Bond Values

High inflation erodes the purchasing power of fixed-income investments. Bonds offer a fixed return, meaning their real return (return adjusted for inflation) diminishes when inflation rises unexpectedly.

- Real Returns Decline: If inflation outpaces the bond's yield, the real return becomes negative, meaning investors lose purchasing power over time.

- Potential for Negative Real Yields: In high-inflation environments, it's possible for bond yields to fall below the inflation rate, resulting in negative real yields.

- Investor Uncertainty: High and unpredictable inflation creates uncertainty among investors, leading to increased volatility in the bond market.

Central banks attempt to control inflation through monetary policy, but unexpected inflation spikes can significantly impact bond yields and prices. For instance, the surge in inflation during 2021-2022 caused a decline in real yields for many government bonds. The relationship between inflation rates and bond market performance historically demonstrates this negative correlation.

Geopolitical Instability and its Ripple Effects on the Bond Market

Global events such as wars, political upheavals, and trade disputes can profoundly impact bond markets. Uncertainty surrounding geopolitical events often leads to a "flight to safety," where investors move their money into perceived safe-haven assets, such as government bonds of stable economies.

- Increased Volatility: Geopolitical instability increases market volatility, making it challenging for investors to predict bond prices accurately.

- Capital Outflows: Investors may withdraw capital from riskier bond markets, leading to a decline in bond prices and increased liquidity risks.

- Credit Rating Downgrades: Geopolitical events can trigger credit rating downgrades for sovereign debt or corporate bonds, further impacting investor confidence and bond prices.

The Russian invasion of Ukraine in 2022 exemplifies how geopolitical events can create significant market disruptions. The conflict led to increased volatility in global bond markets and caused capital outflows from several emerging markets. Diversification across different geographies and asset classes can help mitigate geopolitical risks.

Identifying Early Warning Signs of a Bond Market Crisis

Several indicators can signal potential problems in the bond market. Monitoring these indicators is crucial for proactive risk management.

- Credit Spreads Widening: A widening of credit spreads (the difference in yields between high-yield and investment-grade bonds) can indicate increased risk aversion and potential credit problems.

- Yield Curve Inversions: A yield curve inversion (where short-term yields exceed long-term yields) is often considered a predictor of future economic slowdowns and potential bond market distress.

- Declining Investor Confidence: A decrease in investor confidence, often reflected in market sentiment indicators, can signal growing concerns about the stability of the bond market.

- Sharp increase in bond defaults: A sudden spike in the number of bonds defaulting payments is a clear sign of trouble.

- Significant sell-offs in bond markets: Large scale selling of bonds can indicate a crisis is looming.

- Downgrades in credit ratings: A significant number of credit rating downgrades is a major warning sign.

Past crises have shown that these warning signs often precede significant market downturns. Proactive risk management strategies, including careful analysis of market indicators and diversification, are crucial for navigating potential crises.

Conclusion: Navigating the Uncertainties of the Bond Market

A bond market crisis can have devastating consequences for investors. Understanding the key warning signs—rising interest rates, inflationary pressures, geopolitical instability, and indicators like widening credit spreads and yield curve inversions—is vital. Monitoring these factors closely and diversifying investments are crucial for mitigating risk. Investors should engage in thorough analysis and implement proactive risk management strategies to protect their portfolios. Stay informed about potential bond market crisis developments and seek professional financial advice to effectively manage your bond investments. Don't underestimate the importance of understanding the potential for a bond market crisis and taking the necessary steps to protect your financial future.

Featured Posts

-

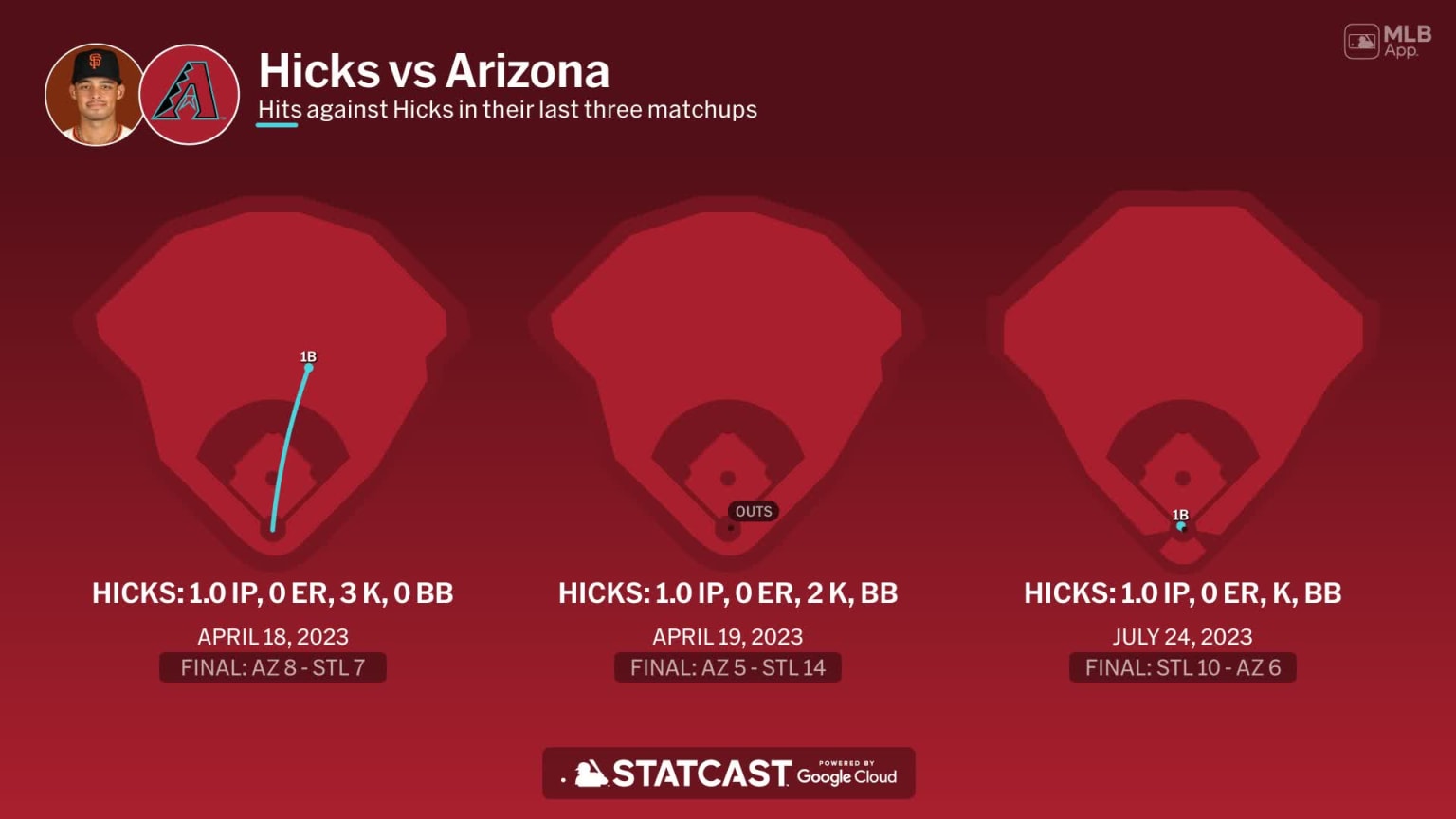

Diamondbacks Defeat Giants Jordan Hicks Takes The Loss

May 28, 2025

Diamondbacks Defeat Giants Jordan Hicks Takes The Loss

May 28, 2025 -

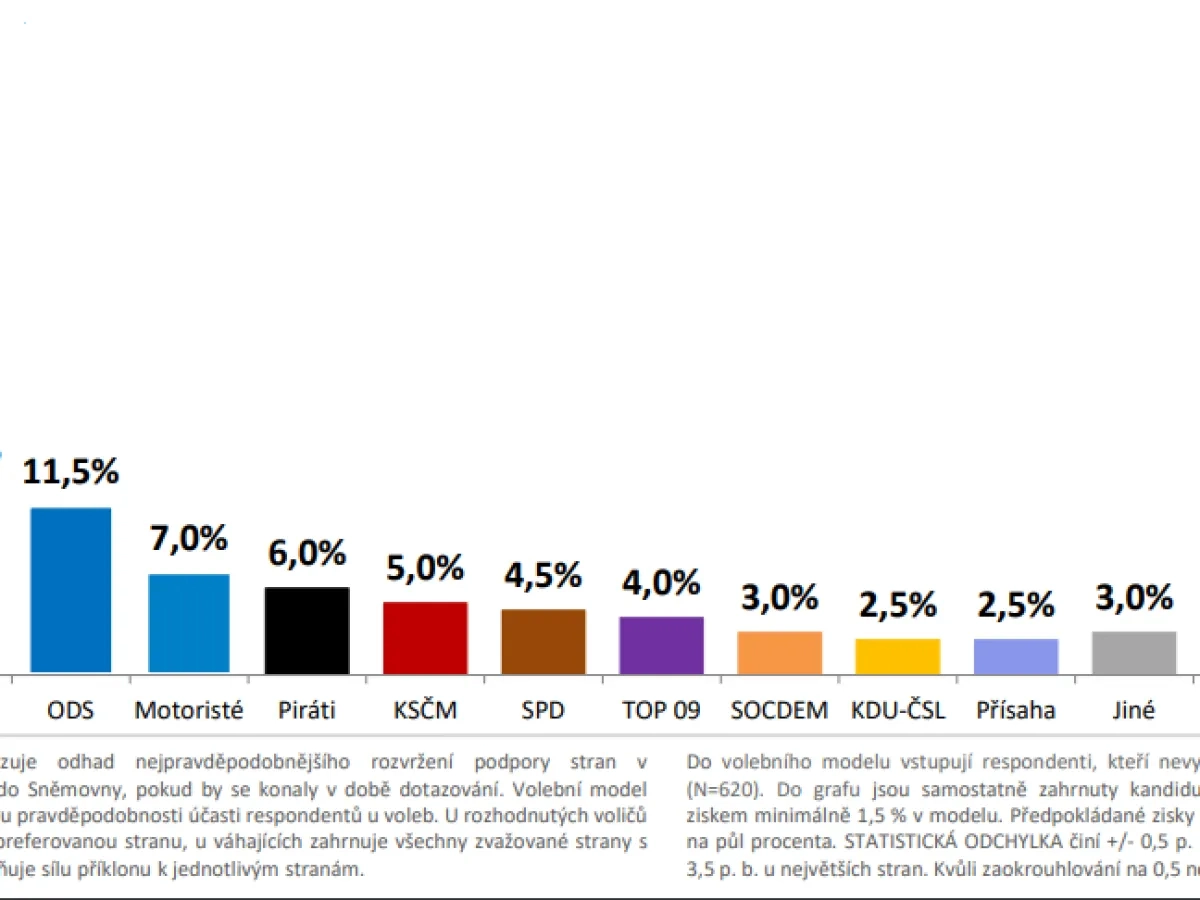

Snemovni Volby Pirati A Zeleni Spojuji Sily

May 28, 2025

Snemovni Volby Pirati A Zeleni Spojuji Sily

May 28, 2025 -

I Ekthesi Toy Goyes Anterson Sto Londino Bythisteite Ston Kosmo Toy

May 28, 2025

I Ekthesi Toy Goyes Anterson Sto Londino Bythisteite Ston Kosmo Toy

May 28, 2025 -

Amorims Shock Plan Selling A Man Utd Star Against Ratcliffes Will

May 28, 2025

Amorims Shock Plan Selling A Man Utd Star Against Ratcliffes Will

May 28, 2025 -

Shein Under Eu Scrutiny Consumer Rights Violations And The Threat Of Penalties

May 28, 2025

Shein Under Eu Scrutiny Consumer Rights Violations And The Threat Of Penalties

May 28, 2025

Latest Posts

-

Newbuild Cruise Ships Fincantieris Agreement With Tui Ag For Marella Cruises

May 29, 2025

Newbuild Cruise Ships Fincantieris Agreement With Tui Ag For Marella Cruises

May 29, 2025 -

Marella Cruises Expands Fleet Fincantieri Wins Major Shipbuilding Contract

May 29, 2025

Marella Cruises Expands Fleet Fincantieri Wins Major Shipbuilding Contract

May 29, 2025 -

Cruise Ship Nieuw Statendam Anchors At Invergordon

May 29, 2025

Cruise Ship Nieuw Statendam Anchors At Invergordon

May 29, 2025 -

Nieuw Statendams Invergordon Visit Easter Ross Ports Busy Start

May 29, 2025

Nieuw Statendams Invergordon Visit Easter Ross Ports Busy Start

May 29, 2025 -

Nieuw Statendam In Invergordon Cruise Season Begins

May 29, 2025

Nieuw Statendam In Invergordon Cruise Season Begins

May 29, 2025