Boston Celtics Sold For $6.1B: Fans React To Private Equity Ownership

Table of Contents

The $6.1 Billion Sale: Details and Implications

The sale of the Boston Celtics represents one of the largest transactions in NBA history. Understanding the specifics and potential consequences is crucial for fans and analysts alike.

Who bought the Celtics?

The details surrounding the buyer are still emerging, but initial reports suggest a consortium of private equity firms led by [Insert Name of Leading Private Equity Firm Here]. This firm has a history of significant investments, including [Mention previous successful investments, if publicly known, e.g., investments in other sports teams or entertainment properties]. Their involvement signals a substantial financial backing for the Celtics' future.

- Name of the firm: [Insert Name of Leading Private Equity Firm Here] (and any other significant partners)

- Previous successful sports investments: [List known relevant investments and outcomes]

- Financial backing: [Mention the scale of investment, if available, e.g., the total investment amount or the firm's assets under management]

- Public statements regarding the purchase: [Quote any official statements released by the purchasing firm regarding their plans for the Celtics]

What does this mean for the Celtics' future?

The implications of this private equity ownership are multifaceted and potentially far-reaching. While some fans are optimistic, others harbor significant concerns.

- Potential for increased spending on players: Private equity's deep pockets could lead to increased spending in free agency, attracting top talent and strengthening the team's competitive edge. This could significantly improve the Celtics' chances of winning a championship.

- Potential changes in team management: New ownership may bring about changes in the front office and coaching staff, potentially altering the team's overall strategy and direction. This could involve bringing in new expertise or restructuring existing roles.

- Possible upgrades to TD Garden: Investment in infrastructure improvements, including renovations to TD Garden, could enhance the fan experience and further boost revenue. Modernization and upgrades could significantly improve the overall game-day atmosphere.

- Potential risks associated with private equity ownership: The primary concern is the potential focus on short-term profits over long-term team building. This could lead to cost-cutting measures that negatively impact team performance and player morale.

Fan Reactions: A Divided Fandom

The Boston Celtics sale has sparked a wave of reactions from the passionate fanbase, with opinions ranging from cautious optimism to outright concern.

Concerns about prioritizing profit over winning

Many fans express anxiety about potential cost-cutting measures that could negatively impact the team's competitiveness. The shift in ownership to a private equity firm raises concerns about short-term financial gains potentially trumping long-term success on the court.

- Examples of fan comments on social media: [Summarize negative sentiments found on platforms like Twitter or Facebook]

- Articles expressing concerns: [Link to or mention articles highlighting fan concerns]

- Potential implications for ticket prices and merchandise: Fans worry about potential increases in ticket prices and merchandise costs, making attending games and supporting the team less accessible.

Hope for improved infrastructure and investment

Conversely, some fans are hopeful that private equity investment will lead to significant improvements in infrastructure and resources. The potential for increased funding could translate to a stronger team and an improved fan experience.

- Potential for upgraded training facilities: State-of-the-art training facilities could enhance player development and overall team performance.

- Potential for increased scouting and player development resources: Improved scouting and development could help identify and nurture future stars.

- Positive fan comments emphasizing potential benefits: [Summarize positive social media comments and forum discussions]

The Impact of Private Equity Ownership in Professional Sports

The Boston Celtics sale is part of a broader trend of private equity investment in professional sports leagues. Understanding this larger context is key to assessing the long-term implications.

Comparing the Celtics sale to other recent deals

Several other professional sports teams have recently been acquired by private equity firms. Examining the outcomes of these transactions provides valuable insights into the potential successes and failures of this model.

- Examples of other teams sold to private equity: [List examples and briefly describe the outcomes]

- The successes and failures of these transactions: [Analyze successful and unsuccessful cases, highlighting key factors]

- Lessons learned from past deals: [Summarize key lessons learned from previous private equity acquisitions in sports]

The broader trend of private equity in sports

Private equity's growing involvement in professional sports reflects the increasing value of these franchises as lucrative investment opportunities. This trend has significant implications for the future of sports ownership.

- Statistics on private equity involvement in various sports: [Include statistics on the growth of private equity in different sports leagues]

- Reasons for this growing trend: [Discuss the reasons behind the increasing attractiveness of sports franchises as investments]

- Potential implications for the future of sports ownership: [Analyze the potential long-term impact on team management, player recruitment, and fan engagement]

Conclusion

The $6.1 billion sale of the Boston Celtics marks a significant turning point for the franchise and underscores the increasing role of private equity in professional sports. While the sale has generated both excitement and apprehension among fans, the potential for substantial investment in player recruitment, infrastructure, and overall team improvement is undeniable. However, concerns remain regarding the potential prioritization of short-term profits over long-term team success. The coming years will reveal whether this private equity ownership model translates into sustained on-court success and a positive fan experience.

What are your thoughts on the Boston Celtics sale? Share your predictions for the Celtics' future under new ownership. Join the conversation about the impact of private equity on the Boston Celtics and the future of professional sports! #CelticsSale #NBASale #PrivateEquityInSports

Featured Posts

-

Red Carpet Rules Common Violations And Their Causes

May 17, 2025

Red Carpet Rules Common Violations And Their Causes

May 17, 2025 -

Fortnite Item Shop Update Leaves Fans Disappointed

May 17, 2025

Fortnite Item Shop Update Leaves Fans Disappointed

May 17, 2025 -

Erdogan Ve Bae Devlet Baskani Arasinda Oenemli Telefon Goeruesmesi

May 17, 2025

Erdogan Ve Bae Devlet Baskani Arasinda Oenemli Telefon Goeruesmesi

May 17, 2025 -

Network18 Media And Investments Stock Price Live Nse Bse Data 21 Apr 2025

May 17, 2025

Network18 Media And Investments Stock Price Live Nse Bse Data 21 Apr 2025

May 17, 2025 -

Putovanje U Ujedinjene Arapske Emirate Kompletni Vodic

May 17, 2025

Putovanje U Ujedinjene Arapske Emirate Kompletni Vodic

May 17, 2025

Latest Posts

-

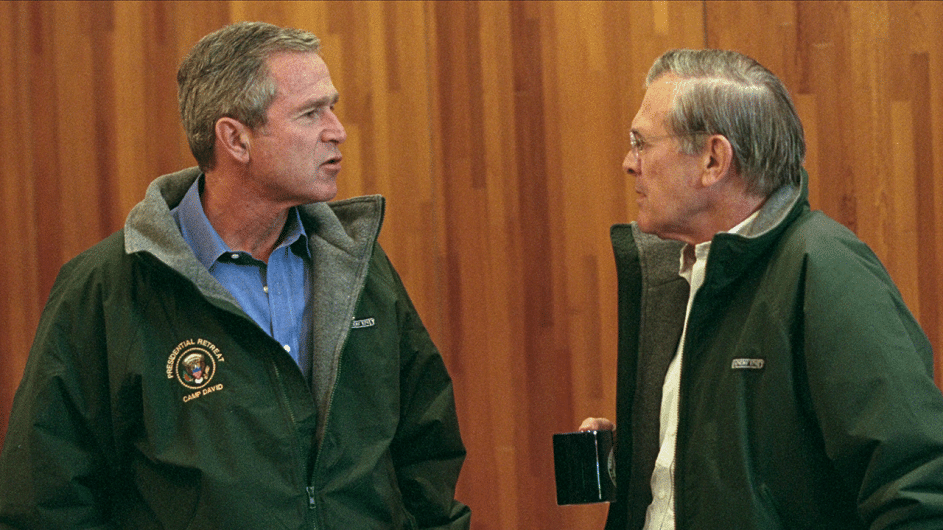

Where To Watch The American Manhunt For Osama Bin Laden Not Netflix

May 18, 2025

Where To Watch The American Manhunt For Osama Bin Laden Not Netflix

May 18, 2025 -

Asamh Bn Ladn Ky Shkhsyt Awr An Ke Hamywn Ka Jayzh Alka Yagnk Ka Byan

May 18, 2025

Asamh Bn Ladn Ky Shkhsyt Awr An Ke Hamywn Ka Jayzh Alka Yagnk Ka Byan

May 18, 2025 -

Alka Yagnk Asamh Bn Ladn Ky Teryf Awr An Ke Mdahwn Ky Fhrst Myn An Ka Mqam

May 18, 2025

Alka Yagnk Asamh Bn Ladn Ky Teryf Awr An Ke Mdahwn Ky Fhrst Myn An Ka Mqam

May 18, 2025 -

The Absence Of The Osama Bin Laden Manhunt On Netflix Explained

May 18, 2025

The Absence Of The Osama Bin Laden Manhunt On Netflix Explained

May 18, 2025 -

Netflix Missing The American Manhunt For Osama Bin Laden

May 18, 2025

Netflix Missing The American Manhunt For Osama Bin Laden

May 18, 2025