Boston Celtics Sold For $6.1 Billion: Fans React To Private Equity Ownership

Table of Contents

Fan Reactions to the Boston Celtics Sale: A Mixed Bag

The sale of the Boston Celtics for $6.1 billion has elicited a wide spectrum of emotions among the passionate fanbase. While some greet the news with cautious optimism, others express deep-seated concerns about the future of their beloved team. Celtics fans are grappling with a complex mix of hope, skepticism, and apprehension.

Positive reactions stem largely from the potential for increased investment. Many believe that the influx of capital from private equity could lead to significant upgrades in infrastructure, improved player recruitment, and a stronger competitive edge in the NBA. The hope is for a brighter future, with enhanced fan experiences and a return to championship contention.

Conversely, negative reactions are fueled by fears that prioritizing profit over winning could compromise the team's integrity. Concerns include potential ticket price hikes, making games less accessible to long-time loyal fans. There's also apprehension about the potential alienation from the team's rich history and strong community ties, a crucial aspect of the Celtics' identity. The worry is that a focus on pure financial returns could overshadow the team's cultural significance.

Bullet Points:

- Positive Reactions: "#CelticsFutureLooksBright," "#NewEraNewChampionships," tweets expressing hope for stadium upgrades and better player signings.

- Negative Reactions: Concerns about ticket price increases flooding social media, "#SelloutCeltics" trending briefly on Twitter, petitions circulating online against potential changes that might alienate fans.

- While no large-scale organized protests have emerged yet, online forums and social media reveal a significant level of anxiety and debate among the fanbase.

Understanding the Role of Private Equity in Sports Ownership

Private equity firms operate on a business model centered around acquiring ownership stakes in companies, restructuring them, and eventually selling them for a profit. Their investment strategies typically involve leveraging debt and focusing on maximizing returns within a defined timeframe. In professional sports, this can translate to increased capital for stadium renovations, player acquisitions, and advanced analytics. Keywords: private equity firms, investment strategy, financial benefits, potential drawbacks, cost-cutting.

However, this approach also carries potential drawbacks. The short-term focus on maximizing ROI can lead to cost-cutting measures that might negatively impact player morale, team performance, and fan experience. There’s a risk that the emphasis on financial gains could overshadow the long-term vision and strategic planning needed for sustained success.

Bullet Points:

- Successful Examples: The acquisition of the Los Angeles Dodgers by Guggenheim Partners, which resulted in significant upgrades and a World Series victory.

- Unsuccessful Examples: Instances where private equity investment led to cost-cutting measures that negatively impacted team performance and fan loyalty.

- Return on Investment (ROI): Private equity firms in sports aim for significant returns within a 5-7 year timeframe through increased revenue, asset appreciation, and potential future resale.

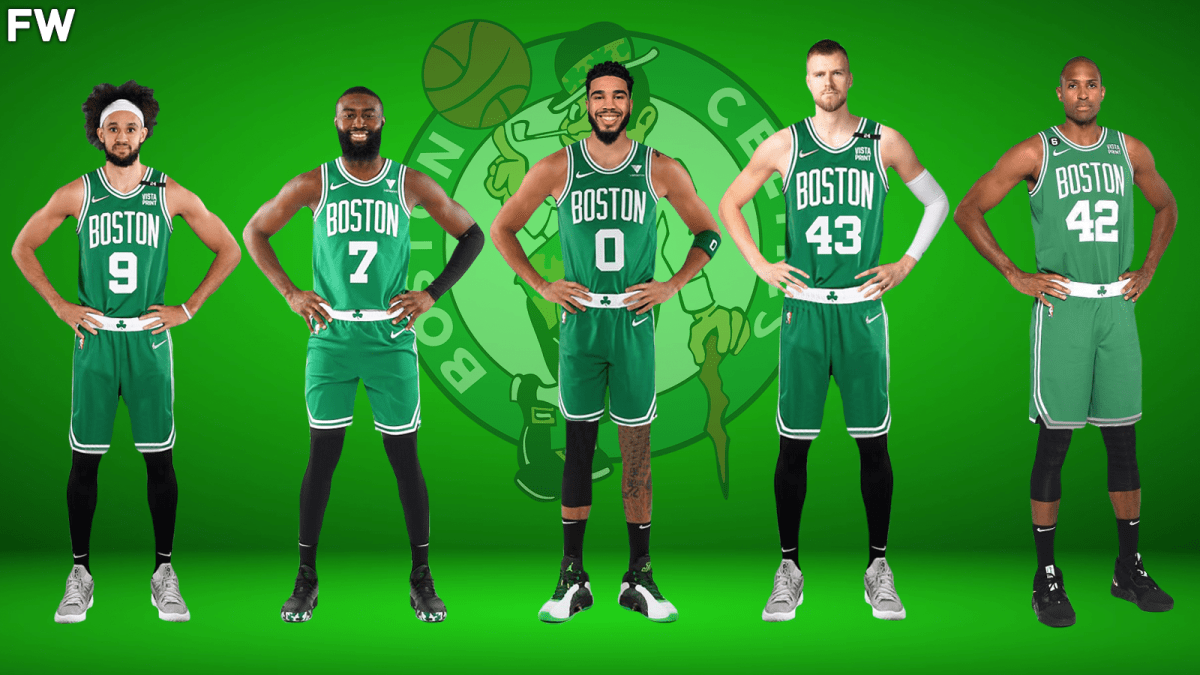

The Future of the Boston Celtics Under New Ownership

The $6.1 billion sale undoubtedly signifies a turning point for the Boston Celtics. The new ownership will likely implement changes across various aspects of the franchise. This could involve coaching changes, strategic player acquisitions, significant stadium renovations, and innovative marketing strategies. Keywords: future of the Celtics, new ownership, potential changes, impact on fans, ticket prices, merchandise.

Maintaining the team's rich history and cultural significance will be crucial. The new owners must strike a balance between modernizing the franchise and honoring its legacy. The challenge lies in attracting new fans while keeping the loyal fanbase engaged and satisfied. The impact on ticket prices, merchandise costs, and overall fan accessibility will be a key indicator of the success of this new era.

Bullet Points:

- Predictions: Some analysts predict a push for younger, more marketable players to boost revenue streams and fan appeal.

- Player Development: Increased investment in player scouting and development programs is a likely outcome.

- Long-Term Financial Implications: The sale positions the Celtics for significant long-term financial growth, but the immediate impact on fans remains to be seen.

The $6.1 Billion Question: What Lies Ahead for the Boston Celtics?

The sale of the Boston Celtics for $6.1 billion has sparked a diverse range of reactions among fans, highlighting both the excitement and apprehension surrounding this major ownership change. While private equity investment offers potential financial benefits and resources for improvement, it also carries the risk of prioritizing short-term profits over long-term team success. The key to navigating this new era will lie in balancing financial goals with the preservation of the Celtics' storied legacy and their strong connection with the community.

What are your thoughts on the future of the Boston Celtics after this record-breaking sale? How will this significant change in ownership impact the Boston Celtics’ legacy? Share your predictions and opinions in the comments below!

Featured Posts

-

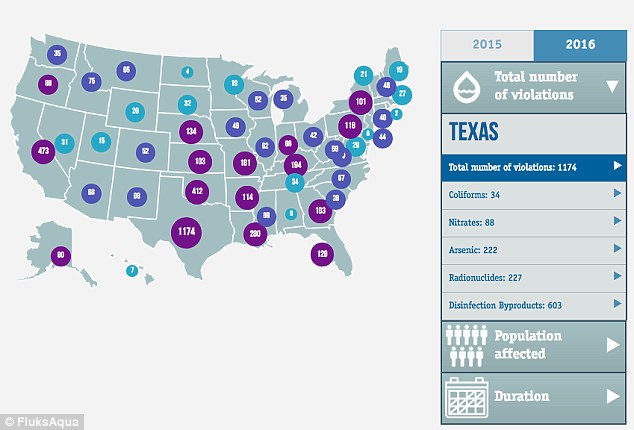

Contaminated Drinking Water Report Reveals Millions Affected In The Us

May 15, 2025

Contaminated Drinking Water Report Reveals Millions Affected In The Us

May 15, 2025 -

Limited Time Celtics Finals Gear Under 20

May 15, 2025

Limited Time Celtics Finals Gear Under 20

May 15, 2025 -

Celtics Playoffs Game 3 Preview Orlandos Impact

May 15, 2025

Celtics Playoffs Game 3 Preview Orlandos Impact

May 15, 2025 -

Debate Heats Up Car Dealers Renew Opposition To Electric Vehicle Rules

May 15, 2025

Debate Heats Up Car Dealers Renew Opposition To Electric Vehicle Rules

May 15, 2025 -

The 48 Year Wait Is Over Star Wars And The Unveiling Of A Legendary Planet

May 15, 2025

The 48 Year Wait Is Over Star Wars And The Unveiling Of A Legendary Planet

May 15, 2025