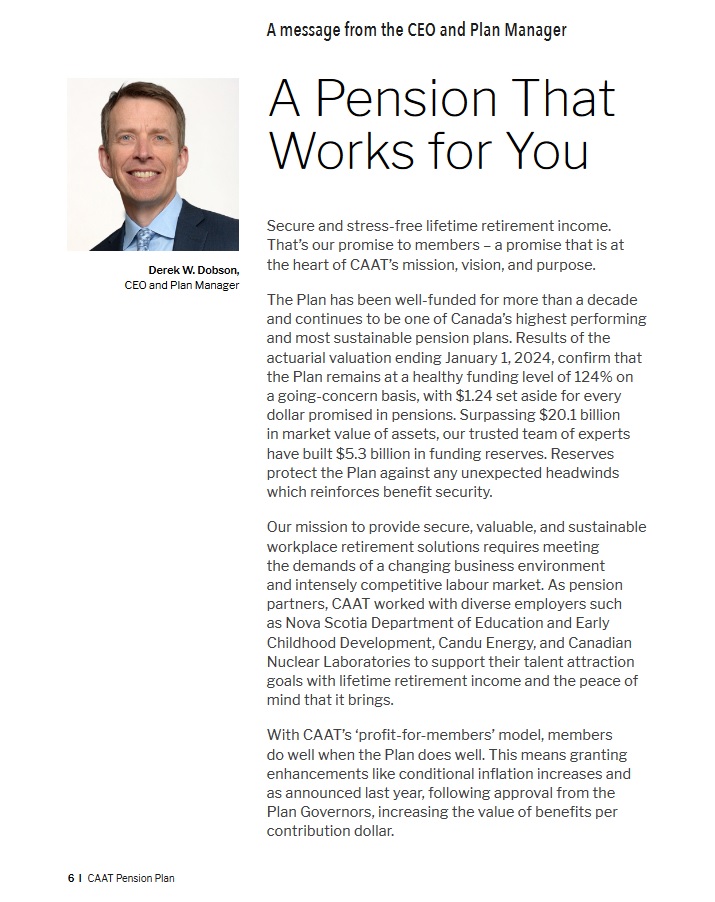

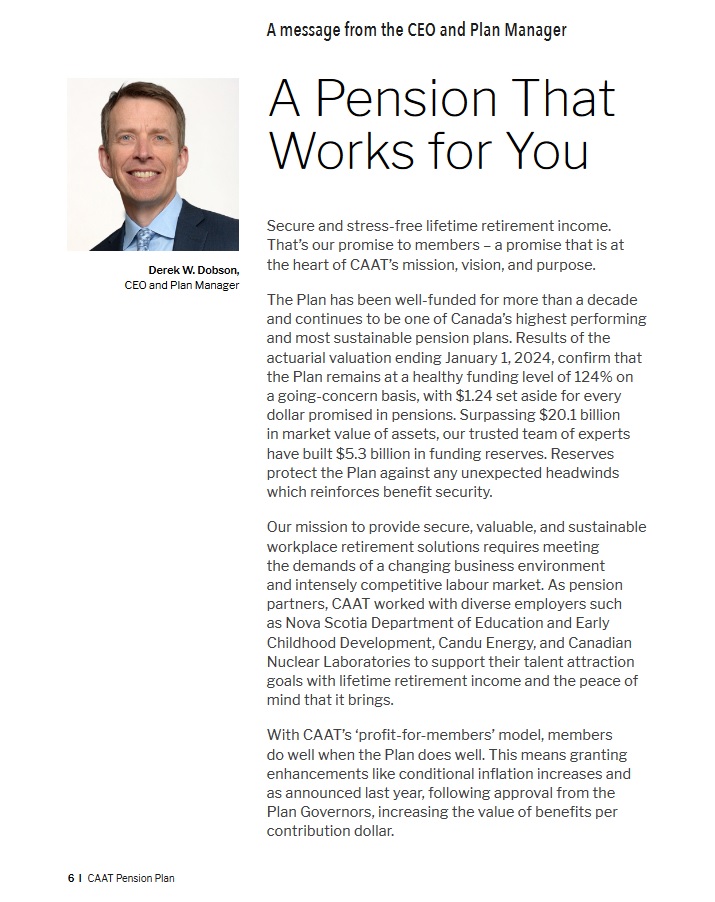

Boosting Returns: CAAT Pension Plan's Pursuit Of Canadian Private Investments

Table of Contents

Why Canadian Private Investments? Diversification and Enhanced Returns

Traditional public market investments, such as stocks and bonds, while providing a degree of stability, often exhibit limitations in terms of return potential. CAAT's strategic move towards Canadian private investments offers a compelling solution, providing crucial diversification and the potential for significantly enhanced returns. By venturing into the private markets, CAAT aims to reduce its overall portfolio risk and capitalize on opportunities unavailable in the public sphere.

Investing in Canadian private equity offers several key advantages:

- Reduced Volatility: Private investments tend to be less susceptible to the short-term fluctuations that characterize public markets.

- Potential for Higher Alpha Generation: Skillful investment in private companies can lead to significantly higher returns compared to passively managed public market indices.

- Long-Term Capital Appreciation: Private equity investments are designed for the long haul, aiming for substantial capital appreciation over several years.

- Inflation Hedging: Certain asset classes within private investments, such as real estate and infrastructure, can act as a hedge against inflation.

The lower correlation between private market performance and public market indices provides a vital buffer against systemic risk, strengthening the resilience of CAAT's overall investment portfolio.

CAAT's Investment Strategy: Targeting Specific Sectors and Investment Types

CAAT's approach to Canadian private investments is highly strategic, focusing on specific sectors and investment types with promising growth potential. This targeted approach allows for a deeper understanding of market dynamics and a more effective risk management strategy. Their investment strategy encompasses a diverse range of asset classes, including:

- Venture Capital: Investing in early-stage companies with high growth potential.

- Growth Equity: Providing capital to established companies experiencing rapid expansion.

- Real Estate: Investing in both developed and developing properties across diverse geographical locations.

- Infrastructure: Investing in essential infrastructure projects, such as renewable energy and transportation.

CAAT's sector selection is influenced by a number of factors including:

- Strong Economic Growth Prospects: Focusing on sectors exhibiting robust growth potential within the Canadian economy.

- Favorable Regulatory Environment: Considering the regulatory landscape to ensure compliance and minimize risks.

Their due diligence process is rigorous, involving extensive research, thorough financial analysis, and detailed assessment of management teams. Furthermore, CAAT actively seeks strategic partnerships with experienced private equity firms to leverage their local expertise and networks. This collaborative approach allows them to identify and capitalize on the most promising opportunities in the Canadian private investment landscape.

Navigating the Challenges: Due Diligence and Risk Mitigation in Private Markets

Investing in private markets presents unique challenges, primarily illiquidity and limited transparency. Unlike publicly traded securities, private investments cannot be readily bought or sold, and accessing detailed financial information can be more difficult. To mitigate these risks, CAAT employs a sophisticated approach encompassing:

- Thorough Due Diligence: A rigorous process to thoroughly vet potential investments, assessing financial health, management capabilities, and market opportunities.

- Robust Risk Assessment Models: Sophisticated quantitative and qualitative models to assess and manage potential risks associated with private investments.

- Diversification Across Asset Classes and Managers: Spreading investments across different asset classes and private equity firms to reduce exposure to any single risk.

The importance of experienced investment professionals cannot be overstated. CAAT employs a team of experts with specialized knowledge in private equity, allowing them to navigate the complexities of these markets effectively. This specialized expertise is crucial for successful risk mitigation and optimal return generation.

Measuring Success: Assessing the Performance of CAAT's Private Investments

Assessing the performance of private equity investments requires a different approach than evaluating publicly traded securities. CAAT utilizes key performance indicators (KPIs) such as:

- Internal Rate of Return (IRR): Measures the profitability of an investment, considering the time value of money.

- Multiple of Invested Capital (MOIC): Indicates the overall return generated on the initial investment.

It's vital to remember that private equity investments are long-term endeavors. CAAT understands the importance of patient capital and takes a long-term perspective when evaluating performance. They benchmark their performance against peers and relevant market indices to ensure they are meeting their investment objectives. Transparency and regular reporting are crucial components of CAAT's performance monitoring strategy, ensuring accountability and effective communication with stakeholders.

Conclusion: The Future of CAAT's Pursuit of Canadian Private Investments

CAAT's strategic focus on Canadian private investments offers significant benefits: enhanced diversification, potential for superior returns, and reduced correlation with public market volatility. While navigating the challenges inherent in private markets requires expertise and a robust risk management framework, CAAT's strategic approach, coupled with its experienced investment team, positions it for continued success. The future looks bright for CAAT's expansion within the Canadian private investment market, promising further growth and enhanced returns for its members.

To learn more about CAAT's innovative investment strategies and the exciting opportunities in the Canadian private investment market, explore their resources and stay updated on their progress. Consider exploring other Canadian private investment strategies to further boost your understanding of this high-growth sector.

Featured Posts

-

Chistiy Ponedelnik 3 Marta 2025 Traditsii Molitvy I Osobennosti Velikogo Posta

Apr 23, 2025

Chistiy Ponedelnik 3 Marta 2025 Traditsii Molitvy I Osobennosti Velikogo Posta

Apr 23, 2025 -

350 Kata Kata Motivasi Senin Semangat Baru Di Awal Pekan

Apr 23, 2025

350 Kata Kata Motivasi Senin Semangat Baru Di Awal Pekan

Apr 23, 2025 -

Trading Et Seuils Techniques Ameliorer Vos Alertes Trader

Apr 23, 2025

Trading Et Seuils Techniques Ameliorer Vos Alertes Trader

Apr 23, 2025 -

Record Breaking 9 Home Runs Power Yankees To Victory In 2025 Season

Apr 23, 2025

Record Breaking 9 Home Runs Power Yankees To Victory In 2025 Season

Apr 23, 2025 -

Parental Notification For Lgbtq Literature In Elementary Schools Supreme Court Case

Apr 23, 2025

Parental Notification For Lgbtq Literature In Elementary Schools Supreme Court Case

Apr 23, 2025