BP CEO Targets Valuation Doubling: Remains Committed To Current Stock Exchange Listing, According To Financial Times

Table of Contents

The CEO's Strategy for BP Valuation Doubling

The CEO's plan to double BP's valuation is multifaceted, focusing on a blend of traditional energy optimization and a significant push into renewable energy sources. This strategy aims to capitalize on both existing strengths and emerging opportunities within the evolving energy landscape. Key elements of the plan include:

-

Increased Investment in Renewable Energy: BP is committing substantial resources to expanding its renewable energy portfolio. This includes significant investments in solar, wind, and hydrogen technologies. The goal is to establish a strong position in the burgeoning green energy market, diversifying revenue streams and attracting environmentally conscious investors.

-

Efficiency Improvements and Cost-Cutting: Within the existing fossil fuel operations, BP plans to implement aggressive efficiency improvements and cost-cutting measures. This will involve streamlining processes, optimizing production, and reducing operational expenses to maximize profitability from existing assets.

-

Strategic Acquisitions and Mergers: To accelerate growth and expand its market share, BP is exploring strategic acquisitions and mergers. These moves could involve acquiring companies with complementary technologies, expanding into new geographical markets, or gaining access to critical resources.

-

Technological Innovation: A crucial component of the strategy is a strong focus on technological innovation. BP aims to leverage cutting-edge technologies to reduce operational costs, improve efficiency, and minimize its environmental impact, enhancing its ESG profile and attracting a broader range of investors.

The feasibility of this strategy hinges on several factors, including the success of its renewable energy initiatives, the ability to effectively manage the transition away from fossil fuels, and the overall stability of the global energy market. Significant risks remain, including competition from established players and emerging startups in the renewable energy sector, as well as potential regulatory changes and geopolitical instability.

Market Reaction and Analyst Opinions on BP's Valuation Goal

The market's initial reaction to the CEO's announcement was mixed. While some investors expressed optimism, others remain cautious. The immediate stock price movement was relatively modest, indicating a wait-and-see approach among many investors.

Analyst opinions are equally diverse. Some analysts view the CEO's goal as achievable, highlighting the potential for growth in renewable energy and the company's strong operational capabilities. Others express concerns about the challenges involved in transitioning to a low-carbon economy, the intense competition in the energy sector, and the inherent volatility of global energy markets.

Concerns raised include:

- Global Energy Market Volatility: Fluctuations in oil and gas prices pose a significant risk to BP's profitability and the overall success of its valuation doubling strategy.

- Competition from Other Energy Companies: The energy sector is highly competitive, with numerous companies vying for market share in both traditional and renewable energy markets.

- Geopolitical Factors: Geopolitical events and regulations can significantly impact the energy industry, creating uncertainty and potential disruptions.

- Transition to Renewable Energy: The transition to renewable energy is a complex and challenging undertaking, requiring substantial investment and potentially impacting profits from traditional fossil fuel operations.

Implications of Continued Stock Exchange Listing for BP

The CEO's commitment to maintaining BP's current stock exchange listing is a crucial strategic decision. Remaining listed provides several benefits, including:

- Access to Capital: A public listing allows BP to access capital markets for funding its growth initiatives, including investments in renewable energy and strategic acquisitions.

- Investor Relations: A stock exchange listing enhances investor relations, facilitating communication with shareholders and attracting potential investors.

- Corporate Governance: Listing on a reputable stock exchange often leads to improved corporate governance practices and increased transparency.

While there are advantages to remaining listed, alternatives were likely considered. The choice of a specific stock exchange might have been carefully weighed, considering factors such as regulatory environments, investor base, and liquidity. However, the decision to remain publicly listed suggests that the benefits outweigh any potential drawbacks associated with alternative structures. The possibility of a future delisting or a move to a different stock exchange remains a long-term possibility depending on the company's performance and market conditions.

Long-Term Outlook and Future of BP Stock

The long-term outlook for BP stock is complex and dependent on several factors, including the success of its strategy, global energy market dynamics, and its performance in the ESG arena. Optimistic scenarios suggest a successful transition to a diversified energy portfolio, leading to strong revenue growth and higher valuation. However, pessimistic scenarios point to challenges in achieving the transition, increased competition, and the potential for setbacks due to unforeseen circumstances.

Projecting a future valuation is inherently difficult. However, a successful implementation of the CEO's strategy, combined with favorable market conditions and strong ESG performance, could significantly increase BP's valuation, potentially bringing the doubling goal within reach. Conversely, challenges in transitioning to renewable energy, increased competition, or major geopolitical events could hinder progress and impact the stock's performance.

Conclusion: BP Stock Valuation: A Path to Doubling?

BP's CEO has set an ambitious goal of doubling the company's stock valuation. The proposed strategy involves a significant shift towards renewable energy, coupled with efficiency improvements and strategic acquisitions. While the market's initial reaction was mixed, the long-term success hinges on navigating the complexities of the energy transition and overcoming significant competitive challenges. The CEO's commitment to the current stock exchange listing reflects a strategic decision to leverage the benefits of a public listing to achieve these ambitious goals. Whether the BP stock valuation doubling goal is achieved remains uncertain, dependent on many factors. However, the outlined strategy represents a bold attempt to reposition the company for success in a rapidly evolving energy landscape. Stay informed on BP's progress towards doubling its stock valuation by following our updates on the energy market and company news.

Featured Posts

-

Aims Group And World Trading Tournament Announce Official Partnership

May 22, 2025

Aims Group And World Trading Tournament Announce Official Partnership

May 22, 2025 -

The Impact Of Self Love On Vybz Kartels Skin Bleaching Decision

May 22, 2025

The Impact Of Self Love On Vybz Kartels Skin Bleaching Decision

May 22, 2025 -

Nuffy Realizes Dream Touring Alongside Vybz Kartel

May 22, 2025

Nuffy Realizes Dream Touring Alongside Vybz Kartel

May 22, 2025 -

Musics Reach Defining The Sound Perimeter Of Collective Experience

May 22, 2025

Musics Reach Defining The Sound Perimeter Of Collective Experience

May 22, 2025 -

Britains Got Talent The Fallout Between David Walliams And Simon Cowell

May 22, 2025

Britains Got Talent The Fallout Between David Walliams And Simon Cowell

May 22, 2025

Latest Posts

-

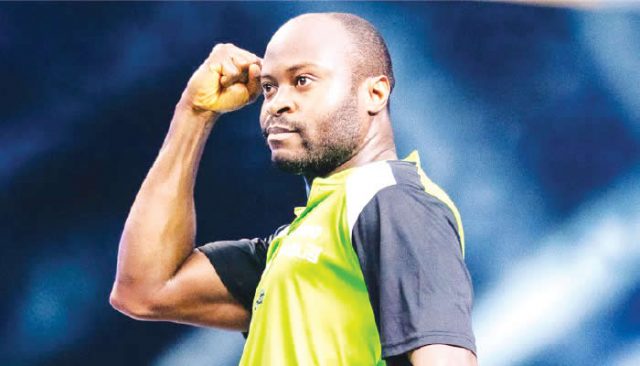

Early Exit For Aruna At The Wtt Chennai

May 22, 2025

Early Exit For Aruna At The Wtt Chennai

May 22, 2025 -

Conquering Lack Of Funds A Step By Step Guide

May 22, 2025

Conquering Lack Of Funds A Step By Step Guide

May 22, 2025 -

Arunas Unexpected Loss At Wtt Chennai Open

May 22, 2025

Arunas Unexpected Loss At Wtt Chennai Open

May 22, 2025 -

Wtt Star Contender Chennai 2025 Snehit Suravajjula Upsets Sharath Kamal In Farewell Match

May 22, 2025

Wtt Star Contender Chennai 2025 Snehit Suravajjula Upsets Sharath Kamal In Farewell Match

May 22, 2025 -

Lack Of Funds Strategies For Financial Success

May 22, 2025

Lack Of Funds Strategies For Financial Success

May 22, 2025