Bond Market Instability: Navigating The Current Crisis

Table of Contents

Understanding the Causes of Current Bond Market Instability

The current turbulence in the bond market stems from a confluence of factors, primarily rising interest rates and persistent inflation, further exacerbated by geopolitical uncertainty.

Rising Interest Rates and Their Impact

The inverse relationship between bond prices and interest rates is a fundamental principle of finance. When interest rates rise, the value of existing bonds with lower coupon payments falls to reflect the higher yields available on newly issued bonds. Recent aggressive Federal Reserve rate hikes have significantly impacted bond valuations.

- Higher rates affect existing bond yields: Bonds issued before the rate hikes now offer lower yields compared to newer bonds, making them less attractive to investors.

- Impact on different bond types: Government bonds, typically considered safer, have also experienced price declines, although generally less severe than corporate bonds, which are more sensitive to interest rate changes and credit risk.

- Implications for investors: Investors holding bonds face potential capital losses if they need to sell before maturity. Reinvestment risk also increases as maturing bonds may yield less than their predecessors.

Inflation's Erosive Effect on Bond Returns

Inflation significantly erodes the real return on fixed-income investments. If inflation rises faster than the bond's yield, the investor's purchasing power diminishes. Unexpected inflation spikes further exacerbate this problem.

- Inflation-adjusted returns: Investors need to consider inflation-adjusted returns (real returns) rather than nominal returns to assess the true performance of their bond holdings.

- Importance of inflation-protected securities (TIPS): TIPS are designed to protect investors from inflation risk, as their principal adjusts with changes in the Consumer Price Index (CPI).

- Strategies for mitigating inflation risk: Diversification into assets that tend to perform well during inflationary periods, such as real estate or commodities, can help mitigate inflation risk in a broader investment portfolio.

Geopolitical Uncertainty and its Ripple Effect

Global events, such as wars, political instability, and trade disputes, significantly impact bond market sentiment and yields. Uncertainty often drives investors towards safer haven assets, putting downward pressure on bond prices.

- Recent geopolitical events: The war in Ukraine, for example, significantly impacted global bond markets, leading to increased volatility and a flight to safety.

- Diversification strategies: Geographic diversification of bond holdings can help mitigate the impact of specific geopolitical events.

- Role of safe-haven assets: During periods of heightened geopolitical uncertainty, investors often flock to government bonds of countries perceived as politically stable, such as US Treasury bonds, driving up demand and potentially increasing their price.

Strategies for Navigating Bond Market Instability

Effectively navigating the current bond market instability requires a proactive approach focusing on diversification, risk assessment, and exploration of alternative fixed-income options.

Diversification and Portfolio Rebalancing

Diversifying bond holdings across various maturities, issuers, and credit ratings is crucial to reduce risk. Regular portfolio rebalancing helps maintain the desired asset allocation.

- Diverse bond portfolios: A well-diversified portfolio might include a mix of government bonds, corporate bonds, municipal bonds, and international bonds with varying maturities.

- Risk tolerance assessment: Understanding your risk tolerance is paramount before making any investment decisions. A conservative investor might prioritize lower-risk bonds, while a more aggressive investor may include a higher proportion of higher-yield bonds.

- Professional investment advice: Seeking professional advice from a qualified financial advisor can provide valuable insights and a tailored strategy.

Assessing Risk Tolerance and Investment Goals

Investors must align their bond investments with their long-term financial goals and risk tolerance. A longer time horizon allows for greater risk-taking, while shorter horizons necessitate a more conservative approach.

- Different risk profiles: Conservative investors prioritize capital preservation, moderate investors seek a balance between risk and return, and aggressive investors are willing to take on more risk for potentially higher returns.

- Time horizon's impact: Long-term investors can weather short-term market fluctuations better than those with shorter time horizons.

- Importance of a financial plan: A comprehensive financial plan outlines your financial goals, risk tolerance, and investment strategy, ensuring your bond investments align with your overall objectives.

Exploring Alternative Fixed-Income Investments

Beyond traditional bonds, investors can explore alternative fixed-income options, each with its own set of risks and rewards.

- Inflation-protected securities (TIPS): TIPS offer protection against inflation, making them attractive in times of rising prices.

- Floating-rate notes: These bonds offer yields that adjust with changes in prevailing interest rates, mitigating some interest rate risk.

- High-yield bonds (with risk warnings): These bonds offer higher yields but carry significantly higher default risk. They are suitable only for investors with a higher risk tolerance.

Monitoring Market Trends and Staying Informed

Staying informed about market developments is essential for making sound investment decisions. Monitoring key economic indicators and utilizing reliable financial news sources are crucial for navigating bond market instability.

Key Indicators to Track

Several key indicators provide valuable insights into the bond market's direction.

- Inflation rate: A persistent increase in inflation puts downward pressure on bond prices.

- Interest rate forecasts: Future interest rate changes significantly affect bond yields and prices.

- Credit ratings: Credit rating downgrades can significantly impact the value of corporate bonds.

- Reliable sources for economic data: The Federal Reserve, the Bureau of Labor Statistics, and reputable financial news outlets provide reliable economic data.

Utilizing Financial News and Expert Analysis

Staying informed through reputable sources and expert opinions is crucial for understanding market dynamics.

- Reputable financial news websites: Seek information from sources with a strong track record of accuracy and impartiality.

- Following key economists and financial analysts: Staying abreast of their views and predictions can offer valuable insights.

- Critical evaluation of information: Always critically evaluate information from multiple sources before making any investment decisions.

Conclusion

Bond market instability, driven by rising interest rates, persistent inflation, and geopolitical uncertainty, presents significant challenges for investors. However, by understanding the underlying causes, diversifying portfolios, carefully assessing risk tolerance, and staying informed about market trends, investors can navigate this challenging environment more effectively. Key takeaways include the crucial role of diversification, the importance of aligning investments with risk tolerance and long-term goals, and the need for continuous monitoring of market developments. Don't let bond market instability derail your financial goals. Take control of your investments by implementing the strategies discussed above, and consider consulting a financial advisor for personalized guidance.

Featured Posts

-

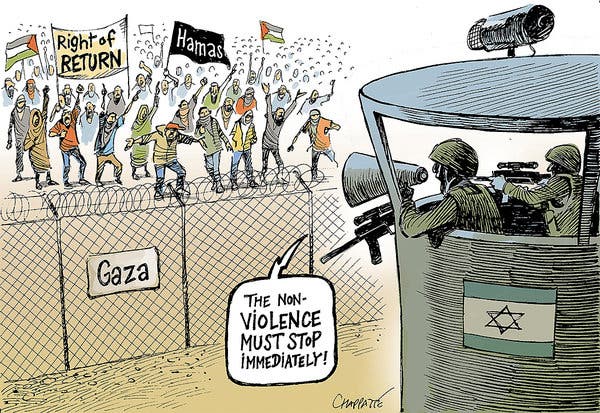

State Librarys Action Against First Nations Writer Gaza Post Controversy

May 29, 2025

State Librarys Action Against First Nations Writer Gaza Post Controversy

May 29, 2025 -

Bayrn Mywnkh Wbrshlwnt Ytnafsan Ela Dm Sfqt Jdydt

May 29, 2025

Bayrn Mywnkh Wbrshlwnt Ytnafsan Ela Dm Sfqt Jdydt

May 29, 2025 -

Diddy Trial Ex Employee Details Alleged Threat To Kill Kid Cudi

May 29, 2025

Diddy Trial Ex Employee Details Alleged Threat To Kill Kid Cudi

May 29, 2025 -

New Horror Movie Sinners To Haunt Louisiana Theaters

May 29, 2025

New Horror Movie Sinners To Haunt Louisiana Theaters

May 29, 2025 -

Every Air Jordan Sneaker Releasing In May 2025 A Complete Guide

May 29, 2025

Every Air Jordan Sneaker Releasing In May 2025 A Complete Guide

May 29, 2025

Latest Posts

-

Banksys Immersive Vancouver Exhibit What To Expect

May 31, 2025

Banksys Immersive Vancouver Exhibit What To Expect

May 31, 2025 -

Nypd Commissioner During 9 11 Bernard Kerik Passes Away

May 31, 2025

Nypd Commissioner During 9 11 Bernard Kerik Passes Away

May 31, 2025 -

Bernard Kerik 9 11 Nypd Commissioner Dies At Age 69

May 31, 2025

Bernard Kerik 9 11 Nypd Commissioner Dies At Age 69

May 31, 2025 -

Death Of Bernard Kerik Remembering The Nypd Commissioners Life And Career

May 31, 2025

Death Of Bernard Kerik Remembering The Nypd Commissioners Life And Career

May 31, 2025 -

The Life And Death Of Bernard Kerik Former Nypd Commissioner

May 31, 2025

The Life And Death Of Bernard Kerik Former Nypd Commissioner

May 31, 2025