BP's Chief Executive Plans For Significant Valuation Increase: Denies US Listing Transfer, Says FT

Table of Contents

BP's Strategy for Valuation Growth

Bernard Looney's vision for increased BP valuation rests on a three-pronged approach: a robust transition to renewable energy, a laser focus on operational efficiency, and shrewd capital allocation to maximize shareholder returns.

Focus on Renewable Energy Transition

BP's shift towards renewable energy sources is no longer a side project; it's a cornerstone of Looney's plan to dramatically increase BP's market capitalization. This involves a multi-faceted strategy:

- Aggressive Investment: Increased investment in wind, solar, and other renewable energy projects is already underway. This includes significant capital expenditure on new projects and the development of cutting-edge technologies.

- Technological Innovation: BP is actively developing innovative technologies in low-carbon energy solutions, aiming to become a leader in the green energy sector and secure a significant share of this rapidly expanding market.

- Strategic Acquisitions: Acquisitions of renewable energy companies are expected to accelerate BP's expansion in this field, broadening its portfolio and expertise.

- Strategic Partnerships: Collaborations with established players in the renewable energy sector will allow BP to leverage existing infrastructure and expertise, fostering rapid growth.

Operational Efficiency and Cost Reduction

Improving operational efficiency and cutting costs are crucial for enhancing profitability and boosting the BP share price. Looney's plan includes:

- Digital Transformation: Automation and digitization of operations are streamlining processes, improving productivity, and reducing operational expenses.

- Production Optimization: Optimization of oil and gas production processes is key to maximizing output and minimizing waste, contributing directly to the company's bottom line.

- Supply Chain Streamlining: Efficiency gains throughout the supply chain are reducing costs and improving delivery times.

- Strategic Cost-Cutting: Cost-cutting measures across various departments are targeted at eliminating redundancies and improving overall financial performance.

Capital Allocation and Shareholder Returns

Effective capital allocation is vital for driving BP valuation growth. Looney's approach emphasizes:

- Strategic Investments: Strategic investments in high-growth areas, both within traditional energy and renewable energy sectors, are designed to generate strong returns.

- Share Buyback Programs: Share buyback programs are a key mechanism for returning value directly to shareholders, boosting investor confidence and supporting the BP share price.

- Sustainable Dividends: Dividend payouts, reflecting strong financial performance, reinforce the company's commitment to rewarding its investors.

- Investor Communication: Transparency and clear communication with investors are essential for maintaining trust and attracting further investment.

Denial of US Listing Transfer

Recent speculation in the Financial Times suggested a potential transfer of BP's listing to a US exchange. However, BP has categorically denied these claims.

Reasons for Remaining on the London Stock Exchange

Several factors underpin BP's decision to remain listed on the London Stock Exchange:

- Established Investor Base: BP benefits from a strong and loyal investor base in the UK and Europe.

- Regulatory Compliance: The regulatory environment and compliance requirements in the UK are well-understood and established, minimizing potential complexities.

- Cost Considerations: A listing transfer to the US would involve significant costs and complexities.

- FTSE 100 Presence: Maintaining its presence on the FTSE 100 index is strategically important for BP's profile and access to investors.

Benefits of Staying on the London Stock Exchange

The London Stock Exchange offers several key advantages for BP:

- Access to Investors: The London Stock Exchange provides access to a vast and diverse pool of investors globally.

- Strong Regulatory Framework: A strong regulatory framework and investor protection are crucial for maintaining investor confidence.

- Market Liquidity: Established market infrastructure and liquidity ensure efficient trading of BP shares.

- Global Recognition: The London Stock Exchange offers strong global reach and recognition.

Investor Sentiment and Market Reaction

The success of Looney's plan for increased BP valuation depends heavily on several external factors.

Analyst Opinions on BP's Valuation Strategy

Financial analysts offer a range of opinions on the feasibility of BP's ambitious plan. Some express optimism, highlighting the potential for growth in renewable energy, while others remain cautious, citing the volatility of the energy sector and the challenges of transitioning away from fossil fuels. Their detailed analysis provides valuable insight into the potential impact on the BP share price.

Impact of Global Energy Markets

Fluctuations in oil and gas prices, along with broader macroeconomic factors, will significantly influence BP's valuation. Geopolitical events and changing global demand for energy resources play a critical role in determining the company's financial performance.

Competition within the Energy Sector

BP faces fierce competition from other major players in the energy sector, both in traditional oil and gas and in the burgeoning renewable energy market. The company's ability to innovate, secure market share, and execute its strategic plan effectively will be key determinants of its future success and BP valuation.

Conclusion

BP's CEO, Bernard Looney, has outlined an ambitious plan to significantly increase BP's valuation. This strategy centers on a transition to renewable energy, operational efficiency improvements, and smart capital allocation. Despite speculation, BP remains firmly committed to the London Stock Exchange. The realization of this ambitious goal depends on several factors, including the global energy market dynamics, the success of its renewable energy initiatives, and the maintenance of strong investor confidence. Investors should closely monitor BP's progress in executing its strategy to assess the potential for future growth in BP valuation and share price. Stay informed about future developments regarding BP's ambitious plans to increase its valuation and make informed investment decisions.

Featured Posts

-

Unlocking The Potential Of Cassis Blackcurrant From Farm To Table

May 22, 2025

Unlocking The Potential Of Cassis Blackcurrant From Farm To Table

May 22, 2025 -

Clisson Le Collectif Le Bouillon Et Son Festival De Spectacles Engages

May 22, 2025

Clisson Le Collectif Le Bouillon Et Son Festival De Spectacles Engages

May 22, 2025 -

Sharath Kamals Defeat At Wtt Star Contender Chennai 2025 Marks Emotional Retirement

May 22, 2025

Sharath Kamals Defeat At Wtt Star Contender Chennai 2025 Marks Emotional Retirement

May 22, 2025 -

Puede Javier Baez Recuperar Su Productividad Analisis De Su Salud Y Futuro

May 22, 2025

Puede Javier Baez Recuperar Su Productividad Analisis De Su Salud Y Futuro

May 22, 2025 -

The Growing Tension David Walliams And Simon Cowells Britains Got Talent Dispute

May 22, 2025

The Growing Tension David Walliams And Simon Cowells Britains Got Talent Dispute

May 22, 2025

Latest Posts

-

Dexter Resurrection John Lithgow And Jimmy Smits To Reprise Roles

May 22, 2025

Dexter Resurrection John Lithgow And Jimmy Smits To Reprise Roles

May 22, 2025 -

The Amazing World Of Gumball A New Streaming Era On Hulu And Disney

May 22, 2025

The Amazing World Of Gumball A New Streaming Era On Hulu And Disney

May 22, 2025 -

Dexter Resurrection Hype Own The Dexter Original Sin Steelbook Blu Ray Now

May 22, 2025

Dexter Resurrection Hype Own The Dexter Original Sin Steelbook Blu Ray Now

May 22, 2025 -

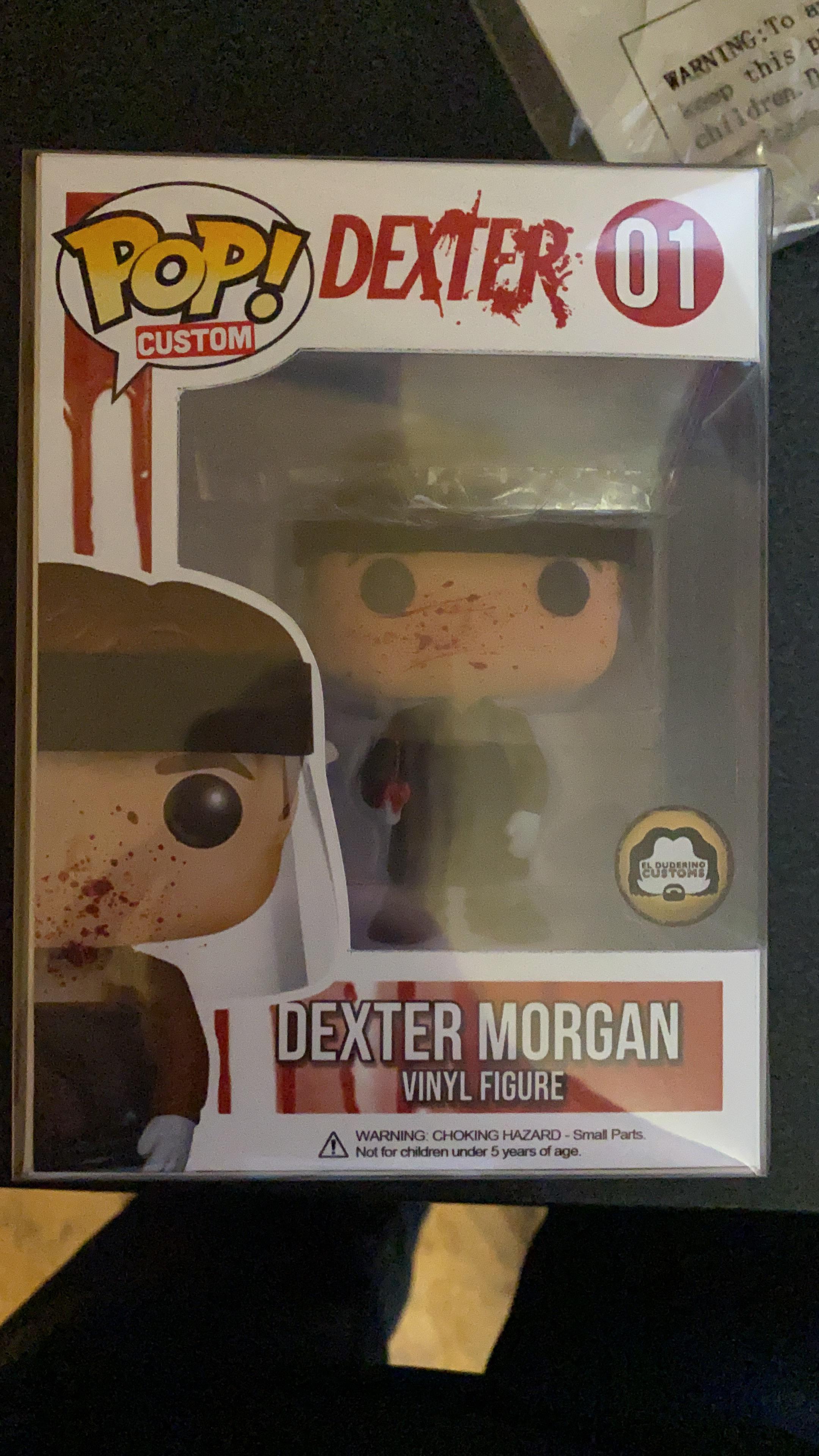

Dexter Pop Vinyl Figures A Collectors Guide

May 22, 2025

Dexter Pop Vinyl Figures A Collectors Guide

May 22, 2025 -

How Original Sin Season 1s Conclusion Compounds Dexters Debra Morgan Error

May 22, 2025

How Original Sin Season 1s Conclusion Compounds Dexters Debra Morgan Error

May 22, 2025