Bond Trader Sentiment Shifts After Powell's Less Dovish Comments

Table of Contents

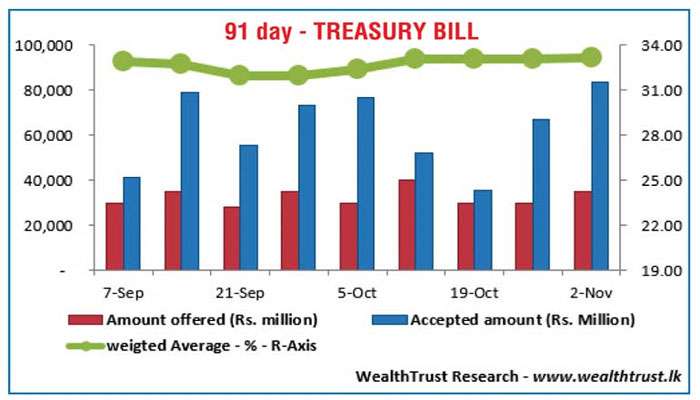

Impact on Treasury Yields

Powell's less accommodative stance immediately impacted Treasury yields. The immediate effect was a noticeable upward movement across the yield curve.

- Short-term yields: The 2-year Treasury yield, highly sensitive to near-term interest rate expectations, saw a sharp increase of approximately X%, reflecting the market's pricing in of higher future rate hikes.

- Long-term yields: The 10-year Treasury yield also climbed by approximately Y%, indicating a reassessment of long-term inflation expectations and economic growth prospects. This steepening of the yield curve signifies a growing belief in a sustained period of higher interest rates.

These yield changes are primarily driven by:

- Increased inflation expectations: Powell's comments fueled concerns that inflation might remain stubbornly high, necessitating a more prolonged period of tighter monetary policy.

- Revised economic outlook: The market is now factoring in a potentially slower economic growth trajectory due to the impact of higher interest rates on borrowing and investment. This has led to a re-evaluation of the risk-free rate offered by Treasury bonds.

Corporate Bond Market Reaction

The corporate bond market mirrored the Treasury market's reaction, albeit with a more amplified effect. Corporate bond yields rose significantly, reflecting increased borrowing costs for companies.

- Widening credit spreads: The spread between Treasury yields and corporate bond yields (credit spreads) widened, indicating increased risk aversion among investors. This reflects the heightened uncertainty surrounding corporate profitability in a higher interest rate environment.

- Increased borrowing costs: Companies will now face significantly higher costs for borrowing, potentially impacting investment plans and future economic growth.

- Vulnerable sectors: Sectors highly sensitive to interest rate changes, such as real estate and highly leveraged companies, are particularly vulnerable to these increased borrowing costs. These sectors may experience reduced investment and potentially slower growth.

Analysis of Trader Positioning and Strategies

Before Powell's comments, many bond traders were positioned for a relatively stable, low-interest-rate environment. However, the less dovish tone prompted a significant shift in strategies:

- Hedging strategies: Traders have likely adjusted their hedging strategies to account for increased interest rate risk. This involves utilizing derivatives and other instruments to mitigate potential losses from rising yields.

- Portfolio allocations: We've witnessed shifts in portfolio allocations, with many investors reducing their exposure to longer-duration bonds and increasing their allocation to shorter-term, less interest-rate-sensitive securities. There has also been a shift toward higher credit quality bonds, reflecting a decrease in risk appetite.

- Trading volumes: Increased trading volumes in the bond market post-Powell's speech indicate a heightened level of activity as traders rebalance their portfolios and respond to the changing market conditions. This demonstrates the immediate and considerable impact of Fed policy on bond market dynamics.

Future Outlook and Implications

The outlook for bond yields depends heavily on the future course of Fed policy. Several potential scenarios exist:

- Sustained higher rates: If the Fed maintains its aggressive stance, bond yields could continue to rise, potentially impacting economic growth and inflation.

- Gradual rate hikes: A more gradual approach to rate hikes could stabilize yields, but this depends on the success of the Fed's efforts to control inflation.

- Premature rate cuts: Early rate cuts could lead to a decline in yields, but this carries risks if inflation remains high.

The implications for investors are significant:

- Inflation risk: Higher inflation erodes the purchasing power of bond returns.

- Interest rate risk: Rising interest rates can lead to capital losses on existing bond holdings.

- Opportunity for short-term bonds: Short-term bonds offer relatively higher yields in a rising rate environment.

Conclusion:

Powell's less dovish comments triggered a substantial shift in bond trader sentiment, leading to a sharp increase in both Treasury and corporate bond yields. Traders are actively adjusting their strategies, reducing duration, and increasing their focus on credit quality. The future outlook for the bond market remains uncertain, heavily dependent on the Fed's future actions and the trajectory of inflation. Stay tuned for further updates on how shifting bond trader sentiment will impact your portfolio and learn more about managing risk in a changing interest rate environment. Understanding these shifts in bond trader sentiment is crucial for making informed investment decisions.

Featured Posts

-

Bitter Einde Voor Bayern Muenchen Thomas Muellers Vertrek Een Verlies Voor De Club

May 12, 2025

Bitter Einde Voor Bayern Muenchen Thomas Muellers Vertrek Een Verlies Voor De Club

May 12, 2025 -

Satos Entry Brings Indy 500 Field To 34 Drivers

May 12, 2025

Satos Entry Brings Indy 500 Field To 34 Drivers

May 12, 2025 -

Adidas 3 D Printed Shoes Performance Design And Innovation

May 12, 2025

Adidas 3 D Printed Shoes Performance Design And Innovation

May 12, 2025 -

Four Year Old Daughter Of Rory Mc Ilroy Sinks Putt At Augusta Watch Now

May 12, 2025

Four Year Old Daughter Of Rory Mc Ilroy Sinks Putt At Augusta Watch Now

May 12, 2025 -

Hotel Transylvania A Family Friendly Look At The Monster World

May 12, 2025

Hotel Transylvania A Family Friendly Look At The Monster World

May 12, 2025

Latest Posts

-

Doom The Dark Age Spoilers Revealed Ahead Of Official Launch

May 13, 2025

Doom The Dark Age Spoilers Revealed Ahead Of Official Launch

May 13, 2025 -

Cubs Vs Dodgers Game Day Lineups Tv Info And Live Game Thread 2 05 Ct

May 13, 2025

Cubs Vs Dodgers Game Day Lineups Tv Info And Live Game Thread 2 05 Ct

May 13, 2025 -

Cubs Vs Dodgers 2 05 Ct Lineups Broadcast Info And Game Thread

May 13, 2025

Cubs Vs Dodgers 2 05 Ct Lineups Broadcast Info And Game Thread

May 13, 2025 -

Dispute Erupts Gov Abbotts Warning Vs Epic City Developers Claims

May 13, 2025

Dispute Erupts Gov Abbotts Warning Vs Epic City Developers Claims

May 13, 2025 -

Texas Mosque Restrictions Spark Concerns For Growing Muslim Community

May 13, 2025

Texas Mosque Restrictions Spark Concerns For Growing Muslim Community

May 13, 2025