Boosting Capital Market Cooperation: Pakistan, Sri Lanka, And Bangladesh Join Forces

Table of Contents

Shared Challenges and Opportunities in South Asian Capital Markets

Pakistan, Sri Lanka, and Bangladesh, while distinct economies, share common hurdles in their capital markets. These include: regulatory inconsistencies hindering seamless cross-border investments, a relatively limited investor base compared to global standards, and infrastructure limitations impacting efficient trading and settlement processes. The lack of standardized accounting practices and varying regulatory frameworks also create barriers. However, regional cooperation offers significant opportunities to overcome these challenges:

- Access to a larger investor pool: Collaboration opens access to a wider range of investors across the three nations, increasing capital availability for businesses and infrastructure projects.

- Diversification of investment portfolios: Investors gain access to a more diverse range of investment opportunities, reducing overall portfolio risk.

- Enhanced market liquidity: A larger, more integrated market leads to increased trading volumes and improved market liquidity, benefiting all participants.

These opportunities can be realized through several key initiatives:

- Regulatory harmonization: Standardizing accounting practices, securities regulations, and investor protection mechanisms will facilitate cross-border investments.

- Development of common market infrastructure: Creating interconnected trading platforms and clearing houses will streamline transactions and reduce operational costs.

- Joint marketing campaigns: Targeted marketing efforts will attract foreign investment and enhance the international profile of the region's capital markets.

- Collaboration on capacity building and skill development: Investing in human capital is essential for building a skilled workforce to support the growth of the integrated capital market.

Specific Initiatives for Enhanced Cooperation

The commitment of Pakistan, Sri Lanka, and Bangladesh to capital market cooperation is evident in several concrete initiatives. While details may vary, depending on the level of information available publicly, these initiatives are crucial steps forward. Examples include:

- Memoranda of Understanding (MOUs): Bilateral and trilateral MOUs have been, or are being, signed, focusing on information sharing, mutual recognition of market participants, and collaborative regulatory oversight.

- Joint Investment Platforms: The creation of joint investment platforms will provide a more streamlined process for cross-border investments. This could involve the establishment of a regional investment fund or a collaborative platform to connect investors with investment opportunities across the three countries.

- Regulatory Harmonization Working Groups: Dedicated working groups are being established to address the complexities of harmonizing regulatory frameworks, focusing on issues such as listing requirements, disclosure standards, and investor protection.

These initiatives, though still in their nascent stages in some cases, mark a significant move toward fostering a more integrated capital market within South Asia.

Potential Economic Impacts and Benefits

The economic benefits of this increased capital market cooperation are potentially transformative for Pakistan, Sri Lanka, and Bangladesh. These include:

- Increased Foreign Direct Investment (FDI): A more integrated and attractive market will attract significantly higher levels of FDI, fueling economic growth and job creation.

- Economic Growth: Increased investment and improved market efficiency will contribute to higher GDP growth rates across the three nations.

- Job Creation: FDI inflows and domestic investment will stimulate job creation across various sectors, particularly in finance, infrastructure, and manufacturing.

- Improved Macroeconomic Stability: Deeper capital markets can help to stabilize macroeconomic conditions, reducing volatility and improving investor confidence.

The projected increase in FDI and subsequent economic growth will vary based on multiple factors, including global economic conditions and the pace of implementation of these collaborative initiatives. However, the potential for substantial positive impact is significant.

Addressing Potential Risks and Challenges

While the potential benefits are substantial, several risks and challenges need to be addressed proactively to ensure the success of this capital market cooperation:

- Political Instability: Political instability in any of the three nations could negatively impact investor confidence and undermine the progress of the initiative.

- Regulatory Hurdles: Overcoming existing regulatory inconsistencies and ensuring a harmonized regulatory framework remains a significant challenge.

- Differing Economic Policies: Differences in economic policies and priorities among the three countries could hinder the smooth functioning of the integrated capital market.

Mitigation strategies include:

- Strengthening Regional Cooperation Mechanisms: Fostering stronger political and economic dialogue will help manage political risks and align economic policies.

- Transparent and Accountable Regulatory Frameworks: Ensuring transparency and accountability in regulatory processes will build investor trust.

- Phased Implementation: A phased approach to implementation, starting with smaller, manageable projects, can help to minimize risks and ensure smoother integration.

Conclusion

Boosting capital market cooperation among Pakistan, Sri Lanka, and Bangladesh is crucial for unlocking the region's substantial economic potential. The collaborative efforts undertaken by these nations, focusing on regulatory harmonization, infrastructure development, and joint initiatives, represent a significant step towards creating a more integrated and efficient capital market. This integration promises increased FDI, higher economic growth, and enhanced regional stability. However, addressing potential risks through proactive strategies and a commitment to transparency and accountability is crucial for ensuring long-term success. The future of South Asian economic growth hinges on continued and strengthened capital market cooperation. Let's work together to foster a more integrated and prosperous region through strategic investment and collaborative initiatives, driving regional economic growth and maximizing South Asian investment potential.

Featured Posts

-

Makron I Tusk Podpisanie Vazhnogo Dogovora Mezhdu Frantsiey I Polshey Eksklyuziv Ot Unian

May 09, 2025

Makron I Tusk Podpisanie Vazhnogo Dogovora Mezhdu Frantsiey I Polshey Eksklyuziv Ot Unian

May 09, 2025 -

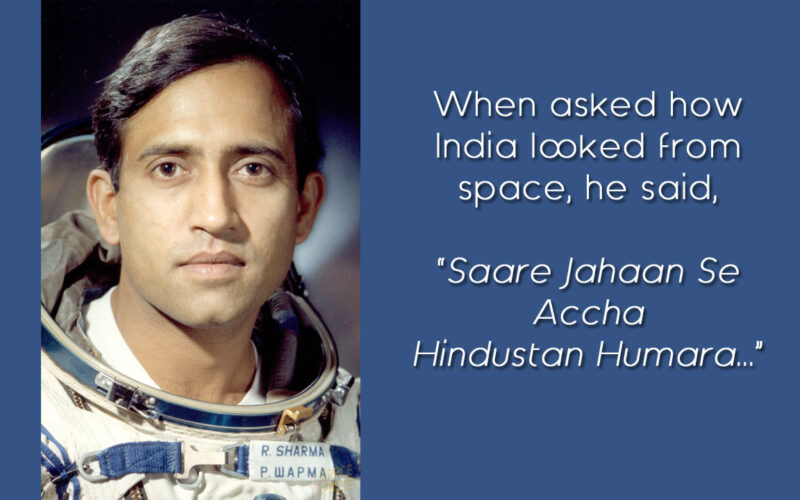

Post Spaceflight Life Of Rakesh Sharma Indias First Astronaut

May 09, 2025

Post Spaceflight Life Of Rakesh Sharma Indias First Astronaut

May 09, 2025 -

Bollywood Actress Lisa Rays Air India Complaint The Airlines Response

May 09, 2025

Bollywood Actress Lisa Rays Air India Complaint The Airlines Response

May 09, 2025 -

Wednesday March 12 Nyt Strands Answers Game 374

May 09, 2025

Wednesday March 12 Nyt Strands Answers Game 374

May 09, 2025 -

Beyonces Tour Boosts Cowboy Carter Streams A Detailed Look

May 09, 2025

Beyonces Tour Boosts Cowboy Carter Streams A Detailed Look

May 09, 2025